It's been over a week since the Hamas terrorist attacks on October 7, 2023, which marked the beginning of hostilities with Israel.

The Israeli military is gearing up for a substantial operation in the Gaza Strip, necessitating the evacuation of over 1 million residents from the northern part of the Palestinian enclave. Simultaneously, international responses are witnessing the United States extending military support to Israel, while Arab countries, particularly Iran, are issuing threats of involvement in the conflict if the Israeli army enters Gaza.

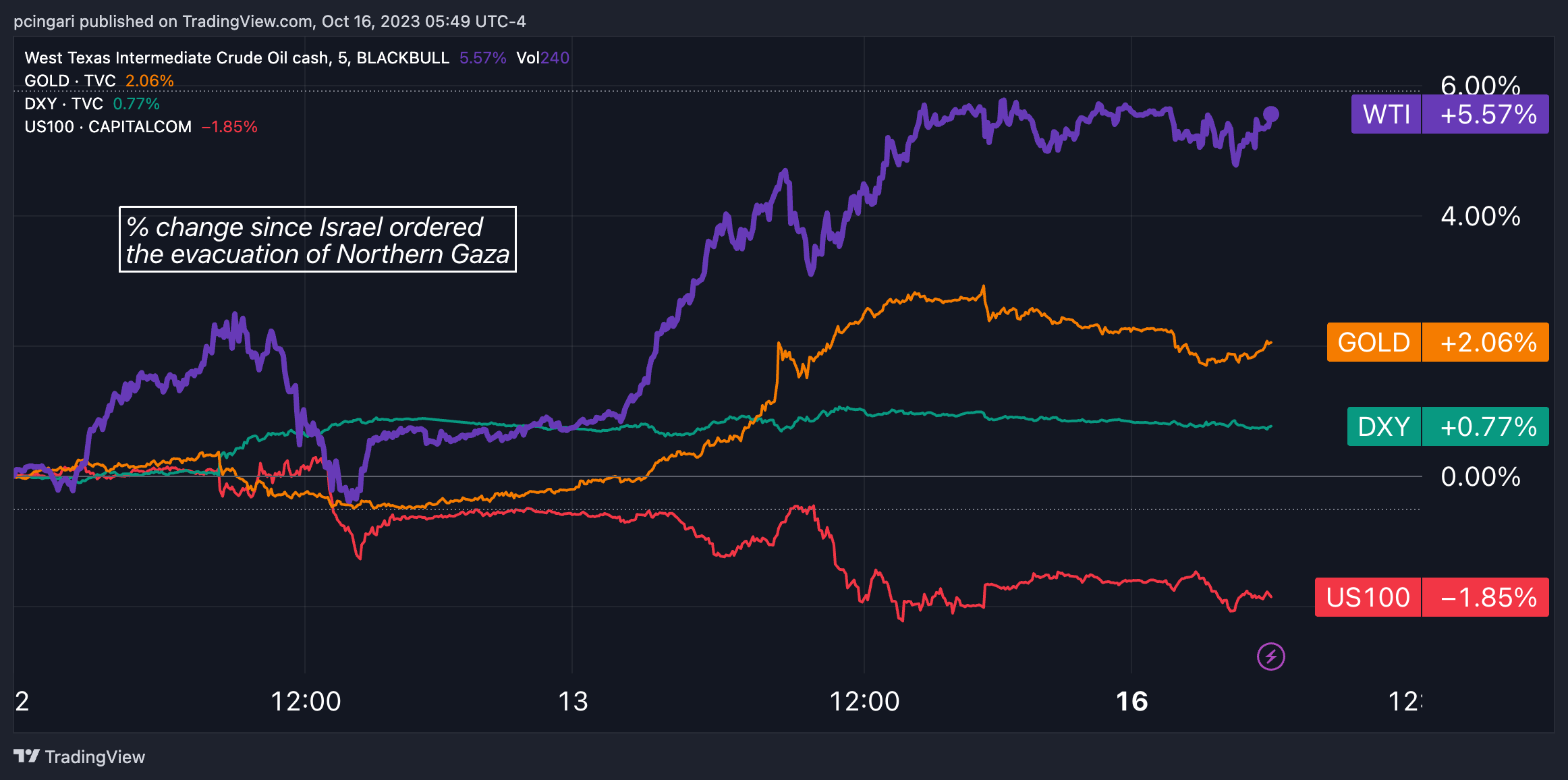

This intricate scenario is impacting financial markets, as investors grapple with the potential consequences of the conflict.

