One of the key determinants of success as a trader is to use Forex Trading Strategies that work.

Whether you’re a newbie hoping to kick start your Forex trading journey or a veteran trying to improve your performance, your Forex trading strategy is a cornerstone on the path to consistent profits while minimizing losses. This detailed article provides information on what is a forex trading strategy, what a good strategy includes, and some examples of top forex trading strategies to get you started.

Overview : What is Forex Trading?

Forex Trading Strategies are ultimately a list of rules you follow when you trade FX markets.

They determine a trader’s interaction with the market environment. Markets often change their behavior and structure, so dealing with this requires a combination of technical analysis, fundamental analysis, market psychology, and risk management, all put together into a ‘strategy’.

It is these strategies that give the ability to traders to navigate through price swings in the markets, see the opportunities and make informed decisions.

Whether you are a scalper looking for quick profits, a swing trader interested in profiting from price patterns, or a position trader with a long-term outlook, this article will introduce, explain, and provide expert suggestions to Forex trading strategies that can be tailored according to your personality.

Picking the Right Strategy for You

Forex, also known as foreign exchange trading, involves the buying and selling of currencies on a global market. Carefully choosing the right Forex Trading Strategy means considering everything from your own personality to the time you have available to trade to what currency pairs interest you.

Aligning Strategy with Your Trading Personality

Before choosing any specific forex trading strategy, it is important to ensure that your selected approach fits your trading personality.

Each trader is different; what may work for one will not necessarily be effective for another. When choosing a strategy, consider your :

- Risk tolerance

- Time commitment

- Long-term as well as short-term financial objectives

Are you a risk taker? Or someone who would prefer a lower risk-lower profit approach? You need to make sure that your strategy considers your risk appetite.

Typically if you exhibit a high-risk attitude and can devote more time in front of the screens, then it could be better for you to consider working on day trading or scalping strategies. Alternatively, if you prefer minimal pressure and don’t have much time for trading, swing or positional trading could be an ideal option for you.

Time Frames in Forex Trading

Your timeframe in forex trading will dictate the duration of trades that you make. Traders have a wide range of timeframes they can choose from.

Trading forex can be done on various timeframes, ranging from very short-term (like minutes or hours) to long-term (like days, weeks, or even months).

Here are some pros and cons of trading on short vs. long timeframes:

|

Aspect |

Short Timeframes |

Long Timeframes |

|

Opportunities |

More frequent opportunities for trades. |

Fewer opportunities, but potential for capturing significant trends. |

|

Results Timing |

Quick feedback on trades. |

Results can take a long time to materialize. |

|

Overnight Risk |

No overnight risk as positions are usually closed by the end of the day. |

Exposure to overnight risk due to holding positions for longer periods. |

|

Transaction Costs |

Higher due to frequent trading. |

Lower as trades are less frequent. |

|

Time Requirement |

High — constant monitoring needed. |

Lower — less time spent actively trading. |

|

Stress Level |

High stress and emotional pressure. |

Generally less stressful. |

|

Overtrading Risk |

Higher risk of overtrading. |

Lower risk of overtrading. |

|

Analysis |

Quick decisions, less time for in-depth analysis. |

More time for thorough analysis. |

|

Leverage |

Often utilized to maximize gains from small price movements. |

Less utilized, as the focus is on larger, more gradual moves. |

|

Patience |

Less patience required for seeing trade outcomes. |

High level of patience required. |

|

Capital Utilization |

Capital is not tied up for long, quick turnover. |

Capital can be tied up for extended periods. |

The choice between short and long-term forex trading often depends on an individual’s trading style, risk tolerance, time commitment, and the capital they have available for trading. Each trader must evaluate these factors and decide which approach best suits their objectives and lifestyle.

Risk Management in Forex Strategies

Proper risk management forms the core of all profitable trades in the forex market. Traders should learn why position sizing is essential, where to place stop loss and take profit orders so that they can lock in profits, cut losses and avoid losing all their capital.

