1109 days ago • Posted by Jasper Lawler

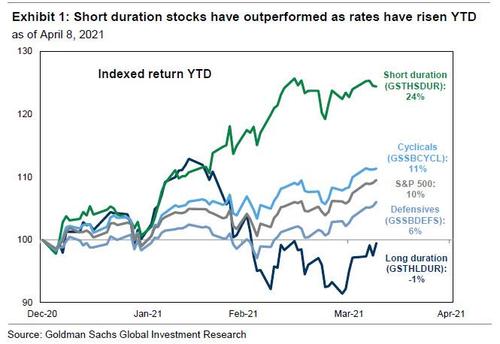

Trading rates sensitivity with short duration stocks has created alpha

The strong focus on inflation as well as governemnt debt issuance has pushed up bond yields and any stocks senstive to interest rates this year.

A sector-neutral portfolio of short duration stocks (GSTHSDUR) has climbed by +24% YTD compared with a -1% return for a long duration portfolio (GSTHLDUR). As Exhibit 1 shows, duration has been a major contributor to alpha generation.

Source: Goldman Sachs / Zerohedge