This guide is to show you step-by-step how to start trading forex. It is a follow-up to our guide ‘What is Forex? And how it works’. If you’re completely new to forex trading, we recommend you start there to learn about the forex market before returning to this one to learn how to trade it.

Choosing the right Forex Broker

The choice of a broker is a crucial first step. You need a broker to gain access to live forex and CFDs prices and the software platform from which you’ll place the trades. A good broker provides competitive spreads, a reliable trading platform, and good customer service. Consider the following when choosing a broker :

- Regulation : Ensure a reputable financial authority regulates your broker. This offers a layer of protection in case there is a dispute. If the broker will not resolve your issue to your satisfaction, you can contact the regulator to intervene. FlowBank is regulated by BaFin in Switzerland.

- Spreads and Commissions : Different brokers have different fee structures. Look for competitive spreads and transparent fee disclosures. If you plan to trade very frequently, tight spreads are very important. For less frequent traders, spreads should be competitive but needn’t be the tightest.

- Customer Support : Opt for a broker with a responsive customer support team, available 24/7, given the round-the-clock nature of Forex trading. You want to know that you can speak or live chat to somebody when you have an issue, especially with open trades and a running P&L.

Source: DataScienceSociety

Selecting the best trading platform

The trading platform is your portal to the Forex market and should form a part of your decision on which broker to choose because most brokers offer specific platforms from which to use their services. The platform should be :

- An intuitive interface will help you execute trades efficiently.

- Look for platforms offering advanced charting tools, multiple timeframes, and a variety of technical indicators.

- Ensure the platform uses top-tier encryption and security protocols to protect your data and funds.

- In today's mobile age, a good platform should have a responsive mobile version or a dedicated app.

- The availability of trading multiple markets via CFDs can add some needed diversification for forex traders.

Opening your Forex trading account

Once you've chosen a broker, the next step before you learn how to trade is to open an account. This typically involves :

- Providing personal details for identification verification.

- Submitting documentation, like a copy of your passport or driver's license and a utility bill for address verification.

- Choosing an account type based on your trading goals and deposit amount.

Click here to open a FlowBank trading account.

Understanding the risks of Forex trading

Forex trading offers plenty of profit potential, but there are risks. Firstly, anytime you make an investment or place a trade, the value of what you are buying can fall as well as rise, meaning you are liable to lose money as well as to make money. Forex and CFDs trading has some specific risks to consider :

- Leverage Risks : Using leverage can amplify both profits and losses. It allows you to control a large position with a relatively small amount of capital, but it can also magnify your losses.

- Market Risks : Currency values can be volatile, influenced by factors such as geopolitical events, interest rates, and economic data.

- Liquidity Risks : Although the Forex market is highly liquid, there are moments, especially in exotic pairs, where liquidity can decrease, leading to slippage. Although it doesn’t happen often, you need to accept that at any given time, you might temporarily not be able to close a trade because of market conditions, potentially leading to a bigger loss than you anticipated.

To manage these risks, always use stop-loss orders, diversify your trading strategy, and never invest money you can't afford to lose. We talk more about risk management further down in this guide.

How to fund your Forex account

Once your account is set up, you'll need to deposit funds. Most brokers offer various funding options, including Bank Transfers, Credit/Debit Cards and E-Wallets like PayPal or Skrill. Always ensure the broker's website uses SSL encryption when entering your financial details.

The value of Forex trading education

Continuous learning can set you apart from novice traders. Learn how to trade effectively with online courses, webinars, and seminars. Follow expert analyses and stay updated with market news. The more informed you are, the better your trading decisions will be. So keep reading to learn more !

Understanding the basics of forex trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in a bid to profit from fluctuations in their value.The forex market is the world's largest financial market, with currencies traded in pairs, like the EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). Let's dive into concrete examples to further elucidate the mechanics of forex trading.