Source: www.howtotrade.com

Position Sizing

Proper position sizing entails deciding how much capital you are willing to put at stake in one trade. A typical rule of thumb is to never risk more than three percent of your trading capital in any respective trade, while many trades opt for 1-2%.

Say you have 10,000 CHF in your trading account, risking 1% means that you must make sure your stop loss amounts to a loss of no more than 100 CHF. This way, it would take a streak of 100 losses in a row to wipe out your trading capital, an unlikely occurrence.

Sizing your positions is paramount so as not to lose your money in a handful or even one single trade. You should specify your position size to survive a losing streak without losing the entire balance of your trading portfolio.

Setting a Stop Loss and Take Profit

To safeguard your investments, it is vital to have stop-loss and take-profit orders in your risk management toolkit. The stop-loss order is an order that exits a loss-making trade when its price moves against your position. On the other hand, take-profit orders are aimed at protecting your profits by designating a certain price at which the trade is closed with a profit.

- Stop Loss: A stop-loss refers to a predetermined price level at which you are prepared to exit the losing trade. For instance, if you buy a currency pair at $1.2000, you can set your stop loss at $1.1950. This means that if the price drops to $1.1950, your trade will terminate on its own with a loss of 50 pips, preventing you from incurring more losses.

- Take Profit: Take-profit is the order through which one locks in the profits. In the same trade at which you bought a currency pair at $1.2000, and set your stop loss at $1.1950, you can set a take profit order at $1.2050. Therefore, if the price moves higher and hits the level of $1.2050, then your trade will automatically close, but this time with a profit of 50 pips.

Several other risk management tools are widely used among traders. Moving your stop-loss to breakeven, trailing your stop-loss to catch a trend while preserving your profits, and a lot more! With proper use of stop-loss and take-profit orders, it is possible to adequately mitigate risks and preserve trading funds.

Types of Forex Trading Strategies

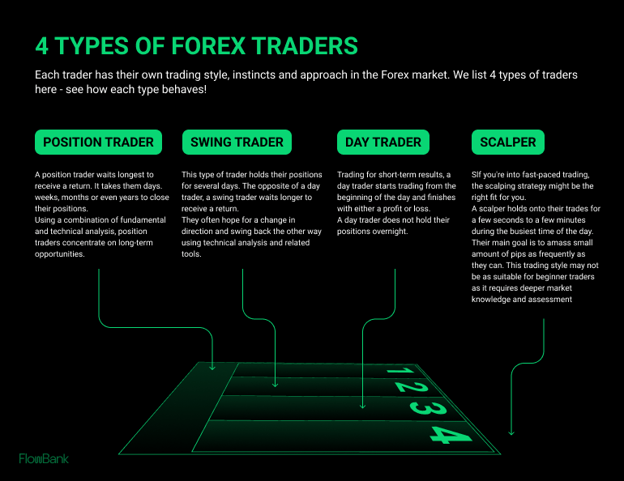

There are different types of trading strategies that traders can choose from depending on several factors. Your trading strategy can be a quick scalping approach, day trading, swing trading, or position approach. For traders to excel in the forex market, they must understand these strategy types. They also need to pick the approach that matches their objectives and preferences in trading.

Scalping Strategies

This is the quickest approach to trading, and it comes with the highest risk. A trader following this trading strategy -often called a scalper- enters many very short-term trades to make profits from the smallest price changes. The success of this approach requires a fast, reliable data feed and tight spreads as well as the ability to make fast decisions.

- Time Frame: 1minute, 5minutes, 15minutes.

- Risk Level: Very High.

- Key Tools: The three tools required include a high-speed internet connection, access to real-time data, and the ability to make swift decisions.

Scalping the forex markets is highly profitable but has considerable extra risks associated with loss.

Day Trading Strategies

Day trading strategies focus on exploiting the price changes within the day. Traders who choose this type of strategy try to open and close their trades within the same day. Trades are longer in duration than scalping as they can remain open for a few hours and are slightly lower in risk.

- Time Frame: 15minutes, 30minutes, 1hour

- Risk Level: High.

