It’s January 2024 so corporate earnings season is underway, with companies publishing results from the fourth quarter of 2023.

The way a stock reacts to the release of quarterly earnings can tell you a lot about the expectation from investors and overall sentiment in the market.

Earnings vs Expectations

As a rule of thumb, a stock performs well if earnings results beat market expectations and performs badly if it misses expectations.

Equity analysts will update their stock ratings and price targets in the leadup to earnings season. These updates form the basis for market expectations before the results are released. If analysts are generally raising their forecasts, it suggests rising expectations for earnings whereas if they on average lower guidance it indicates falling expectations.

Investors can use these expectations as a basis from which to decide if stocks will react favorably to earnings or not. While higher expectations increase the likelihood of strong results, it also raises the bar for beating expectations. Likewise lower expectations increase the chance of weaker results, but make it easier for a company to beat the lowered expectations.

How a stock can react to earnings

The move a stock makes after earnings can be assessed by two criteria, direction and size.

Bullish Reaction: If a company reports earnings that are significantly better than expected, the stock price might jump upwards. This indicates a bullish sentiment, as investors are optimistic about the company's future and are willing to pay more for its shares.

Bearish Reaction: Conversely, if earnings fall short of expectations, the stock might plummet, reflecting a bearish sentiment. This suggests that investors are concerned about the company's future prospects and are selling off their shares.

Exaggerated Moves: These suggest strong investor emotions and high levels of speculation. For example, if a stock surges or plummets dramatically on earnings news, it might indicate that investors were overly optimistic or pessimistic before the release, and are now rapidly adjusting their positions.

Muted Moves: If the stock shows a relatively small change in price despite significant earnings news, it could suggest that the market had already priced in the news, or that investors are uncertain about how to interpret the earnings results.

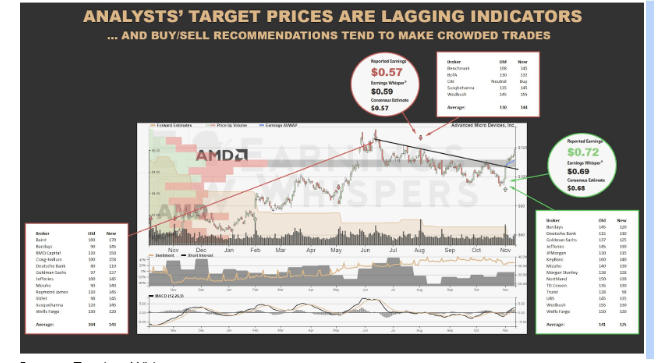

Analysts quite often get it wrong

The biggest positive price reactions to earnings tend to happen when expectations have been lowered incorrectly and the company beats them by a wide margin. The biggest negative price moves occur when expectations have been lifted too far and the company misses by a wide margin.

This happens more often than you think. Making a prediction about where a stock price will be in 12 months is very difficult. It is especially difficult to ‘go against the herd’ and forecast something very different from consensus as a professional analyst. Hence analyst ratings, which form the basis of expectations tend to be backwards looking.

As such, part of the preparation an investor must make for earnings season is to determine what has happened to analyst estimates in the lead up. Have they been rising or falling?

Example: AMD Earnings

Shares of Advanced Micro Devices (AMD) just reached a 2-year high this week after Barclays raised their price target, citing the benefits of AI. But the latest leg higher in the price began much earlier, when consensus was much less bullish.

Looking back to prior quarters, we can see that analyst estimates tracked the share price higher and lower, and when estimates became too high or too low (crowded) the company at some point missed the too high estimates or beat the too low estimates.

Source:EarningsWhisper.com

AMD will report Q4 2023 earnings on January 30.

Looking forward, AMD looks likely to continue to increase earnings but at the same time the probability is rising that estimates get pushed too high and the company will miss.

Expectations for S&P 500 Earnings (Q4, 2023)

Overall for 2024, analysts expect S&P 500 earnings to climb nearly 11%, according to data compiled by BI. However, as is often the case - there are different ways to interpret expectations, as demonstrated by the two different views below held by Fidelity and Morgan Stanley.

Fidelity: “Earnings expectations may be too high. Analyst estimates imply a profit rebound of about 11 percent in 2024, on the heels of a slight contraction in 2023. If businesses have less pricing power and slower top-line sales than when inflation was running hotter, they’ll probably need to increase profit margins to meet the market’s growth expectations.”

Morgan Stanley: “Analysts’ consensus estimate for fourth-quarter results has dropped 7% over the past three months, with earnings growth now expected to be flat compared to the year before.This downward revision creates a lowered bar into the quarter, which likely leads to another mid-single-digit earnings-per-share beat rate.”

In Summary

A stock's reaction to earnings is influenced by whether it beats or misses market expectations set by equity analysts, with positive surprises typically leading to a bullish reaction and negative surprises to a bearish reaction. The reaction also depends on how the actual earnings compare to the analysts' revised forecasts leading up to the earnings season, and can range from exaggerated to muted moves based on the level of investor speculation and sentiment.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.