1095 days ago • Posted by Charles-Henry Monchau

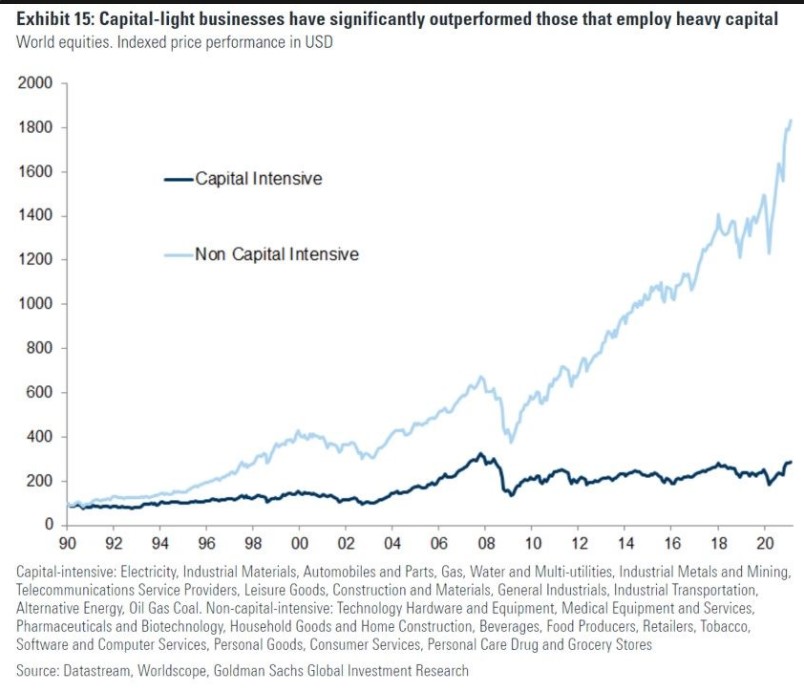

The massive outperformance of capital-light businesses vs. capital-intensive ones

The chart below from Goldman shows that non-capital intensive businesses have outperformed capital-intensive companies on an unprecedented scale during the last 30 years or so. This could also be seen with the outperformance of growth vs. value stocks. With the massive Biden infrastructure plan and the green revolution, are we going to see some catch-up? Would such a trend benefit value/cyclicals stocks? Or will we see another false start, with "capital light" businesses soon reasserting their long-term / secular outperformance trend? Source: Goldman Sachs