It was supposed to be another benign inflation report according to economist estimates, potentially paving the way for the Federal Reserve to initiate rate cuts in the first half of the year.

Instead, the January figures have surprised investors to the upside, now pushing further ahead the start of policy easing in the United States.

United States Federal Reserve | Shutterstock.com

The dollar spiked immediately following the release of the inflation data, dragging down stocks and other risk-related assets.

In this article, we’ll delve into the key highlights of the inflation release, analyze the market reactions, and explore potential trade opportunities in the aftermath of this event.

US Inflation Report: Key Highlights

- The US Consumer Price Index (CPI) rose 3.1% year-over-year in January, down from December’s 3.4% annual rate, but surpassing expectations of 2.9%.

- On a monthly basis, inflation accelerated to 0.3%, surpassing expectations and the previous rate of 0.2%.

- Excluding food and energy, core inflation was 3.9% year-over-year, unchanged from December and higher than the anticipated 3.7%.

- Core CPI on a monthly basis increased by 0.4%, exceeding both December's figures and economists' predictions of 0.3%.

- Shelter – the housing component of the index – continued its upward trend in January, rising by 0.6% and accounting for more than two-thirds of the overall monthly inflation increase.

- The food index saw a 0.4% increase in January, with both the food at home and food away from home indices rising by 0.4% and 0.5%, respectively, over the month.

- In contrast, the energy index experienced a 0.9% decline over the month, primarily driven by a decrease in the gasoline index.

Market Reactions in 5 Charts

- U.S. Dollar Index (DXY) Surge: The DXY spiked to 104.70 levels post-inflation report, hitting its highest since November 14th, 2023.

- FX Volatility: Major currencies weakened against the greenback, with the euro and Japanese yen both depreciating significantly. The euro dropped towards the $1.07 mark, while the yen fell past 150 per dollar, hitting its lowest levels in 12 weeks.

- Interest Rate Expectations: The hotter-than-expected inflation data led speculators to delay their expectations for the start of rate cuts by the Federal Reserve. Traders had previously priced in nearly five rate cuts of 25 basis points each for 2024, but this number fell to four following the inflation data release.

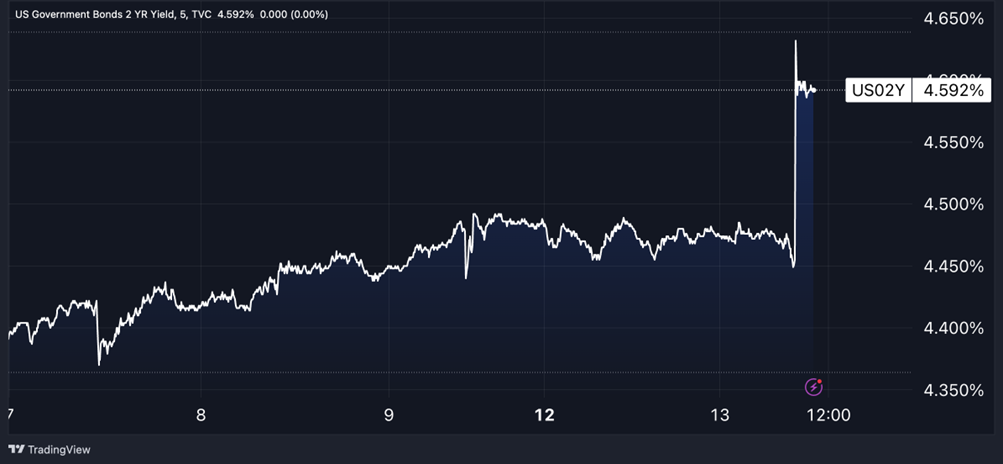

- Treasury Yields: Policy-sensitive 2-year treasury yields jumped by 10 basis points, surging back above 4.5%.

- Stock Market Downturn: In equity markets, stocks experienced a notable decline in response to the inflation data. The S&P 500 Index fell below the psychologically significant level of 5,000, losing over 1% on the day. The Dow Jones Industrial Average sank over 300 points, while the Nasdaq Composite Index was down almost 1.5%.

Trade idea of the week: Long USD/CHF

USD/CHF is on track to record its strongest one-day rally since March 2023, as inflation data releases in both the US and Switzerland diverged.

While inflation in the US came in hotter than expected, Switzerland reported easing price pressures, with consumer prices rising by only 1.3% year-over-year in January, well below market expectations of 1.7% and below the SNB’s upper target of 2% for the seventh consecutive month.

The diverging inflation dynamics between the two countries have led traders to anticipate contrasting monetary policy responses. While the Federal Reserve may now be less inclined to cut interest rates aggressively, the Swiss National Bank (SNB) could consider lowering its benchmark policy rate in response to subdued inflationary pressures.

Additionally, the Swiss National Bank (SNB) boosted its foreign exchange reserves for the second consecutive month in January. This action signals a recovery from the prolonged decline observed over the past two years, which had driven reserve levels to their lowest point in seven years, and should lead to franc weakness going forward.

As a result, the USD/CHF exchange rate is likely to experience upward pressure in the coming days and weeks. Technically, on Tuesday, USD/CHF surpassed the 200-day moving average, marking a significant shift from its previous three-month trend of trading below this indicator.

The recent pattern observed in the daily chart appears to resemble an inverted head and shoulders formation. This pattern suggests the potential for a continued bullish trend, with a target extension towards the November high of 0.9110.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.