1198 days ago • Posted by Charles-Henry Monchau

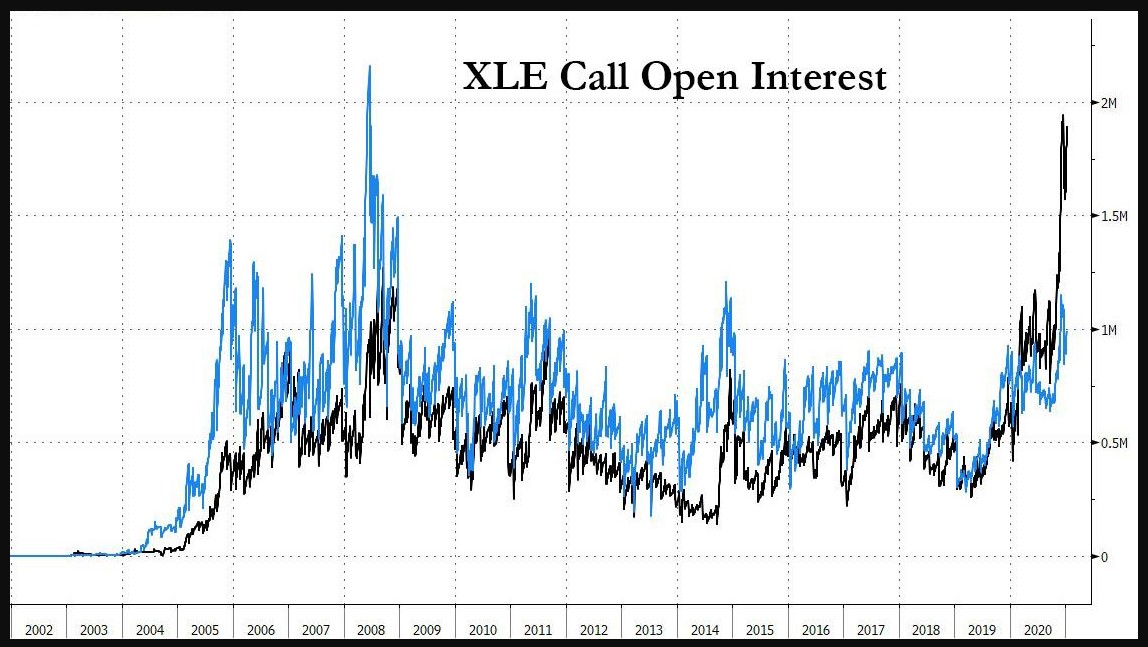

The XLE (or Energy Select Sector SPDR Fund) option call buying has exploded higher. Is the Energy Sector bracing for a huge Melt Up?

As Susquehanna's Chris Murphy pointed out, "option investors have never been so bullish on energy stocks." As shown in the chart below, open interest in call options for the most popular energy ETF, the XLE (or Energy Select Sector SPDR Fund) has exploded higher in just the last few days sending its ratio relative to puts to a record. This record energy call buying may explain why there has been a sharp spike higher in such energy names as Exxon in recent weeks; it's also why the surge across energy names may be just starting. Curiously, this appears to be a phenomenon isolated within energy: other ETFs in cyclical sectors such as banks and small caps, haven’t seen a similar phenomenon in option activity. As Bloomberg notes, while President-elect Joe Biden has pledged to focus on green energy, which in turn has made such ESG ETFs as the TAN explode in late 2020, the potential for "trillions" more in stimulus under a Democrats blue sweep, as well as Saudi Arabia’s shocking $1mm bbd crude-supply cut have sent WTI above $52 a barrel. The XLE ETF has already rallied 44% since Nov. 3. But if options traders have their way, this could be just the start of the next massive gamma squeeze - source: www.zerohedge.com .