Engaging in Forex trading offers enticing opportunities, yet it's crucial to be aware of the inherent risks involved. At Flowbank, we stress the critical need for all traders, from novices to experts, to have a thorough understanding of the various risks associated with Forex trading. This knowledge is key to navigating the market effectively, regardless of one's experience level.

This article delves into the various risks of the Forex market and provides strategies for effective management. With a clear understanding of risk and appropriate mitigation measures in place, traders can make informed decisions and navigate the market with confidence.

Understanding Forex market volatility

At its core, volatility in the Forex market refers to the degree of price fluctuations of currency pairs over a specific period. It’s measured by the difference between the opening and closing prices within that timeframe. For instance, a currency pair with daily movements of 5-10 pips is considered less volatile compared to one with fluctuations of 50-100 pips.

Certain currency pairs and individual currencies naturally exhibit more volatility. Safe-haven currencies like the US dollar, Swiss franc, and Japanese yen typically experience less volatility. In contrast, emerging markets and exotic currencies such as the Turkish Lira, Mexican Peso, Indian Rupee, and Thai Baht are often more volatile.

However, there's a currency pair suited to every trading style and preference. While some traders excel in the dynamic environments of highly volatile markets, others prefer the relative stability of trading safe-haven currencies. Flowbank's expertise and resources are designed to guide traders in identifying the currency pairs that align best with their trading strategies and risk tolerance.

Factors contributing to market fluctuations

Forex trading, akin to sailing in vast seas, is subject to various forces that can lead to unpredictable market movements. Here's an easy-to-understand explanation of these influences :

- Geopolitical Events : Imagine global politics as a chess game where significant moves (like political upheavals or military conflicts) can shake the currency markets. For instance, if a country faces political instability, its currency might fluctuate wildly, much like a boat in choppy waters.

- Trade Wars : Consider this as a high-stakes negotiation between countries, impacting huge sums of money. When powerhouse nations like the USA and China engage in trade disputes, it creates ripples in the forex market. Such economic standoffs can either strengthen or weaken the involved currencies, affecting traders globally.

- Monetary Policies : Central banks act as the economy's navigators. They adjust interest rates, similar to adjusting the sails of a ship, to maintain economic balance. When institutions like the US Federal Reserve or the European Central Bank change their rates, it can cause significant shifts in currency values, akin to changing wind directions affecting a sailboat’s course.

- Market Sentiment : This is the collective mood of traders and investors. If the majority are optimistic and buying a currency, its value may rise (like a stock becoming more valuable as more people invest in it). Conversely, widespread selling due to pessimism can decrease a currency's value, similar to a product losing its demand in the market.

At Flowbank, we equip traders with the knowledge and tools to understand these dynamic forces in the forex market. Our platform offers insights and resources to help traders make informed decisions, ensuring they can sail through the complex currents of forex trading with confidence and expertise.

Understanding the impact of volatility in Forex trading

Volatility in Forex trading is like the daily tide - it brings both risks and opportunities. Understanding how it affects your trading style is key :

- Short-Term Trading : This is for those who like quick action. Day traders make their moves based on hourly price shifts. Think of them as sprinters in a race, seizing quick opportunities.

Swing traders, on the other hand, hold out a bit longer - a few days or weeks. They're more like long-distance runners, using tools to predict when to start and finish their race. Both styles thrive on the ups and downs of market prices. - Long-Term Trading : Then there are the long-term traders. They're in it for the long haul, like gardeners who plant seeds and wait for them to grow. These traders know that small price moves, over time, can add up to big gains. They need patience and a good sense of where the market's headed, often holding onto trades for a long while.

No matter your style, volatility is what makes Forex trading exciting. It’s all about making the right moves at the right time. But remember, it's not just about guts; it's about smart strategies and knowing the market. That's where Flowbank comes in - we're here to help you learn Forex, giving you the tools and advice to make your trading journey smoother and more successful.