Examples of Forex Trading

Currency pairs consist of a base currency and a quote currency. For instance, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. The price of the pair signifies how much of the quote currency is required to purchase one unit of the base currency.

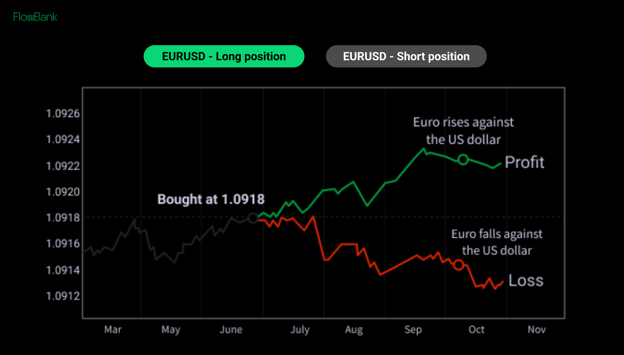

An example of a Gain :

Imagine you believe that the euro will appreciate against the dollar. You decide to buy (or go "long" on) the EUR/USD pair at 1.0810. This means that for every euro, it costs 1.0810 dollars.

After thorough analysis and monitoring market news, your prediction turns out right. The price of the EUR/USD pair rises to 1.0860. This increase of 0.0050 is termed as 50 "pips." By deciding to close (sell) your position at this point, you've made a profit from the price difference.

Source: FXTM

An example of a Loss :

Forex trading is not always about gains; there's a flip side to the coin. Let’s say that instead of rising as you had expected, EURUSD actually drops 50 pips after some unforeseen financial news from Germany causes a dip in the euro's value.

If you had opened your long position at 1.0810 and the price falls to 1.0760, you've incurred a loss of 50 pips. It's crucial for traders, especially beginners, to learn and employ strategies to manage such risks, such as using stop-loss orders.

Making your first trade

Placing your first trade can feel daunting, but by breaking down the process into steps and first practising on a demo account, you can soon get comfortable with it.Practise trades to be done in a demo account

Before diving into the live markets, getting comfortable with how to trade on the platform using a demo account is wise. FlowBank offers a demo trading account to allow beginners to learn the nuances of trading without risking real money. It's a safe space to get accustomed to the platform and understand the dynamics of currency exchange. Essentially, you'll be making hypothetical trades to see how they would have played out in real-time markets.

Selecting a Forex pair

The Forex market revolves around pairs. As a trader, you'll be buying one currency and selling another.

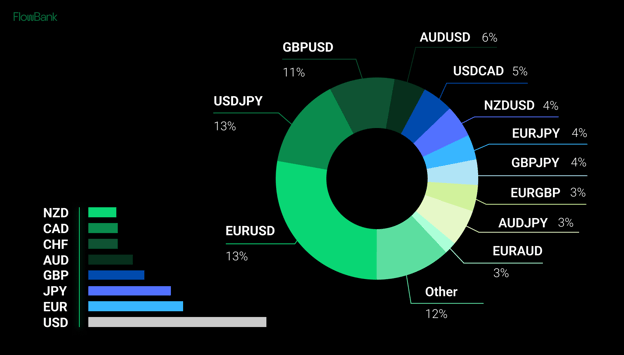

For instance, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. For beginners just starting, it's advisable to focus on major pairs like EUR/USD, GBP/USD, or USD/JPY as they are more liquid and have ample information available for analysis.

DailyForex conducted a survey of over 3000 traders to show which currency pairs are most actively traded. The results were as follows :

However, some traders focus on cross pairs that involve two major currencies but not the USD such as EUR/GBP (Euro-Great British Pound) or exotic pairs involving currencies from smaller economies like USD/ZAR (South African Rand).

