Last week, the release of January's US inflation data, which surpassed expectations, initially rattled currency markets. The dollar surged against all counterparts, buoyed by a reassessment of future rate projections. However, as investors digested the data, the dollar retraced its gains in later sessions.

One Hundred Dollars Bills | Shutterstock.com

This week, all eyes are on the minutes from the latest Federal Reserve meeting. Traders are eager to gauge whether there is consensus among board members regarding the timing of potential rate cuts. Currently, the market anticipates the first cut in June, with nearly a full percentage point of cuts priced in by December.

In Europe, attention is focused on several key indicators, including the Eurozone's flash PMIs for February, final inflation figures, and the release of the ECB policy accounts on Thursday.

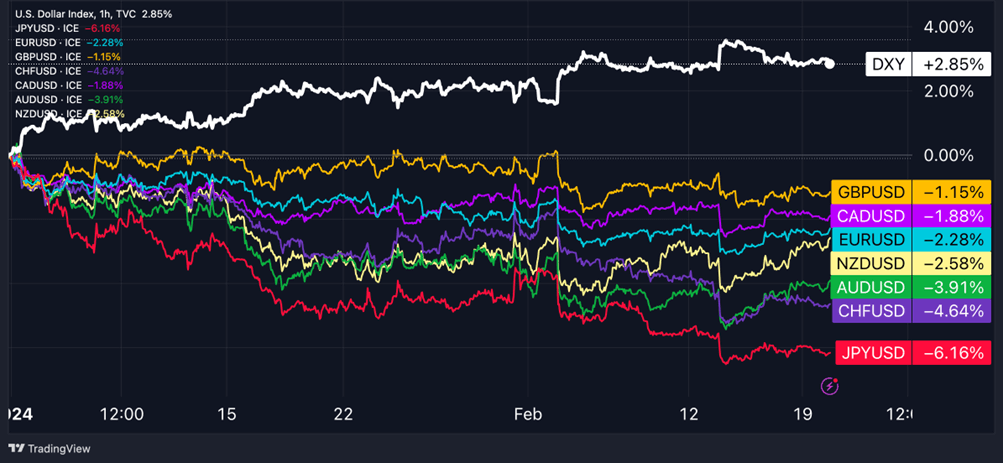

Year-To-Date Performance of Major Currencies: USD Leads, JPY Underperforms

Source: TradingView

U.S. Dollar Update: On Tuesday morning's trading, the U.S. dollar index hovered around 104.1 levels, just slightly above its levels before the inflation data was released a week ago. In January, the U.S. annual Consumer Price Index (CPI) exceeded expectations, with a 3.1% increase compared to the anticipated 2.9%. Additionally, core figures also surprised on the upside, reaching 3.9% versus the expected 3.7%. Consequently, traders revised their 2024 full-year expectations from 125 basis points to approximately 100 basis points of cuts. Despite the movement in rates and the broader increase in Treasury yields, the dollar failed to rally as strongly as suggested by fundamental indicators. On Wednesday, traders anticipate gaining more clarity on whether the Federal Reserve's board leans towards more hawkish positions, as hinted at by Fed Chair Jerome Powell during the meeting.

Euro update: After dipping to 1.0690 following the release of stronger-than-expected US CPI data, the euro rebounded to 1.0790 during Tuesday morning trading, essentially returning to its pre-inflation levels. Last week, ECB President Christine Lagarde restated that although data from the eurozone suggested inflation was slowly nearing target levels as expected, the central bank needed more evidence, especially concerning wage trends, before considering any adjustments to interest rates. However, the outlook remains bleak for the currency bloc, as the European Commission reduced both growth and inflation forecasts for 2024 and 2025. Additionally, the German Bundesbank continued to issue warnings about the current decline in Germany's economic activity. Traders are eagerly awaiting further insight from the eurozone's PMI surveys for this month, as well as the ECB policy accounts scheduled for release on Thursday.

Pound update: The pound remains relatively stable around the 1.26 mark, showing little fluctuation following last week's events. This lack of movement is attributed to the balancing effect of strong UK retail sales data for January, which surged by an impressive 3.4% on a month-over-month basis, far exceeding the anticipated 1.5% increase. January's inflation rate held steady at 4%, slightly below the expected 4.2% and the Bank of England's projection of 4.1%. Additionally, wage growth in the fourth quarter surpassed expectations. Currently, money markets are factoring in approximately 72 basis points of rate cuts for the year.

