We all know about Netflix, Amazon Prime and Disney+, but do we have a European-born streaming service strong enough to compete with the giants? In fact, we might.

Key Takeaways

- Currently 141 million Europeans are subscribed to streaming services, 86% of which are US services;

- Nent offers Viaplay, one of the only European streaming service that can oppose competition to Americans;

- The company has revenues of $1.5 billion, vs. Netflix's $25 billion turnover;

- The Nent stock is up 50% over the last year, but investors should be wary of the company's debt;

- More companies ought to copy Netflix's model, but many European media company are still attached to their ads-dependent business model.

Dominance of American streaming providers in Europe

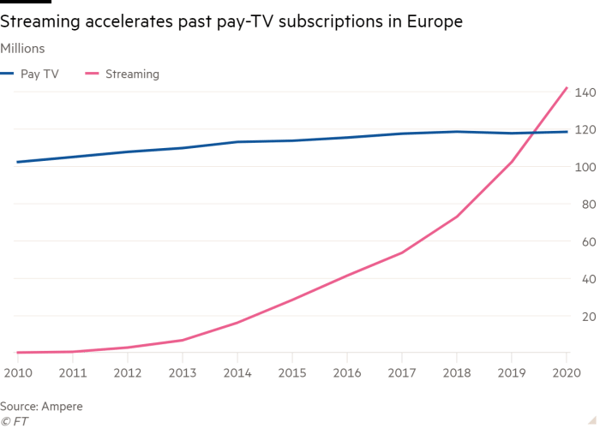

With a great push from the global pandemic, paid subscribers for streaming video services have sharply risen, surpassing the number of pay-tv customers for the first time ever. However, there are only few European companies which can be proud of this achievement, as most streaming providers are American.

The overall number of subscriptions in Europe is of around 141 million, with 86% of them coming from American services such as Netflix, Amazon Prime or Disney+, according to Ampere Analysis. In the end, the narrative did not change: the US are selling us their streaming services in the same way they used to provide us with their Hollywood movies. However, what gives even more contrast now is that companies like Netflix are starting to film locally, with productions such as Dark in Germany or Lupin in France. It has always been a question of budget in the end: Netflix has over $17 billion this year, which for comparison purposes, represents 8 times the BBC TV budget.

Disney+ and Discovery are also making their way into the European scene: in less than one year, Disney+ managed to register 13 million subscribers in Western Europe, while Discovery rolled out a month ago, integrating the Eurosport network, which has the exclusive rights to broadcast the Olympics.

Streaming just passed pay-TV subscriptions in Europe (Source: FT)

Nent is one of Netflix's most serious competition

There are almost no companies able to face the American streaming giant. Not Vivendi's Canal +, not Sky, not TF1 in France or ITV in Italy. No one seems to be able to compete, except maybe one.

