The U.S. dollar is undergoing a consolidation phase following its strongest performance in over a year earlier this month, driven by a rush to safe-haven assets amidst geopolitical tensions in the Middle East.

Shutterstock | Dollar fluctuation

With those concerns likely subsiding in recent days, both the dollar and gold have experienced some easing as traders return to riskier assets.

This week holds particular significance for the short-term trajectory of the greenback. The U.S. is set to release the advance estimate for first-quarter gross domestic product on Thursday, along with the Personal Consumption Expenditures price index—commonly referred to as the Fed’s preferred inflation gauge—on Friday.

These releases will be crucial in assessing the momentum of the U.S. economy following a 3.4% increase in the final quarter of 2023. Moreover, they will shed light on whether recent inflationary pressures are permeating the basket of goods and services the Fed closely monitors.

Federal Reserve officials reiterated last week that an imminent rate cut is unlikely, aligning with our assessment that a cut in June is improbable.

Furthermore, this week marks a pivotal period for corporate earnings, with around 180 companies in the S&P 500 scheduled to report. Notably, four of the ‘Magnificent Seven’ giants—Tesla, Meta, Microsoft, and Alphabet—might influence the sentiment in riskier assets, potentially diminishing the appeal of safe havens .

Beyond these developments, the economic calendar for the week is relatively light. The Bank of Japan will convene on Friday, and although no rate hikes are anticipated, attention will be directed towards any indications of potential intervention measures given the persistent pressure on the Japanese yen.

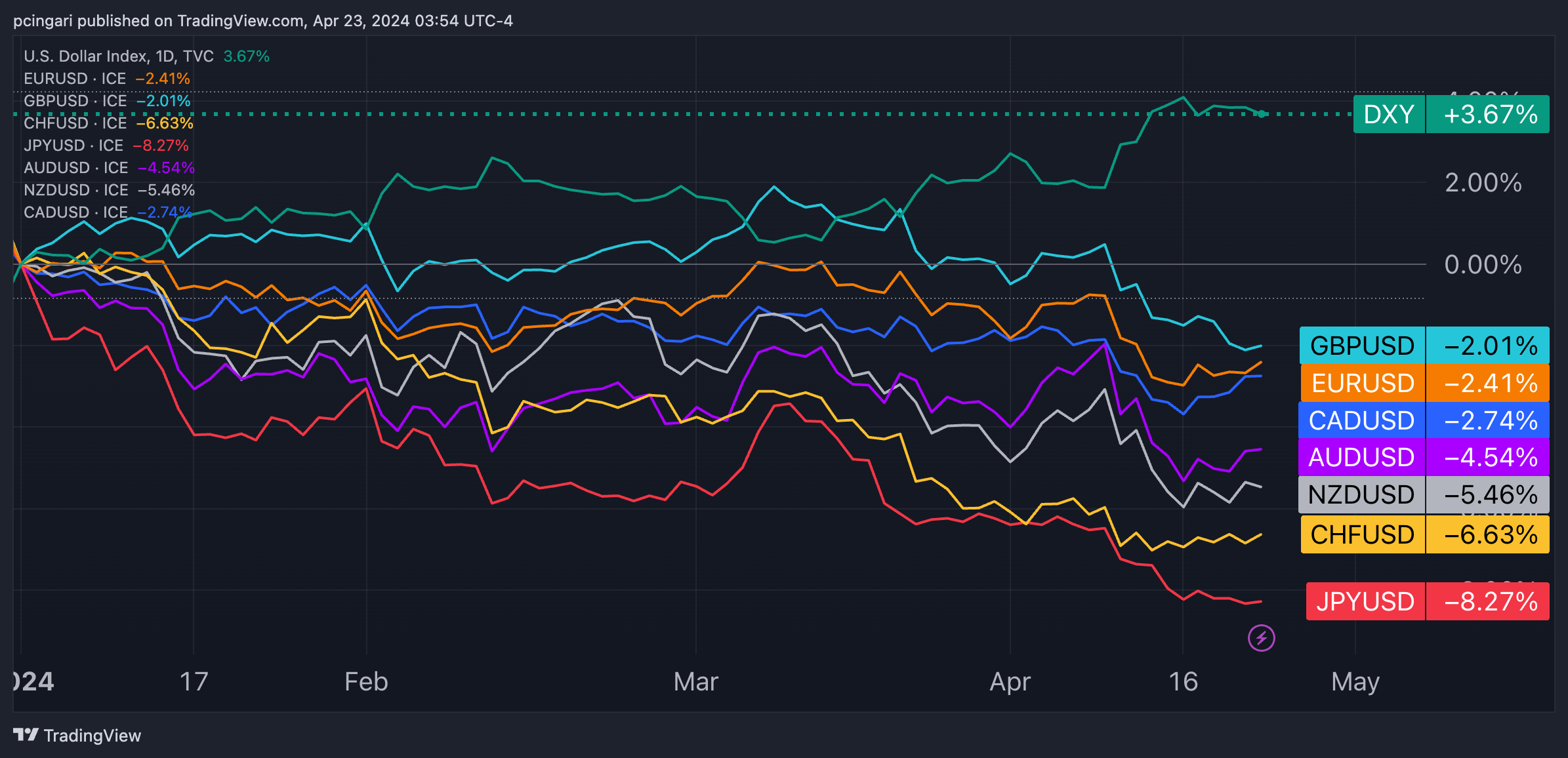

Year-to-Date Performance Of Major Currencies: USD Leads, JPY Lags

U.S. Dollar Index (DXY) update:

