The dollar has surged to levels not seen since mid-November, propelled by hawkish comments from Fed officials and stronger-than-anticipated manufacturing activity data. On Friday, Federal Reserve Chair Powell hinted that lowering interest rates would be inappropriate until there's greater assurance that inflation is effectively managed.

Dollars Closeup | Shutterstock

This has sparked uncertainty among traders regarding the timing of imminent rate cuts, with implied probabilities signaling a 55% chance of a cut by June, down from 70% a week earlier.

Despite the strengthening in the greenback and Treasury yields, the rally in precious metals persists unabated, buoyed by signs of economic resurgence in China. In March 2024, the Caixin China General Manufacturing PMI rose to 51.1, surpassing market expectations and representing the swiftest pace of growth since February 2023.

Commodities ended March on a positive performance and kicked off April with strong momentum.

Gold has experienced a streak of six positive weeks out of the last seven, consistently surpassing previous highs and breaching the $2,250 per ounce mark. Silver, previously highlighted as a trade idea in the last report, has enjoyed a five-day consecutive rally, with prices surpassing $25 per ounce.

WTI crude oil prices surged past $84 a barrel, reaching levels last witnessed in late October 2023, driven by a mix of bolstered global demand and escalating geopolitical tensions in the Middle East.

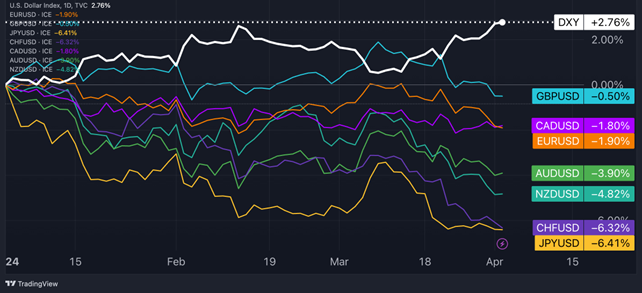

Year-to-Date Performance Of Major Currencies: USD Leads, CHF Lags

Chart of the week: Gold Prices Keep Breaking Record Highs

Trade Ideas For The Week

Long USD/JPY

- Entry: 151.61

- Take profit: 155.76

- Stop loss: 149.35

- Risk-reward ratio: 1.9

USD/JPY analysis: The strength of the U.S. economy is currently reflected in the renewed upward momentum of the dollar, as markets begin to speculate that the Federal Reserve may not be in a rush to reduce interest rates.

The USD/JPY pair – a proxy for interest rate differentials, between the Fed and the Bank of Japan – is currently testing the resistance at 152, marking highs not seen since October 2022 and August 1990. Meanwhile, the yield spread of the U.S. 10-year Treasury bond over its Japanese counterpart has climbed back above 360 basis points, as the BoJ failed to indicate any serious commitment of further rate hikes in the coming months.

The week ahead promises to be eventful in the United States, with investors closely tracking Friday's labor market report, encompassing non-farm payrolls and the unemployment rate, alongside Wednesday's release of the ISM Services PMI. The highs of June 1990, reaching 155.76, may offer an opportunity for further extension of the bullish momentum.

Short CHF/AUD

- Entry: 1.6937

- Take profit: 1.65

- Stop loss: 1.7140

- Risk-reward ratio: 2.1

CHF/AUD Fundamental Analysis: The Swiss Franc carries a negative yield of over 3 percentage points against the Australian Dollar, when looking at the 10-year yield differentials. Furthermore, the recent unexpected rate cut by the Swiss National Bank signals a significant shift towards more accommodative monetary policies.

In contrast, the Reserve Bank of Australia opted to maintain unchanged rates, reiterating its commitment to bring inflation back to target and indicating a data-dependent approach to future monetary policy adjustments.

Moreover, the recent surge in commodity prices is expected to bolster the AUD's strength in trade, particularly against countries like Switzerland that heavily rely on commodity imports, particularly energy.

Switzerland's annual inflation rate is projected to edge up from 1.2% to 1.3% in March, yet it remains below the central bank's target. If the reported figure aligns with or falls below these forecasts, it's expected to intensify speculation about potential rate cuts by the SNB in the near future.

CHF/AUD Technical Analysis: From a technical standpoint, the CHF/AUD pair is attracting attention due to its potential for bearish movements, backed by the emergence of a death cross pattern and negative price momentum.

On Tuesday, the 50-day moving average dipped below the 200-day average, signaling a potential shift in the pair's long-term trend. Additionally, the Relative Strength Index (RSI) has consistently remained below the 50 mark for over a month, indicating a prevailing bearish sentiment.

There might be a likelihood for CHF/AUD to revisit levels around 1.65, last seen in July 2023, in the upcoming weeks. However, any rebound above 1.7140 would invalidate this idea, as it would suggest a resurgence in the Swiss Franc, surpassing levels observed on March 21st when the SNB reduced interest rates.

Short EUR/CAD

- Entry: 1.4593

- Take profit: 1.4158

- Stop loss: 1.4779

- Risk-reward ratio: 2.3

EUR/CAD Fundamental Analysis: This week's eurozone inflation rate data holds significant importance for the euro, potentially accelerating speculation about an ECB rate cut in June. With Germany's inflation rate slightly lower than anticipated on Tuesday, there may be anticipation of a similar outcome for the broader euro area print on Wednesday. Meanwhile, market focus in Canada revolves around March's employment report, March's PMI figures, and February's trade statistics. Notably, the Canadian dollar may draw support from rising oil prices. Regarding rate divergence, Germany's 2-year yield trades at negative 145 basis points compared to Canada's 2-year yields, implying a negative carry condition for the EUR against the CAD.

EUR/CAD Technical Analysis: EUR/CAD's price action has dipped below both the 50-day and 200-day moving averages, indicating a leaning towards increased bearish momentum. The RSI is sharply pointing south, reflecting the strongest bearish momentum since late September 2023. The next support levels are at 1.4470 (2024 lows), followed by 1.4322 (October 2023 lows) and 1.4158 (September 2023 lows). The latter could be an enticing target for bears, with a stop placed above 2024 highs at 1.4779.

Stay ahead of market movements. Subscribe for FlowBank’s daily insights and updates!

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.