945 days ago

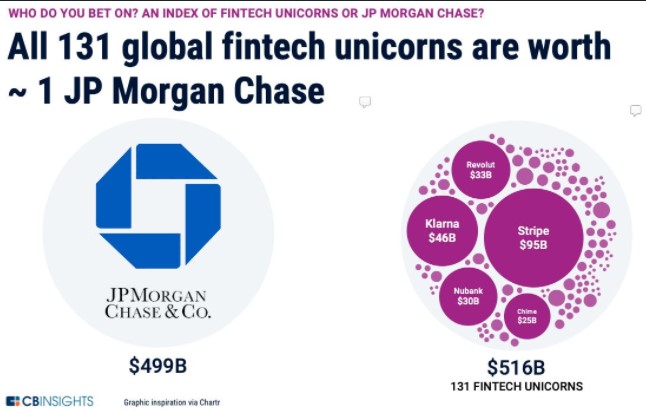

Fintech unicorns or JP Morgan? Who do you bet on?

CB Insights graphic showcasing an interesting question: JPM or a Fintech index?

945 days ago

CB Insights graphic showcasing an interesting question: JPM or a Fintech index?

957 days ago

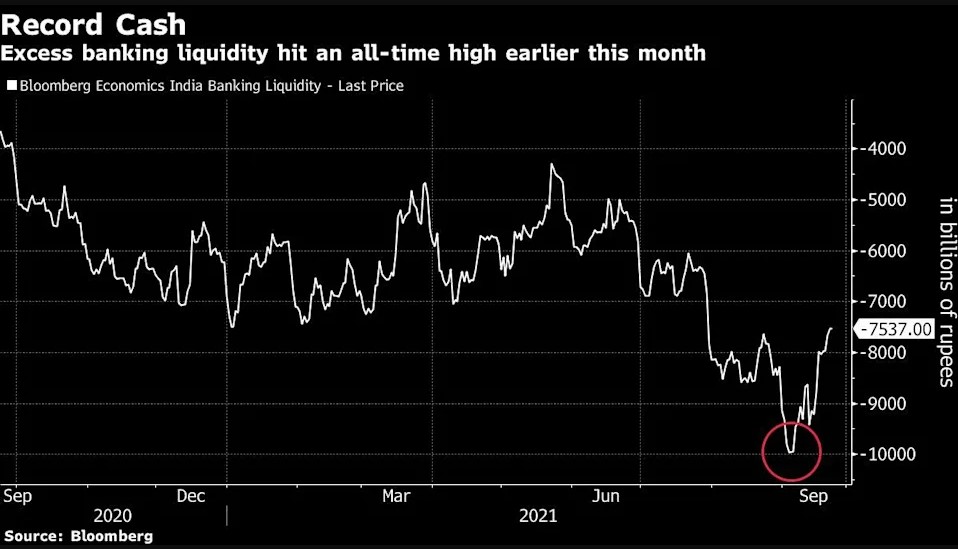

Traders are seeing hints that India's central bank is seeking to drain record liquidity from the banking system, another sign that the global flood of pandemic-era easy money may begin to ease. The Reserve Bank of India is increasingly shifting its forex intervention to the forwards market to keep from injecting rupee liquidity. @Bloomberg

958 days ago

The Swiss National Bank is retaining its ultra-loose monetary policy, it said on Thursday, despite early moves by the European Central Bank and the U.S. Federal Reserve to start normalising policy during the post-pandemic recovery. The SNB kept its policy rate locked at minus 0.75%, as unanimously forecast by economists in a Reuters poll, the same rate it charges on sight deposits held by commercial banks. The central bank repeated its commitment to foreign exchange interventions "as necessary" to curb the appreciation of the safe-haven Swiss franc, which it continued to describe as "highly valued". @Yahoo

