Last week was a very busy one in terms of US corporate news as a flood of quarterly earnings reports were published.

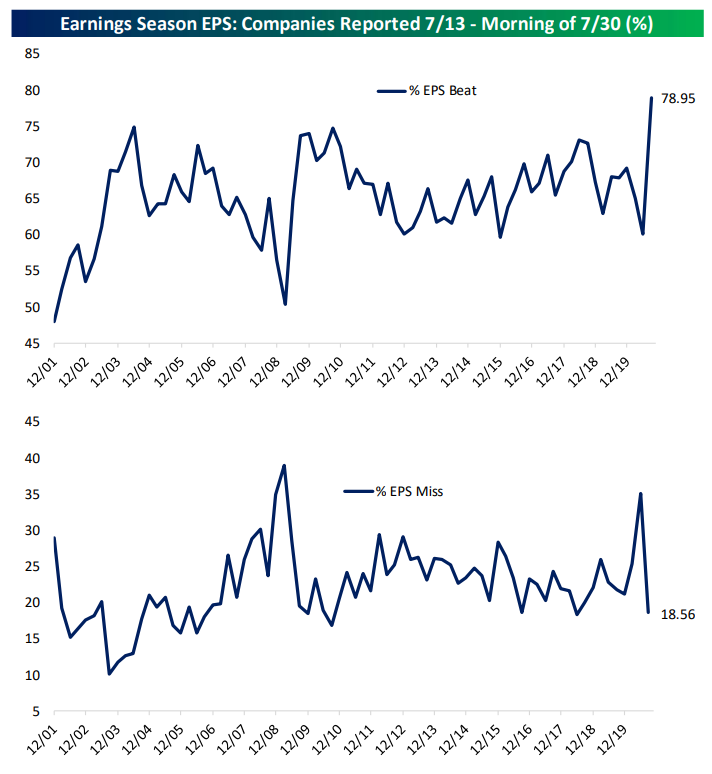

With about half of the S&P 500 companies having reported quarterly results, around 80% of the companies have exceeded analyst estimates (source: Bespoke).

While the better-than-expected results are welcome, it is worth highlighting that they're more a reflection of low expectations heading into the earnings season, with earnings being forecasted to decline by 41% in the second quarter and 22% for the year.

Another reason behind the positive surprises is the fact that almost half of the S&P 500 earnings are derived from sectors which are either less impacted or even benefit from the pandemic. For instance, health care and technology both anticipate growing earnings this year. However, industrials, consumer discretionary and energy earnings are expected to decline by more than 50%.

This wide divergence in earnings trends among sectors and stocks is already well reflected in the stocks prices. Indeed, the S&P 500 has become very polarized with the largest five stocks in the S&P 500 (Microsoft, Apple, Amazon, Facebook and Google) now accounting for about 23% of the index and being up 30% on average this year, versus an average decline of -9% for the remaining 495 stocks in the index.

What’s next?

Investors seem to be looking beyond 2020 as they start to anticipate a gradual improvement in corporate profitability and a return to earnings growth next year. This optimism is based on the following assumptions: 1) A sustained economic recovery but shaky, 2) interest rates will stay low; and 3) margins to stay high thanks to corporate cost-cutting efforts.

With regards to the narrow market breadth (i.e index returns being driven only by a few mega-caps tech and healthcare leaders), some analysts are pointing out that the current situation is very different than during the 2000 tech boom and bust. Indeed, the big 5 (Microsoft, Apple, Amazon, Facebook and Google) have low debt levels, high returns and resilient earnings growth supported by consistent secular trends (e-commerce, social media, work-from-home, etc.).

For those investors who want to get exposed to a change of market leadership (e.g sell the “growth” stocks and switch into the sectors which have been harder hot by the pandemic), they need to take a bet on a potentially faster-than-expected progress on vaccine development, a stronger than expected economic recovery or a larger-than-expected fiscal and monetary stimulus.

Examples of ETFs being exposed to Secular growth trends:

• The Technology Select Sector SPDR Fund (XLK US)

• The Health Care Select Sector SPDR Fund (XLV US)

• Invesco QQQ Trust (QQQ)

• First Trust Dow Jones Internet Index Fund (FDN)

Examples of ETFs which could benefit from a swift return to pre-pandemic levels in the US:

• The Industrial Select Sector SPDR Fund (XLI US)

• The Financial Select Sector SPDR Fund (XLF US)

• The Energy Select Sector SPDR Fund (XLE US)

• The Consumer Discretionary Select Sector SPDR Fund (XLY US)

• The US Global Jets ETF (JETS US)

Read our next article: Worst month in a decade for the dollar