Choose how much currency to trade

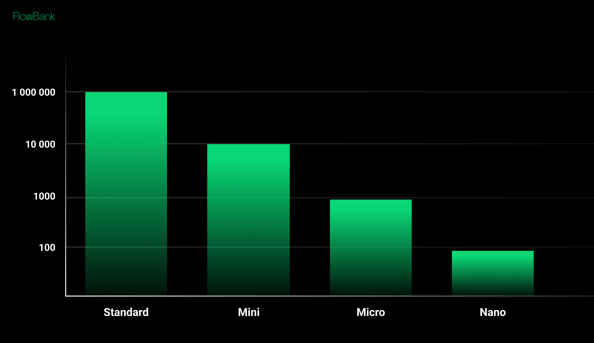

This involves deciding the size of your position. This decision is paramount in managing risks and achieving consistent profitability. Two essential concepts come into play when deciding the amount : lot size and leverage.

As a beginner, trading a standard lot can be riskier due to the significant capital required and the potential for larger losses. Starting with mini or micro lots offers a way to get a feel for the market without exposing too much of your account balance.

Leverage allows traders to control a large position with a fraction of the capital. While this can amplify profits, it also increases risk. For instance, with a leverage ratio of 100:1, a $200 deposit can control a trade worth $20,000 (which is 2 mini lots).

How to trade Long and Short

In the forex market, it is just as easy to go long (buy) or go short (sell). Because currencies are traded in pairs, you are basically always long one currency and short another.1. Buy (Long): If you believe the base currency will strengthen against the quote currency.

2. Sell (Short): If you believe the base currency will weaken against the quote currency.

Decide entry and exit prices

Don’t get too hung up on ‘why’ you are placing a trade at this stage, just focus on the ‘how’. You can afford to get comfortable with the process of trading thanks to the riskless environment in the demo account.

You can enter the trade at the market price or wait for the price to change before entering. Before opening a position, it's crucial to determine exit points, both on the profitable side and the loss side. This involves setting a price where you will take profits and where you will cut your losses.

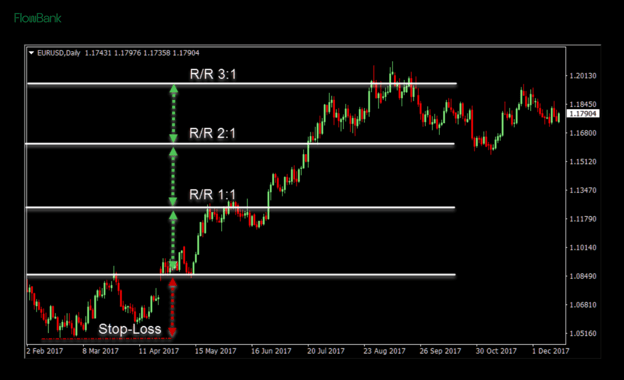

The goal should usually be to try to get more reward (profit) than you risk (loss).

Source: ForexSpringBoard

Place orders

With your plan of where to enter and exit the trade ready, you can use your trading platform to place the orders.

The most straightforward price to trade at is the current market price, in which case you’d place a market order - or simply click the ‘Buy’ button to go long or the ‘Sell’ button to go short the market. If you want to enter the market at a different price than is currently available, you’d set a limit order or stop order.

Source: FXSSI

You can then place your stop loss order, which is sell stop in a long position or a buy stop in a short position. Luckily the trading platform labels it a stop loss, so there is no need to choose. The same goes for the take profit order, which is a limit order to sell in a long position or a limit order to buy in a short position.

Position sizing and risk management in Forex Trading

Navigating the volatile waters of the Forex market requires more than just intuition and basic knowledge. A precise, calculated approach, especially when it comes to position sizing and risk management, is what often separates novice traders from seasoned experts. Let's delve deeper into these core principles.The crucial role of stop losses

A **Stop Loss (SL)** is perhaps one of the most invaluable tools in a trader's arsenal. Think of it as a safety net, ensuring you don't plummet too far even if you stumble. By setting a stop loss, you're essentially determining a price level at which your trade will automatically close, thus preventing further losses.

