CFD (Contract for Difference) trading lets you participate in the financial market without actually owning the assets you're trading. It's a way to potentially profit whether prices go up or down. If you're new to this, don't worry! This article is designed to guide you through the basics of CFD trading, from understanding what CFDs are to making your first trade. With FlowBank, embark on your CFD trading journey with confidence, equipped with the fundamental insights needed to navigate the market.

How CFDs Work ?

CFD trading allows individuals to engage in financial markets without owning the actual assets being traded. It offers the opportunity to profit or incur losses based on price movements—whether they rise or fall. Even if you're new to this, there's no need to worry. With FlowBank, embark confidently on your journey into CFD trading, learning the basics and navigating through your first transactions seamlessly.

Here's a simple breakdown of how CFDs work, using Apple shares as an example :

- Position : If you believe Apple's share price will increase, you can buy a CFD (go long). Conversely, if you think the price will decrease, you sell a CFD (go short).

- Outcome : Success in CFD trading hinges on your price movement predictions. Accurate predictions lead to profits, while errors result in losses.

- Ownership and Tax : When you trade CFDs on Apple shares, you're not buying the shares themselves but speculating on their price changes. This means you won't own any Apple shares, won't receive dividends, and won't have voting rights in shareholder meetings. Additionally, you typically don't pay capital gains tax on profits from CFD trading, as you're not owning the underlying asset.

Flowbank simplifies CFD trading, offering a platform that guides you through the nuances of market speculation, ensuring you're well-informed and ready to trade.

Benefits of CFD Trading

Flexibility : CFD trading provides the versatility to access and trade a wide range of markets through one platform. For instance, you can trade on the price movements of Apple shares, gold, or the EUR/USD currency pair without needing to own the underlying assets.Leverage : Leverage allows traders to control a larger position with a relatively small deposit, amplifying both potential profits and losses. For example, with a 10:1 leverage, you could open a position worth $10,000 in Google stocks with just $1,000.

Access to International Markets : CFDs offer the opportunity to trade on international markets easily. Whether it's trading on the NASDAQ, London Stock Exchange, or the Tokyo Stock Exchange, you can speculate on global market movements from your trading account.

Ability to Hedge : CFDs can serve as a hedging tool to offset potential losses in your investment portfolio. If you own physical shares of Tesla and anticipate a short-term decrease in the stock's price, you could open a short CFD position on Tesla. This way, any loss in the value of your shares may be offset by gains in your CFD trade.

Understanding the Market : Key CFD Trading Terms

Leverage in CFD Trading

Leverage in CFD (Contract for Difference) trading allows traders to amplify their trading position beyond their initial investment. It's a powerful tool that can significantly increase potential profits but also potential losses.

How Leverage Works : By using leverage, a trader can control a much larger position with a relatively small amount of capital. This magnifies both gains and losses.

Example of Leverage in action :

- Initial Investment : You decide to trade Apple CFDs and have $1,000 to invest.

- Leverage Used : You apply a leverage of 1:10, which increases your trading power to $10,000.

- Market Movement : Apple's stock price increases by 10%.

- Profit Without Leverage : Without leverage, a 10% increase would net you a $100 profit.

- Profit With Leverage : With leverage, the same 10% rise translates to a $1,000 profit, as you're controlling a $10,000 position.

Risks of Leverage : While the profit potential is higher, remember that leverage also means increased risk. A 10% move in the opposite direction could lead to a significant loss, equally amplified by the leverage.

Key Takeaway : Leverage can be a powerful tool in CFD trading, offering the chance for substantial profits on a small initial investment. However, it's crucial to manage risk carefully, as losses are also amplified.

