At Flowbank, we recognize the critical role of currency values in reflecting a country's economic health and stability. This comprehensive guide delves into how global events significantly influence currency prices and mold trading strategies in the forex market.

Our goal is to equip traders with the knowledge to effectively interpret and utilize this information, thereby enhancing their decision-making in a market that is intricately linked globally.

Join us as we navigate the complexities of forex trading and uncover the impact of worldwide events on currency trends and trading approaches.

Understanding the link between Global events and Forex Markets

In the last two decades, the Forex (FX) market has evolved into the largest financial market globally, boasting a staggering market capitalization of $6.6 trillion, as per 2019 Triennial Central Bank Survey of FX and OTC derivatives markets. This market is characterized by its sensitivity to a range of factors, broadly categorized under economic policies, global crises, and geopolitical dynamics.

At Flowbank, we understand that major global events, from elections to economic shifts, significantly affect forex trading. A prime example is the 2016 Brexit referendum, which led to a dramatic fluctuation of over 1800 pips in the GBP/USD pair in a single day.

Key economic indicators such as GDP, unemployment rates, and inflation play crucial roles in determining exchange rates. Additionally, central bank decisions, particularly regarding interest rates, are pivotal in shaping forex market trends.

Geopolitical events, although seemingly having a subtle impact, can notably influence the forex market. This was evident in recent times with events like the COVID-19 pandemic and the US presidential election, both of which heightened market volatility. Political developments, natural disasters, and humanitarian crises, such as wars or pandemics, are also critical factors contributing to market fluctuations.

For forex traders, grasping the interplay between economic policies, geopolitical events, and global crises is essential. Staying informed on vital economic data, monitoring economic calendars, and being attuned to geopolitical changes are key practices that can help traders stay ahead.

In the inherently volatile forex market, such knowledge is invaluable in developing effective strategies to navigate and leverage market movements. Flowbank is dedicated to providing traders with the insights and tools needed to skillfully maneuver in the forex market, capitalizing on these global events and trends.

Historical case studies : Global events and their market impact

At Flowbank, we believe that studying historical events offers invaluable lessons in understanding their impact on Forex markets. Analyzing past global events helps traders discern the direct and long-term effects on foreign exchange markets.

Let's explore some significant historical events and their implications :

- The Brexit Referendum of 2016 : This pivotal event caused a seismic shift in the forex market. The UK's decision to exit the European Union led to heightened volatility, particularly in the GBP/USD pair. This case study underscores how geopolitical uncertainties, especially those tied to political decisions, can trigger immediate and substantial market reactions.

- The 2008 Financial Crisis : This global crisis, triggered by the collapse of significant financial institutions and a subsequent economic downturn, had far-reaching effects on the forex markets. During this period, safe-haven currencies like the US dollar and Japanese yen saw increased demand as investors sought stability amidst the chaos. The crisis's aftermath saw central banks worldwide adopting various monetary policies like quantitative easing and interest rate adjustments, influencing long-term currency values. These events are crucial for traders in developing both short-term and long-term trading strategies.

- The COVID-19 Pandemic of 2019 : The outbreak of COVID-19 dramatically altered market dynamics at an unprecedented pace. The global response to the pandemic, including lockdowns and economic slowdowns, led to a rush towards safe-haven assets such as the US dollar and gold. Additionally, substantial financial measures by central banks to mitigate recessionary impacts raised concerns about hyperinflation, affecting commodity markets and currency valuations.

- Australian Bushfires of 2020 : This natural disaster had a significant economic impact, leading to a series of interest rate cuts by the Reserve Bank of Australia (RBA). These cuts profoundly affected the exchange rate between the Australian dollar and the US dollar, exemplifying the inextricable link between economic factors and geopolitical events.

These historical case studies demonstrate the complex interplay between economic policies, geopolitical events, and global crises. They provide essential insights for forex traders at Flowbank, highlighting the importance of staying informed and adaptable in a market influenced by a wide array of global factors.

Analyzing the role of news and economic reports

At Flowbank, we emphasize the critical role of economic news and reports in the forex market. These data points significantly impact traders and investors navigating the complexities of international finance. Understanding key economic indicators such as GDP, CPI, PPI, and unemployment rates is essential for anyone participating in the forex market.

