As Uber's shares surge by 92% this year, the company heads into its latest earnings report on the back of a substantial settlement with New York's Attorney General.

Uber Earnings Anticipation

Uber prepares to report earnings that will cast a spotlight on the company's recent performance.

Wall Street expects earnings of $0.13 per share — a significant uptick from the previous year. Revenue forecasts also suggest robust growth, with projections hovering around $9.47 billion, marking a potential year-over-year increase of 13.5%.

Analysts have expressed optimism, with upgrades reflecting expectations of continued financial improvements and new avenues for revenue, particularly in advertising. This sentiment is mirrored by the share price growth witnessed this year.

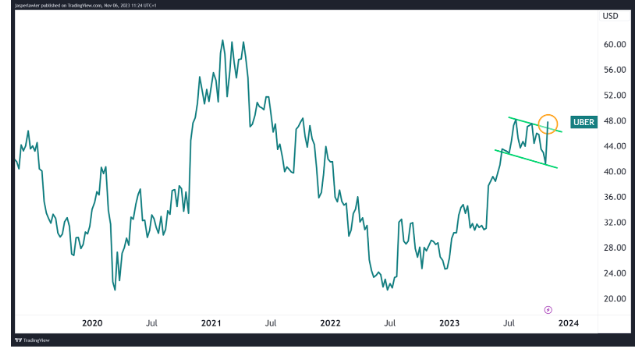

Uber price chart (all-time)

Uber's (UBER) price action shows an ongoing bullish trend since bottoming above $20 in July 2022, matching the record low set in 2020. Recently a bull flag pattern indicates another leg higher, perhaps setting up a test of the record high near $60.

The Investment Landscape of Ridesharing

The recent settlement of $290 million with New York's Attorney General, which is part of a larger $328 million agreement involving both Uber and Lyft, marks an important resolution to a long-standing dispute over driver compensation. Uber's management has welcomed the settlement, heralding it as a stride towards better working conditions for drivers and a win for their operating model in New York State.

The investor reaction has been cautiously optimistic, as evidenced by the share price gain over the past few days, mirroring broader optimism across stock markets after the Fed opted to keep interest rates steady. These gains suggest that, despite the financial outlay for the settlement, the market is responding favorably to Uber’s strategy and growth prospects.

Upside Catalysts for Uber

Uber's potential upside catalysts include its expansion into additional markets and service verticals. The company is not just focusing on ride-hailing but is also steadily growing its delivery services, including grocery, which could capture more consumer spending.

Furthermore, investment in technology to enhance user experience and operational efficiency may provide long-term cost savings and customer loyalty.

Uber’s adoption of an environmentally friendly fleet and commitment to sustainability could also resonate with increasingly eco-conscious consumers and investors, potentially leading to a favorable market positioning as regulations and preferences shift towards greener transportation options.

Risks and Considerations in the Ridesharing Sector

The company faces distinct risks that could sway its financial future. Firstly, there's the ever-present specter of regulatory challenges. Despite settling with New York's Attorney General, the agreement brings to light the potential for further legal scrutiny and the associated financial implications—not just in New York but potentially in other jurisdictions where Uber operates.

Secondly, the market is observing how Uber's advertising business will perform as a new revenue stream. While the initiative is margin accretive, its long-term contribution to the bottom line remains to be seen, especially as it intersects with the core ride-hailing services amidst aggressive competition in the advertising space.

Lastly, the risk of margin pressure looms large. Analysts’ consensus is for stable margin improvement into 2024; however, this optimism must be balanced against cost variables such as insurance impacts and operational expenses, which could potentially temper margin growth.

Uber vs Lyft

This year has witnessed Uber’s shares significantly outperforming those of Lyft, with an impressive 92% rise compared to Lyft's 6% decrease. The divergence reflects a notable contrast in investor sentiment surrounding the two ridesharing contenders.

Uber's aggressive move into advertising and its settlement in New York appear to be well-received, suggesting a possible cushion for its core ride-hailing service and room for margin growth. Lyft, meanwhile, faces investor caution as it grapples with cost structures and seeks to demonstrate sustainable volume growth.

In Summary

The anticipated earnings report from Uber will provide critical data points that reflect the company's current financial standing and future prospects. The stock's strong performance this year brings additional focus to these results, as they will help investors to better understand the company's operational efficiency and market position.

Key elements, such as the impact of regulatory settlements and the potential of new revenue streams, will be assessed to gauge their effect on Uber's financial health. As investors review these factors, the earnings will offer a clearer picture of the stock's valuation and the broader ridesharing market's potential.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.