Forex Market Review: What Happened Last Week

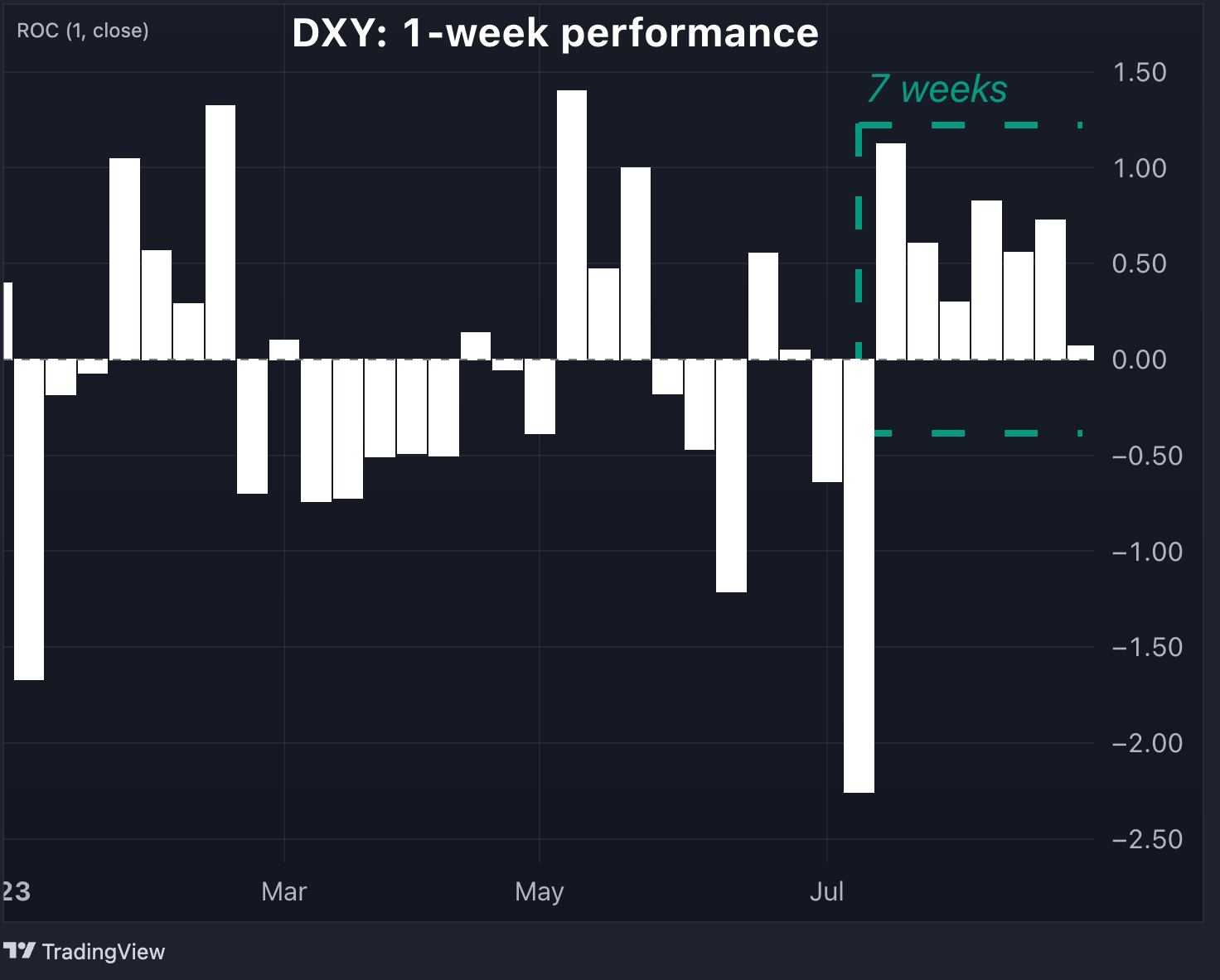

Last week, major currencies remained relatively stable, with the U.S. Dollar Index (DXY) showing a modest but positive gain of 0.1%, marking its seventh consecutive week of growth. In the U.S., key economic indicators fell into the "not too hot, not too cold" category - non-farm payrolls for August exceeded predictions at 187,000 jobs added, though the unemployment rate unexpectedly rose to 3.8%. The Federal Reserve's preferred inflation metric met expectations, while the Q2 GDP was revised downward from 2.4% to 2.1%. In summary, this data solidified expectations of the Fed maintaining interest rates steady in September.

In the euro zone, inflation exceeded expectations at 5.3% compared to the projected 5.1%. However, manufacturing PMI surveys continued to indicate a contractionary phase, raising economic concerns, especially regarding Germany.

The Australian dollar (AUD) and the New Zealand dollar (NZD) were the top-performing currencies of the week, bolstered by optimistic developments in China. Chinese authorities took measures to stimulate capital markets and restore investor confidence, including cutting mortgage interest rates and reducing stock trading stamp duties by half.

The upcoming week in the United States is expected to be relatively quiet, with the most impactful FX market data releases coming from Australia and Canada, where both central banks are set to announce their interest rate decisions.

Key Economic Events To Monitor This Week

United States:

- ISM Services PMI – Flash August (Wed.): 52.5 expected, 52.3 previous

- Fed speakers: Logan (Wed.), Williams & Bowman (Thu.), Barr (Fri.)

Euro Area:

- Retail Sales for August (Wed.): -0.2% expected, -0.3% previous

- Q2 GDP Growth Rate 3rd Estimate (Thu.): 0.3% prior estimate

- ECB Speakers: Lagarde (Mon. & Tue.)