Economic news as market movers

Economic news can trigger substantial movements in currency markets. For instance, a higher-than-expected GDP growth rate suggests robust economic development, potentially bolstering the nation's currency. Conversely, a spike in the Consumer Price Index (CPI), indicating rising inflation, might weaken a currency due to fears of escalating prices.

Market sentiment and economic news

Market sentiment is heavily influenced by economic news. Positive reports, like better-than-expected GDP growth, can enhance market sentiment, driving up demand for a country's currency. On the other hand, negative news can lead to poor market sentiment and a decrease in currency demand, resulting in depreciation.

Central Bank statements and market impact

Central bank statements, often issued in response to economic news, are crucial in shaping market sentiment. These statements offer insights into future monetary policy directions. Announcements indicating interest rate hikes can create positive sentiment, boosting the economy's outlook and attracting foreign investment. Conversely, signals of interest rate cuts can lead to negative sentiment and currency depreciation.

Policy decisions based on economic indicators

Central banks, responsible for monetary policy, base their decisions on economic indicators. For example, if inflation is higher than expected, a central bank may raise interest rates to curb inflation, thus strengthening the currency. In contrast, during economic slowdowns, lower interest rates might be implemented to stimulate growth, potentially leading to currency depreciation.

Timeliness of economic news releases

The timing of economic news releases is crucial for forex traders, as immediate market reactions can increase volatility. Traders monitor these release times attentively, responding swiftly to key reports like the non-farm payroll, which provides valuable insights into job additions in the US economy. The outcome of such reports can significantly influence the demand for currencies like the US dollar.

Example :

For instance, the release of the Non-Farm Payroll (NFP) report is a key event for forex traders due to its potential to cause significant market fluctuations. This report, which excludes farm workers and a few other job classifications, is a prime indicator of the United States' economic health, providing insights into employment trends outside the agricultural sector.

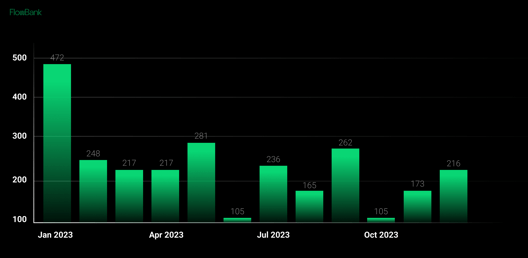

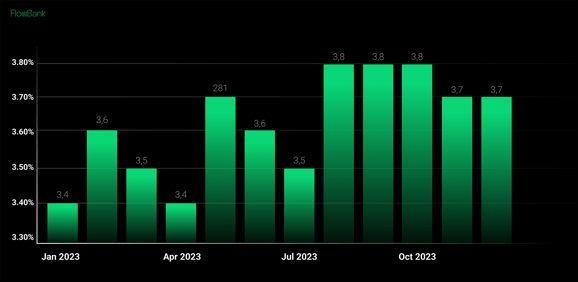

Recent NFP Release Impact :

Let's examine the most recent NFP release and its effects on the market. On the chart provided, we see the gold market's response to the NFP data. Before the release, gold prices were relatively stable. However, as the NFP figures were published, we observed a notable price movement.

The data indicated a change in employment numbers and an update on the unemployment rate. For example, the employment figures came in at 216K, against a forecast of 168K.

The unemployment rate slightly improved from 3.8% to 3.7%. These figures suggest a stronger-than-expected job market in the U.S., which can lead to bullish sentiment for the U.S. dollar.

Gold Market Reaction

In the aftermath of the NFP report, gold prices experienced a sharp decline. From the chart, we can see a drop represented by a significant bearish candle. The price of gold fell by approximately 0.73%, translating to a $14.963 decrease per ounce.

This movement is indicative of traders' reaction to the stronger U.S. dollar, as a robust job market can hint at possible interest rate hikes by the Federal Reserve, thus increasing the dollar's attractiveness.

