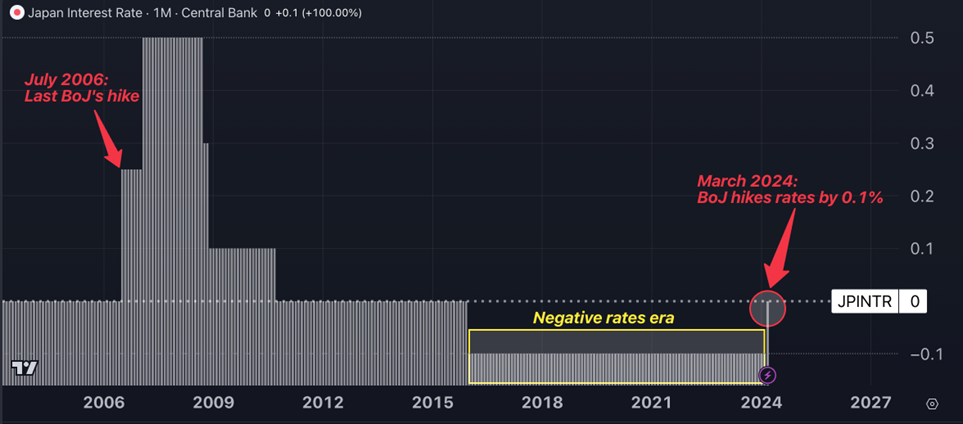

It’s a historic week for central banks, as the Bank of Japan (BoJ) raised interest rates by 10 basis points to 0%-0.1% for the first time in 17 years, marking the end of the period of negative interest rates globally.

Rates Figure | Shutterstock

Attention now shifts to the highly awaited Federal Open Market Committee (FOMC) meeting, which is poised to provide crucial insights into the trajectory of interest rates in the United States.

In addition to the widely anticipated decision to maintain current interest rates, all eyes are fixated on the "dot plot," revealing the individual stances of policymakers regarding the future interest rate path.

Elsewhere, this week features meetings of the Bank of England and the Swiss National Bank, along with significant speeches from key figures at the European Central Bank.

Fed Meeting Looms: What Traders Look At

In December 2023, the Fed outlined three rate cuts for 2024, followed by four in 2025 and two in 2026. Any adjustments to these projections are likely to trigger significant reactions across various asset classes, particularly in the forex market.

A downward revision in the anticipated rate cuts—such as a shift to two in 2024 and three in 2025—would indicate policymakers' heightened concerns over recent inflation surprises. This could lead them to favor maintaining higher rates for a prolonged period or making only marginal adjustments. Such a scenario might trigger buying pressure on the dollar, with rising Treasury yields to reflect a potentially slower pace of rate cuts by the Fed.

Conversely, if the Fed sticks to its previously communicated rate trajectory from December, markets may find some relief. Investors could interpret this decision as an indication that the recent inflationary uptick is merely a transient disruption to the prevailing disinflationary trend. Consequently, concerns about an inflation resurgence might ease, potentially diminishing the dollar's appeal as the anticipated rate cuts draw nearer.

Chart of The Week: BoJ Raises Rates Ending Negative Interest Rates Era

FX Market Update And Fed Meeting Implications

EUR/USD: The EUR/USD pair is hovering at 1.0840 levels, maintaining a bearish sentiment for the second week after peaking at 1.0960. The upcoming FOMC meeting will likely influence its near-term direction, with the pair expected to experience heightened volatility based on the Fed's stance. A hawkish Fed could strengthen the dollar against the euro, while a dovish stance may lead to the opposite effect.

GBP/USD: The pound is currently undergoing a corrective phase, breaching the key technical support level at 1.2700 on Tuesday. Sterling is facing pressure from the overall strength of the US dollar and remains vulnerable to additional selling pressure leading up to important meetings of both the Federal Reserve and the Bank of England later this week. Wednesday will see the release of February's inflation data for the UK. Analysts anticipate a decline in the headline inflation index to 3.5%, a level not observed since September 2021. The pair could see heightened volatility due to the crucial events of the week.

