Markets have been on a roller coaster ride. Here are our latest forex trading ideas.

Markets overview

It will be another busy week in terms of economic events affecting the FX market.

The Federal Reserve's monetary policy decisions on Wednesday (19:00 CET) and the ECB's on Thursday (13:15 CET), both of which are likely to raise interest rates, are the two crucial events to watch.

While the Fed is expected to move toward a rate hike of 25 basis points to 4.75-5%, the highest level since October 2007, the ECB's decision is more uncertain between 25 and 50 basis points, with the market pricing in an implied rate hike of 31 basis points.

When it comes to the Federal Reserve, investors will be watching to see if this is the final hike of the cycle or if Powell will continue to leave the door open for more raises in June. The second alternative might generate a lot of market jolts and be clearly very positive for the dollar, since the market is pricing in rates on hold in June with a 65% chance today, according to CME Group data.

For the ECB, however, an increase of 25bps would be slightly negative for the euro, while a boost of 50bp would likely result in a big bounce for the single currency.

In addition to these two significant events, there will be crucial economic data releases, including ISM Manufacturing (Mon 15:00 CET) and Services (Wed 15:00 CET) PMIs for the US, as well as Eurozone (Tue 10:00 CET) and Swiss (Fri 07:30 CET) inflation rates.

At the strategy level, the Fed and ECB events will clearly dictate the mood in the FX market, but with rising rates, low-yielding currencies may suffer the most, with the JPY resuming a depreciation trend against the USD and other crosses, following the BoJ's dovish signals last week. CHF might also potentially experience selling pressure ahead of Friday's CPI release.

Open Trades From Last Week:

- Short EUR/USD: Opened at 1.0982; Target Price 1.07; Stop Loss 1.11; P&L current -0.2%

- Long USD/CHF: Opened at 0.8932; Target Price 0.92, Stop Loss 0.8850; P&L current -0.05%

- Long USD/JPY: Opened 134.35; Target Price 138, Stop Loss 132.5; P&L current +1.87%

- Short AUD/USD: Opened at 0.6690; Target 0.638; Stop loss 0.678; P&L current +0.9%

Closed trades from last week:

- Short GBP/USD: Opened at 1.2385; Target 1.2178; Stop loss 1.2483; Stop loss triggered a loss of 0.85%.