Imagine you're trading the EUR/USD pair. You buy in, anticipating the Euro will strengthen against the Dollar. However, markets can be unpredictable. If the Euro starts to decline, your SL will automatically close your trade at the predetermined level, ensuring you don't suffer extensive losses. This automation removes emotion from the decision, allowing you to stick to your trading plan even when things don't go as expected.

How much capital to trade with

Determining how much capital to commit to the Forex market is a personal decision. You might be tempted to dive in headfirst, investing a significant portion of your savings, lured by tales of traders turning modest sums into fortunes. But, remember, Forex trading, like any form of investment, comes with risks.

Start with what you're willing to lose. This might sound pessimistic, but in the world of trading, it's a pragmatic stance. Beginning with a smaller amount not only limits your potential losses but also gives you the room to learn, make mistakes, and grow as a trader without the pressure of significant sums hanging in the balance.

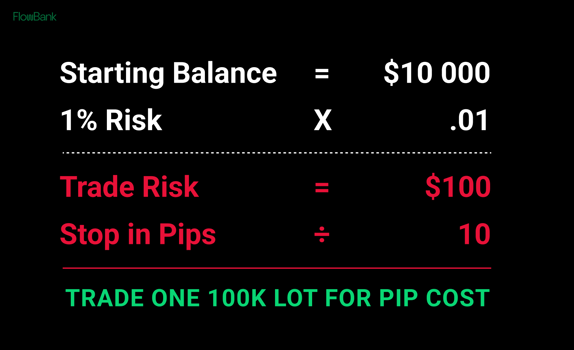

How much to risk per trade

As a general guideline, many seasoned traders advocate for the 1-2% rule. That is, never risk more than 1-2% of your trading capital on a single trade. By adhering to this principle, even a series of unsuccessful trades won't decimate your account.

Say, for instance, your account balance stands at $10,000. Going by the 1% rule, you wouldn't risk more than $100 on a single trade. By keeping risks low, you ensure longevity and sustainability in the market, allowing your account to weather the inevitable stormy days.

Risk : Reward Ratio - Cut your losers short, let your winners ride !

The risk: reward ratio is another cornerstone of robust risk management. It represents the potential loss (risk) versus the potential gain (reward) on any given trade. A commonly recommended ratio is 1:3, meaning for every dollar you're willing to risk, you aim for three dollars in potential profit.

For instance, if you set a stop loss at 10 pips below your entry point, you might set your take profit (or target price) at 30 pips above your entry. This way, even if you have more losing trades than winning ones, the potential profits from your winners can offset and surpass losses, ultimately yielding a positive balance.

In essence, risk management in Forex is not just about preventing losses but optimizing potential gains. By meticulously planning your entry, setting diligent stop losses, and adhering to the principles of risk: reward ratios, you position yourself to grow and prosper in the world of Forex trading.

Forex trading analysis

To thrive in the Forex market, traders rely on meticulous analysis. This analysis forms the backbone of decision-making, offering insights into past market behaviors, current market states, and potential future trends. Generally, the two predominant forms of analysis in Forex are technical and fundamental analysis.

The difference between technical and fundamental analysis

At its core, technical analysis focuses on price and volume data, interpreting historic price movements to predict future market behavior. It operates on the belief that all market information and potential future movements are already factored into the price.

On the other hand, fundamental analysis considers the underlying causes like economic, social, and political forces that drive supply and demand for currencies. It seeks to understand the intrinsic value of an asset and the external factors affecting it.

An introduction to technical analysis

Technical analysis operates on the premise that history tends to repeat itself. By studying historical price patterns and market trends, traders believe they can forecast future price movements.