USD/JPY: On Tuesday, the Japanese yen weakened by almost 1%, falling below 150 per dollar for the first time in about two weeks. This occurred despite the Bank of Japan's decision to raise interest rates and abandon its yield curve control policy. However, the central bank maintained a dovish tone, pledging to buy long-term bonds if needed, and two board members dissented from the rate hike decision. A hawkish Fed could bolster the US dollar against the Japanese yen, potentially pushing the pair higher.

USD/CHF: The Swiss franc depreciated to 0.8890 per dollar, marking its lowest level since mid-November 2023, as the Swiss National Bank persisted in its foreign exchange buying to boost reserves. With no anticipated interest rate adjustments on Thursday, attention will turn to whether the SNB hints at a potential rate cut, given that inflation dipped to 1.2% in February 2024, the lowest since October 2021. If the Fed indicates a hawkish stance, USD/CHF could rally towards 0.90 or beyond.

AUD/USD: As expected, the Reserve Bank of Australia (RBA) kept the Cash Rate Target steady at 4.35%. Unlike previous meetings, the RBA didn't maintain a hawkish tone, stating it "cannot rule out anything in the future," implying a potential rate cut. Consequently, the AUD/USD plummeted below 0.6560, approaching 0.6500. A hawkish Federal Reserve could drive the AUD/USD pair to retest 2024 lows near 0.6445.

This Week’s FX Trading Ideas

Short GBP/USD

- Enter: 1.2675

- Take profit: 1.2485

- Stop loss: 1.2760

- Risk-reward ratio: 2.2/1

GBP/USD Analysis: The pound has breached below the 50-day moving average against the US dollar, indicating a bearish trend. The Relative Strength Index (RSI) has dropped below 50 for the first time in March, suggesting further downside potential.

Fundamentally, the sterling faces headwinds, with the 2-year yield differentials between gilts and Treasuries reaching negative 46 basis points.

Bears may anticipate a combination of factors including a hawkish Federal Reserve, slowing UK inflation rate, and a dovish Bank of England, potentially driving GBP/USD below 1.25 by week's end. A prudent approach could involve setting a stop above last Friday’s highs at 1.2760.

Long AUD/CHF

- Enter: 0.5776

- Take profit: 0.5868

- Stop loss: 0.5728

- Risk-reward ratio: 2/1

AUD/CHF Analysis: The Swiss franc's trade outlook remains bearish due to the SNB's continued focus on its reserve-boosting program. To mitigate potential dovish risks from the Fed, traders may consider shifting focus from USD/CHF to potential buy-on-dip opportunities with AUD/CHF.

Despite a relatively dovish RBA meeting, the Australian dollar maintains a positive trajectory. Technically, AUD/CHF has been following an ascending channel since February and is seeking to establish support at the 200-day moving average.

Interest rate differentials for carry trades remain volatile, with the potential for further widening in the 2-year yield spread should the SNB signal a dovish stance on rates this Thursday. Bulls may target the upper bound of the channel at 0.5868, with a stop set at the 50-day moving average at 0.5728.

Long CAD/JPY

- Enter: 110.98

- Take profit: 116.70

- Stop loss: 108.95

- Risk-reward ratio: 2.7/1

CAD/JPY Analysis: The Bank of Japan's failure to significantly alter the yen's trajectory is seen as a missed opportunity by traders, potentially eroding market confidence. CAD/JPY, serving as a proxy for USD/JPY, may benefit from higher oil prices acting as a favorable tailwind.

Additionally, the rate divergence with the yen remains wide, favoring carry trade behaviors.

Considering a medium-term perspective, the pair could surpass 2024 highs at 111.82 and aim for a test of 116.69, last seen in December 2007. Setting a stop around March lows would provide protection in case of a shift in the BoJ's language.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.