Chart of The Week: Dollar Retraced Most Of Its Post-CPI Gains

Source: TradingView

This Week's Forex Trading Ideas

Long DXY Index

- Entry: 104.15

- Take profit: 106.00

- Stop loss: 103.40

- Risk/reward ratio: 1:2.5

Source: TradingView

DXY Fundamental analysis: The dollar index has underperformed relative to interest rate movements, despite traders revising down their expectations for Federal Reserve rate cuts. This counterintuitive performance suggests that the DXY could witness a rebound to higher levels, buoyed by hawkish Fed minutes and data indicating that Europe is now on the verge of a recession this week. Real interest rates are once again on the rise, with the yield on the 10-year Treasury inflation-protected security hovering around 2%. Further upside in Treasury rates could unleash the strength of dollar bulls.

DXY Technical analysis: The DXY has been on a winning streak for 5 weeks, with momentum potentially paving the way for further gains. Currently, the gauge is testing the trendline of an ascending channel, which could present an opportune entry point for trend-seeking traders. Although the relative strength index has shown some easing recently, it remains above 50, suggesting that bulls still dominate the market. Aggressive traders may set their sights on the 106.00 level as an enticing target for the upcoming weeks, while placing a stop at around 103.40 in case the DXY breaks below the 50-day moving average.

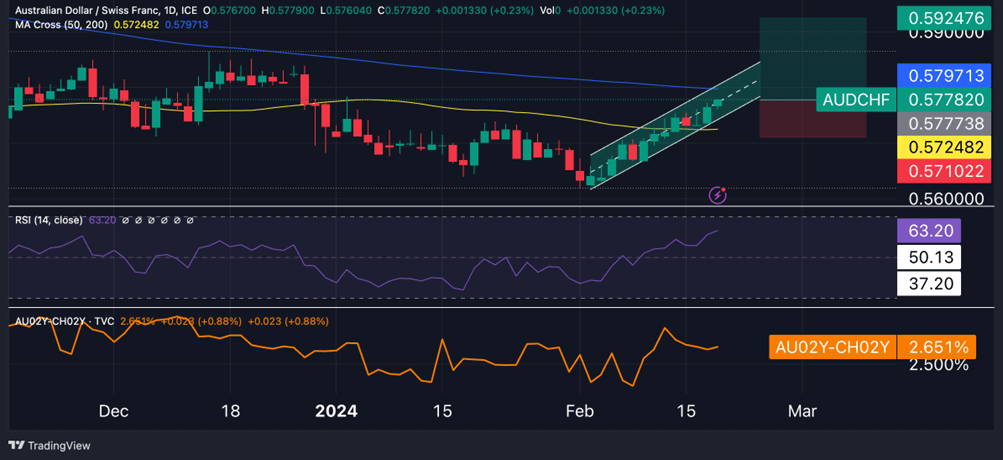

Long AUD/CHF

- Entry: 0.5777

- Take profit: 0.5924

- Stop loss: 0.5710

- Risk-reward ratio: 1:2.2

Source: TradingView

AUD/CHF Fundamental analysis: The Swiss franc remains under pressure across the board, largely due to the Swiss National Bank (SNB) terminating its currency-purchasing program and focusing on bolstering FX reserves instead. This leaves the CHF particularly exposed against major currencies. With interest rates holding steady at 1.75% and expectations for future cuts, it also becomes an attractive funding currency against high-yielding counterparts. In addition to the conventional long USD/CHF position, traders may diversify their strategies by considering AUD/CHF. This pair offers over 250 basis points of spread in the 2-year yield, presenting an alternative opportunity for profit.

AUD/CHF Technical analysis: AUD/CHF has climbed nearly 3% since the beginning of the month, surpassing its 50-day moving average and currently aiming for a test of the 200-day MA. The 14-day RSI indicator has surged to 63, reaching its highest level since November 2023. Looking at a medium-term horizon, the September 2023 high at 0.5925 presents an intriguing target. A prudent stop could be placed below the 50-day moving average at 0.5710.

Long CAD/CHF

- Entry: 0.6536

- Take profit: 0.6830

- Stop: 0.6420

- Risk-reward ratio: 1:2.4

Source: TradingView

CAD/CHF Fundamental analysis: Similar to the AUD/CHF idea mentioned earlier, a long position on CAD/CHF provides a dollar proxy to benefit from a depreciating Swiss franc. Presently, the 2-year yield differential between Canada and Switzerland stands at over 3%, making it one of the widest spreads in the G10 FX space. If the short-term rate differential continues to widen, it could support CAD/CHF towards the high levels seen in 2023.

CAD/CHF Technical analysis: CAD/CHF has surged 2% in February, currently enjoying a positive streak for the past 3 weeks. The highs from the second half of 2023 sit approximately 4.5% above current levels, presenting an intriguing target for a 1-month horizon, banking on momentum. Currently, the pair is testing resistance at the 200-day moving average, which has proven to be sturdy over the past week. A break above this level could potentially lead to a surge up to 0.6830. Placing a stop-loss below the 50-day average at 0.6420 offers a risk-reward ratio of 1:2.4.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.