586 days ago

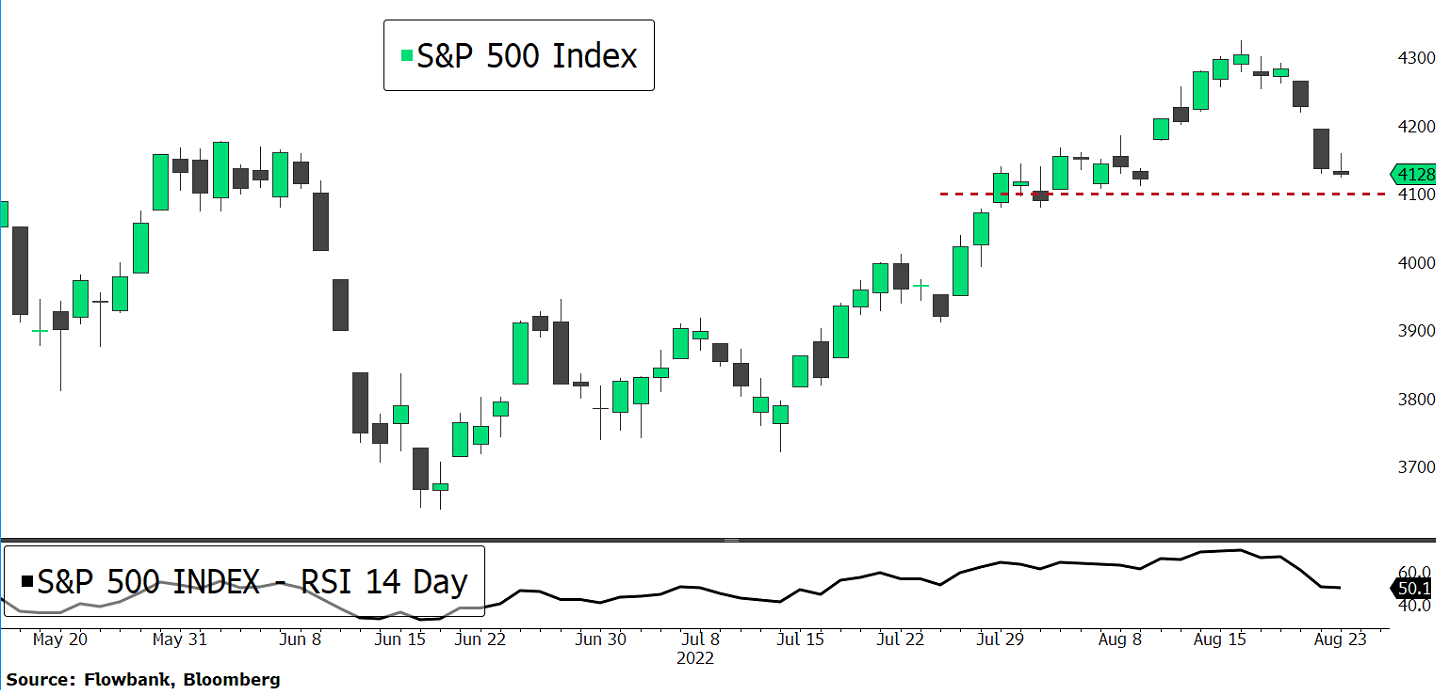

#Stocks rebound on better economic data #markets #trading

Stocks are seeing positive momentum after this mornings better than expected economic data. The UK reported higher growth numbers and softer housing prices, a net positive for inflation. And the Swiss KOF leading indicator also came stronger than estimated, pointing to a better growth outlook in the region.