800 days ago

A volatile day ahead for the euro #EURUSD #ECB

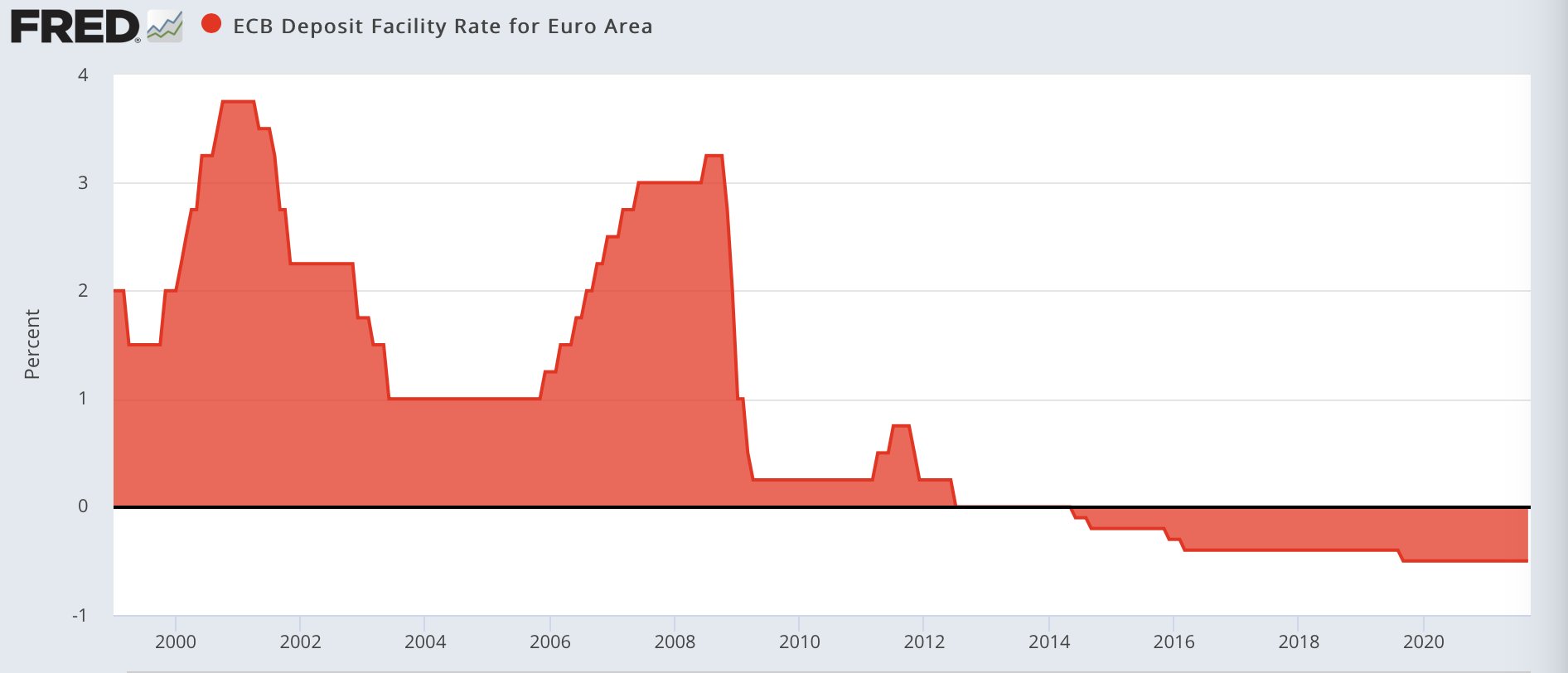

The euro is losing some strength against the US dollar just ahead of the European Central Bank meeting. Early in the week, following a report indicating that the Euro Zone is planning to jointly issue bonds and news that the conflict may last less than expected, the European currency had a strong rebound. Though this morning the euro (-0.35%) is returning to the threshold of 1.10 dollars. Traders are wondering how the monetary institute will react to Russia's invasion of Ukraine and its economic consequences. President Christine Lagarde will have a difficult job finding the words to explain that the central bank wants to remain flexible while reassuring the market that it is taking rising inflation risks seriously.