Strategies for Forex Trading during volatile times trading

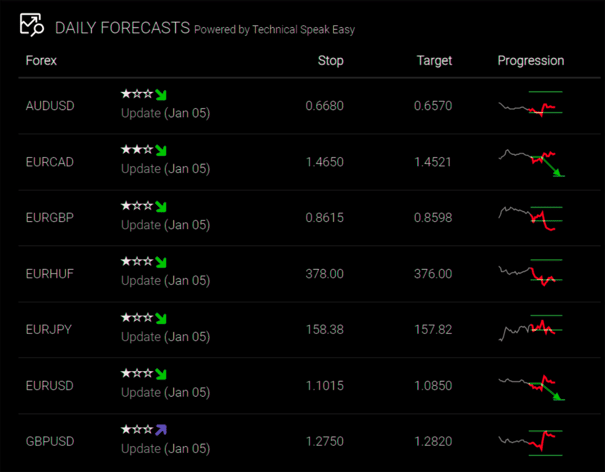

To navigate market volatility, solid risk management, intelligent decision-making, technical analysis, and adapting to rapid changes are required. When the Forex market is unpredictable, having the right strategies can turn challenges into opportunities.

Here's a simple guide for traders to thrive even when the market is bumpy.

Risk Management Essentials

Smart risk management is like wearing a seatbelt in a fast-moving car; it's essential. Imagine you're on a rollercoaster — setting a stop-loss order is like deciding in advance exactly how scary you want the ride to be. If the market gets too wild, you've decided where to draw the line and get off the ride, minimizing your losses.

For instance, if you're trading euros and you see the market start to dip, you might set a stop-loss order just below your entry point. That way, if the euro keeps falling, you won't lose more than you're comfortable with.

Leveraging Economic Indicators with Flowbank

Economic indicators are akin to a weather forecast for the currency market, providing valuable clues about the economic climate. Just as a sunny forecast can lift your spirits, a positive job report can send currency values soaring. Conversely, a gloomy inflation report might signal a downturn for a currency, just like storm clouds can dampen your day.

To stay ahead of these economic weather patterns, savvy investors turn to resources like Flowbank's economic calendar (available at flowbank.com/economic-calendar), which lists upcoming economic events. Moreover, in-depth analyses of these events and their potential market impacts are readily accessible on Flowbank's website, offering traders insights to make informed decisions.

By staying informed with Flowbank's tools and analyses, you can strategically open or close trades, just as you'd carry an umbrella if rain was in the forecast.

Handling sudden market swings and leveraging technical analysis Flowbank

In the forex market, currencies can swing wildly, much like a weather vane in a gusty wind. Traders need to be nimble, ready to move with the market, and savvy enough to snatch up opportunities that come with these swings.

When the market gets rough, think of technical analysis as your GPS.

It uses charts, past price patterns, and various tools—like the lines that tell you where support and resistance are, or the Bollinger Bands that act like market 'bumpers'—to help you navigate through the market's twists and turns. These tools can help you spot safe spots to enter or exit the market, and help you chart a clear course through the choppy waters of trading.

Staying cool and continuing Education

Keeping a cool head when market storms hit is tough. It's easy to get swept up in the waves of fear or ride the high tide of greed, but the seasoned traders know the value of sticking to their map—their trading plan—and waiting out the storm with patience. Sometimes, the bravest move is to do nothing at all.

But just like a captain studies the seas, traders must keep learning. The market is an ocean of information—economic updates, success stories, and strategy reviews.

Flowbank not only offers trading academies packed with the latest forex insights but also keeps you updated on the ever-shifting tides of the market.

Best practices for sailing through Forex volatility

To steer through the choppy seas of forex volatility, consider these navigational aids :

- Set firm stop-loss and take-profit orders as your safety nets to protect your trades from unexpected squalls.

- Use tools like the Average True Range (ATR) to measure market mood swings, giving you a heads-up on potential storms.

- Diversify your trade routes by engaging with various currency pairs, diluting the risk of a single stormy market.

- Keep an eye on the economic horizon with calendars and news updates to forecast potential market shake-ups.

- Embrace short-term strategies, like day trading, to ride the waves of daily market moves. And remember, adjust your sail—the size of your trades—according to the wind's strength, or market volatility, for a smoother journey.

By incorporating these strategies, you'll be better equipped to navigate the uncertain waters of forex trading, making the most of both the calm and the stormy days.

