This week holds pivotal importance for markets, as a plethora of data releases and events are poised to significantly influence the trajectory of monetary policies set by major central banks.

Currencies image | Shutterstock

Currencies image | Shutterstock

Wednesday is anticipated to witness substantial volatility in the FX market, as traders eagerly await the unveiling of the March Consumer Price Index (CPI) inflation report and the minutes from the latest Federal Reserve meeting.

Economist forecasts indicate a marginal uptick in the annual inflation rate from 3.2% to 3.4% for March, likely driven by last month's surge in oil prices. Conversely, the core rate, excluding volatile energy and food prices, is expected to see a slight easing from 3.8% to 3.7%, marking its lowest level since April 2021.

Currently, market-implied probabilities indicate an almost equal chance of either a Federal Reserve interest rate cut or a decision to maintain rates steady in June.

In addition, Thursday witnesses the release of US producer inflation data, followed by Michigan consumer confidence figures on Friday, alongside a series of speeches from Federal Reserve officials throughout the week.

In Europe, the European Central Bank convenes on Thursday, and while no policy changes are anticipated, all eyes will be on whether Governor Lagarde offers detailed hints regarding a potential rate cut in June.

Elsewhere, central bank meetings are scheduled in Canada and New Zealand, both on Wednesday, which are expected to wield notable influence on CAD and NZD currencies. In Japan, attention will be focused on potential interventions by the Bank of Japan to bolster the yen, particularly amidst its recent plunge to nearly 24-year lows against the dollar.

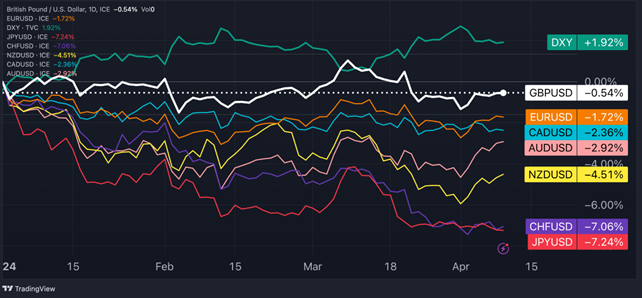

Year-to-Date Performance Of Major Currencies: USD Leads, JPY Lags

US Dollar update: The U.S. Dollar Index (DXY) traded at 104.20, stepping back from last week's highs near 105 levels, despite a hotter-than-expected March labor market report and rising Treasury yields. Money markets currently predict only 64 basis points of rate cuts by the Fed in 2024, indicating less than three 25-bp cuts. Investors now await the US CPI report and Fed minutes. Last week's Fed remarks leaned hawkish, with a typically dovish member (Goolsbee) expressing concern about the recent inflation surge, and some members (Barkin and Bostic) questioning the necessity of rate cuts.

Euro update: The EUR/USD pair has rebounded to 1.0860, lifted by positive indicators of manufacturing and services activity in the Euro area. All eyes are now on the upcoming ECB meeting scheduled for Thursday, which could potentially alter the short-term trend of the EUR/USD pair.

Swiss franc update: The depreciation of the Swiss franc against the greenback took a pause, with the USD/CHF pair remaining within a narrow range (90-91) since the beginning of the month. Recent data indicates that the Swiss National Bank (SNB) intervened further to weaken the CHF in March, as reserves increased by 6% month-on-month, marking the fourth consecutive month of growth. Inflation figures released last week showed a slowdown to 1% in March, the lowest since September 2021, falling short of market expectations of 1.3%. Overall, the SNB may continue to utilize a combination of rate cuts and interventions to further weaken the franc.

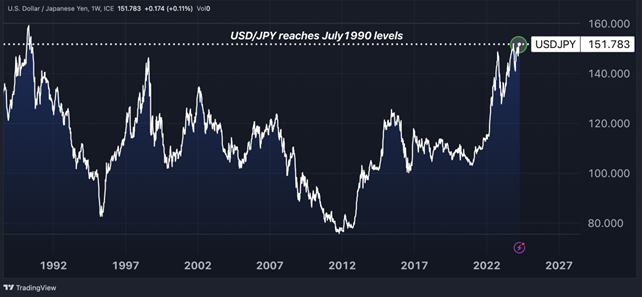

Yen update: The yen concluded the first day of the week at its weakest level against the dollar in nearly 24 years, as USD/JPY hovered around the 152 mark. Market dynamics persist in probing the determination of Japanese authorities to support the JPY. Traders remain vigilant for any signs of intervention by the Bank of Japan, especially with Governor Kazuo Ueda scheduled to speak on Wednesday.

Chart of The Week: Yen Weakens to Lowest Levels Since July 1990

Trade Ideas For The Week

Short EUR/USD

- Entry: 1.0869

- Take profit: 1.0615

- Stop loss: 1.0941

- Risk-reward ratio: 3.5

EUR/USD Analysis: The outlook for EUR/USD hinges entirely on key events of the week: US inflation data, the release of Fed meeting minutes, and the ECB meeting, with significant volatility expected between Wednesday and Thursday.

Should inflation surprise to the upside and the Fed minutes indicate a considerable representation of members favoring postponing rate cuts until after the summer, the EUR/USD pair could face substantial downward pressure, potentially descending towards 1.07.

Conversely, lower-than-expected inflation, particularly on the core front, could propel EUR/USD above 1.09 in anticipation of the ECB meeting on Thursday.

If President Lagarde intimates that rate cuts are imminent, signaling a dovish stance, it could further substantially drive down the EUR/USD exchange rate.

On the contrary, an emphasis on a meeting-by-meeting approach, uncertainties regarding inflation decline, and a call to await additional data could lend support to the euro.

From a technical perspective, the pair is currently trading within a symmetrical triangle, which may break either to the upside or downside depending on this week’s macroeconomic developments. The 50-day and 200-day moving averages are trading at the same level (1.0830).

As the pair nears the upper boundary of the triangle, a higher risk-reward opportunity may arise from a short position, with a target of 1.0615. This would be consistent with a combination of events including a hotter-than-expected US CPI, hawkish Fed minutes and dovish ECB. A stop could be set at the near 1.0941 in the case of weaker US inflation data and hawkish ECB.

Long NZD/CHF

- Entry: 0.5465

- Take profit: 0.5678

- Stop loss: 0.5369

- Risk-reward ratio: 2.3

NOK/SEK Analysis: The Norwegian krone has yet to rally as expected given the rise in oil prices, presenting potential catch-up opportunities for new bullish participants. Amid the macroeconomic events of the week, traders may explore prospects emerging in the NOK/SEK pair to avoid the volatility of the EUR/NOK and USD/NOK.

In Sweden, the Riksbank maintained its key policy rate at 4% at the close of March but indicated the possibility of a rate cut in May or June if inflation outlook remains favorable. Conversely, the Norges Bank hinted at keeping rates steady for a longer duration, with the possibility of a cut not expected before autumn. The yield spread between a 10-year Norwegian bond and its Swedish counterpart stands at 125 basis points.

With Brent crude now trading above $90 a barrel, the NOK could benefit from favorable terms of trade in the upcoming weeks and months. Technically, NOK/SEK has breached the 50-day moving average and may target the 200-day moving average at 0.9979 and the psychological level of 1.00. If a breakout occurs at this juncture, the pair could advance towards the October 2023 highs at 102-102.50.

Stay ahead of market movements. Subscribe for FlowBank’s daily insights and updates!

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.