Have you heard of people who trade all types of financial markets - from gold to stocks to currencies - all through one online trading account? They were probably trading CFDs - and with the help of this guide - you can too!

Overview: What is CFD Trading?

Imagine you could trade stocks, currencies, or commodities without the need to physically buy or sell them. That's where CFD trading comes in!

CFD stands for "Contract for Difference." It's a type of trading that allows you to speculate on the price movements of various financial assets without actually owning them. When you trade CFDs, you're speculating on whether the price of an asset will go up or down.

Think about it: when you are trading - you want something you bought to go up in price - or something you sold to go down in price. You don’t actually need to own the thing you are buying and selling like when you are investing for the long term - you just want to benefit from the price difference of when you bought and sold it.

CFD trading is popular because it offers opportunities in various markets, including stocks, indices, commodities, cryptocurrencies, and more. Additionally, you can access both rising and falling markets, potentially making profits in any economic situation.

Understanding CFD Trading

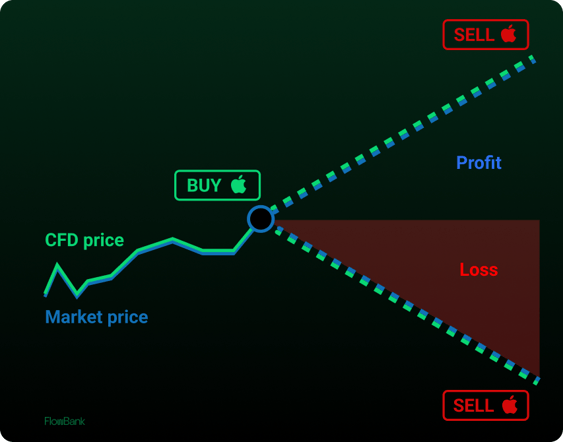

When you open a CFD trade, you use a trading platform to enter into a contract with a broker. If you predict that the asset's price will rise, you go "long" (buy). If you predict the price will fall, you go "short" (sell). As the asset's price moves in the direction you predicted, you profit. However, if it moves against you, you'll incur a loss.

The diagram above shows a theoretical trade to buy Apple stock CFDs. You can see the CFD price has been rising, and then you decide to buy it. If the price of Apple CFDs continues to rise and you sell your CFDs, you’ll stand to earn a profit, whereas if the Apple stock CFD goes down in price and you sell it, you’ll stand to make a loss.

WARNING! Let’s just clarify this important point early on in your exploration of CFDs. CFD trading carries risk, and you should only trade with money you can afford to lose. It's a good idea to learn more about the markets (like you’re doing here!) and develop a trading plan, and use risk management strategies to protect your capital.

The History of CFDs

The history of Contract for Difference (CFD) trading dates back to the early 1990s. It was initially developed as a financial instrument by a British financial institution called Smith New Court, which later became part of the investing arm of Merrill Lynch. The main reason behind the creation of CFDs was to offer an alternative way for institutional investors to hedge their positions in the UK stock market without incurring certain taxes. The first CFD trade occurred in 1990 between two hedge fund managers, Jon Wood and Brian Keelan, and their brokerage firm Tullett & Tokyo.

The concept gained popularity among institutional investors, and by the late 1990s, CFDs started becoming available to retail traders as well. Over time, CFD trading expanded beyond the UK and became popular in other countries, driven by advances in technology and the growth of online trading platforms. Brokers started offering CFDs on various financial instruments, including stocks, indices, currencies, commodities, and, later, even cryptocurrencies.

CFD Trading vs Other Financial Instruments

Although very popular and arguably the easiest to access for individual traders, CFDs are not the only instrument available on a trading platform. It’s well worth considering all your options and thinking about what it is you’d like to achieve.

CFDs vs Stocks

CFDs offer speculative trading without owning the underlying stock, providing leverage for potentially higher gains but increasing the risk of losses. Stocks grant ownership in a company, offering potential dividends and long-term investing, but lack leverage and can incur additional fees.