The influence of central bank decisions and policies trading

Central bank decisions are a major driving force in the forex market, with policies and announcements having a substantial impact on currency values. Traders and investors keep a close eye on these decisions, which can range from interest rate changes to unconventional monetary policies. Here’s a breakdown of the key areas:

1. Currency Interventions : The Central Bank’s Tactical Play

Central banks may trade their own currency to influence its market value, either to boost it during depreciation or to reduce its value when it's considered overpriced.

The success of such interventions depends on various factors, including market conditions and the scale of the intervention.

2. Interest rate decisions: The pulse of economic health

Interest rates are adjusted to control inflation and stimulate economic growth, with hikes often attracting foreign capital and boosting currency value.

Conversely, rate cuts aim to encourage spending and can lead to a decrease in currency value.

3. Quantitative easing: The great balancing act

A tool for economic stimulation, QE involves central banks purchasing assets to inject liquidity into the economy.

Although intended to lower interest rates and encourage lending, QE can lead to currency depreciation due to an increased money supply.

Navigating the Waves: Trader Strategy in Response to Central Banks

Here’s how traders can respond to central bank activities :

- Stay Informed : Regular updates on central bank decisions can be found on financial news platforms, such as Flowbank's website. Understanding the potential outcomes of central bank policies is crucial for anticipating market movements.

- Plan Your Trades : Use stop-loss orders to protect against sudden market shifts triggered by central bank announcements. Adjust trading strategies in real-time to align with the current economic landscape.

- Monitor Market Sentiment : Central bank policies can sway market sentiment; positive announcements may lead to bullish trends, while negative news can cause bearish reactions.

By remaining vigilant and adaptable, traders can effectively navigate the forex market amid the ebbs and flows dictated by central bank policies.

Preparing for future global events as a Forex Trader

In the ever-shifting world of forex trading, preparedness for global events is paramount. A successful trading plan isn't just a set of rules; it's a personalized roadmap that adapts to both your trading style and the market's moods. Here's how to future-proof your forex strategy :

Designing a versatile trading plan :

- Self-Assessment : Begin by evaluating your trading personality to choose a style that suits you, be it the fast-paced day trading or the more calculated swing trading.

- Pair Selection : Pick currency pairs that align with your trading style. Opt for pairs like EUR/USD for its liquidity if you're a day trader or GBP/JPY for its volatility if swing trading is more your tempo.

- Trading Hours : Align your trading with periods that suit your schedule and energy levels, ensuring you're at your sharpest when the market matches your chosen style.

- Entry and Exit Strategy : Define clear entry and exit points, refining them through experience, backtesting, and learning from proven strategies to build consistency and curb emotional decisions.

- Risk Management : Incorporate firm stop-loss and take-profit orders to protect your capital and lock in gains, steering clear of emotional trading.

- Evolving with the Market : Remain open to adjusting your plan as markets evolve. Whether it's shifting from day to swing trading or tweaking profit targets, an adaptable plan can withstand the test of time and change.

- In Practice : Imagine you're a forex trader eying the EUR/USD pair. Your day begins with a market review, matching trading times to peak market activity.

With a disciplined approach, you've set a stop-loss at a 2% loss threshold and a take-profit at a 5% gain. Yet, as the market fluctuates, you're ready to adjust these parameters or even switch to swing trading if the day's news hints at a longer-term trend.

By preparing for future global events with a flexible and informed trading plan, you stand ready not just to respond to the market, but to thrive within it.

Key Takeaways

In the ever-evolving world of Forex trading, awareness and adaptability have become more crucial than ever. Understanding the intricate connections between economic policies, geopolitical events, and global crises is essential. Historical events like Brexit and the 2008 financial crisis offer profound lessons on the potential impact of global happenings on currency markets.

Effective strategies, including meticulous analysis of economic news and reports, robust risk management practices, and leveraging economic indicators, are indispensable. Furthermore, the importance of discipline and foresight in anticipating central bank decisions cannot be overstated.

A flexible trading plan is a foundational tool for any Forex trader, enabling adaptation to shifting market dynamics and enhancing decision-making skills. If you're poised to dive into Forex trading, remember: thorough research, staying well-informed, and crafting a solid trading plan are your keys to success.

Explore the depths of Forex trading and refine your strategies with Flowbank. Stay ahead with our expert insights and comprehensive learning resources tailored for your trading journey.

Join us at Flowbank, where informed trading meets opportunity !