Market Recap from the Previous Week

Last Friday, global markets experienced significant turbulence. Oil prices recorded their most substantial single-day gain (+4.9%) since early April, the VIX, often referred to as the "market's fear index," surged by over 15% within a day, and gold delivered its second-best performance of the year, posting a gain of over 3%.

The U.S. dollar exhibited strength over the past week, with the DXY index showing a 0.5% increase, appreciating against all major currency pairs except for the oil-linked Canadian dollar (CAD) and the gold-linked Swiss franc (CHF). High-beta currencies, such as the New Zealand dollar (NZD), experienced a 1.7% decline for the week, and the Australian dollar (AUD) dropped by 1.4% against the greenback.

On the rates front, 10-year sovereign yields experienced downward movement across the board as traders sought refuge in bonds amid escalating uncertainties. Notably, the 10-year yields for the U.S., UK, and Germany each saw a nearly 20 basis point decline.

Key Economic Highlights for the Upcoming Week

In the United States, traders will closely monitor September's retail sales data, along with speeches from Federal Reserve representatives. Federal Reserve Chair Jerome Powell is scheduled to deliver remarks on Thursday.

In Europe, attention will be directed towards the ZEW Economic Sentiment Index for Germany and the European Union. The United Kingdom is slated to release jobs report on Tuesday, inflation rate data on Wednesday, followed by retail sales figures on Friday. Canada and Japan will also unveil inflation statistics on Tuesday and Thursday, respectively.

United States:

- September’s retail sales (Tue.): 0.3% month-on-month previous, 0.3% expected

- Fed Powell speech (Thu.)

Euro Area:

- Germany’s ZEW Economic Sentiment (Tue.): -11.4 previous, -9 expected

- Lagard speech (Wed.):

- EU Inflation rate – final reading for September (Wed.): 4.3% flash estimate

Other Data To Follow:

- UK Unemployment rate (Tue.): 3% previous, 4.3% expected

- UK Employment change (Tue.): -207k previous, -195k expected

- UK Inflation rate (Wed.): 6.7% y/y previous, 6.5% expected

- UK Retail sales (Fri.): 0.4% m/m previous, -0.1% expected

- Canada’s inflation rate (Tue.): 4% y/y previous, 4% expected

- Japan’s core inflation rate (Thu.): 1 % y/y previous, 2.7% expected

Chart Of The Week: Gold, Oil Surged, While Tech Stocks Tumbled As Israel-Hamas Conflict Escalated

FX Trade Ideas for The Week

Short EUR/CAD

- Entry: 1.4375

- Stop loss: 1.4502

- Take profit: 1.3990

- Risk-reward ratio: 2.9

EUR/CAD Fundamental Analysis:

EUR/CAD Fundamental Analysis: The EUR/CAD pair has realigned itself with the (inverse) correlation to WTI crude oil prices in recent months, as crude prices surged above $80 per barrel. Further increases in crude prices, driven by geopolitical dynamics in the Middle East and/or economic stimulus policies from China, could potentially trigger a fresh bearish wave on EUR/CAD. This week's data includes Canadian inflation, which may surprise on the upside, with estimates hovering around 4%. Meanwhile, the euro may encounter turbulence as the ZEW economic sentiment unfolds.

EUR/CAD Technical Analysis:

The timid rebound from oversold levels at 1.4158, which began in late September, lost its steam in the first week of October. Since then, EUR/CAD has regained confidence in the prevailing bearish trend. The relative strength index has struggled to decisively breach the 50-mark, and the trend has resumed its downward trajectory. Fibonacci retracement analysis between the 2023 highs and 2022 lows points to 1.4255 as the next support level, followed by 1.3992, which could serve as an enticing short-term bearish target. Any rally above the October highs at 1.4502 would invalidate the bearish thesis.

Long CHF/SEK

- Entry: 12.1280

- Take profit: 12.80

- Stop loss: 11.85

- Risk-reward ratio: 2.50

CHF/SEK Fundamental Analysis:

Amid the escalating conflict between Israel and Hamas, the Swiss franc is steadily gaining ground as one of the preferred safe-haven currencies. Its strong correlation with gold prices provides the franc with a hedge against risk-linked currencies, including the Swedish krona. Rising global economic slowdown risks, coupled with a deteriorating outlook in Europe, weigh on SEK, while CHF benefits from market turmoil.