CFDs vs Forex

CFDs allow the trading of various assets, including stocks, commodities, and cryptocurrencies, with potential leverage. Forex focuses solely on currency pairs, offering high liquidity and lower costs, but with limited diversification.

CFDs vs Futures

CFDs are flexible contracts with no expiration date, accessible through brokers, and offer diverse markets. Futures are standardized contracts traded on exchanges, with set expiration dates and strict specifications.

CFDs vs Options

CFDs allow speculative trading without ownership, offering leverage and diverse market access. Options grant the right but not the obligation to buy or sell an asset at a predetermined price, with limited risk to the premium paid.

|

Category |

CFDs |

Stocks |

Forex |

Options |

Futures |

|

Contract Size |

No standard size |

Number of shares |

Lot size (currency) |

Varies |

Standardized |

|

Ownership |

No ownership |

Ownership in a company |

No ownership |

Right, no obligation |

No ownership |

|

Leverage |

Available |

Not available |

Available |

Available |

Available |

|

Expiration |

No expiration |

No expiration |

No expiration |

Expiry date |

Expiry date |

|

Market Access |

Various assets |

Individual stocks |

Currency pairs |

Various assets |

Various assets |

|

Liquidity |

Varies |

High |

High |

Varies |

High |

|

Exchange |

Over-the-counter (OTC) |

Stock exchanges |

Over-the-counter (OTC) |

Options exchanges |

Futures exchanges |

|

Flexibility |

Highly flexible |

Limited |

Limited |

Flexible |

Limited |

|

Settled |

Cash-settled |

Ownership transfer |

Cash-settled |

Cash or physical settlement |

Cash-settled |

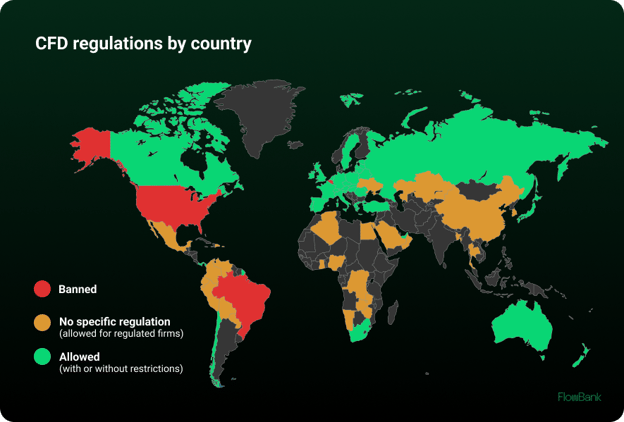

Legal Landscape and Regulations in CFD Trading

The legal landscape and regulations in CFD trading can vary significantly from country to country. In general, CFD trading is subject to financial regulations to protect retail investors and ensure fair market practices.

Each country typically has its financial regulatory authority responsible for overseeing CFD trading activities as well as other types of financial trading and investing. For example, in the UK, it's the Financial Conduct Authority (FCA) and in Switzerland, it is the Swiss Financial Market Supervisory Authority (FINMA).

There are a few steps you can take to protect yourself as a newbie in CFD trading:

- Choose a Regulated Broker: Always select a reputable broker regulated by a recognized authority. Regulation helps ensure that the broker adheres to the required standards and offers client protection. FlowBank is regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA).

- Start with a Demo Account: Many brokers offer demo accounts that allow you to practice trading without risking real money. Use a demo account to familiarize yourself with the trading platform and develop your strategies.

- Use Risk Management: Implement risk management tools like stop-loss and take-profit orders to protect your trades from significant losses and secure profits.

- Don't Overleverage: While leverage can amplify gains, it can also lead to substantial losses. Use leverage cautiously and avoid overexposing your account.

- Avoid Unreasonable Promises: Be cautious of brokers, traders, educators or trade signal providers that make unrealistic promises of guaranteed profits. CFD trading involves risk, and no one can guarantee consistent profits.

