1112 days ago • Posted by Jasper Lawler

Tax havens threatened with extinction in new global minimum corporation tax plans

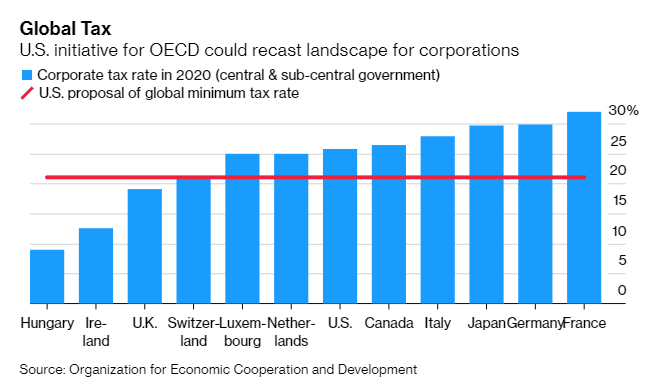

American proposals address two objectives: setting a 21% global minimum tax and ensuring that the world’s 100 or so biggest companies pay more in places they actually do business.

Behind the new drive is a pandemic that swelled national debts. The shift is not unlike the regime change toward treatment of income-tax havens such as Switzerland that followed the 2008 financial crisis.

Source: OECD / Bloomberg