780 days ago

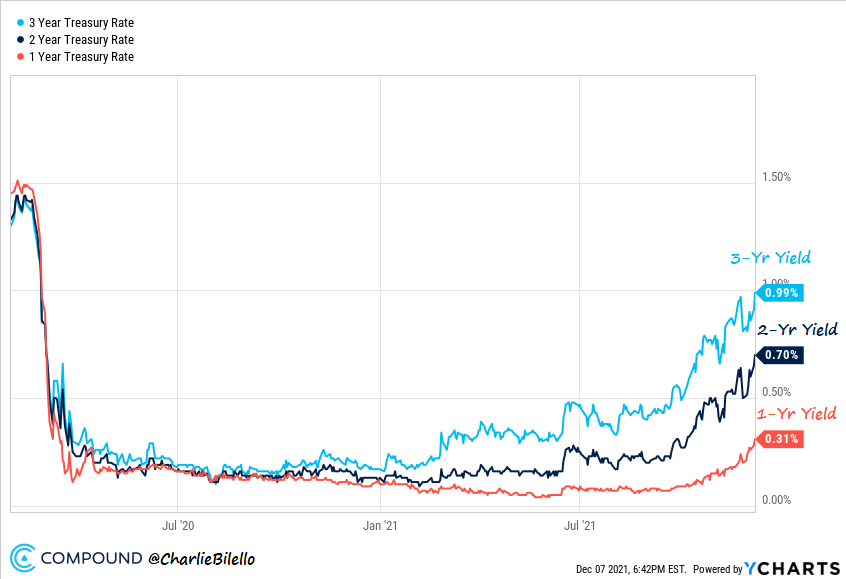

Yields inverted. Any impact on #stocks? #spy #yields #trading

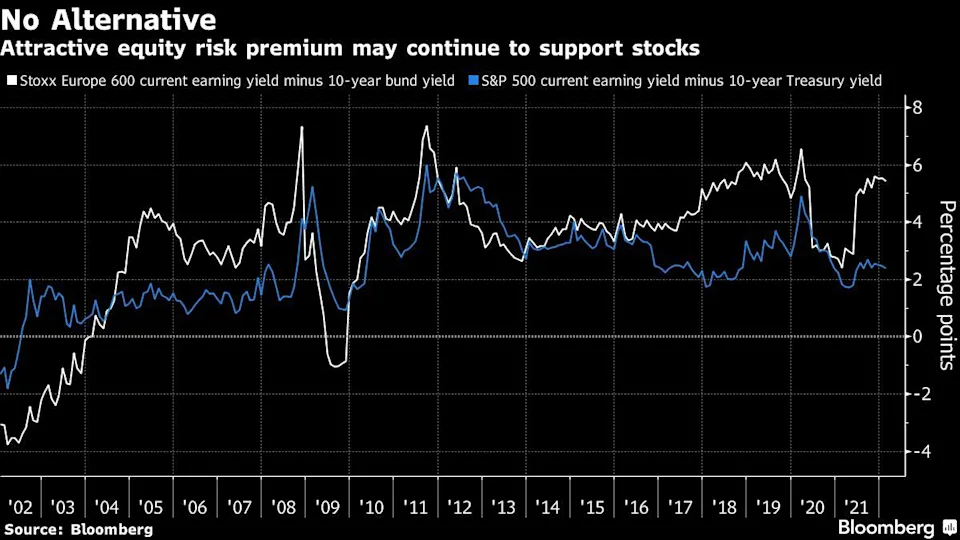

Yields on the 2-year Treasuries briefly exceeded those on the 10-year Yesterday, a first since 2019, a sign that bond investors are pessimistic about the long-term outlook. Historically, inverting yield curve, an abnormal state, did lead to recessions in the US as Fed officials pursued an aggressive tightening policy to combat inflation. But it is important to note that the inverting yield curve by itself has not been the catalyst for a drop in equity markets. Consequently, while yesterday's move is rare in its kind, it does not necessarily represent a threat to stocks in the near term.