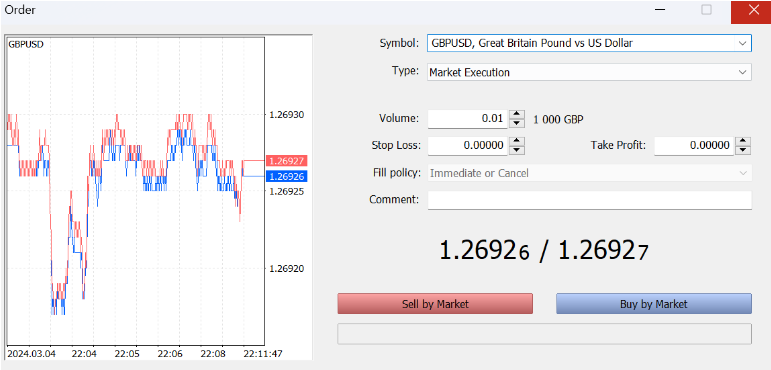

Spread in CFD Trading

In CFD (Contract for Difference) trading, the spread is the difference between the bid price (sell price) and the ask price (buy price). It represents the broker's profit on the trade.

- Bid and Ask Prices :

- Bid Price : The price at which you can sell a CFD.

- Ask Price : The price at which you can buy a CFD.

- Bid Price : The price at which you can sell a CFD.

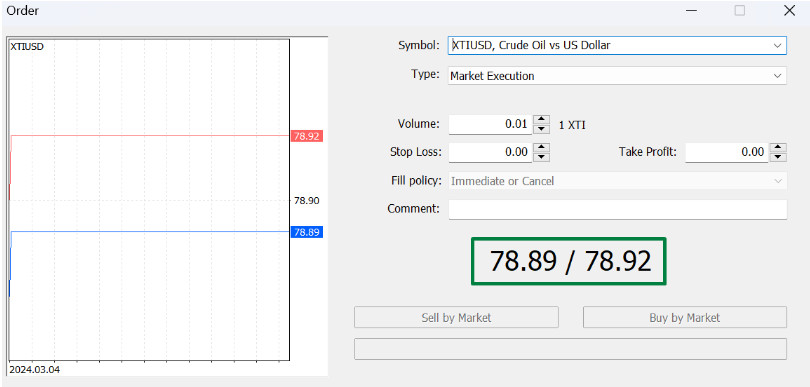

Example of Spread :

- Market : You decide to trade CFDs on oil.

- Ask Price : The current price to buy oil CFDs is $78.92.

- Bid Price : The current price to sell oil CFDs is $78.89.

- Spread Calculation : The spread is $0.03 ($78.92 ask price - $78.89 bid price).

- How Spread Works :

- If you buy one oil CFD at the ask price of $78.92 and immediately sell it at the bid price of $78.89, the $0.03 difference is the broker's profit.

- If you buy one oil CFD at the ask price of $78.92 and immediately sell it at the bid price of $78.89, the $0.03 difference is the broker's profit.

- Impact on Trading : The spread is a cost to the trader and impacts the break-even point of a trade. A narrower spread is generally favorable as it means lower trading costs.

- Key Takeaway : Understanding the spread is crucial in CFD trading as it affects the cost of entering and exiting trades. Traders should consider the spread as a fundamental part of their trading strategy to manage costs effectively.

Going long and short in CFD Trading

In CFD trading, "going long" means buying a CFD with the expectation that its price will rise. Conversely, "going short" involves selling a CFD, anticipating a price decline.

- Example of going long :

- Scenario : You're trading CFDs on the EUR/USD currency pair.

- Action : Believing the euro will strengthen against the US dollar, you decide to go long on the EUR/USD CFD.

- Outcome : If the price of the EUR/USD pair increases, you profit from the trade.

- Example of going short :

- Scenario : Still focusing on the EUR/USD currency pair.

- Action : Expecting the euro to weaken against the dollar, you go short on the EUR/USD CFD.

- Outcome : If the price of the EUR/USD pair decreases, you profit from the trade.

- Scenario : Still focusing on the EUR/USD currency pair.

- Key Insights :

- CFD trading allows you to speculate on price movements in both directions, offering the flexibility to profit from rising and falling markets.

- Your trading strategy can adapt to your market expectations—whether bullish (long) or bearish (short).

- CFD trading allows you to speculate on price movements in both directions, offering the flexibility to profit from rising and falling markets.

- Remember : Successful CFD trading involves understanding market trends and making informed decisions based on your analysis. details.