Long and Short CFD Trading

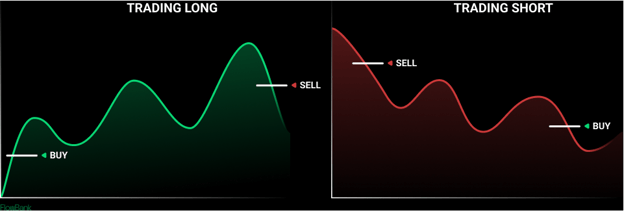

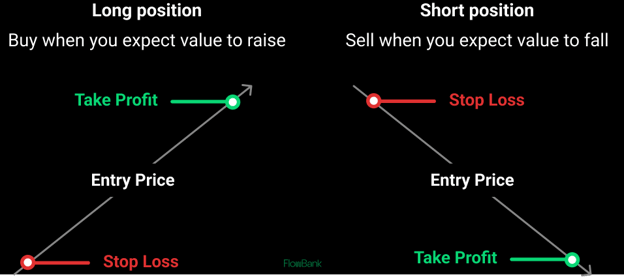

Going short in CFD trading involves the same basic operation as going long but with the intention of profiting from a price decrease rather than an increase.

When going long, you buy a CFD, expecting the price of the underlying asset to rise, and you profit from the price difference between the entry and exit points. On the other hand, when going short, you sell a CFD, expecting the price of the underlying asset to fall, and you profit from the price difference between the entry and exit points.

Example of a Long Position (Win)

Let's say you decide to go long on Microsoft stock using CFDs. You buy 100 CFD contracts of Microsoft at $300 per share, with a total value of $30,000 (100 CFDs x $300). After a few days, Microsoft's stock price rises to $320, and you decide to close your position. You sell the 100 CFD contracts at $320 per share, making a profit of $2,000 (100 CFDs x ($320 - $300)).

Example of a Long Position (Loss)

In another scenario, you go long on Microsoft stock when it's trading at $300 per share. Unfortunately, the stock price doesn't perform as expected and drops to $280 after some days of waiting. You decide to close your position to limit your losses. You sell the 100 CFD contracts at $280 per share, resulting in a loss of $2,000 (100 CFDs x ($280 - $300)).

Example of a Short Position (Win)

Now, let's consider going short on Microsoft stock using CFDs. You sell 100 CFD contracts of Microsoft at $300 per share, with a total value of $30,000 (100 CFDs x $300). As anticipated, Microsoft's stock price declines to $280 in a couple of days, and you decide to close your short position. You buy back the 100 CFD contracts at $280 per share, making a profit of $2,000 (100 CFDs x ($300 - $280)).

Example of a Short Position (Loss)

In a different scenario, you go short on Microsoft stock when it's trading at $300 per share. However, the stock price unexpectedly rises to $320. To limit your losses, you decide to close your short position. You buy back the 100 CFD contracts at $320 per share, resulting in a loss of $2,000 (100 CFDs x ($320 - $300)).

In both long and short positions, the profit or loss is determined by the difference between the entry and exit prices.

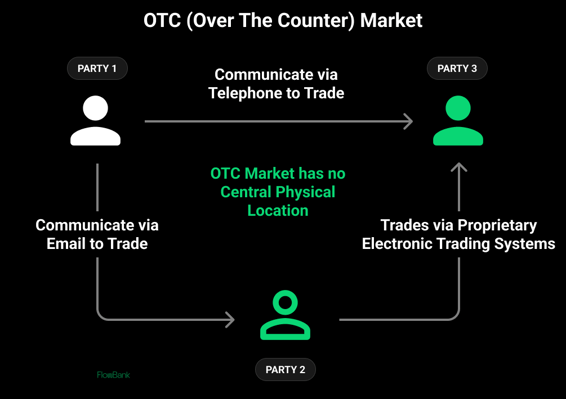

OTC Markets vs Exchanges

CFDs (Contracts for Difference) trade in over-the-counter (OTC) markets, which means they are not traded on formalized exchanges like traditional stocks and commodities. Instead, they are directly traded between parties, usually between individual traders and CFD brokers or market makers.

CFDs are directly negotiated between traders and brokers, without an intermediary exchange. When you trade CFDs, you are effectively entering into a contract with the broker, mirroring the price movements of the underlying asset.

