368 days ago

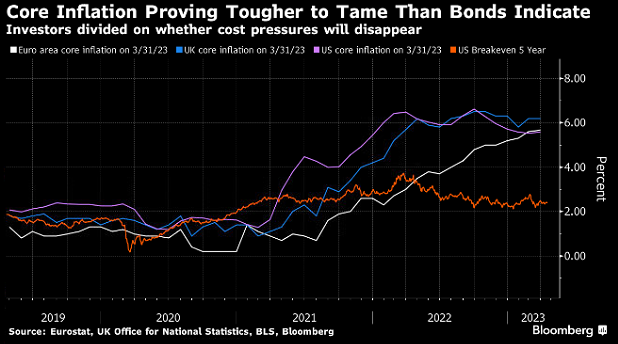

#Inflation at Highest Level in Decades – #Investors are divided #stocks $SPY

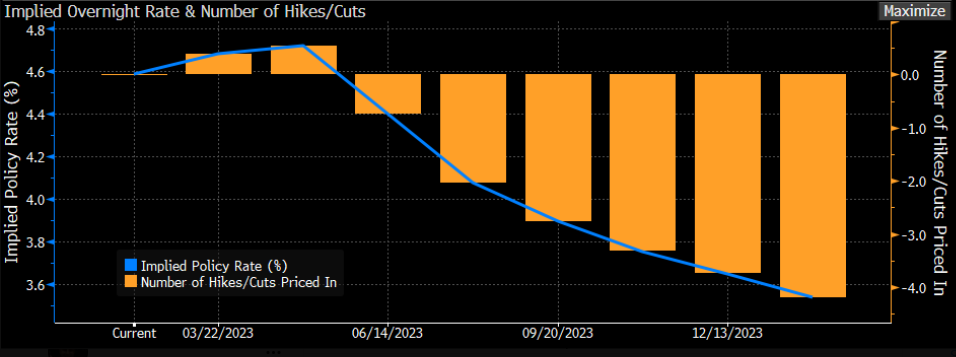

Investors are split over how much further inflation will retreat. Determining the direction of inflation should be key to tactical investment positioning. Investors will watch PCE data on Friday for clues on US inflation. Do you see Core inflation staying elevated or coming down?