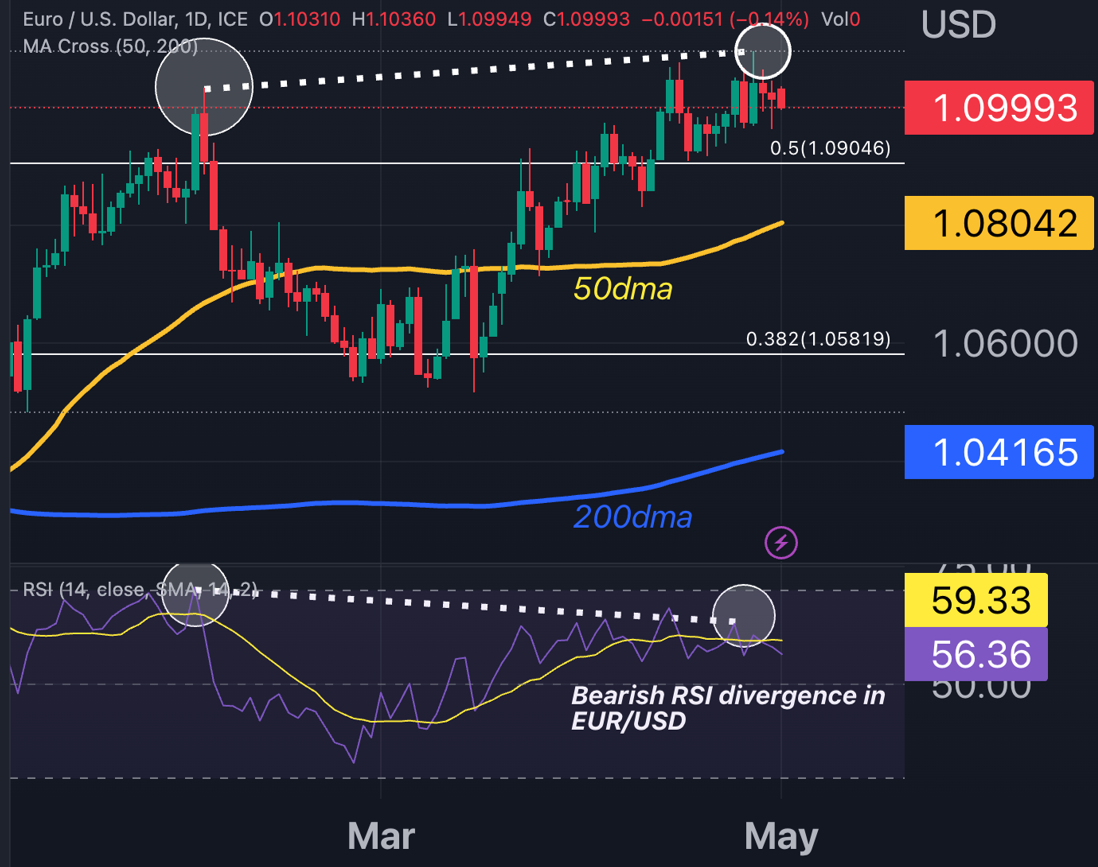

EUR/USD Trading Strategy: Holding A Brave Bearish View

Short EUR/USD: Target Price 1.07; Stop Loss 1.115 (reviewed)

Last week, EUR/USD reached a new 2023 high of 1.1095, just a few pips below our stop loss level 1.1100, before slipping again by 100 pips, as we write.

The pair's volatility will be high this week due to major economic events in both regions.

From a macro standpoint, the pessimistic view is obviously centered on a more hawkish than expected Fed and a more dovish than predicted ECB.

We believe Powell will opt to leave the door open for a rate hike in June, given that core inflation remains high and sticky, and there are no clear signs of a slowdown in the labor market, with the increasing possibility that the much-anticipated recession by the market could be significantly delayed.

On the other hand, even if the ECB rises rates by 50 basis points, we believe that a hawkish Fed will still be able to dominate the trend in the pair, albeit to a lesser extent than if the ECB raises rates by 25 basis points.

The April inflation data for the Eurozone, which is expected out on Tuesday, will be a preparation for the ECB meeting, with the market anticipating a year-on-year increase to 7% from 6.9% overall, and core inflation remaining at 5.7%. After the German CPI came in lower than expected last week (7.2% vs 7.3% yoy and 0.4% vs 0.6% mom), there may be room for slightly lower-than-expected inflation prints.

Technically, following the pair's new relative highs, but with daily RSI falling, more evidence of a bearish reversal RSI has emerged.

Given the high volatility expected for the week, and the stop-loss trigger narrowly avoided last week, it is prudent to raise the stop loss by 50 pips to 1,115, with a target of 1.07 and a risk-reward ratio of 2.

