Currency markets are gearing up for a crucial week marked by a flurry of economic events that could spark substantial fluctuations.

Euro sign and European Central Bank | Shutterstock.com

In the United States, investors will be closely watching the release of January jobs data on Friday, alongside a series of speeches by Federal Reserve officials, including Fed Chair Powell's two-day testimony before Congress on monetary policy.

Over in Europe, all eyes will be on the European Central Bank's meeting on Thursday. Market expectations suggest that Frankfurt will likely maintain unchanged rates following higher-than-expected inflation, thus reinforcing its cautious monetary policy stance. Additionally, in the United Kingdom, anticipation surrounds Finance Minister Jeremy Hunt's pre-election budget announcement. The Bank of Canada is expected to keep interest rates unchanged.

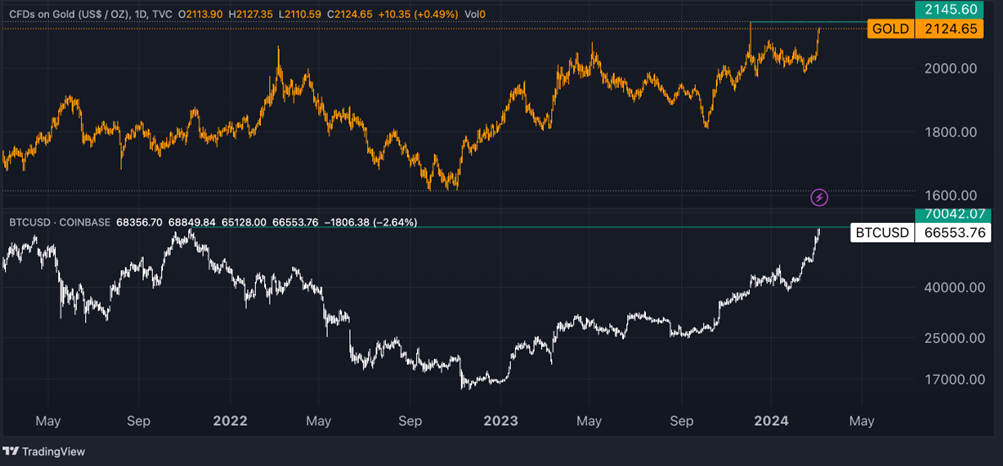

Meanwhile, stock markets are maintaining their upward momentum, with major U.S. indices hitting record highs. Risk appetite appears to be shifting towards high-risk assets such as bitcoin and altcoins.

Interestingly, gold is nearing all-time highs despite the absence of significant depreciation in the dollar or a decline in U.S. treasury yields. Traders seem to be gravitating towards the precious metal in anticipation of potential Fed rate cuts.

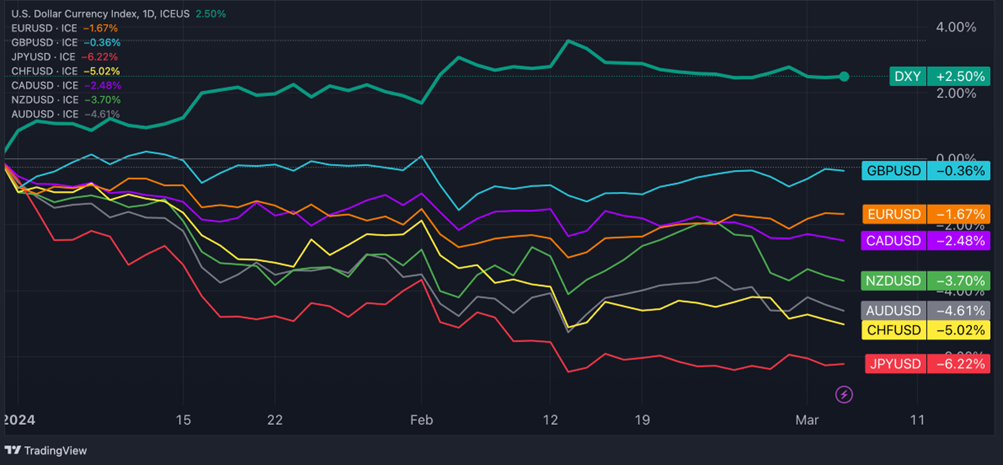

Year-To-Date Performance of Major Currencies: USD Leads, JPY Lags Behind

Source: TradingView

US Dollar update:

The US dollar index held steady at 103.90 levels, showing minimal change from the previous week. Traders are focused on Fed Chair Powell's congressional testimony scheduled for Wednesday and Thursday, along with a series of data releases, culminating in the eagerly awaited jobs report on Friday. There is strong anticipation that Powell will emphasize the Fed's need for increased confidence before considering rate cuts. As for February's jobs report, the consensus predicts non-farm payrolls to rise by 215,000, while the unemployment rate is expected to remain steady at 3.7%.

While yields on the 2-year Treasury note dipped last week, they began the new week with a slight increase, hovering around 4.60%. Market expectations indicate a 65% probability of a rate cut in June, with 90 basis point of rate reductions projected by December 2024.

Euro update:

The euro held steady around 1.0850 levels, with traders gearing up for the upcoming ECB meeting on Thursday. While it's widely expected that interest rates will remain unchanged, all attention will be on President Lagarde's remarks during the press conference to assess the potential timing of rate cuts. However, it's anticipated that Lagarde will stick to a data-dependent approach, without pre-commitments. February's inflation for the euro area slowed less than anticipated, indicating some resilience in returning price pressures to the 2% target. Currently, markets forecast a full percentage point of rate cuts by the end of 2024, with the first expected in June.

British Pound Update:

The pound has reclaimed levels above 1.2650 versus the greenback, nearing February highs. Recent data indicates robust expansion in private sector output in February, especially in services, while the decline in manufacturing activity has eased. However, retail sales growth fell short of expectations, registering at 1% year-on-year compared to 1.4% in February. With inflation persistently above the Bank of England’s target, rate cuts in the UK are anticipated to follow those by the Fed and ECB. This week's focal point is Finance Minister Jeremy Hunt's budget announcement on Wednesday, with attention on potential tax cuts or spending reviews.

Chart of The Week: Gold, Bitcoin Approach Record Highs

Source: TradingView

This Week's Forex Trading Ideas

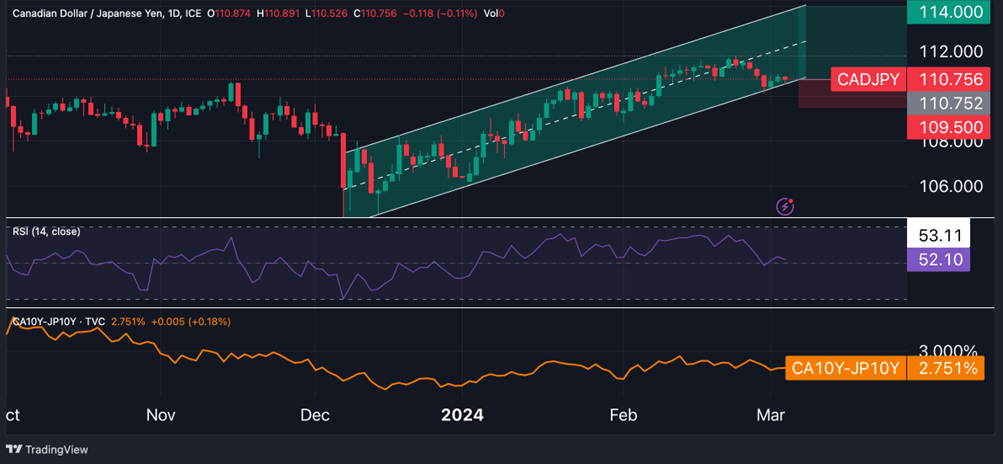

Long CAD/JPY

- Entry: 110.72

- Take profit: 114.00

- Stop loss: 109.50

- Risk-reward ratio: 1:2.7

Fundamental analysis:

