851 days ago

#Yields rise, causing #markets to pull-back. #stocks #rates #trading

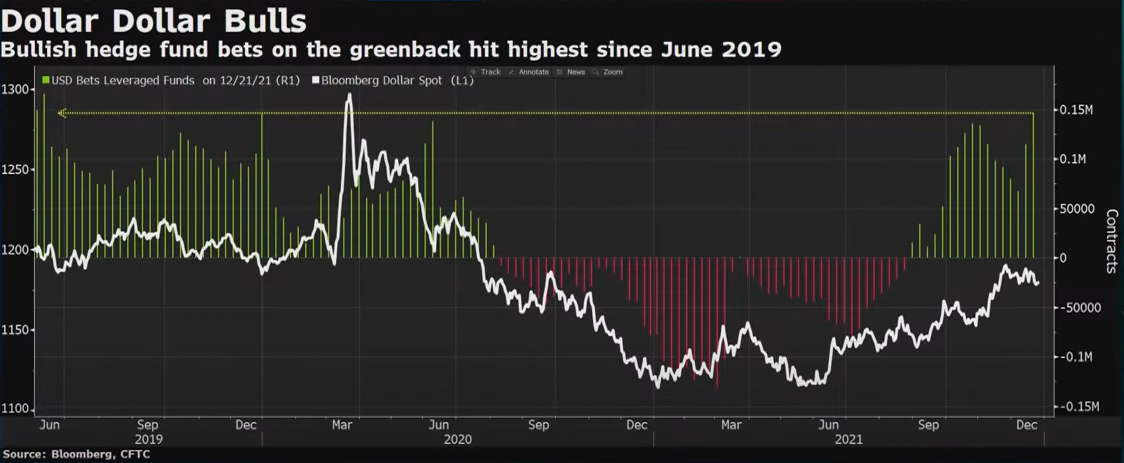

Yields on US 10-year Treasury Note is causing havoc on markets, up 4-5bp at 1.83%, after retreating from 1.857% at one point. Investors are expecting interest rates to rise and its putting pressure on the yield curve. The rise in borrowing costs is pressuring down stocks globally this morning. The Nasdaq is lower by 1.7% and the S&P 500 by 1%. Europe's Stoxx 500 is down by 1%. As we are entering earnings season, stocks are particularly sensitive as companies resume buybacks only after earnings are out. More visibility from central banks would be welcomed by markets and possibly lower the volatility.