- Key Tools: Technical analysis patterns, and strict money management rules.

Swing Trading Strategies

Swing traders don't have much time to monitor the markets daily, and hence choose to enter and hold trades for a few days up to a few weeks. They aim to profit from price swings within a trend or counter-trend retracements, offering a balance between short-term and long-term strategies which makes it a popular choice for many traders.

- Time Frame: 1hour, 4hours, Daily.

- Risk Level: Moderate.

- Key Tools: Technical analysis tools, risk management, and patience.

Positional Trading Strategies

This is the longest approach to trading the markets. Traders who refer to this type of strategy are often regarded as forex market investors. They are willing to hold positions for a few weeks or months and often focus on fundamental analysis and key economic drivers.

- Time Frame: Daily, Weekly, Monthly

- Risk Level: Low.

- Key Tools: Fundamental analysis, trend analysis, and an economic perspective.

Advanced Forex Strategies

Having learned the main categories of forex trading strategies, it is now time to explore some advanced ones. Examples of this include Algorithmic trading and sentiment analysis.Algorithmic and High-Frequency Trading

Algo trading is an evolution in FX trading strategies where software algorithms enter trades by themselves based on input parameters. It eliminates emotional factors in trading through data-driven and objective decisions. This strategy requires a deep understanding of markets as well as coding experience, making it the perfect choice for institutional traders.

High-frequency trading (also known as HFT) is one form of algorithmic trading which is the fastest type. Using the help of technology and computerization, the algorithm carries out many trades very quickly (often working in nano-seconds!) to gain from even insignificant price fluctuation. HFT algorithms are very complicated and must access ultra-high-frequency data feeds. It also requires very low trading spreads and fees.

Sentiment Analysis in Forex

Sentiment analysis is a forex trading strategy that many traders overlook. It provides important insights about the mood of the markets based on economic news, indicators, and even social media trends.

The strategy requires an in-depth comprehension of what influences the price of a particular asset or currency. It also entails studying and analyzing the investors’ views on the most recent happenings and releases. If the overall sentiment surrounding a specific trading asset is bullish, sentimental traders will look out for only buy positions. The opposite happens in a bearish sentiment market.

Trend-Based Strategies

Identifying Market Trends

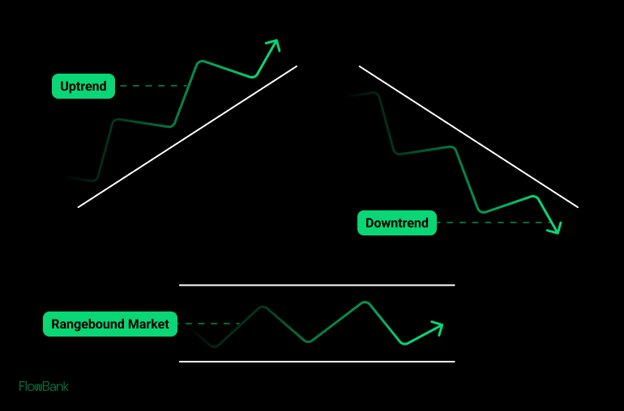

Whether you are willing to trade with the trend or against it, the first step is always to identify the market trend.

The general rule of technical analysis and Dow theory states that markets do trend.

If prices have been consistently moving higher for some time, it is said to be in a bullish (upward) trend, and that is when you should only look for buying opportunities.

On the other hand, a bearish (downward) trend is formed when prices are consistently heading lower for some time, and that's when short trades are more favorable.

If, however, markets have been ranging with no clear direction either to the upside or to the downside, it is said to be in a rangebound market (sideways).

Trend-Following vs Counter-Trend Strategies

In the world of forex markets and trading, two main approaches are most followed: trend-following and counter-trend strategies. Trend-following traders aim to profit from markets that are trending, going long when prices are consistently rising and going short when they're falling. This strategy hopes that existing trends will persist for as long as possible.