OTC trading offers greater flexibility in terms of contract size, leverage, and duration. Brokers can tailor CFD contracts to suit individual traders' preferences and risk profiles, providing more customization options.

Unlike exchange-traded instruments with set trading hours, CFDs in the OTC market can be traded 24/5, reflecting the availability of the underlying markets and global time zones.

In OTC markets, brokers often act as market makers, providing liquidity by quoting bid and ask prices for CFDs. They essentially create the market, which can lead to potentially narrower spreads compared to exchange-traded instruments.

Leverage in CFD Trading

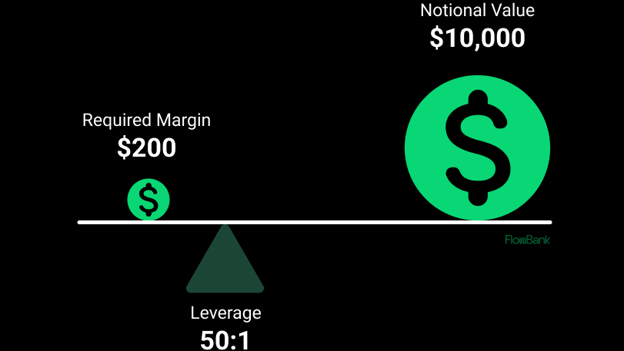

Leverage in CFD trading is a feature that allows traders to control larger positions in the market with a smaller amount of capital. It's like borrowing funds from your broker to increase the size of your trade. The leverage ratio indicates how much more significant your position can be compared to your initial deposit.

For example, if the leverage is 1:10, it means you can control a position ten times larger than the amount of money you deposit. At the time of writing, the maximum leverage available under European regulation is 30:1, whereas, in Switzerland, it is much higher at 200:1.

Let's see a simple example of how leverage works:

Suppose you want to trade CFDs on a stock with a leverage ratio of 50:1, and you have $200 in your trading account.

Without leverage, you can only control a position equivalent to your initial deposit. So, with $200, you can only buy CFDs worth $200.

With a leverage ratio of 50:1, your $200 deposit can control a position worth $10,000 ($200 x 50). This means you can buy CFDs worth fifty times your deposit amount.

Assuming the price of the stock is $100 per share, without leverage, you can buy 2 shares (200 / 100 = 2). But with leverage, you can control a position equivalent to 100 shares (10,000 / 100 = 100).

So, by using leverage, you can have more significant exposure to the market with a relatively small deposit. This amplifies your potential profits, but it also magnifies your potential losses. The misuse of leverage is known as overleveraging and is a common pitfall of beginner traders. It's essential to use leverage carefully and have a clear understanding of the risks involved.

Margin in CFD Trading

In CFD trading, margin refers to the amount of money you need to deposit with your broker to open and maintain a CFD position. It serves as a security deposit, ensuring that you have enough funds to cover potential losses.

The margin requirement is typically expressed as a percentage of the total position value and is determined by the leverage ratio and the contract size.

You can see from this table how different leverage ratios affect the number of shares of a stock you can trade while keeping your margin requirement roughly the same.

|

Number of Shares |

Position Value ($) |

Leverage Ratio |

Margin Requirement ($) |

|

100 |

$10,000 |

05:01 |

$2,000 |

|

200 |

$20,000 |

10:01 |

$2,000 |

|

500 |

$50,000 |

20:01 |

$2,500 |

|

1000 |

$100,000 |

50:01:00 |

$2,000 |

|

2000 |

$200,000 |

100:01:00 |

$2,000 |

Suppose you want to trade CFDs on a stock with a contract size of 1,000 shares. The current price of the stock is $50 per share.

Let's assume the leverage ratio offered by your broker is 1:5.

The margin requirement is the percentage of the total position value that you need to deposit. In this example, let's assume the margin requirement is 5%.