1. Navigating leverage risks in Forex Trading

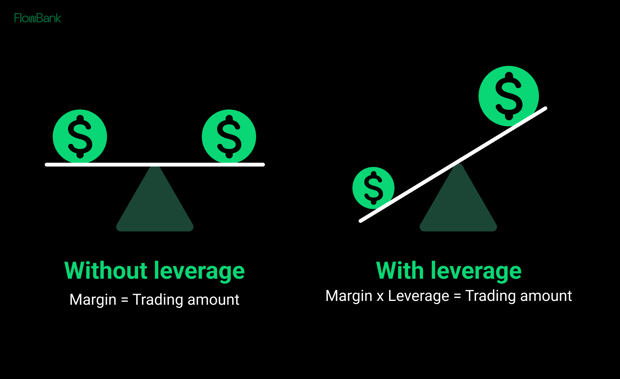

Understanding and managing leverage is essential in Forex trading. Here’s how leverage works and its implications :

1. Financial Leverage Explained : Leverage in Forex is a ratio, such as 1:1 or 1:100, indicating the extent to which your trading size can be amplified relative to your initial investment. For instance, with a $1,000 investment :

- 1:1 (No Leverage): Trade size of $1,000

- 1:5: Trade size of $5,000

- 1:10: Trade size of $10,000

- 1:20: Trade size of $20,000

- 1:50: Trade size of $50,000

- 1:100: Trade size of $100,000

2. Setting Up for Leverage Trading : The leverage you choose determines how large your trade can be. It allows for significant market exposure with a relatively small initial deposit. However, it’s crucial to select a level of leverage that aligns with your risk tolerance and trading strategy.

3. Importance of Initial Margin : Margin is the required deposit to open a leveraged position. It varies based on the trade size and chosen leverage. For example, to open a standard lot ($100,000) position :

- 1:1 Leverage: 100% margin required

- 1:5 Leverage: 20% margin required

- 1:10 Leverage: 10% margin required

- 1:20 Leverage: 5% margin required

- 1:50 Leverage: 2% margin required

- 1:100 Leverage: 1% margin required

With 1:50 leverage, an investor needs $2,000 in their account as margin for a $100,000 position.

4. Balancing Potential Gains with Risks : While leverage can amplify profits, it also increases the potential for losses. It's not inherently good or bad; its effectiveness depends on your trading knowledge and discipline.

5. Using Leverage Wisely : Leverage should be used judiciously, especially in volatile markets. It’s vital to understand how leverage can impact your trades and to adjust your strategies accordingly.

2. Interest rate risks and their impact on currency values

Understanding how interest rates influence currency values is crucial in Forex trading :

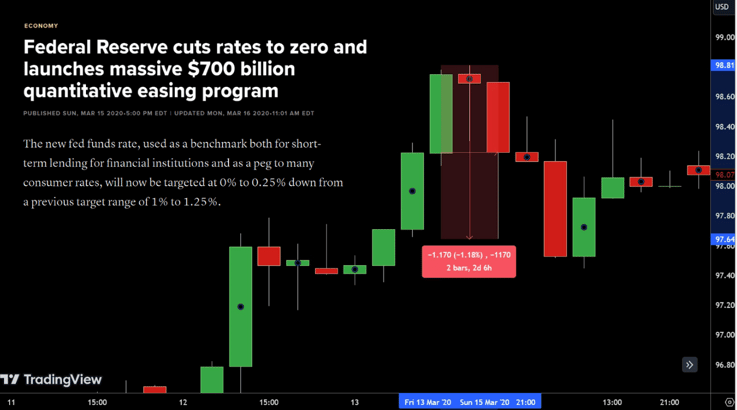

1. Interest Rates and Currency Appeal : High interest rates can make a currency more desirable, boosting its value as investors seek better returns. Conversely, low rates can reduce a currency's appeal, potentially devaluing it. In this example below, the Federal Reserve's decision to lower the interest rate to below 0.25% from the previous rate of 1.25% led to a significant drop in the value of the US dollar against a basket of currencies.

This change is reflected in the Dollar Index's decrease, as indicated by the candlestick chart. It shows a marked decrease in price, with the index falling approximately 1.18%, translating to a 1.17 point drop in the index value. The chart captures the market's immediate response to the interest rate cut, emphasizing the sensitivity of currency values to central bank monetary policy decisions.