959 days ago

The Chinese central bank increased its gross injection of short-term cash into its financial system after concern over a debt crisis at China Evergrande Group roiled global markets. Indeed, there was a strong need to calm down markets, as Chinese stocks are tumbling with the CSI 300 Index falling 1.9% on Wednesday only. However, analysts believe that Evergrande will not be a second episode to the Lehman Brothers series. Source: Bloomberg

961 days ago

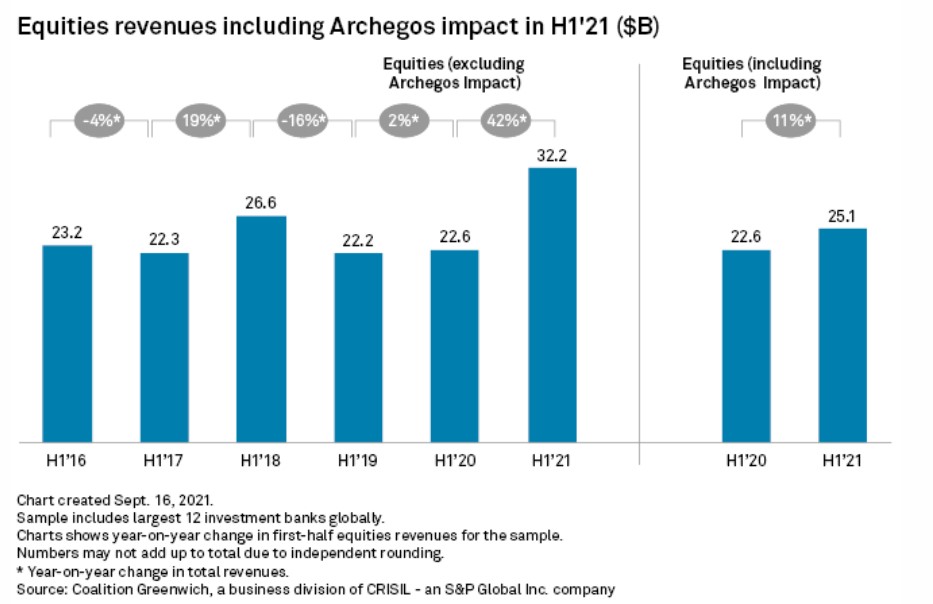

Putting the Archegos problems aside, in aggregate, the top 12 banks saw first half equities trading revenues surge 42% to $32 billion, which is its best in a decade. French banks bore the brunt of the turmoil created by the pandemic in 2020 as firms canceled dividends, which hit the banks' structure derivative business. The French banks' recovery in the second quarter was a key driver of equities revenue growth in Europe. @S&PGlobal

CFDs are complex instruments and are not suitable for everyone as they can rapidly trigger losses that exceed your deposits. You should consider whether you understand how CFDs work. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk.

This website is owned and operated by FlowBank S.A, a company regulated by the Swiss Financial Market Supervisory Authority (FINMA) and a member of esisuisse. The list of banks and securities firms authorized by FINMA can be accessed here. Depositor protection in Switzerland is provided by esissuisse for a maximum of CHF 100,000.- per client. Details concerning this protection system are explained at www.esisuisse.ch/en

FlowBank is affiliated with the Swiss Banking Ombudsman. Therefore, if you wish to initiate a mediation procedure with the Swiss Banking Ombudsman after your complaint to FlowBank, please contact the Ombudsman according to the instructions provided on its website: https://bankingombudsman.ch/en/

The information on this site is not directed at residents of the United States, Belgium, Canada, or any person in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

Trading Forex and other leveraged products carries high risks and may not be apt for everyone. Before you consider trading these instruments please assess your experience, goals, and financial situation. You could lose your initial investment, so don't use funds you can't afford to lose or that are essential for personal or family needs. You can consult a licensed financial advisor and ensure you have the risk tolerance and experience.

Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

FlowBank S.A, Esplanade de Pont-Rouge 9, 1211 Geneva 26, Switzerland

FlowBank S.A, Seidengasse 20, 8001 Zurich, Switzerland