CHF/SEK Technical Analysis:

Following the oversold levels reached on September 28, the pair underwent a retracement of over half the range between the September highs and September lows last week. The next significant resistance level is marked by the 50-day moving average at 12.28. A breach of this level could potentially lead to a retest and potential breakthrough of the all-time highs set on September 18 at 12.54. Bulls may set their sights on extending the target to 12.75 in the medium term, while placing a stop at 11.85, implying a risk-reward ratio of 2.5.

Long XAU/USD

- Entry: $1,912/oz

- Take profit: $2,050/oz

- Stop loss: $1,860/oz

- Risk-reward ratio: 2.7

XAU/USD Fundamental Analysis:

Gold is poised to end its challenging bearish phase, as traders closely watch the possibility of the Fed refraining from raising interest rates next month. This could trigger a much-awaited relief rally for the precious metal, with the market already factoring in this possibility. Simultaneously, the emergence of a stagflationary scenario for the global economy, characterized by low growth and sustained inflation due to the Middle East conflict, could further bolster the upward trajectory of gold. After recent spikes, Treasury yields appear to have stabilized at these levels, paving the way for gold bulls.

XAU/USD Technical Analysis:

On Friday, October 13, gold surged past key resistance levels represented by the 50 and 200-day moving averages, recording an impressive 3.4% gain for the session. Additionally, the bullion closed above the 2023 downtrend line for the first time, potentially confirming a significant trend reversal. While in the early hours of Monday, XAU/USD isn't showing immediate continuation, if it manages to test and break through the 1,950 level (representing a 50% retracement from the 2023 lows to highs) in the coming hours, it could open the door to the next target at $2,000/oz. As we approach the end of 2023, traders may have their sights set on $2,050/oz, taking advantage of the strong December seasonality and the potential for a weaker dollar.

Open trading ideas:

- Short EUR/USD

- Opened on October 9 at 1.0535

- Take Profit: 1.000

- Stop Loss: 1.0750

- Profit & Loss: +0.1%

- Short GBP/CAD

- Opened on October 9 at 1.6646

- Take Profit: 1.6082

- Stop Loss: 1.6823

- Profit & Loss: +0.3%

- Short NZD/USD

- Opened on October 9 at 0.5975

- Take Profit: 0.5512

- Stop Loss: 0.6130

- Profit & Loss: +0.8%

- Short AUD/NZD

- Opened on October 2 at 1.0711

- Take Profit: 1.0470

- Stop Loss: 1.0793

- Profit & Loss: +0.3%

- Long USD/JPY

- Opened on September 25th at 148.56

- Take Profit: 154

- Stop Loss: 147.20

- Profit & Loss: +0.7%

- Long USD/HUF

- Opened on September 25th at 366.97

- Take Profit: 383.60

- Stop Loss: 359.81

- Profit & Loss: +0.1%

- Short GBP/AUD

- Opened on September 18th at 1.9250

- Take Profit: 1.8600

- Stop Loss: 1.9560

- Profit & Loss: +0.1%

- Short CHF/JPY

- Opened on September 18th at 164.61

- Take Profit: 155.34

- Stop Loss: 167.00

- Profit & Loss: -0.5%

- Short GBP/JPY

- Opened on September 11th at 182.96

- Take Profit: 175.9

- Stop Loss: 185.6

- Profit & Loss: +0.6%

- Short EUR/JPY

- Opened on September 11th at 156.78

- Take Profit: 151.88

- Stop Loss: 158.5

- Profit & Loss: -0.6%

- Long USD/PLN:

- Opened on September 11th at 4.3058

- Take Profit: 4.6311

- Stop Loss: 4.1745

- Profit & Loss: -1.2%

- Short GBP/CHF

- Opened on September 4th at 1.1156

- Take Profit: 1.09

- Stop Loss: 1.1250

- Profit & Loss: +1.6%

- Short EUR/AUD

- Opened on September 4th at 1.6708

- Take Profit: 1.6200

- Stop Loss: 1.6900

- Profit & Loss: +0.3%

- Long USD/CHF

- Opened on August 28th at 0.8840

- Take Profit: 0.9250

- Stop Loss: 0.8680

- Profit & Loss: +2.2%

- Short NZD/CAD:

- Opened on July 24th at 0.8174

- Take Profit: 0.7975

- Stop Loss: 0.8263

- Profit & Loss: +1.2%