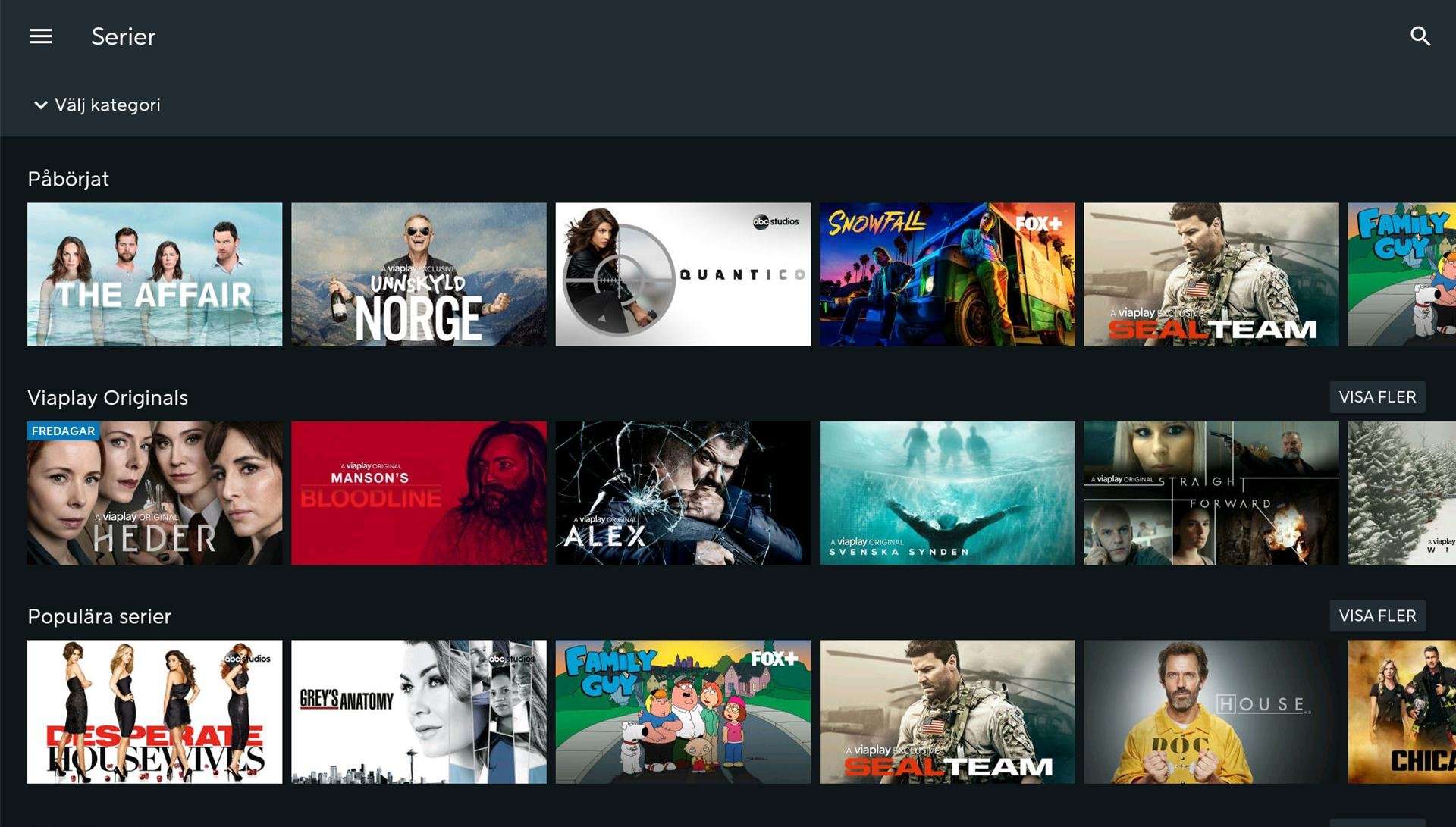

One company called Nordic Entertainment Group (NENT) owns the streaming service Viaplay. With headquarters in Stockholm, Nent remains a relatively small player, with estimated revenues of $1.5 billion. It sure is small compared to Netflix's 25 billion turnover, but we need to leave it to Nent that they are the only real European challenger in the industry. The company has around 3 million subscribers, and they stand only second to Netflix in Sweden, Denmark, Finland, and Norway, where there are around 4.2 million Netflix subscribers. Moreover, their packages include original content but also sports coverage. They claim to derive more revenue from these subscriptions than Netflix does from theirs.

Anders Jensen, chief executive of Nent does not seem to have a high opinion of other European streaming services. On a scale of 1-10 where 10 is readiness to compete with Netflix, he says that they all rate for a strong 2.

One stroke of luck for Nent is that they could make the switch fast, because they did not have much to lose, being some second class TV provider. Going from advertising to low-cost subscriptions is not an easy transition for every company. The company started heavily cutting cost in their legacy division to invest in streaming technology and original productions. Nent is basically practicing the art of copying, as their service is extremely similar to Netflix. If you do not copy some (of Netflix) with pride, then you’re making a mistake,” said Mr Jensen.

They are now planning further expansions, with plans to launch in the US next year. They are confident that a growing subscribers base will make their investments worthwhile. They are currently aiming for 10.5 million subscribers by 2025, 4.5 million of which shall be outside of the Nordic region.

Company's stock, debt and financial details

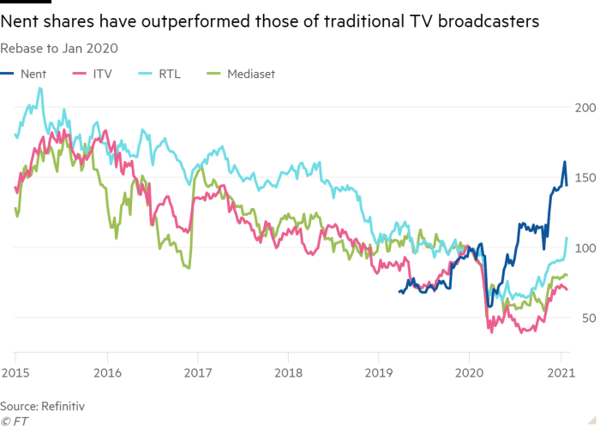

Nent plans to raise SKr3.5 billion to fund the rollouts in the Baltics and Poland. The stock is doing relatively well, with a 50% growth year to date, following the benchmark of other major streaming services this year - SKr 218 in June, up to SKr 450 today. The company is also planning a secondary listing in the US. Their PE ratio sits at 10.8, much lower than the average for the Swedish market at 23.2. In the meantime, Netflix proudly sits at 88.

All in all, Analysts at simply wall street said the company was rather robust, but that its debt level was to be kept in mind as a risky factor, too. The success will mostly be determined by future cashflows, the success of its European and international expansions, and its potential US listing.

Nent stock performance vs. other rivals (Source: FT)

Nent stock performance vs. other rivals (Source: FT)

If copying Netflix is easy, why are the others not doing it too?

It is not easy to abandon your main cash cow, even when its profit is diminishing. Most companies chose to launch an extra subscription service, making old and new hang in harmony.

The biggest fear of these companies is not to be able to scale fast enough, because after all, the streaming business is a scale business. Even Disney+, which was generally welcomed by the public, does not expect to be profitable before 2023.

Many companies also choose to form joint ventures to reduce costs and dilute risks. Nent is also considering partnerships, being aware that they have a working platform, but that there is also plenty of great locally produced content out there.

In the end, Nent is the living proof that to launch a streaming service, you do not need to be US owned, nor have an outstanding budget. Smart alliances and agility seem to be the golden rule to follow the movement. Nent moved, will the others do too?

Sources:

Netflix meets its match in Nordic minnow Nent, in the Financial Times

Nordic Entertainment Group (STO:NENT B) Has A Somewhat Strained Balance Sheet, in Simply Wall Street

NENT Group makes key appointments, in Broadband TV News