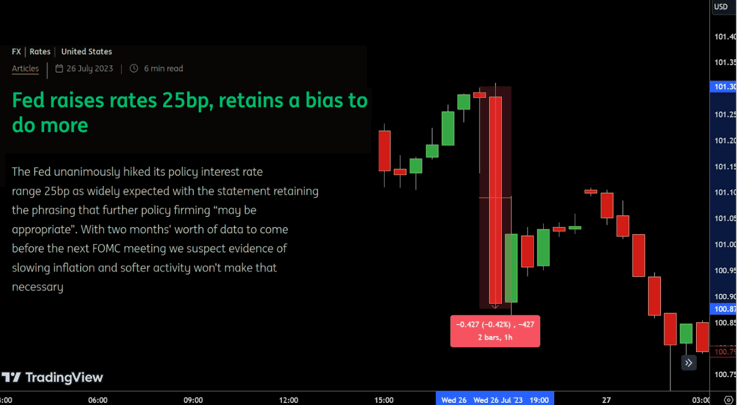

2. Exceptions to the Rule : Exceptions to the standard correlation between interest rates and currency values can occur and often catch traders by surprise. For instance, in a hypothetical scenario, if the Federal Reserve raised interest rates from 5.25% to 5.50%, the expected outcome would typically be a strengthening of the dollar. However, if the market had already anticipated this rate hike and priced it into the dollar's value, the actual announcement could lead traders to take profits, resulting in a decline in the dollar's value.

For instance :

Event : Federal Reserve Interest Rate Decision

Date : July 26, 2023

Action : Interest rate increased from 5.25% to 5.50%

Immediate Market Reaction : Despite the rate hike, which typically would increase the currency's value, the dollar index fell.

Price Change : The dollar index dropped from a pre-announcement price of 101.303 to 100.877.

Percentage Change : This represents a -0.42% decrease.

This is a classic case of "buy the rumor, sell the fact," where the currency reacts contrary to expectations due to market psychology and preemptive positioning by traders.

3. Trading Opportunities : Traders can capitalize on these movements. Buying currencies from countries with rising interest rates can be profitable, as their value may increase. Conversely, short-selling currencies from countries with falling rates can lead to gains if their value drops.

Role of Central Banks in currency rates

Central banks play a key role in influencing currency values through various methods :

1. Adjusting Benchmark Interest Rate :

- Higher rates generally lead to currency devaluation, indicating weak demand for money.

- Lower rates often result in currency appreciation, showing strong money demand.

2. Foreign Exchange Interventions :

- Central banks buy foreign currency to increase demand and strengthen their own currency.

- Selling their currency leads to depreciation due to decreased demand.

3. Fixed Exchange Rate Management :

- Central banks manage foreign reserve policies to maintain a currency peg, keeping exchange rates within a set range.

- An example is China's Central Bank maintaining a peg on the yuan to control its appreciation.

Predicting Interest Rate Movements

1. Central Bank Communications : Forex traders often analyze central bank statements to anticipate interest rate changes. Terms like 'Hawkish' (implying potential rate increases) and 'Dovish' (suggesting potential rate decreases) are critical cues.

2. Carry Trades : Changes in interest rates enable carry trades, where traders profit from the interest rate differential between two currencies. High-yielding currencies are traded against low-yielding ones to earn overnight interest.

3. Political and economic risk factors

Political stability is a cornerstone for attracting foreign investment and strengthening a country's currency. Countries known for their stable governments, like Switzerland, often see their currencies valued higher because investors feel more secure placing their money there. In contrast, nations plagued by political turmoil tend to experience a depreciation of their currency rates due to the perceived higher risk and uncertainty.

Economic performance is another barometer for gauging a currency's strength. A nation boasting a healthy employment rate generally indicates a robust economy with higher consumer spending power. This economic vigor attracts foreign capital, bolstering the currency's value. However, it's not just about the employment figures; "economic health" encompasses a suite of interrelated factors including but not limited to interest rates, inflation levels, and the balance of trade. Collectively, these elements paint a picture of a nation's economic stature and, by extension, the potential trajectory of its currency in the Forex market.

4. Geopolitical events impacting currency rates

Geopolitical events can significantly sway the currency market in various ways :

- Policy Changes : Geopolitical tensions can lead to new economic policies or alter existing ones, affecting market dynamics. For example, trade sanctions imposed due to geopolitical conflicts can disrupt currency values by limiting market access or imposing additional costs on trade.

- Economic Growth : Political unrest, like coups or civil strife, can halt a country's economic progress. This often results in a less favorable outlook for the economy and its currency. To counteract economic downturns, governments might resort to austerity measures, which could include tax hikes and spending cuts.

- Supply Chain Disruptions : Natural disasters or health crises like pandemics can disrupt a country's production and exportation of goods, impacting its currency value. For instance, a major earthquake in a country can destroy infrastructure, slowing down economic activity and depreciating the currency due to reduced investor confidence.