Now, let's calculate the margin required for opening a CFD position:

The total position value is calculated by multiplying the contract size by the stock price:

Total Position Value = Contract Size x Stock Price

Total Position Value = 1,000 shares x $50 per share

Total Position Value = $50,000

The margin required is calculated as a percentage of the total position value:

Margin Required = Margin Requirement x Total Position Value

Margin Required = 5% x $50,000

Margin Required = $2,500

In this example, you need to deposit $2,500 as margin with your broker to open and maintain the CFD position worth $50,000. The leverage ratio of 1:5 allows you to control a position five times larger than your deposit.

What Influences Prices in CFD Trading?

In CFD trading, prices are influenced by various factors, and the influences can vary depending on the asset class being traded. Some common factors that influence prices in CFD trading include the following:

Market Supply and Demand

Like any financial market, the basic principle of supply and demand applies to CFD trading. If there is high demand for a particular asset, its price is likely to rise, and vice versa.

Economic Indicators

Economic indicators such as GDP growth, employment rates, inflation, and interest rates can significantly impact the prices of various assets. Positive economic data may boost investor confidence and lead to higher prices, while negative data can have the opposite effect.

Corporate Earnings and News

For stocks and equity-based CFDs, the financial performance of the underlying companies and their news announcements can influence prices. Positive earnings reports or news can drive prices up, while negative news can lead to declines.

Geopolitical Events

Political and geopolitical events, such as elections, trade disputes, or geopolitical tensions, can cause market volatility and affect asset prices.

Commodity-Specific Factors

For commodities like oil, gold, and agricultural products, supply disruptions, geopolitical tensions, weather conditions, and global demand play significant roles in price movements.

Interest Rates and Central Bank Policies

In forex trading, central bank decisions on interest rates and monetary policies can impact currency valuations and currency pairs.

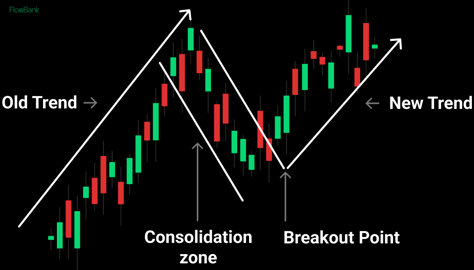

Using Technical Analysis for CFDs

Technical analysis is a popular approach used by many traders to analyze and forecast price movements in multiple asset classes without requiring intricate knowledge of each asset's fundamentals. Technical analysis involves studying historical price charts, patterns, and market indicators to identify potential trends and reversals.

Traders employing technical analysis can use various tools like moving averages, trendlines, support and resistance levels, and oscillators to make trading decisions. These tools can be applied to various asset classes, such as stocks, forex, indices, and commodities, allowing traders to spot potential entry and exit points based on price patterns and market trends.

Technical analysis provides a more systematic and objective way of trading, allowing traders to focus on price action rather than delving into the specific fundamentals of each asset. However, it's essential to recognize that while technical analysis can be a valuable tool, it's not foolproof, and market movements can also be influenced by unexpected events or changes in fundamental factors.

How does CFD Trading work?

Before you even think about deciding which CFDs to buy and sell, you need to get comfortable with how to execute your ideas a trade. That requires an understanding of a few core concepts and you can put these ideas into practice using a demo trading account.

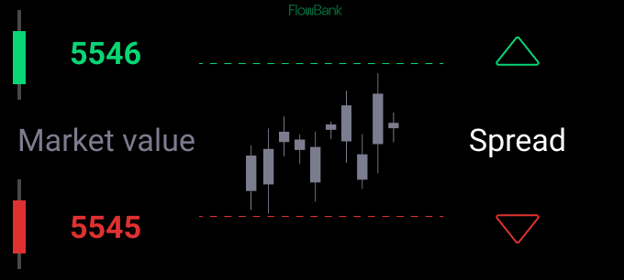

Spread and Commission Explained

In CFD trading, the "spread" refers to the difference between the buying (ask) and selling (bid) price of an asset. When you open a trade, you start at a small loss equal to the size of the spread. The price needs to move in your favor by at least the spread amount for you to break even.

Brokers typically earn revenue from CFD trading through the spread and/or commission. The spread is the primary way brokers make money, as it represents the difference between the buy and sell price of a CFD. When you open a trade, you'll start with a small loss equal to the size of the spread. Some brokers also charge commissions on each trade, which is an additional fee paid to the broker.

