Markets are in a state of volatility due to ongoing events in the Middle East as we approach the Federal Reserve's week. While the Fed is anticipated to maintain interest rates at their current levels, investors will be scrutinizing Powell's comments to ascertain whether this signifies the conclusive conclusion of the rate hike cycle.

Market Recap from the Previous Week:

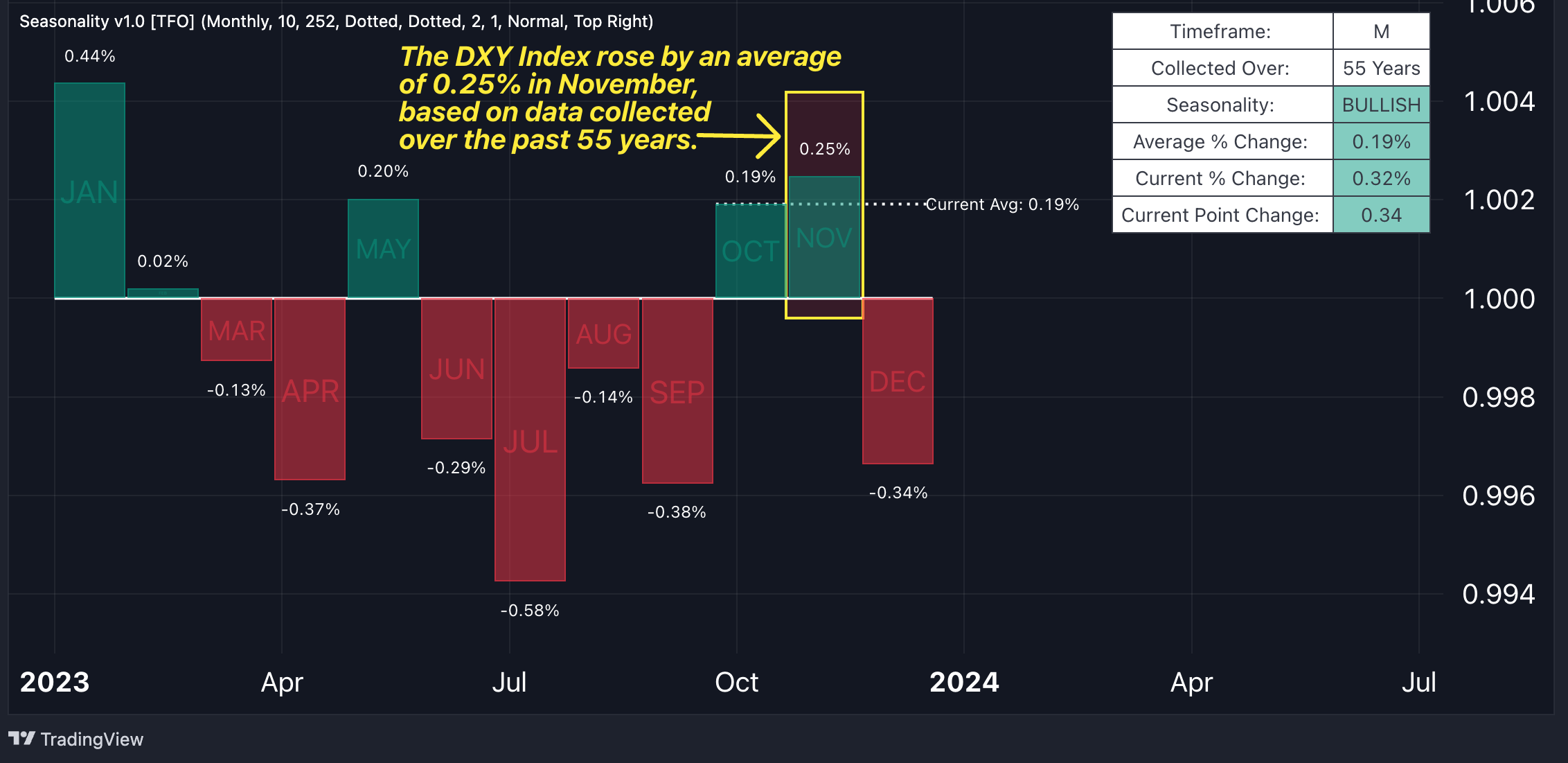

The U.S. Dollar Index (DXY) rebounded last week, aided by a stronger-than-expected Q3 GDP growth print for the U.S. (4.9% vs 4.3%) and by rising safe haven demand stemming from heightened uncertainties in the war between Israel and Hamas. The dollar now enters November, which is the second-strongest month after January in terms of seasonality for the greenback.

