360 days ago

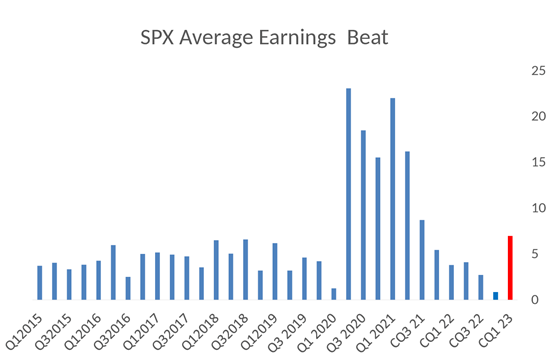

S&P 500 Average #Earnings Beat $SPY $QQQ #trading #bears #bulls

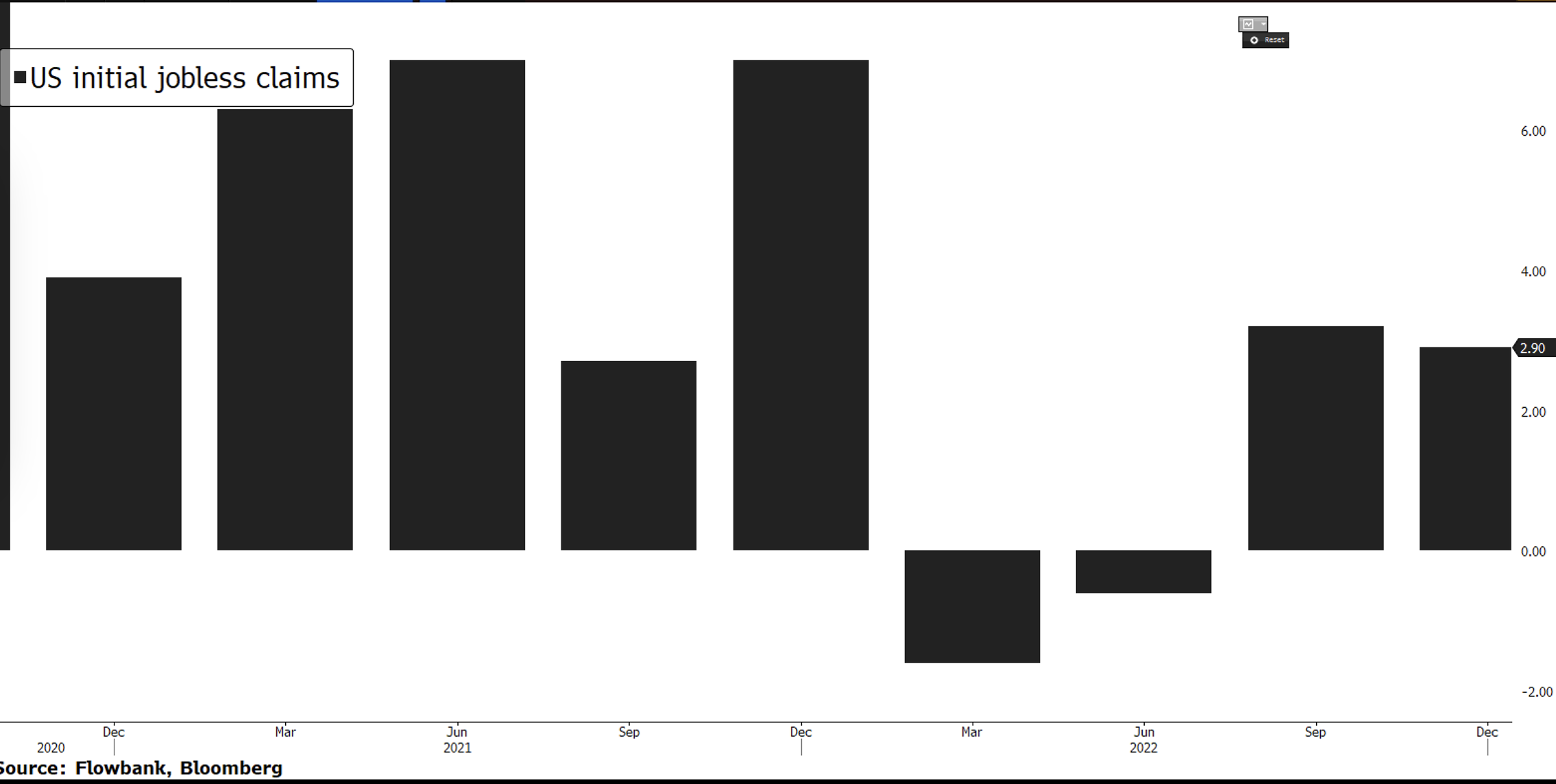

The earnings season is doing much better than expected, particularly for companies with pricing power muscle. Bulls have won, but they will need to perhaps caution as valuation are now overall expensive. ⚠️ "price is what you pay, value is what you get". Also, a word of caution, as so far it's earnings, not revenues, which are putting in the impressive beats. Per Bloomberg, "What is more striking is that the average earnings beat has jumped to 7%, really a 2021 type level beat and among the highest beat levels in the recent years." Source: Bloomberg