On Tuesday, the dollar index traded around the 106 level, slightly down from the 106.50 peak reached last week. The upward momentum, driven by the significant reassessment of the Fed's interest rate trajectory, persists. However, for the greenback bulls to push for additional gains toward the 107-107.30 range (reaching 2023 highs), they may require sustained global geopolitical tensions and economic data from the U.S. surpassing expectations this week.

Euro update:

The EUR/USD pair made a push to test the 1.07 level, buoyed by the release of private sector activity data that surpassed expectations, after the pair had dropped to as low as 1.06 last week. Recent statements from European Central Bank officials have solidified expectations for a rate cut in June, with some suggesting the potential for three rate cuts by the end of 2024. Such dovish signals could potentially curtail any short-term rebound of the euro, especially if the ECB moves ahead of the Federal Reserve in the easing cycle.

Yen update:

The Japanese yen continued its descent, reaching approximately 154.8 per dollar, marking fresh 34-year lows and eliciting renewed caution from a senior official regarding extreme currency fluctuations. Recent economic indicators indicated a favorable trend in private sector activity last month, with the Composite PMI climbing to an 8-month peak. All eyes are on the BoJ meeting this week to gauge officials’ communication on potential currency intervention. Governor Kazuo Ueda last week also hinted that the central bank might consider raising interest rates once more if the yen's depreciation results in persistent inflationary pressures via elevated import expenses.

Pound update:

The GBP/USD pair traded at 1.2370 Tuesday, after hitting 1.23 at the start of week, marking its lowest level since mid-November, as investors adjusted their outlook on the timing of the first rate cut, influenced by dovish remarks from Bank of England members. Market sentiment now leans towards the likelihood of the first reduction in borrowing costs happening at the August meeting, previously anticipated for September. There's even speculation of an earlier adjustment as soon as June. Recent PMI data presented a mixed view, with the services sector surpassing expectations and experiencing its most significant rise in 11 months. However, manufacturing activity disappointed, slipping back into contraction territory.

Trade ideas for the week

US Dollar Index (DXY)

- Long at 104.30, Take profit at 107, Stop loss at 103.40, Risk-reward ratio 2.8

- Short at 107.30, Take profit at 105.45, Stop loss at 107.95, Risk-reward ratio 2.6

DXY analysis:

The U.S. Dollar Index (DXY) faces a pivotal week ahead, with markets eagerly awaiting the release of U.S. first-quarter economic growth data and, notably, the PCE inflation figures.

A beat in economic data expectations could provide further upward pressure on the greenback. However, considering the already high levels of the 2-year yield (around 5%) and the fact that the DXY is nearing the upper bound of the bullish channel initiated in late December 2023, room for substantial upside may appear limited.

It might be wiser to buy on dips if the dollar retraces to around 104.30 (near the 50-day moving average) to engage in the uptrend from a more favorable position, placing a stop loss around 103.40 in case the dollar breaks out of the bullish channel.

Conversely, a sudden spike towards 107.10-107.30 (October 2023 highs) could push the RSI into overbought territory, likely attracting some contrarian bears back into the market. In such a scenario, the dollar could be vulnerable to pullbacks, potentially retracing towards the mid-line of the upward channel around 105.50.

Short GBP/AUD

- Entry: 1.9190

- Take profit: 1.8800

- Stop loss: 1.9360

- Risk-reward ratio: 2.3

AUD/GBP analysis:

The GBP/AUD pair has managed to close below both the 50 and 200-day moving averages in two consecutive sessions, signaling a potential reversal of the uptrend. Despite finding some support around the 1.9110-1.9115 area, the potential for further downward movements remains significant, especially considering momentum indicators like the relative strength index (RSI), which suggests that bears have seized control of the short-term trend.

Positive catalysts for the AUD may stem from the first-quarter inflation report, scheduled for release in the early hours of Wednesday.

Meanwhile, the yield differentials between 2-year UK gilts and Australian bonds have been narrowing over the past two months. Further narrowing could potentially lead to short-term yield differential parity in the near future, especially as the BoE commits to interest rate cuts.

A significant resistance level to monitor is at 1.9080, representing the 50% retracement from the highs of March 2024 to the lows of December 2023. Below this level, the GBP/AUD pair could potentially aim to test 1.8800, which is the 78.6% Fibonacci retracement level.

Stay ahead of market movements. Subscribe for FlowBank’s daily insights and updates!

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.