The euro (EUR) saw losses as the European Central Bank (ECB) announced to keep rates unchanged, pausing after 10 straight rate increases since July 2022. Concerns about an impending recession weighed on the single currency, after both manufacturing and services PMI data signaled a contractionary environment in October.

The pound (GBP) also faced declines falling to near 1.20 following the release of disappointing economic data.

The Japanese yen (JPY) fell sharply on Monday after the Bank of Japan disappointed hawkish expectations.

The Australian dollar (AUD) was the best performing G-10 currency last week, strengthening 0.4% vis-à-vis the greenback and starting the new week on the right foot. Latest data showed that retail sales rose 0.9% in September, the largest increase in eight month, while inflation also slightly surpassed expectations (5.4% vs 5.3%), raising speculation of a new rate hike from the Reserve Bank of Australia. Meanwhile, the announcement of fresh policy stimulus in China strengthened a broad range of commodities, which in turn pushed the Aussie higher."

Key Economic Events for the Upcoming Week

Markets will anxiously await two major central bank meetings this week: the Federal Reserve on Wednesday and the Bank of England (BoE) on Thursday.

Additionally, the Norges Bank will convene Thursday to decide on interest rates. While no interest rate hikes are expected, the language and stance adopted by these central banks will play a pivotal role in influencing their respective currencies.

Another significant event to watch for is the release of the October U.S. labor market report, including the highly anticipated non-farm payrolls data, scheduled for Friday. The market anticipates a sharp decline in the pace of private sector hiring, dropping from 336,000 in September to 188,000 in October.

Furthermore, other noteworthy data releases include October's inflation rates for the Euro Area (Tuesday) and Switzerland (Thursday), as well as the October Purchasing Managers' Index (PMI) releases for China and the United States.

United States:

- Federal Reserve’s interest rate decision (Wed.): 5.5% expected, 5.5% previous

- Non farm payrolls (Fri.): 188,000 exp., 336,000 pre.

- Unemployment rate (Fri.): 3.8% exp., 3.8% pre.

- Average hourly earnings (Fri.): 4% year-on-year exp., 4.2% pre.

- ISM Manufacturing PMI (Wed.): 49 exp., 49 pre.

- ISM Services PMI (Fri.): 53 exp., 53.6 pre.

Euro Area:

- Inflation rate for October (Tue.): 3.2% exp., 4.3% pre.

- GDP Growth rate for Q3 (Tue.): 0.0% exp., 0.1% pre.

United Kingdom:

- Bank of England’s interest rate decision (Thu.): 5.25% exp., 5.25% pre.

Other Data To Follow:

- Norges Bank’s interest rate decision (Thu.): 4.25% exp., 4.25% pre.

- Switzerland’s inflation rate for October (Thu.): 1.8% exp., 1.7% pre.

Chart Of The Week: Dollar Bulls Await A Bullish November Seasonality

New Trading Ideas For The Week

Short EUR/JPY

- Entry: 160.66

- Take profit: 155.28

- Stop loss: 162.16

- Risk-reward ratio: 2.7

Fundamental view:

The euro will enter the week following the ECB meeting with several hurdles to overcome, including the third-quarter GDP data and October's inflation figures. The reasons behind the ECB's decision to keep interest rates steady are linked to its perception of weakening growth and the effects of interest rates on price pressures. At this point, it is plausible to anticipate weak readings. In its October meeting, the Bank of Japan (BoJ) kept key short-term interest rate at -0.1% and the reference 10-year bond yield at approximately 0%. However, it altered its stance regarding the 1.0% level, describing it as a flexible upper limit rather than a strict cap, and removed the commitment to defend this level. The 10-year yield rose to 0.94% as a result, and markets could likely test this upper bound soon.

Technical view:

On Monday, EUR/JPY experienced a substantial increase to 160.85, marking a 1.5% rise subsequent to the BoJ meeting and rebounding off 50-day moving average support. It's worth noting that this reaction may have been exaggerated, potentially prompting intervention from the BoJ as the pair reached September 2008 highs. If the pair peaks here and subsequently initiates a reversal in its trend, a Fibonacci retracement analysis of the high-to-low range in 2023 indicates that 155.28 could serve as a notable support zone, corresponding corresponds to the 23.6% retracement level. However, attaining this level may not be straightforward unless the BoJ signals a substantial shift in its policy stance.

