Tech giant Apple (AAPL) became the first company in the world to hit a $3 trillion valuation in July, but sales are falling (including iPhones), which could spell trouble ahead.

What's happening?

- Apple’s diversified hardware and service offerings maintained momentum despite a flagging global economy post-pandemic.

- Supply chains and geopolitical concerns could pose a major problem for the company, and there’s little management can do to mitigate the issue.

- There are indications that Apple’s foray into financial services isn’t as fruitful as hoped, and imminent student loan repayments may cut into Apple’s core consumer demographic’s budget.

Hot Off the Presses: Q2 Earnings

Although the firm beat analyst expectations, it still reported lagging sales with a 1.4% drop over the quarter. Executives didn’t paint a rosy picture for the future, either, as CFO Luca Maestri said to expect annual revenues to fall further by the end of the year.

After the lukewarm report, Apple shares tumbled 2% in after-hours trading, falling as low as $185.25. What happens tomorrow is anyone’s guess. Still, with a bevy of bad news just below the surface, investors bullish on Apple should step back and consider whether now is the time to take profit – before it’s too late.

DID YOU KNOW?

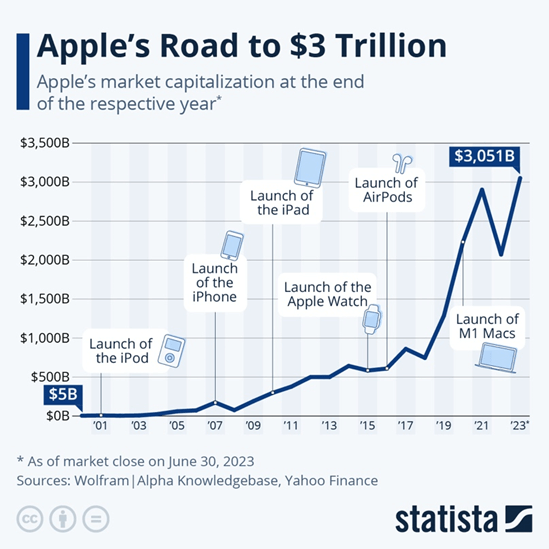

Apple’s major market cap milestone is belied by its (relatively) humble beginnings.

For years, the company chugged along at a standard growth trajectory before exploding around 2019. But more time may show the firm grew too quickly, too fast, and its valuation may revert to the mean.

Renewed Interest in Apple Stock

Apple made major waves at the beginning of July as the first company in the world to hit a $3 trillion market cap. Surprising many analysts, investors didn’t rush to take profit after the peak, and the stock remained fairly stable throughout the month.

In fact, the stock climbed steadily throughout July, closing out the month at $196.45 per share, adding another $1 billion to its massive market cap.

AAPL Share Prices May 31, 2023 – July 30, 2023. Source: EquitySet

What’s the deal? Although much of the market rebounded throughout the year, a company climbing this high this quickly, amid continued inflation concerns and rate hikes, struck many as strange.

Why has Apple stock been rising?

A few factors directly contributed to Apple’s sudden spike:

Solid Financials

Apple’s May financial report reinforced its dominant financial position. The company beat investor expectations substantially, showing its relatively pricy products like the iPhone are firmly entrenched in consumer budgeting even as inflation cuts into household spending power. Illustrating this, iPhone sales jumped 1.5% despite wide expectations that they’d drop (analyst consensus predicted a 3.3% sales volume fall).

Furthermore, the company’s dividend jumped to $0.24 per share from $0.23, and the company affirmed its dedication to ongoing stock buybacks by approving a $90 billion repurchase program.

Diversified Services and New Product Launches

Apple also demonstrated its product diversity, showing investors its success isn't contingent on a handful of hardware offerings. Despite an economic slowdown, the company's service revenues (including iCloud, Apple Pay, Apple Music, and more) climbed another 5.5% between quarters. The company also demonstrated geographic diversification, as emerging markets like India saw massive jumps in hardware sales. Both growth sectors indicate Apple is entrenched in the consumer spending cycle globally regardless of economic conditions.

Apple also made waves by announcing 2024's augmented reality headset, the Apple Vision Pro. Although pricier than other offerings, clocking in at $3,499 for a base model, the new development shows Apple is dedicated to testing and trying new hardware offerings beyond its current scope.

Apple also rode the artificial intelligence bandwagon by announcing Apple GPT and deploying a chatbot for internal use. While both aren't yet in consumer's hands, Apple's willingness to adapt to changing tech trends shows they have their pulse on consumer preferences and will fight to capture market share from newly developed tools.

Risks for Apple stock

Stretched Supply Chains and Early Production Cuts

While many companies, like car manufacturers, more or less rebounded from tight supply lines, rumors abound that Apple is still struggling. Already third-party repair companies report difficulty sourcing OEM components for repairing broken equipment, so it's a safe assumption that lagging production is also plaguing Apple.

Just weeks after announcing the highly hyped Vision Pro, Apple published revised production forecasts for 2024 that saw a massive cut to the planned product. Whether due to supply chain struggles or less demand than expected, one thing is clear: Apple is in a precarious position.

Notably, Foxconn (Apple's main supplier) founder Terry Guo tweeted that "if a war breaks out in the Taiwan Strait, it wouldn't take a month or even an hour, but just 10 seconds for the Wall Street stock market to collapse." Guo's thesis is likely overblown but Apple's dependency on foreign manufacturing in a sensitive region makes the stock very sensitive to geopolitical action.

Financial Foibles

In their quest to diversify, Apple rolled out a high-yield-savings-account (HYSA) program earlier this year. Dipping their toes into pure financial plays beyond the existing Apple Pay program seemed a no-brainer in an era where cash is funneling into HYSAs and money market funds as rates rise. But the program, facilitated by Goldman Sachs, might be a bridge too far for Apple to maintain.

Just weeks after announcing the program, Goldman Sachs began seeking an offramp. If smart money sees trouble on the horizon, investors should consider whether Apple is stretching itself too thin with new initiatives.

Apple may not be as stable on the sales front moving forward, either. More than half of Apple’s core consumer base is younger than 35. At the same time, that demographic holds the bulk of student debt nationally. With repayment restarts on the horizon and continued inflation alongside a lagging job market, Apple’s true consumer resiliency is being called into question.