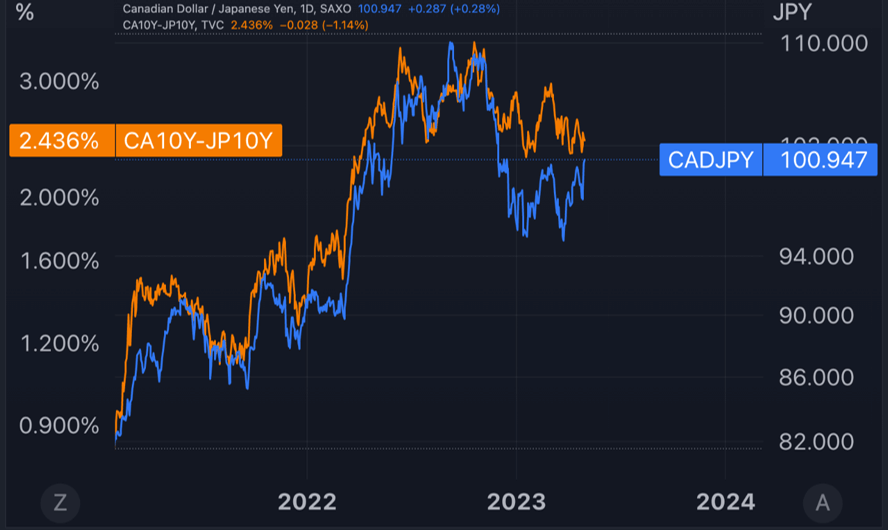

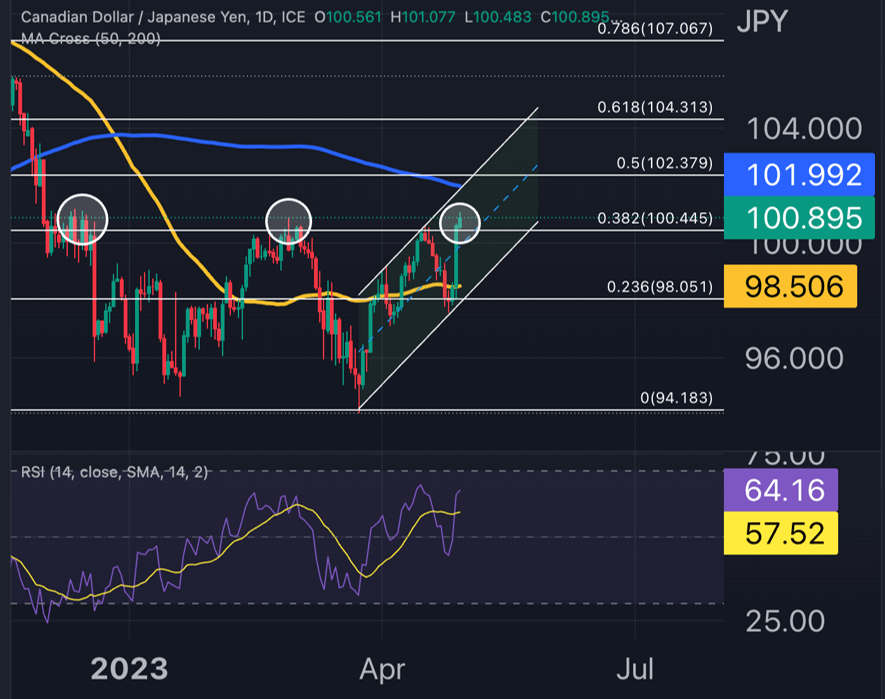

CAD/JPY Trading Strategy: Following the USD/JPY Trend

Long CAD/JPY: Target 104.3; Stop Loss 98.05; Risk-reward-ratio of 1.4

Long CAD/JPY is another expression for the long view in USD/JPY, which we continue to maintain as core.

Rising rates in the US, and the latest economic data demonstrating some resilience of the US economy, could lead the BoC to continue following the Fed.

From a fundamental point of view, the pair is trading at prices slightly lower than the implied level given by the 10-year yield differential between Canada and Japan, and therefore a catch up could be in the cards.

The perfect correlation with the spread should make CAD/JPY trade around 102.5-102.6.

Additionally, during bullish periods in USD/JPY, also CAD/JPY followed the same pattern, even with greater extensions.

Technically, important resistance breakouts were observed last week, with CAD/JPY breaking the 2023 highs hit in February and coinciding with 38.2% of the retracement between March 2023 lows and September 2022 highs. This was also an important resistance region back in December 2022.

The formation of a bullish channel could therefore lead the pair to test the resistance of the 200-day moving average in the 102 area and 50% of the retracement of the aforementioned range.

We like as target 104.31 which is 3.3% higher from current prices, while the stop could be placed at the support of the 50dma at 98.50.

NZD/USD Trading Strategy: The Week of Central Banks Calls for Greater Risk Aversion

Short NZD/USD: Target 0.60; Stop Loss 0.6250; Risk-reward-ratio of 2.5

During a week jam-packed with key macro events, risk appetite should be put to the test.

The New Zealand dollar is shown extraordinary resilience, rising even with other high-beta currencies such as the Australian dollar.

In a week marked by two key Fed and ECB meetings, as well as potential rate shocks, we believe investors could reduce risk appetite globally, and NZD/USD could be one of the best FX expressions.

Technically, the pair currently trades between the 50 and 200 day moving averages.

The major support level of 0.6080 (2023 lows and significant support since mid-November) is just below the 200dma, and a breach of that level would send strong bearish signals.

We favor 0.60 psychological as the initial target, with a stop loss at 0.625 and a risk-reward ratio of 2.5.

Mastering the art of forex trading begins with a solid understanding of the "Basics of Forex Trading." This foundation serves as your anchor in the turbulent seas of currency exchange. Forex trading involves buying and selling currencies to profit from their price fluctuations. To get started, it's crucial to comprehend fundamental concepts such as currency pairs, pips, leverage, and risk management.