The fact is that trends often change direction, and this is when counter-trend traders hope to make profits. Counter-trend strategies hope to pick out the exact price on the chart at which price trends will reverse or at least retrace and give them some profits. They often buy near support and sell near resistance. This type of strategy requires precise entry points and strict money management rules.

We cannot define any of those strategy types as more profitable, it should be your choice to approach the markets in the way that best suits your risk tolerance and market outlook.

Price Action and Technical Analysis

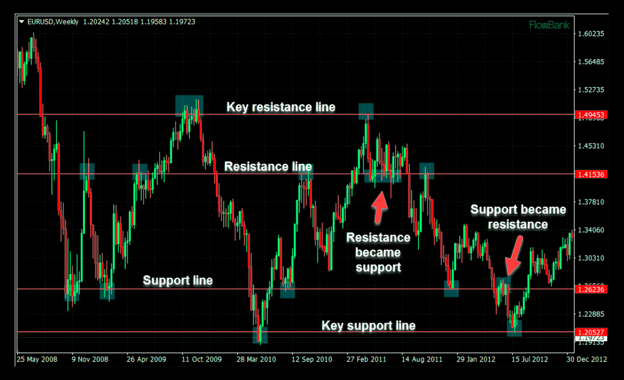

Support and Resistance Levels

The concept of support and resistance levels is the backbone to the technical analysis of the forex market.

What is S&R? These are the prices of a currency pair where the direction of the price has changed direction in the past and so can be reasonably expected again, at least with a greater probability than prices where no reaction has occurred before.

Source: Alpari

Support levels are price points at which a currency pair usually halts before reversing its course. Traditionally support levels serve as entry points for long (buy) trades. This suggests that the demand for a particular currency may rise when the price hits such a level. Various factors may form support levels, among them psychological, historical price points, and fundamental factors, for example, economic data and news events.

Resistance levels are price levels at which a currency pair is likely to halt from climbing, and potentially begin falling again. Resistance levels are generally viewed by traders as points where they can enter short positions as this shows the supply of the currency pair may be higher than demand. Psychological barriers, previous price points, and fundamental factors can also be responsible for the creation of resistance levels.

Traders should understand and recognize the importance of support and resistance levels because these areas help them know where they can enter and exit trades, as well as where to place a stop loss and take profit orders to guide their trading decisions in this market.

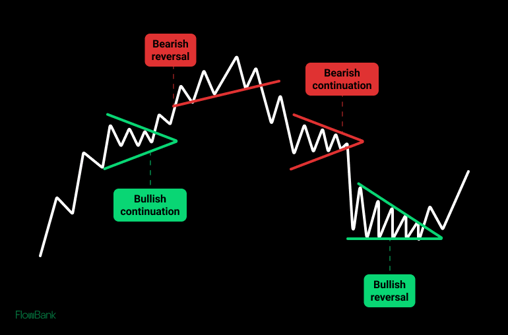

Chart Patterns and Indicators

The chart patterns constitute graphical representations of the prices in the forex chart. These patterns are used by traders to project future price movements.

Source: ThinkMarkets

There are two main types of chart patterns:

Continuation patterns. Patterns indicating continuation include flags and pennants, pointing towards the continuity of the prevailing trend.

Reversal patterns. Patterns that point towards a possible change in the direction of the trend include head and shoulders as well as double tops and bottoms.

Traders can recognize and appropriately decipher such patterns to analyze the market and try to predict the following move.

Technical Indicators

Indicators are mathematical constructions based on prices, time, liquidity, and open interest data. The traders use these indicators to know about the market’s trend, change in speed, and possible reversals. They include moving averages, RSI, and MACD. Moving averages aid in smoothing out prices to pick up trends; RSI measures the velocity and magnitude of price changes to determine overbought/oversold conditions, while MACD shows the relationship between moving averages. Traders commonly combine several indicators to confirm their bias about trades and make sound trading decisions. Interpretation and application of the technical indicators are indispensable in Forex trading.

Adapting Strategies to Market Conditions

Trading in Volatile Markets

The forex market is volatile by nature and dealing with such an environment offers both opportunities as well as risks. Currency prices may rise or fall very rapidly during high volatility.