Long USD/CAD

- Entry: 1.3835

- Take profit: 1.4260

- Stop loss: 1.3678

- Risk-reward ratio: 2.8

Fundamental view:

With global risk sentiment continuing to deteriorate, USD/CAD may be poised for an upward trajectory. Anticipations for the Canadian job market report this week suggest an increase in the unemployment rate from 5.5% to 5.6%. This, combined with a diminishing labor market momentum in the United States, could create challenges for the risk-sensitive Canadian dollar (Loonie). The upcoming Fed policy meeting is also expected to introduce significant volatility into the currency pair. Powell is likely to acknowledge the robust U.S. data observed over the past months, potentially leaving the door open for another interest rate hike in December.

Technical View:

The USD/CAD pair experienced a golden cross formation in late September, marked by the 50-day moving average crossing above the 200-day moving average. Last week, the pair reached new six-month highs, bringing the October 2022 high at 1.3977 within striking distance. Short-term bulls might find April 2022's high at 1.4360 to be an intriguing target for potential gains.

Long XAG/USD

- Entry: 23.18

- Take profit: 26.17

- Stop loss: 21.58

- Risk-reward ratio: 2.7

Fundamental view:

Silver should continue further benefiting from rising gold prices, as the yellow metal crossed above $2,000/oz last week. Clearly an hawkish Fed represents the major, although precious metals have recently decoupled with their relationship with interest rates, to trade more in line with rising global uncertainties. Silver is trading cheap, currently down 13% since 2023’s highs and 17% since 2022’s highs.

Technical View:

Silver is currently undergoing a significant resistance test as it strives to surpass both the 50-day and 200-day moving averages. The momentum indicator, as reflected by the RSI, has consistently remained above 50 for the past three weeks, suggesting that bulls have gained the upper hand in the short term. If a potential breakout above resistance is achieved along with a golden cross formation, it could serve as a robust bullish signal for the precious metal. Medium-term bullish traders may consider setting their sights on a target of 27.00, corresponding to April 2022 highs, which offers a potentially high-risk-high-reward opportunity. It's advisable to set a stop-loss level at 21.75 to manage risk while aiming for this target.

Open trading ideas:

- Short GBP/USD

- Opened on October 24 at 1.2240

- Take Profit: 1.1970

- Stop Loss: 1.2354

- Profit & Loss: +1%

- Short CHF/JPY

- Opened on October 23 at 168.01

- Take Profit: 164.90

- Stop Loss: 169.20

- Profit & Loss: +1.4%

- Long CHF/SEK

- Opened on October 16 at 12.1280

- Take Profit: 12.80

- Stop Loss: 11.85

- Profit & Loss: +1.6%

- Long XAU/USD

- Opened on October 16 at $1,912/oz

- Take Profit: $2,050/oz

- Stop Loss: $1,860/oz

- Profit & Loss: +4.4 %

- Short EUR/USD

- Opened on October 9 at 1.0535

- Take Profit: 1.000

- Stop Loss: 1.0750

- Profit & Loss: -0.4%

- Short GBP/CAD

- Opened on October 9 at 1.6646

- Take Profit: 1.6082

- Stop Loss: 1.6823

- Profit & Loss: -0.8%

- Short NZD/USD

- Opened on October 9 at 0.5975

- Take Profit: 0.5512

- Stop Loss: 0.6130

- Profit & Loss: +2.5%

- Long USD/JPY

- Opened on September 25th at 148.56

- Take Profit: 154

- Stop Loss: 147.20

- Profit & Loss: +0.8%

- Short GBP/AUD

- Opened on September 18th at 1.9250

- Take Profit: 1.8600

- Stop Loss: 1.9560

- Profit & Loss: +1.1%

- Short GBP/JPY

- Opened on September 11th at 182.96

- Take Profit: 175.9

- Stop Loss: 185.6

- Profit & Loss: +0.8%

- Short EUR/AUD

- Opened on September 4th at 1.6708

- Take Profit: 1.6200

- Stop Loss: 1.6900

- Profit & Loss: +0.6%

- Long USD/CHF*

- Opened on August 28th at 0.8840

- Take Profit: 0.9250

- Stop Loss: 0.8680

- Profit & Loss: +2.4%

*Take profit at the current 0.9040