726 days ago

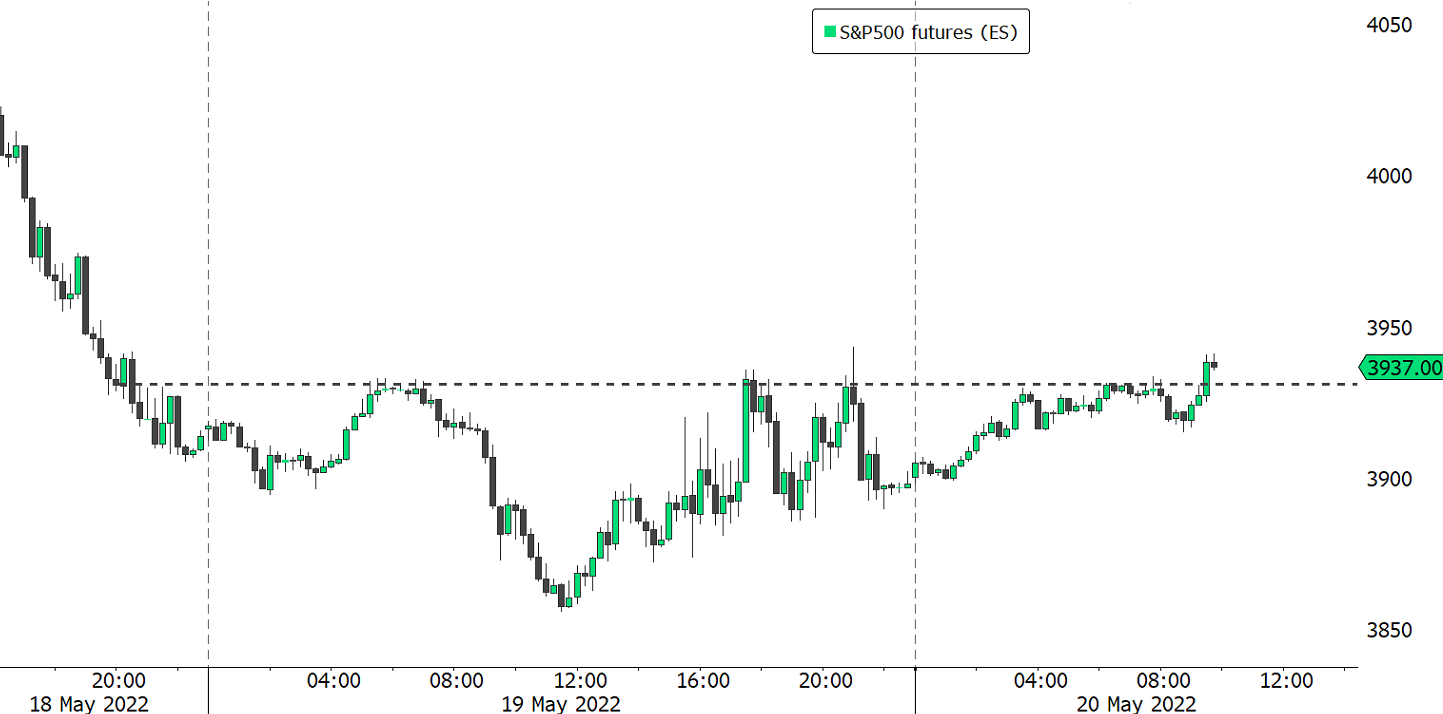

#Bonds rise on #growth scare #trading #fed

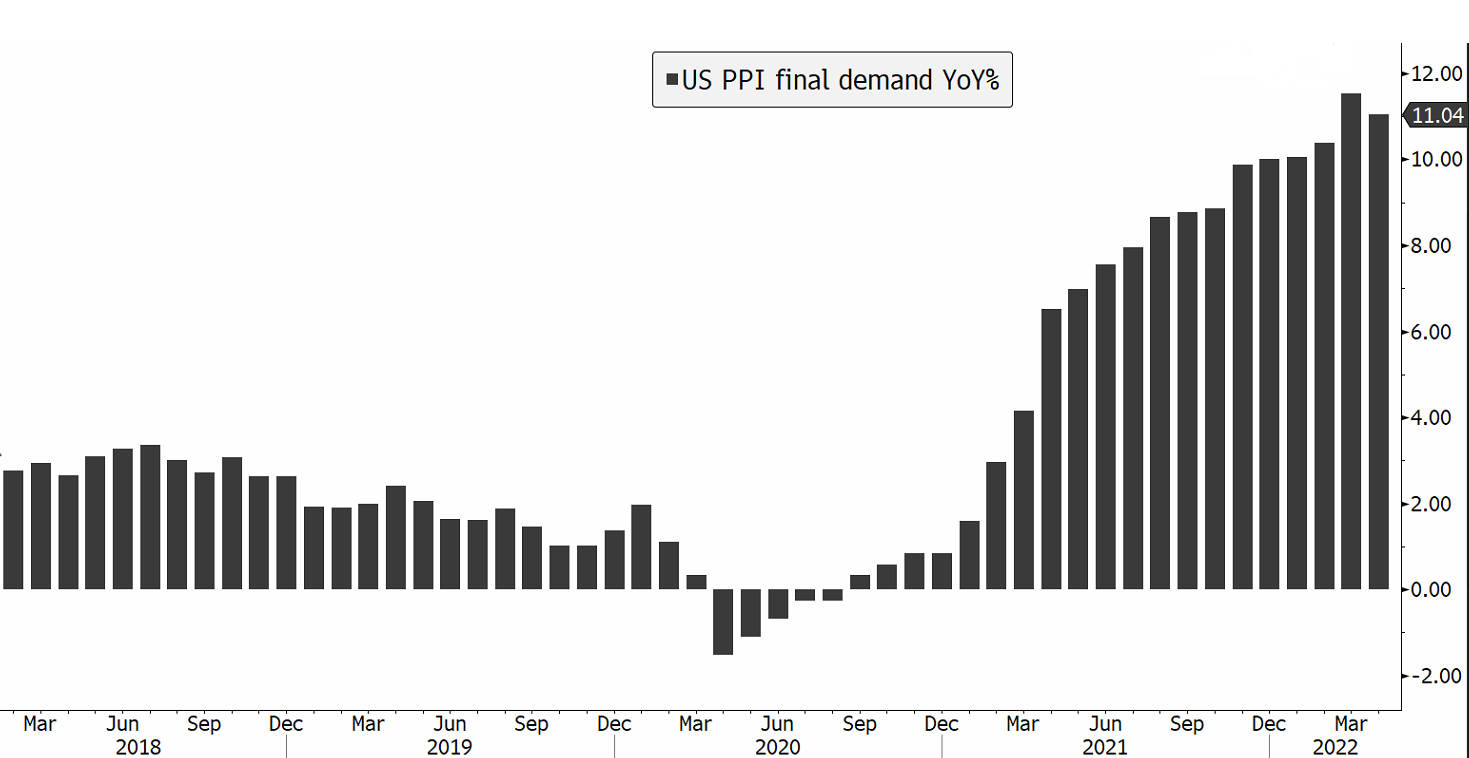

Amid a sharp fall in US stock markets for much of the past month, a fundamental shift in investors' thinking appears to be taking place, one which analysts describe as a "growth scare". A growth scare is characterized by a correction in anticipation of slowing economic growth. For a good portion of this year, bonds displayed a positive correlation with equities: that is, a selloff in bonds was accompanied by a selloff in equities. However, now, we're seeing bonds rally while equities continue to drop. The subtle shift is that bonds are starting to act as a safe haven as markets are expecting that aggressive tightening is rising risks of demand destruction which is likely to lead to lower growth.