Deal Size Explained

The "deal size" in CFD trading represents the quantity of the asset being traded. It is measured in "lots" or "contracts." The size of one lot varies depending on the asset being traded. With CFDs, you can control a larger position in the market with a smaller initial deposit, thanks to leverage.

The deal size refers to the number of CFD contracts or lots you are trading. It determines the value of each price movement in the market. The larger the deal size, the more significant the potential profit or loss per price point movement.

Duration Explained

CFD trading offers flexibility in terms of duration. There is no fixed expiration date, as seen in some other financial instruments like options or futures. You can hold a CFD trade for as long as you want, giving you the ability to capitalize on short-term or long-term price movements.

CFD trades have no fixed expiration date, allowing traders to keep positions open for as long as they choose. You can close the trade whenever you want, whether you see a profit or a loss. This flexibility enables traders to adapt to changing market conditions and implement various trading strategies.

Risk Management

Two commonly used deal types in CFD trading are Take Profit and Stop Loss:

- Take Profit (TP): Take Profit is a type of order that allows traders to set a specific price at which they want to close a position to lock in profits. Once the market reaches the Take Profit level, the CFD trade is automatically closed, and the profit is realized. Take Profit is useful for traders who want to ensure they capture their desired profit target without constantly monitoring the market.

Example: You buy CFDs on a stock at $50 per share and set a Take Profit order at $60. When the stock price reaches $60, the CFD trade is closed, and you secure the $10 per share profit.

- Stop Loss (SL): Stop Loss is a type of order that allows traders to set a specific price at which they want to exit a position to limit potential losses. If the market moves against the trade and reaches the Stop Loss level, the CFD trade is automatically closed, preventing further losses.

Example: You sell CFDs on a stock at $100 per share and set a Stop Loss order at $110. If the stock price rises to $110, the CFD trade is closed, and you limit your loss to $10 per share.

By using these deal types, traders can define their profit targets and maximum acceptable losses in advance, making their CFD trading strategies more disciplined and controlled.

Profit and Loss Explained

In CFD trading, your profit or loss is determined by the difference between the opening price of the trade and the closing price when you decide to exit the trade. If you predict the asset's price will rise and go long (buy), and it does indeed increase, you'll make a profit. Conversely, if the price goes against your prediction, you'll incur a loss.

Your profit or loss in CFD trading depends on the price movement of the underlying asset. If the asset's price moves in the direction you predicted, you'll make a profit. However, if the price moves against your prediction, you'll incur a loss. The profit or loss is calculated based on the difference between the entry and exit prices, factoring in the deal size and any associated costs like spreads or commissions.

CFD Terminology

Understanding these terms will help you navigate the world of CFD trading more effectively and make informed decisions in your trades.

CFD (Contract for Difference): A financial contract that allows you to speculate on the price movements of assets without owning the underlying asset.

Leverage: The ability to control a larger position with a smaller deposit, amplifying potential gains but also increasing potential losses.

Long Position: Buying a CFD with the expectation that the asset's price will rise, aiming to profit from the price increase.

Short Position: Selling a CFD with the expectation that the asset's price will fall, aiming to profit from the price decrease.

Margin: The initial deposit required by the broker to open a CFD position, which allows you to use leverage.

Stop-Loss Order: An order set by the trader to automatically close a position if the asset's price reaches a certain level, limiting potential losses.

Take-Profit Order: An order set by the trader to automatically close a position when the asset's price reaches a specific profit target.

Spread: The difference between the buy (ask) and sell (bid) price of a CFD, representing the broker's commission.

Volatility: The measure of an asset's price fluctuations over a specific period, influencing CFD trading opportunities and risks.

Margin Call: A notification from the broker requesting additional funds if a trade moves against the trader and the account's equity falls below a certain threshold.

Market Order: An order to buy or sell a CFD at the current market price.

Hedging: Using CFDs or other financial instruments to protect an existing investment from potential losses in the market.