Three of the most important tools in technical analysis are :

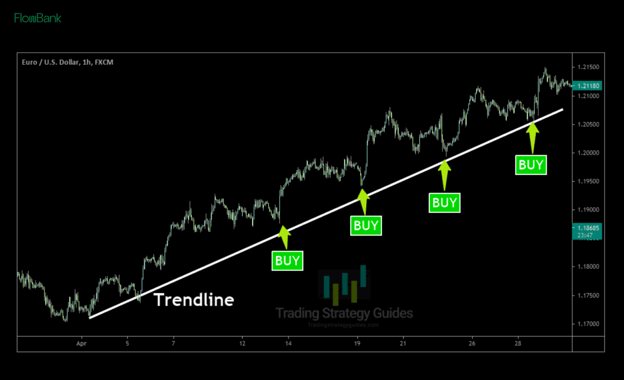

1. Trend Analysis : This involves identifying the market's direction. A market can be trending upwards (bullish), downwards (bearish), or moving sideways (range-bound).

2. Support and Resistance : These are levels where the market price seems to bounce off. Support represents a price level below the current price where the currency tends to find buying interest, while resistance is a level above the current price where selling interest might increase.

3. Candlestick Patterns : These are specific patterns created by the price movements of an asset on a chart. Recognizing these patterns can give insights into potential future market movements. For instance, patterns like 'Doji' or 'Hammer' can indicate a potential trend reversal.

An introduction to fundamental analysis

Analysing economic data and news :

Economic indicators like GDP growth, interest rates, inflation rates, and unemployment rates can provide traders with a pulse on a country's economic health.

Scheduled economic releases, like Central Bank minutes or employment reports, can lead to significant market volatility. Keeping an eye on economic calendars can, thus, be crucial for traders. Some of the most popular economic calendars can be found at :

Investing.com

FXStreet.com

ForexFactory.com

Using fundamental analysis to make trading decisions :

When employing fundamental analysis in trading decisions, especially around economic data releases, traders typically follow one of three approaches :

Predicting the data before release :

Pros :

- Higher potential reward : If you correctly anticipate the data and the market's reaction, the potential rewards can be significant due to the early entry.

- Positioning advantage : Being early allows you to secure a position that might become crowded once the data is out.

Cons :

- Higher risk : Predicting economic data is challenging, and getting it wrong can lead to substantial losses, especially if the market moves violently against the anticipated direction.

- Speculative nature : This approach is inherently speculative since it relies on prediction rather than concrete information.

Waiting for the data and assessing its importance :

Pros :

- Informed decision making : Trading post-release allows traders to make decisions based on actual data rather than speculation.

- Reduced volatility risk : By waiting for the initial market reaction to subside, traders can avoid the most volatile periods.

Cons :

- Missed opportunities : The most significant price movements often occur immediately after the data release. Waiting might mean missing out on some of these moves.

- Crowded trades: Entering the market post-release might mean contending with many other traders who've drawn similar conclusions from the data, making positions more competitive and potentially less profitable.

In summary, each of these approaches has its merits and challenges. The best strategy often depends on a trader's risk tolerance, trading style, and experience.

An introduction to market sentiment

Market sentiment is the prevailing 'mood' or attitude of traders towards the market. This sentiment deeply influences how news and data are perceived and can even dictate the duration and strength of market trends.

In strongly bullish conditions :

- The dominant optimism leads traders to dismiss bearish indicators, focusing instead on positive narratives.

- Any bullish news tends to be overemphasized, further propelling the market upwards.

- Fueled by overwhelming positivity, bullish markets can remain in an uptrend longer than anticipated, defying traditional indicators of overvaluation.

Conversely, during pronounced bearish periods :

- Pervasive pessimism causes traders to neglect bullish indicators, concentrating more on negative outcomes.

- Any bearish news is likely to exacerbate the market's descent.

- The prevailing negative sentiment can cause bearish markets to continue their decline for extended periods, often longer than fundamental data might suggest.

However, extremes in sentiment signal potential market inflections. When bullish sentiment is excessively extended, indicating that nearly everyone is optimistic, the market is vulnerable. At this point, even minor negative news can trigger significant declines. Conversely, when bearish sentiment saturates the market, even slight positive news can instigate sharp rallies.

