As the forex market edge towards the final week of March, attention is squarely fixed on Chair Jerome H. Powell's anticipated remarks at a conference hosted by the Federal Reserve Bank of San Francisco on Friday. Additionally, Friday morning will reveal the February reading of the Personal Consumption Expenditure (PCE) price index, which serves as the Fed's preferred gauge of inflation.

Three Flags of the European Central Bank and European Union | Shutterstock

Despite the significance of these events, their impact on the markets may be tempered by the Easter break, with both the US stock market and major European exchanges closed for Good Friday.

In Europe, investors will closely monitor speeches by ECB members throughout the week, alongside economic business sentiment and final consumer confidence figures for the Euro Area. Preliminary inflation rates for Italy, France, and Spain are also due on Friday.

Meanwhile, Thursday in Japan brings forth a plethora of pertinent data that could sway yen reactions, encompassing Tokyo inflation figures, the unemployment rate, industrial production, and retail sales.

Monetary policy meetings are slated in Hungary, Sweden, and South Africa. The National Bank of Hungary is expected to convene on Tuesday, with a projected 75 basis point rate cut to 8.25%. Sweden's Riksbank will gather on Wednesday and is likely to maintain rates at 4%. Similarly, the South African Reserve Bank is scheduled to meet on Wednesday, with expectations leaning towards unchanged rates at 8.25%.

Year-to-Date Performance Of Major Currencies

US Dollar update:

As of Tuesday, the U.S. dollar index stood at 104.4 levels, showing a 0.6% increase from the previous week. This rebound fully offsets the losses experienced post the March Federal Reserve meeting, suggesting that the initial market reaction, anticipating a more dovish Fed stance, might have been exaggerated. Notably, the dollar closed the preceding week at its highest level in over a month.

Markets are currently pricing in an implied 83 basis points of rate cuts by the year's end, which is slightly more than three 25-basis-point cuts. This aligns closely with the latest indications from the Fed dot plot.

Euro update:

The euro slid to approximately $1.08, marking its lowest level since late February, following dovish remarks from the European Central Bank (ECB) members. Bundesbank President Joachim Nagel's comments on Friday hinted at the possibility of rate cuts by the ECB before the summer break, as inflation trends downward toward the bank's 2% target. Nagel's stance echoes a growing number of policymakers advocating for a potential rate cut in June. Bank of Italy Governor Fabio Panetta also expressed similar sentiments. There's a growing consensus among policymakers regarding the possibility of a rate cut. Presently, markets are pricing in an 89 basis point reduction in rates for the year, which could translate to at least three, potentially four, 25 basis point adjustments, with the first expected in June or July.

Pound Update:

The British pound traded at $1.2650, slightly weakening on reports of stagnant UK consumer spending in February and hints from Bank of England Governor Andrew Bailey about potential interest rate cuts this year. Despite a notable 3.6% surge in January, UK retail sales remained flat last month. Governor Bailey noted some signs of easing inflation but stressed the need for greater certainty in managing price pressures. Nevertheless, the Bank of England voted 8-1 to maintain borrowing costs at a 16-year high of 5.25%.

Swiss Franc Update:

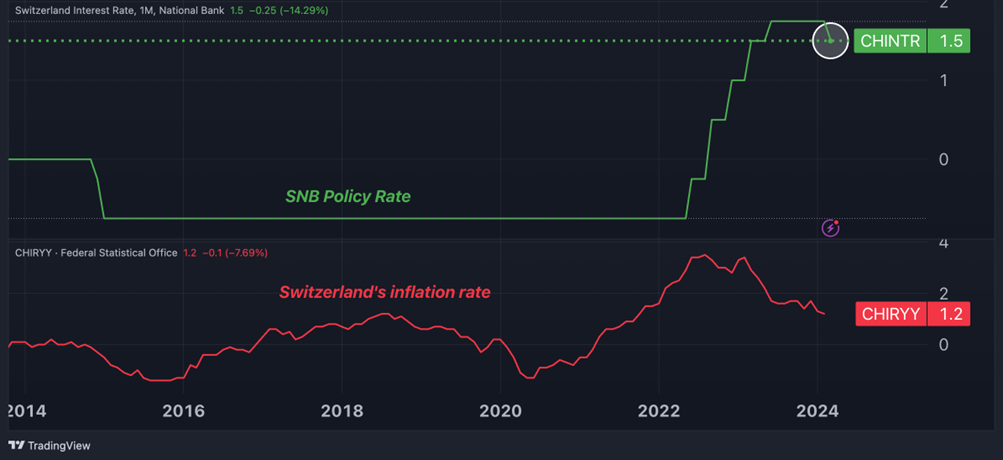

The Swiss franc weakened below 0.895 against the US dollar, hitting its lowest level since mid-November, following an unexpected move by the Swiss National Bank (SNB) last week. For the first time in nine years, the SNB reduced its main interest rate by 25 basis points to 1.50% at its March meeting. This action makes the SNB the first major central bank to ease monetary policy, aiming to tackle inflation concerns. The decision came as Swiss inflation dropped to 1.2% in February, within the SNB's target range of 0-2% for the ninth consecutive month.

Chart of the week: SNB Cuts Interest Rates To 1.5% As Inflation Weakens

Trade Ideas For The Week

Short CHF/JPY

- Entry: 167.82

- Take profit: 162.05

- Stop loss: 170

- Risk-reward ratio: 2.5:1

CHF/JPY analysis:

The Swiss franc has endured four consecutive sessions of decline against the Japanese yen as interest rate dynamics diverge between the two nations. While the Swiss National Bank (SNB) opted for rate cuts, the Bank of Japan initiated a rate hike last week, marking the beginning of its tightening cycle.

Fundamentally, the Swiss franc no longer presents a yield advantage over the yen to institutional investors, given the flattened yield difference between their respective 10-year bonds. Anticipating future rate cuts in Switzerland and hikes in Japan, yields on Japanese bonds denominated in yen could potentially outpace those of Swiss franc bonds, prompting potential capital reallocation.

Technically, bearish traders are now eyeing the 200-day moving average at 166.42 as the next critical support level to breach, while the RSI is showing downward momentum.

As a medium-term target, a retest of December 2023 lows at 162.18 could be considered. However, if the franc manages to climb back above the 50-day moving average in the 170 range, it would invalidate the bearish outlook.

Long XAG/USD

- Entry: 24.77

- Take profit: 27.00

- Stop loss: 24.00

- Risk-reward ratio: 3:1

Silver Analysis:

Silver underwent a robust rally from late February to March 21st, only to encounter a notable 3.4% downturn in Thursday's session last week. Rather than signaling a reversal, this movement may reflect a temporary pause in bullish sentiment following excitement over anticipated central bank rate cuts. While gold remains steadfast above $2,180/oz, the outlook for silver remains optimistic.

The most compelling signals emerge from technical analysis, notably the emergence of a bullish crossover between the 50-day and 200-day moving averages, forming the golden cross pattern.

Bullish momentum remains firmly in control, as evidenced by the RSI persisting above 50. Key resistance levels lie at 26.12 (2023 high) and 27.00 (2022 high), with the latter presenting an enticing opportunity for bulls. Setting a stop-loss at 24 offers a favorable risk-reward ratio of 3.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.