Margin

Trading CFDs (Contracts for Difference) on margin allows you to leverage your positions, enhancing potential returns with a smaller initial investment. Here's a breakdown of how margin and leverage work in CFD trading, using an example for clarity :

Deposit margin

- Definition : The deposit margin is essentially your "entry ticket" into a trade. It's a percentage of the full value of the position you wish to open.

- Example : Imagine you want to trade a CFD on a stock valued at $10,000. If the deposit margin rate is 10%, you only need to deposit $1,000 to open the trade.

Maintenance margin

- Definition : The maintenance margin is the minimum account balance you must maintain to keep your trades open. If your account balance falls below this level due to trading losses, you'll receive a margin call.

- Example : Continuing from the previous scenario, if the market moves against your position and your losses approach your initial deposit ($1,000), your broker will alert you that additional funds are needed to maintain the position open. This is to ensure that there's enough margin to cover potential losses.

Margin call and stop out

- Margin call : If your losses continue to mount and your account balance dips below the maintenance margin, you'll receive a margin call, requiring you to deposit more funds.

- Stop out : Failure to meet the margin call results in a stop out, where the broker closes your position at a loss to prevent further financial damage.

Example Scenario

Let's say you're trading CFDs on Company XYZ's stock :

- You open a position worth $10,000 with a deposit margin of 10%, so you invest $1,000.

- The stock's value decreases, and your losses amount to $900, nearing your initial deposit.

- You receive a margin call to add more funds as maintenance margin requirements are not met.

- Unable to add funds, your position is automatically closed (stop out), locking in your losses.

Setting up your CFD trading account

Setting up a CFD trading account is a straightforward process that opens the door to trading in various markets such as stocks, commodities, and forex. Here's how you can get started :

Choosing a Broker

- Research : Start by researching brokers known for reliable CFD trading services. Consider FlowBank, known for its strong regulatory compliance, advanced trading platform features, and robust customer support.

- Compare : Evaluate different brokers by comparing their trading fees, range of markets available (stocks, forex, commodities, etc.), customer feedback, and overall service quality. Pay attention to the details that matter most to your trading style, such as platform ease of use or educational resources.

- Decision : Select a broker that best suits your trading needs and goals. If you're looking for a broker that combines technology with a wide range of available markets, FlowBank could be a great choice. Getting recommendations from seasoned traders who have experience with different platforms can also guide your decision.

Optimizing your CFD Trading with FlowBank

Choosing the right broker is crucial for a successful CFD trading experience. Flowbank, a Swiss-regulated bank, offers a robust platform with competitive conditions for trading and investing, ensuring traders can leverage market movements effectively. Here's why considering FlowBank for your CFD trading journey could be a game-changer :

- Trade across markets : FlowBank allows trading in diverse markets, including stocks, forex, indices, and metals. Whether the market is rising or falling, there are opportunities to profit.

- Competitive costs :

- Stocks : Enjoy commissions from as low as 2 cents per share or 0.09%.

- Forex : Benefit from tight spreads, with rates like 0.5 on EUR/USD.

- Indices : Access spreads from 0.8 for US 500.

- Metals : Trade with spreads starting from 0.2 on spot gold.

- Stocks : Enjoy commissions from as low as 2 cents per share or 0.09%.

- Advanced Trading Platforms : Choose between MetaTrader 4 for automating your forex trading on the world's most popular platform, or explore MetaTrader 5 for the next-generation platform for forex and stock markets.

- Demo Account : Practice your trading strategies risk-free with a demo account, providing a hands-on experience without any investment.

- Swiss Quality and Security : With FINMA regulation, multilingual customer support available 24/6, and operations based in Switzerland, FlowBank represents Swiss quality, security, and service at its best.

- Educational Resources : Stay informed with the latest market news, learn through the academy, and keep ahead with daily newsletters.

Account Types

- Variety : Brokers typically offer different account types to cater to the diverse needs of traders, from beginners to experienced professionals.

- Standard vs Premium : While standard accounts suit most traders, premium accounts offer perks such as lower spreads and personalized support. Decide based on your trading volume and needs.