Other Data To Follow:

- Reserve Bank of Australia’s Interest Rate Decision (Tue.): on hold at 4.1% expected,

- Bank of Canada’s Interest Rate Decision (Wed.): on hold at 5% expected

Chart Of The Week: DXY Records its Longest Weekly Run Since July 2014

New Trades for The Week

Short GBP/CHF

- Entry: 1.1156

- Take profit: 1.09

- Stop Loss: 1.125

- Risk/Reward Ratio: 2.8

Fundamental View: BoE Chief Economist Huw Pill voiced ongoing concerns about inflation persistence amid economic challenges. The UK manufacturing declined further in August, and the Nationwide House Price Index dropped by an unexpected 5.3% year-on-year, the steepest fall in 14 years. High interest rates are now affecting the British economy, potentially reducing the need for excessive BoE rate hikes. The Swiss franc remained supported by the Swiss National Bank's hawkish stance, as policymakers signaled readiness for a rate hike this month to counter rising inflation risks.

Technical view: A bearish signal emerged on the GBP/CHF daily chart with a death cross, where the 50-day moving average crossed below the 200-day moving average. Despite trading within a narrow range for the year, GBP/CHF has struggled to breach the 1.125 level since mid-July, aligning with the 200-day moving average. This resistance suggests a strong bearish sentiment. Bears could potentially aim for the October 2022 lows around 1.09. A prudent strategy might involve setting a stop loss if GBP/CHF breaks above the 200-day moving average.

Short EUR/AUD

- Entry: 1.6708

- Take Profit: 1.6200

- Stop Loss: 1.6900

- Risk/Reward Ratio: 2.66

Fundamental ViewThere are fundamental reasons to consider that the euro may have appreciated excessively against the Australian dollar. According to the 2-year yield spread, the EUR/AUD pair appears overvalued compared to its current levels, potentially warranting a correction to the range of 1.62-1.63.

While the Reserve Bank of Australia is not expected to deliver any surprising interest rate decisions, with rates likely to remain steady at 4.1%, the European Central Bank faces a diminishing window for further rate hikes due to recent deteriorating economic data.

Moreover, the Australian dollar stands to benefit the most from policy stimulus measures in China, as evidenced in recent developments. Additionally, the global rise in commodity prices is another contributing factor strengthening the AUD and weakening the EUR.

In light of these factors, there's a possibility that the EUR/AUD pair could realign with its short-term interest rate differentials, returning to more balanced trading values.

Bears may consider a near-term target of 1.6200, while setting a stop loss at 1.69, which corresponds to the August 23rd highs.

Long XAU/USD:

- Entry: $1,943/oz

- Take Profit: $2,006/oz

- Stop Loss: $1,918/oz

- Risk/Reward Ratio: 2.4

Fundamental View: Recent economic data in the United States is beginning to indicate a cooling labor market, potentially leading to a slower economic performance in the upcoming months. Market expectations are now leaning towards the Federal Reserve maintaining unchanged interest rates in September. This scenario could provide support for gold, particularly if Treasury yields continue to decline, as observed in the 10-year yield's second consecutive week of rate reductions.

Technical View: Gold experienced a robust recovery since hitting a low point on August 21st, with prices surpassing both the 50 and 200-day moving averages. The Relative Strength Index (RSI) is showing a growing bullish momentum, suggesting the potential for further upward trends.

When applying Fibonacci retracement analysis to the lows and highs of 2023, key levels to watch include 1,960 (38.2%), 1,983 (50%), and 2,006 (61.8%). In the medium term, the latter level at 2,006 could be an attractive target for bulls. It's advisable to set a stop loss just below the opening of the bullish candlestick observed on August 29th to manage the risk-reward balance effectively.

Open trading ideas:

- Long USD/CHF

- Opened on August 28 at 0.8840

- Take Profit: 0.9250

- Stop Loss: 0.8680

- Profit & Loss: +0.00%

- Short GBP/CAD

- Opened on August 28 at 1.7115

- Take Profit: 1.6707

- Stop Loss: 1.7296

- Profit & Loss: -0.3%

- Long USD/CAD

- Opened on August 21 at 1.35

- Take Profit: 1.3860

- Stop Loss: 1.3350

- Profit & Loss: +0.70%

- Long CHF/NOK:

- Opened on August 21 at 12.06

- Take Profit: 12.47

- Stop Loss: 11.89

- Profit & Loss: -0.2%

- Short GBP/USD:

- Opened on August 14 at 1.2690

- Take Profit: 1.2310

- Stop Loss: 1.2850

- Profit & Loss: +0.5%

- Short NZD/JPY:

- Opened on August 14 at 86.70

- Take Profit: 83.50

- Stop Loss: 88.00

- Profit & Loss: -0.3%

- Short EUR/CAD:

- Opened on August 14 at 1.4730

- Take Profit: 1.4280

- Stop Loss: 1.49

- Profit & Loss: +0.4%

- Long U.S. Dollar Index (DXY):

- Opened on August 7 at 102.19

- Take Profit: 105.5

- Stop Loss: 100.90

- Profit & Loss: +1.9%

- Long USD/SEK:

- Opened on August 7 at 10.60

- Take Profit: 11.20

- Stop Loss: 10.46

- Profit & Loss: +3.9%

- Short NZD/CAD:

- Opened on July 24 at 0.8174

- Take Profit: 0.7975

- Stop Loss: 0.8263

- Profit & Loss: +1.2%

- Long USD/CHF:

- Opened on July 17 at 0.86

- Take Profit: 0.89

- Stop Loss: 0.85

- Profit & Loss: +2.8%

- Long CHF/JPY:

- Opened on June 19 at 158.58

- Take Profit: 171.62

- Stop Loss: 152.5

- Profit & Loss: +4.4%