The Canadian dollar is eagerly anticipating the Bank of Canada's meeting on Wednesday, expected to keep interest rates steady at 5%. Meanwhile, in Japan, the Tokyo inflation rate for February met expectations, rising 2.5% from a year ago, marking a four-month high. However, Bank of Japan Governor Kazuo Ueda emphasized the importance of gathering more data, especially regarding wages, before considering a move away from negative interest rates. Consequently, interest rate differentials between Canada and Japan remain significant, presenting an attractive opportunity for carry trades. Moreover, increasing commodity prices may act as a positive force for the Canadian dollar while serving as a headwind for the energy-reliant Japanese yen.

Technical analysis:

The CAD/JPY pair experienced a slight 1% decline from levels observed a week ago, yet it maintains a strong upward trend within a channel established since December 2023. Despite this near-term dip, the relative strength index (RSI) remains above 50, suggesting that bullish momentum prevails. Bulls may target 114 levels, aiming towards the upper line of the channel, while setting a stop at 109.50.

Start Trading CAD/JPY Today

Long EUR/GBP

- Entry: 0.8555

- Take profit: 0.8716

- Stop loss: 0.8490

- Risk-reward ratio: 1:2.6

EUR/GBP fundamental analysis:

In recent weeks, there has been a notable increase in short-term yields on eurozone government bonds due to higher-than-expected inflation data. Consequently, the spread between 2-year Germany and the United Kingdom yields has narrowed from approximately negative 190 basis points in February to the current negative 140 basis points. The key risk events of the week are clearly the ECB on one side and the UK spring budget on the other. We believe the former holds greater significance for the fate of EUR/GBP. The ECB is unlikely to satisfy the markets regarding visibility on rate cuts, reiterating the need to witness further improvements in the fight against inflation. This language could pave the way for scenarios of tactical upside for the euro.

EUR/GBP technical analysis:

The February low at 0.8498 formed a bullish RSI divergence on EUR/GBP, igniting a modest rebound. So far, the 50-day moving average around 0.8570 has represented significant resistance for the pair's upward movement, but with the RSI above 50, it indicates a buyer's dominance over sellers. Breaking above 0.8570-0.8580 could bolster confidence to test the 200-day moving average at 0.8608, then setting sights on 0.8717 (December 2023 highs). Placing a stop just below the February low provides a risk/reward ratio of 2.6.

Start Trading EUR/GBP Today

Long XAG/USD

- Entry: 23.95

- Take profit: 26.12

- Stop loss: 22.87

- Risk-reward ratio: 1:2.1

XAG/USD fundamental analysis:

Silver has lagged behind the recent price surges seen in gold in recent sessions, but typically, the strength of gold is reflected in silver with even greater emphasis later on. Monday's session, with silver up 3.2%, marked the best daily performance since early December 2023, while long-dated Treasury yields (30-year) are beginning to trend downwards. Powell's remarks will represent a volatility factor for silver, as will data on the US labor market. However, as the pace of employment growth is expected to slow, this could ignite further bullish pressure on precious metals, as market expectations for rate cuts will be reinforced.

XAG/USD technical analysis:

Silver has experienced three consecutive bullish sessions, resulting in a 7% increase from late February levels. The precious metal has breached both the resistance levels represented by the 50 and 200-day moving averages, pushing to test the highs of 2024. The RSI has surged above 60, signaling strong bullish momentum. Aggressive medium-term bulls may set their sights on the 2023 highs at 26.12, while maintaining a stop-loss at 22.87, should the support provided by the 50-day moving average be breached.

Start Trading XAG/USD Today

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.