Account Types at FlowBank

- Variety for every trader : Understanding that traders have different strategies, experience levels, and financial goals, FlowBank provides a selection of account types.

- Standard vs. Premium accounts : Choose the Standard account for an all-rounded trading experience suitable for most traders, or opt for the Platinum account if you seek more specialized services and lower costs for higher volumes.

| Feature | Classic | Platinum |

| Commission | Yes | Yes |

| Spread | From 0.88 pips for FX | From 0.5 pips for FX |

| Minimum Deposit | 0 | 100,000 CHF |

| Max. Leverage | 4:20 | 4:20 |

Documentation and compliance

Identity Verification : Prepare to submit a government-issued ID (passport or driver’s license) to verify your identity.

Proof of Residence : You’ll also need a recent utility bill or bank statement as proof of residence.

Additional Documents : Depending on regulatory requirements, you might need to provide financial statements or proof of income.

Example : Setting up a CFD account

Imagine you're interested in trading CFDs on tech stocks. Here’s what you’d typically do :

- Research brokers that offer tech stocks CFD trading with competitive spreads.

- Choose an account type that matches your trading strategy—say, a standard account for starting.

- Gather your ID and a recent utility bill for verification.

- Apply online, uploading the necessary documents.

- Wait for account approval, which may take a few days. Once approved, you can deposit funds and start trading.

Get Started with FlowBank : Setting up your trading account with FlowBank is straightforward. Begin your journey into CFD trading with confidence, backed by Swiss precision and innovative trading solutions. Try the demo to explore the platforms and services offered by FlowBank, ensuring your trading experience is informed, secure, and tailored to meet your investment goals.

Developing a CFD Trading strategy

Creating a successful CFD trading strategy involves a blend of diligent risk management, thorough market research, and clear goal setting. Here's how you can develop a robust approach to navigate the complex world of CFD trading :

Risk management : The foundation of Trading

- Implement Stop-Loss Orders : Use stop-loss orders to protect your capital. For instance, if you buy a CFD on Company X at $100, setting a stop-loss order at $90 means if the price drops to $90, your position is automatically closed, limiting your loss to $10 per CFD.

- Adjust Position Sizes : Determine your position size based on your risk tolerance. If you have $10,000 to trade and wish to risk 1% per trade, you would not risk more than $100 on a single trade. This strategy ensures that you only risk a small fraction of your capital.

- Diversify : Instead of putting all your capital into one asset, spread your investments across different asset classes such as stocks, commodities, and currencies. For example, if the stock market is performing poorly, your investments in commodities or currencies might offset the losses, reducing your overall risk.

Market research : Your trading compass

- Understand Market Dynamics : Begin by diving deep into the markets you're considering. Utilize FlowBank's insights and educational resources to get a grip on economic indicators, geopolitical developments, and overall market sentiment. This foundational knowledge sets the stage for informed decision-making.

- Leverage Analysis Tools : Engage in both technical and fundamental analysis to paint a comprehensive picture of potential investments. Technical analysis, with its focus on price patterns and trends, can be augmented by FlowBank's advanced charting tools. Simultaneously, fundamental analysis assesses an asset's intrinsic value, underpinned by FlowBank's detailed financial reports and market analysis.

- Stay informed and adapt : The market is ever-evolving, influenced by a myriad of factors ranging from policy changes to global events. FlowBank's up-to-the-minute market news and insights ensure you're never left behind. Adaptability, informed by current and forecasted market conditions, can significantly enhance your trading strategy.

Setting goals : your trading roadmap

- Define your objectives : Start by outlining what you aim to achieve with your CFD trading. Whether it's a specific profit target or a percentage return on investment, having clear objectives is crucial.

- Be realistic : Set attainable goals that reflect your investment capacity and risk tolerance. Unrealistic expectations can lead to unnecessary risks.

- Regularly review and adapt : Continuously evaluate your performance against your goals. As markets evolve and your trading experience grows, adjust your strategy to remain aligned with your objectives.

