The Fed has left interest rates unchanged, as widely anticipated. However, Fed Chair Jerome Powell has tempered market optimism regarding imminent rate cuts, indicating that the central bank is in no rush to loosen its policy.

Forex graphic - Source: Shutterstock

Traders were forced to revise their 2024 rate-cut projections, shelving the expected March start and reducing the total cuts for 2024 from six to nearly five.

Powell's unexpectedly hawkish remarks are backed by economic data that continues to reflect impressive resilience in the US economy. January's new payrolls reached 353,000, nearly double expectations. Meanwhile, economic activity surveys in the service sector show strong and ongoing expansion, extending for over a year. It also appears that the manufacturing sector has emerged from its contraction phase.

In this context of reduced rate-cut expectations and better-than-expected economic data, the dollar can only flourish, with the dollar basket reaching its highest level since mid-November.

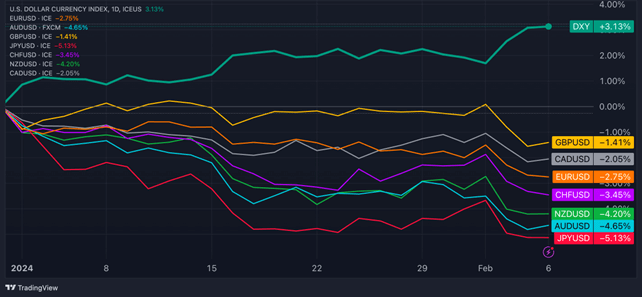

Year-To-Date Performance of Major Currencies: USD Leads, JPY Lags Behind

Source: TradingView

U.S. Dollar Update:

The U.S. Dollar Index (DXY) traded at 104.50 levels on Tuesday, following two consecutive strong sessions during which the greenback gained 1.5%.

Powell has outlined the Fed's intended course for the upcoming months, emphasizing the need for stronger evidence of disinflation before considering rate cuts. His statements are starting to resonate with other Fed representatives who will be sharing their insights in the days ahead. Presently, the market is pricing in a 15% probability of a Fed rate cut in March and expects a total reduction of 115 basis points for the year, down from the earlier estimate of around 150 bps in early January.

Euro Update:

The robust performance of the dollar has pushed the single currency below the 1.08 threshold, reaching its lowest levels since mid-November. Traders are indeed revising down their expectations for rate cuts, yet the Eurozone's lackluster economic data appears to cast doubt on the ECB's ability to delay monetary policy easing for an extended period. At present, markets are pricing in roughly 125 basis points of rate cuts by the ECB by year-end, a slight decrease from the 138 bps estimated just last week.

British Pound Update:

Sterling slipped below the critical 1.26 support against the greenback as the week began, primarily due to the broader reevaluation of Fed interest rate expectations. In the previous week, the Bank of England held its interest rates at nearly a 16-year high in February but left the door open for potential rate cuts in response to declining inflation. According to the BoE, the CPI rate may temporarily dip to the 2% target in Q2 2024 before resuming its ascent in Q3 and Q4.

Chart of The Week: 2-Year Treasury Yields Soar On Strong Jobs Report

Source: TradingView

This Week's Forex Trading Ideas

- Entry: 148.72

- Take profit: 154.64

- Stop loss: 146.36

- Risk-reward ratio: 2.5x

Source: TradingView

USD/JPY fundamental analysis:

The recalibration of Fed rate-cut expectations is significantly influencing USD/JPY, emerging as a key channel for this adjustment. Yield differentials between the United States and Japan may widen once more, although presently, the exchange rate seems to anticipate interest rate movements.

Still, the substantial yield differential, exceeding 400 basis points in 2-year bonds, poses a considerable challenge for anyone contemplating short strategies on this currency pair. In the absence of a substantial policy shift by the Bank of Japan, the yen appears set to continue its decline against the greenback.

USD/JPY technical analysis:

USD/JPY seems to be in the process of forming a bullish flag pattern. At the beginning of the week, a bullish candle broke out of a short-term descending channel that had been in place since late January. The projection based on the initial flagpole suggests a target of 154. Additionally, the MACD indicator is on the verge of producing a bullish crossover.

Fibonacci analysis indicates that the pair has already retraced almost three-quarters of the bearish trend that occurred between mid-November and late December 2023. Looking ahead, key resistance levels include the psychological level at 150, November's high at 151.90, and an extension of the Fibonacci retracement to the 1.236 level at 154.65.

- Entry: 0.5665

- Take profit: 0.5809

- Stop loss: 0.5598

- Risk-reward ratio: 2.4x

Source: TradingView

AUD/CHF Fundamental Analysis:

The Reserve Bank of Australia decided to keep interest rates unchanged at 4.35% on Tuesday but issued a cautionary note, indicating that rate hikes remain a possibility. The board reiterated its commitment to closely monitor the global economy, domestic demand trends, as well as the outlook for inflation and the labor market. These comments are likely to lend support to AUD-related pairs in the coming days or weeks. Instead of pursuing a move against the US dollar, which could be challenged by the renewed Fed hawkishness, the AUD might find an opportunity to regain some ground against the Swiss Franc (CHF). Notably, the substantial interest rate differentials, currently exceeding 250 basis points in the 2-year yield spread, position the AUD/CHF pair attractively in terms of value.

AUD/CHF Technical analysis:

From a technical perspective, AUD/CHF has yet to provide a clear bullish signal, as it remains firmly within a descending channel pattern that has been in place since late December. However, there are some early bullish signs, with the RSI showing a slight uptick, and a potential retest of the channel's resistance line approaching. A key bullish signal to watch for would be a break above the 0.5740-0.5750 zone, which aligns with the February highs and the 50-day moving average. As for an aggressive strategy, targeting the 200-day moving average at 0.5810 could be considered, with a stop placed below 0.66.

- Entry: 22.29

- Take profit: 20.69

- Stop loss: 23.08

- Risk-reward ratio: 2.2x

Source: TradingView

XAG/USD Fundamental analysis:

Silver appears to be in a vulnerable position as Treasury yields rise and the U.S. dollar strengthens. The U.S. 10-year Treasury yield is currently at 4.15%, testing levels not seen since December 12th. If further increases in yields occur, with the 10-year rate reaching levels between 4.40% to 4.50%, silver is likely to face more downward pressure, potentially falling to the lows seen in November.

XAG/USD Technical analysis:

The descending channel remains firmly in place, and what is particularly concerning for bullish sentiment is the formation of a death cross pattern as the 50-day moving average crosses below the 200-day moving average. This signals a potentially bearish outlook ahead. In the coming weeks, there is a possibility of a retest of the lows from October 2023, which were at 20.69.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.