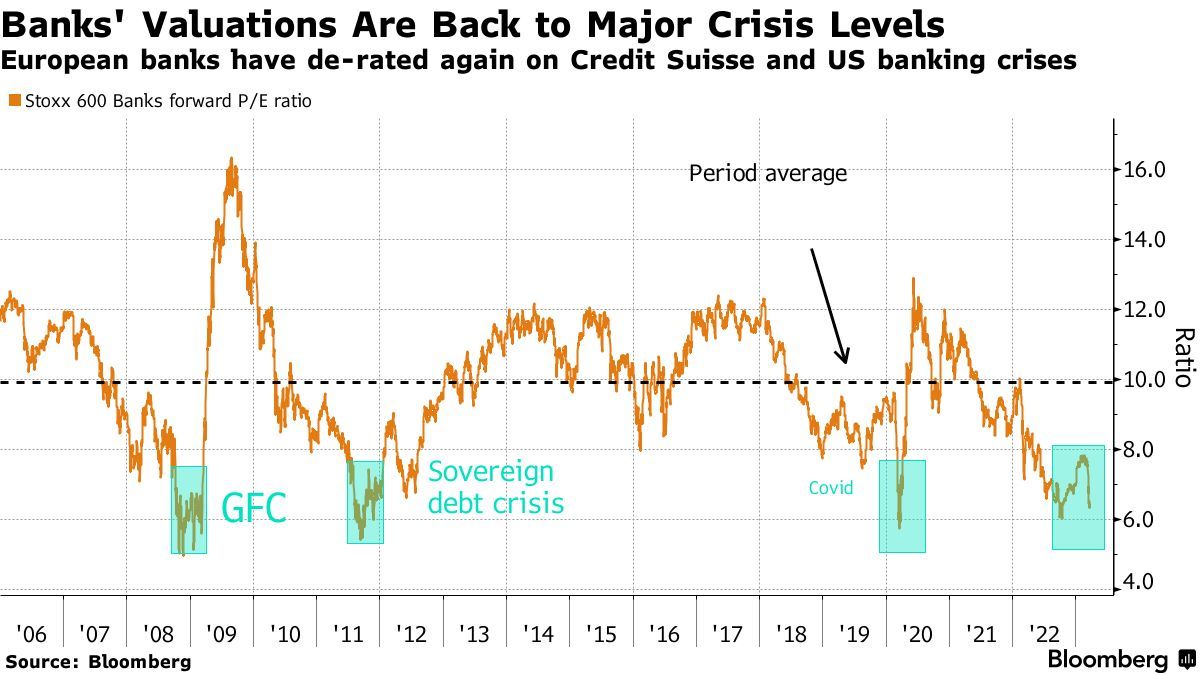

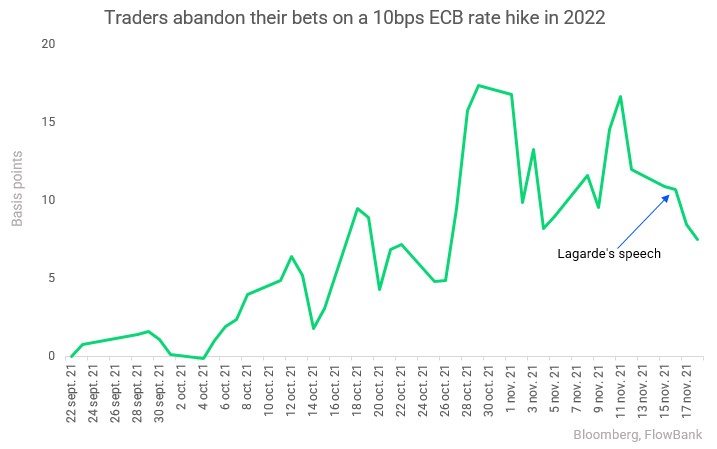

Bloomberg reported sell-side analysts are particularly bullish on European banks stocks for next year. Recent market weakness, combined with rising earnings estimates imply a roughly 22% potential gains for the Stoxx 600 Banks Index. It's about double the return versus what's expected for the broader Stoxx Europe 600. According to analysts, strong earnings recovery, tighter monetary policy outlook (rising rates particularly), and relatively low valuations are factors supporting the outlook for European banks. Similarly, in the US momentum for banks has been particularly strong amid a buoyant economy and Fed tightening. JP Morgan yesterday named Bank of America its top pick for 2022.