Navigating your first CFD trades

Here's a simplified guide to making your first trades, complete with examples to illuminate the path :

- Analyzing markets : Before diving in, it's crucial to understand the assets you're interested in. Let's say you're eyeing the CFD market for gold. Using FlowBank's resources, you'll delve into economic indicators, geopolitical tensions, and currency exchange rates affecting gold prices.

- For instance, inflation concerns weakening the US dollar typically boost gold prices. A technical analysis might reveal a breakthrough of long-term resistance, suggesting an upward trend. Armed with this analysis, you decide to proceed with a gold CFD.

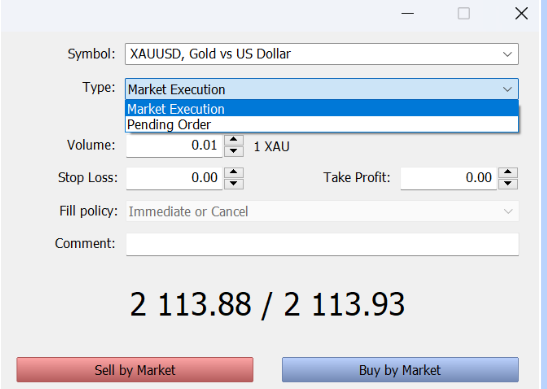

- Placing Orders : FlowBank's platform allows for various orders. Suppose you aim to buy a gold CFD at $1850, slightly below the current price of $1855.

- You set a limit order, meaning your purchase will execute if prices drop to $1850 or lower. After specifying your order's details, you confirm and submit. Once the market matches your price, your order fills, and you're officially trading gold CFDs.

- Monitoring Trades : With FlowBank, monitoring your trades is streamlined. Imagine your gold CFD's price rises to $1870. While tempted to cash in, you set a stop-loss at $1840 to safeguard against sudden downturns and a take-profit at $1900 to secure gains. FlowBank's platform enables real-time tracking, ensuring you're always informed and ready to adapt your strategy.

Common mistakes to avoid in CFD trading

Everybody has flaws. Even the most experienced traders have occasionally failed by purchasing and selling the improper quantity or even the wrong share, or they have sold before they should have. Most of the time, by taking the appropriate steps, such errors may be prevented. It's critical for CFD investors to prevent errors by limiting their borrowing, carefully disclosing change risk, and making decisions without all emotions. The following list highlights major common mistakes :

Overleveraging :

- Problem : The allure of amplifying profits through borrowing can lead traders to overleverage, exposing them to heightened risks.

- Solution with FlowBank : Utilize risk management for optimal leverage levels that align with your risk tolerance and market strategy.

Neglecting risk management :

- Problem : Underestimating or ignoring the importance of risk management can lead to significant financial losses.

- Solution with FlowBank : FlowBank provides comprehensive risk management tools, including stop-loss orders and limits, to help you safeguard your investments.

Emotional Trading :

- Problem : Allowing emotions like fear or greed to dictate trading decisions often results in impulsive actions and losses.

- Solution with FlowBank : Leverage FlowBank's analytical resources and educational content to develop a disciplined, strategy-driven approach to trading.

Conclusion

For novice CFD traders, the journey to success is paved with dedication, continuous education, and meticulous strategic planning. This commitment involves immersing oneself fully in understanding how the markets operate and the inherent risks involved.

Constant learning is crucial, entailing keeping abreast of market trends, mastering risk management techniques, and familiarizing oneself with various trading tactics. Essential to strategic planning is the effective management of your investment capital, emotional resilience, and the development of robust strategies for entering and exiting trades.

Adhering to these principles, beginners can significantly enhance their prospects for long-term success, navigating the complexities of CFD trading with confidence and proficiency.

Join us on your trading journey

At Flowbank, we're here to educate you through each step of your Forex trading path. With our robust platform and dedicated support, we're committed to helping you understand the markets, manage risks effectively, and trade with purpose and confidence.

Join us at Flowbank, where every trader's journey is valued, and the quest for trading mastery never ends.

.png?width=630&height=262&name=Getting%20Started%20with%20CFD%20Trading%20(1).png)