Momentum strategies are particularly effective in high-volatility markets because these strategies capitalize on large and rapid price movements. Traders using momentum strategies look for signs of a strong price trend and enter trades in the direction of that trend, seeking to exploit the market's inertia. They often enter trades on breakouts, where the price moves beyond a defined resistance or support level, signaling a continuation of momentum. They use stop orders to enter the market at these breakout points automatically.

Once in a position, they may employ trailing stops to protect their gains, allowing them to stay in the trade as long as the trend continues without being stopped out prematurely. Because prices can move quickly and reversals can happen suddenly in volatile markets, traders need to be vigilant and ready to act.

Trading in Stable Markets

Volatility is low in stable markets, meaning that currency prices change in a limited range and speed. It is during such periods that traders mostly use the range-bound strategy that involves trading within a determined price range.

Buyers look for support level (low end of the range) and sellers look for resistance (upper end of the range). It is a strategy that seeks to profit by exploiting price fluctuations in the established range. Furthermore, traders can adjust their risk management process to work within this relatively stable market.

Concrete Examples from Our Experts

Now let us delve into some expert advice on the most effective use of each strategy.

Expert Insights on Scalping Strategies

Here is an example scalping strategy to give you some inspiration for trying scalping for yourself.

Timeframe: 1-Minute to 5-Minute Charts

Indicators Used:

- A single exponential moving average (EMA) for fast reaction to price changes, e.g., a 9-period EMA.

- Stochastic Oscillator to identify overbought and oversold conditions, typically with settings (14, 3, 3).

Other Details:

- Liquid currency pairs such as EUR/USD or USD/JPY to minimize spreads.

- High liquidity trading sessions like London or New York, better around the market open or close.

- A tight stop-loss of 5-10 pips, and a take-profit level of around 10-15 pips, depending on the volatility and the spread of the currency pair.

Source: TradingSim

Step-by-Step Trading Strategy

- Place a 9-period EMA and a Stochastic Oscillator on your 1-minute or 5-minute chart.

- Look for the price to pull away from the EMA, indicating a possible retracement or consolidation.

- Wait for the Stochastic to indicate an overbought condition (above 80) for a potential sell, or an oversold condition (below 20) for a potential buy.

- Enter a buy trade when the price is above the 9-period EMA and the Stochastic crosses above 20. Enter a sell when the price is below the EMA and Stochastic crosses below 80.

- Place a stop-loss a few pips below the recent swing low for a buy trade or above the swing high for a sell trade. Set the take-profit at about two times the stop-loss distance.

- Actively manage the trade and be prepared to exit if the price crosses back over the EMA against your trade direction.

- Close the trade when the take-profit is hit or if the price crosses back over the EMA.

Real-World Applications of Swing Trading

This chart shows the Nasdaq index on a daily timeframe. The red arrows show bearish candle patterns that started a move lower with an average holding time of around 20 days. The green arrows, however, are bullish candle patterns that indicate a move higher was set to begin, and each move had a duration of around the same average.

Such moves are perfectly what swing traders are in constant search for. They aim to hold trades for a few days to weeks, which is based mostly on technical analysis, and in this case, trades were based on candlestick patterns alone.

Imagine combining this strategy with several other technical analysis tools to define stop-loss and take profit levels and how powerful it would be!

Forex Trading Strategies Recap

Key Takeaways

This comprehensive guide has covered several forex trading strategies, risk management techniques, and sophisticated tactics. Just like in any form of business, never forget that success in forex is not assured and losses are part of your learning curve. Nevertheless, if you have a strategy in place that you practice and learn from as you go, then you can improve your probability of success.

Next Forex Trends for 2024

The year 2024 promises a lot of changes in the forex industry. Factors such as the increasing incorporation of artificial intelligence and machine learning, a rise in interest in sustainable investing, and the influence of geopolitical events are expected to shape the arena. In the future, traders will expect more sophisticated tools and procedures, better risk management techniques, and changing trends in the global market.