At these extreme sentiment junctures, technical analysis tools like support and resistance levels become crucial. In a highly bullish sentiment, strong resistance levels can hold and potentially mark the top. Similarly, in deeply bearish conditions, robust support levels can prove resilient, indicating a market bottom.

Forex trading strategies

To consistently turn a profit, traders must have a roadmap—a strategy. Here's a deep dive into the significance of strategies and a snapshot of some popular ones:

A well-defined strategy provides a consistent approach, ensuring that traders don't make impulsive decisions based on emotions. It dictates the rules for entry, exit, and stop-loss, minimizing potential losses. Having a strategy allows traders to review and tweak their approach based on past performance.

How to choose the right strategy ?

Choosing a strategy depends on your experience level, risk tolerance, time commitment, market analysis preference, and trading goals. It's crucial to backtest any strategy with historical data and start with a demo account before going live.

Here is a snapshot of some of the best-known trading strategies :

Trend trading strategy

Trend traders aim to capitalize on price momentum by following the market's general direction. They buy in bullish markets and sell in bearish ones, believing that the trend will continue.

Range trading strategy

Here, traders identify currency pairs that are trading within a specific range and capitalize on their predictable movements, buying at support levels and selling at resistance.

Breakout strategy

Traders look for significant price moves out of defined levels of resistance or support. A breakout indicates potential continued movement in that direction.

Position trading strategy

This long-term approach involves holding trades for weeks or even months. Traders base decisions on in-depth fundamental and technical analysis.

Day trading strategy

A strategy for those who prefer closing out trades by the end of a trading day, ensuring no open positions are left overnight. It demands a keen understanding of intraday price actions.

Scalping strategy

A high-frequency strategy, scalping involves making numerous small trades throughout the day, capitalizing on tiny price movements. It requires quick decision-making and execution.

Swing trading strategy

Swing traders exploit "swings" or price oscillations. They hold positions for several days, capitalizing on expected upward or downward market shifts.

Carry trade strategy

Here, traders aim to benefit from the difference in interest rates between two currencies. They buy a currency with a higher interest rate and sell one with a lower rate, earning the differential.

News trading strategy

News traders capitalize on market movements resulting from major news releases. Quick reactions and understanding the implications of news on currency pairs are crucial.

Price action trading strategy

Price action traders rely on historical price data and real-time chart patterns to make trading decisions, eschewing traditional indicators.

Most forex traders employ a mix of the adove strategies. For example, trend trading on a 30-minute chart is a form of day trading or trading breakouts on a 5-minute chart is a type of scalping.

Using Forex trading robots (Algorithmic trading)

The strategies previously discussed can be approached in two primary ways : discretionary trading, where decisions are made on a case-by-case basis, and systematic trading, which relies on predefined rules and can be automated.

One of the most notable advancements in systematic forex trading is the use of trading robots or algorithmic trading. A popular platform for this kind of trading is MetaTrader, which allows traders to deploy Expert Advisors (EAs) to automate their strategies.

What are Forex trading robots ?

Forex trading robots are software programs that automatically execute trades based on predetermined criteria. These robots are designed to remove the psychological element of trading, which can often be detrimental to success.

Advantages of using trading robots

1. Robots operate on algorithms, ensuring trades are executed as planned without emotional interference.

2. Algorithms can process vast amounts of data and execute trades in milliseconds, far faster than a human trader.

3. Markets never sleep, and with trading robots, neither does your trading activity. They can operate continuously, taking advantage of opportunities even when you're away.

Challenges of using trading robots

1. Software and hardware issues can lead to missed opportunities or even unintended trades.

2. There's a risk of creating an EA that works perfectly with historical data but performs poorly in real-time trading.

3. While algorithms are excellent at following rules, they can't interpret qualitative data or unexpected market events like a human can.