However, geopolitical changes can also have positive effects. A country that successfully resolves a regional conflict may see economic growth due to improved stability, which can attract foreign investment and strengthen its currency.

Central Bank’s Role : Regarding economic policies, central banks play a pivotal role in shaping them. These policies are a set of tools designed to keep inflation in check and foster stable economic growth. For example, when a central bank raises interest rates to combat inflation, it can make the currency more attractive to investors because of the higher returns on investments denominated in that currency. Conversely, lowering interest rates can discourage investment and decrease a currency's value.

Risk management strategies in Forex Trading

Risk management is an essential part of Forex trading that helps traders minimize losses and protect their investments. Here are some strategies to manage risk effectively :

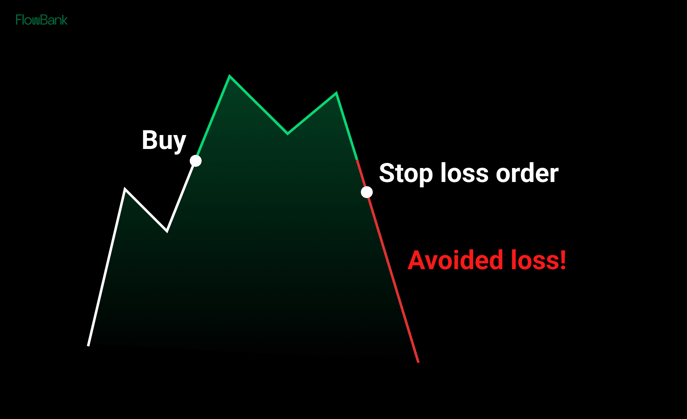

1. Set Stop-Loss Orders : A stop-loss order acts as a safety net, automatically closing a trade when it reaches a certain loss level. By setting a stop-loss, you limit potential losses on both long and short positions, tailoring it to your trading style and risk tolerance.

Source : Babypips

2. Diversify Currency Pairs : Don't put all your eggs in one basket. By trading multiple currency pairs, you spread the risk. If one currency pair moves against you, the losses can be offset by gains in another, reducing your overall exposure to currency risk.

3. Implement Protective Measures : Protective measures, such as maintaining a defined risk-reward ratio, help ensure that potential losses are proportionate to anticipated gains. By sticking to this ratio, you make sure that the risks you take are justified by the potential returns.

Incorporating these risk management strategies into your Forex trading can lead to more consistent results and prevent significant losses that could jeopardize your trading account. Always approach trading with a plan that includes solid risk management tactics.

The importance of a solid trading plan

Having a solid trading plan is crucial in Forex trading. It's the difference between navigating the market with a clear direction or being tossed around by the whims of market sentiment. Here's why a well-thought-out trading plan is non-negotiable :

Building a Risk-Averse Strategy

In Forex, as in any form of trading, the less your decisions are influenced by emotions, the better. A risk-averse strategy emphasizes protecting your capital and aiming for consistent, stable returns. This approach involves :

- Establishing clear goals, such as desired returns over specific time frames.

- Crafting a detailed strategy that sets out entry and exit points, acceptable risk levels per trade, and position sizes.

The role of consistency and discipline

Consistency in trading is about making informed decisions based on a well-considered strategy, not reacting to every market twitch. It fosters a disciplined approach, crucial for managing risk and maintaining the right trading mindset. Discipline isn't just innate; it's a skill that can be developed with practice.

Summing up : Navigating Forex trading risks with confidence

Risk management is the backbone of trading. It includes using stop-loss orders to cap potential losses, diversifying your currency pairs to spread risk, and using leverage judiciously to control exposure. Despite all precautions, Forex trading carries inherent risks. But by understanding these risks and employing strategies to manage them, you can aim to minimize losses and enhance potential gains. It's about playing the long game, using every tool at your disposal to ensure that your Forex journey is as profitable as it can be, even when the market tests your resolve.

Ultimately, a solid trading plan and a disciplined approach to risk management are your best allies in the Forex market. These strategies not only protect your investment but also give you the confidence to trade with clarity and purpose.

Join us on your trading journey

At Flowbank, we're here to educate you through each step of your Forex trading path. With our robust platform and dedicated support, we're committed to helping you understand the markets, manage risks effectively, and trade with purpose and confidence.

Join us at Flowbank, where every trader's journey is valued, and the quest for trading mastery never ends.