1045 days ago

Ark fans must not fear: Cathie Wood is back

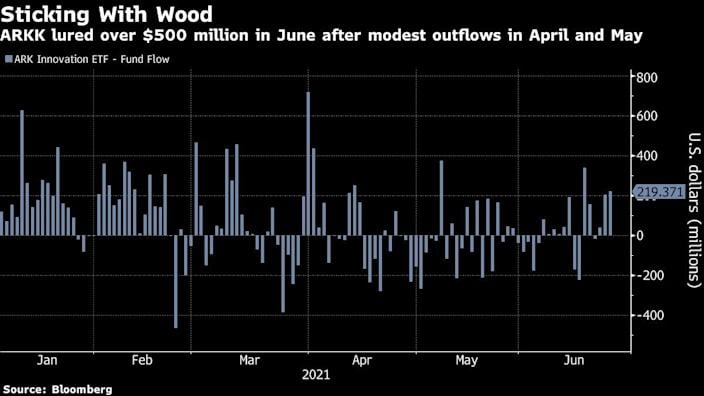

ARKK managed to attract over $500 million of inflows in the month of June, after rather modest outflows in the two previous months. The company's pile of asset under management is rising once again, and her flagship fund has gained 26% since the May low. The question remains: can she keep going? Many analysts argue that her stock picks are long-term ones, as they're mostly based on hypergrowth technology stocks. The only threat would thus only be interest rates expectations, which needs to stay still so that tech can remain well bid.