MetaTrader and expert advisors (EAs)

MetaTrader, especially its fourth and fifth versions (MT4 and MT5), is a favored platform for forex trading due to its user-friendly interface and the ability to use EAs.

EAs can be tailor-made to fit any trading strategy, be it trend trading, scalping, or any of the strategies previously mentioned. Before deploying an EA, MetaTrader allows for backtesting using historical data, providing insights into how a strategy might perform in real market conditions.

The importance of keeping track of your trades

Every successful journey requires periodic reflection and assessment, and forex trading is no exception. Continuous evaluation helps traders recognize their strengths and pinpoint areas of improvement.

Learning from Mistakes : By documenting each trade, you can analyze mistakes and avoid repeating them.

Identifying Patterns : Keeping track helps you notice patterns in your trading habits, which can be crucial in refining your strategy.

Accountability : Recording trades ensures you remain responsible and committed to your trading plan.

Key metrics to monitor your performance :

- Net profit : An obvious but essential metric, it provides the total profit after deducting losses and costs. Ultimately this number needs to be positive otherwise the whole endeavour is not worthwhile. However, it’s important not to only look at this number because it doesn’t give you enough information to make informed decisions.

- Win/Loss ratio : This represents the number of winning trades to losing ones. A ratio greater than 1 indicates you win more trades than you lose. It’s quite possible, even normal, to have a profitable trading strategy where the win/loss ratio is less than 1, ie you lose more trades than you win.

- Risk-Reward ratio : It measures the potential profit of a trade compared to the potential loss. Ideally, if you are correctly following your system, this number should be close to the next one on the list.

- Average profit per trade : This is calculated by adding up all your profits and losses and dividing it by the number of trades. By calculating this, you can gauge the profitability of your trading strategy.

- Drawdown : This highlights the decline in your account from its peak to its lowest point. Large drawdowns are tough financially and emotionally to come back from so a robust system should avoid large drawdowns. A rule of thumb is no more than 30%. conditions.

Trading psychology

Trading psychology refers to the emotions and mental state that influence trading decisions. A trader's psychological makeup can play as significant a role in trading success as any strategy or analysis.

Avoiding emotional trading

Emotional trading often leads to impulsive decisions that stray from a well-thought-out strategy. Keeping emotions like fear and greed in check is crucial.

The role of trading psychology

There are a few skills you need to hone as a trader that you might have gotten away without using in your career or other aspects of your life. One of the great things about trading is that it forces you to get to know yourself - your strengths and your weaknesses. There’s nothing like seeing your hard-earned money going up and down in value in real-time to see what you’re really made of! Here are the main skills needed :

- Discipline : Maintaining a disciplined approach ensures you stick to your strategy, even during market volatility.

- Patience : Not every moment is ideal for trading. Recognizing and waiting for the right opportunities is a vital psychological trait.

- Confidence : Having confidence in your decisions, while also being open to learning from mistakes, is essential.

- Risk Tolerance : Understanding your personal risk tolerance, and not trading beyond it, ensures you don't make hasty decisions in stressful situations.

Recognizing the importance of evaluating one's trading performance and understanding the intricacies of trading psychology can propel traders from mediocrity to consistent success.

Where to learn Forex and seek help

New traders embarking on their forex journey should consider leveraging a myriad of resources available to hone their skills.

Online platforms offer a plethora of educational materials ranging from webinars, tutorials, to e-books tailored for all expertise levels. Forums, like BabyPips and Forex Factory, are invaluable communities where traders share experiences, discuss market trends, and offer guidance. Furthermore, seeking mentorship from seasoned traders or enrolling in structured courses can offer targeted learning experiences.

As the financial landscape continually evolves, continuous education remains paramount for sustained success in forex trading.

Congratulations, you should now feel a lot more informed about forex trading ! Register for a free FlowBank account to put your knowledge to work.

.png?width=630&height=262&name=How%20To%20Trade%20Forex%20(1).png)