The US dollar index (DXY) failed to leverage the tailwinds stemming from unexpectedly high inflation figures in January, rising Treasury yields and further downward adjustments to anticipated rate cuts for 2024. This lackluster performance is likely attributed to the prevailing bullish sentiment surrounding risk assets, evident as both US and European equity markets continue to flirt with record highs.

Dollars on the background Federal Reserve Building | Shutterstock.com

Turning our attention to this week's focal point, all eyes are on the Federal Reserve's preferred inflation gauge, the Personal Consumption Expenditure (PCE) price index, slated for release this Thursday. Additionally, market participants can anticipate insights from various Federal Reserve officials throughout the week, shaping expectations regarding monetary policy trajectories.

Inflation data is in the spotlight in Europe, with preliminary estimates for February due from France, Germany, and the broader euro area.

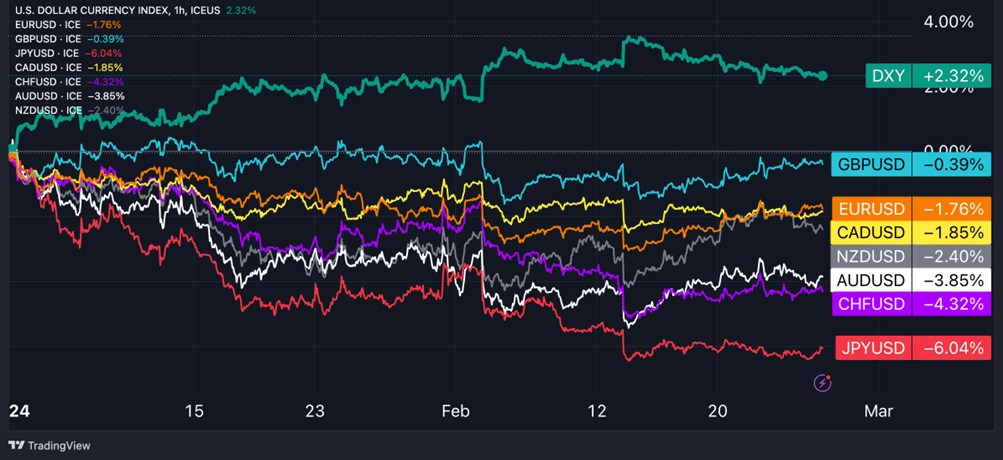

Year-To-Date Performance of Major Currencies: USD Leads, JPY Underperforms

US Dollar Update:

The U.S. dollar index traded at 103.80 levels during morning trading on Tuesday, experiencing a modest 0.3% decline for the week. Minutes from the Fed’s January meeting revealed that "several" FOMC members highlighted upside risks to inflation's outlook, citing the potential resurgence of goods prices, robust wage gains, and geopolitical tensions. Meanwhile, market sentiment led to further reduction of bets on Federal Reserve rate cuts, with expectations now leaning towards slightly more than 80 basis points of cumulative cuts, indicating slightly over three rate cuts by December 2024. Yields on a 2-year Treasury note reached 4.70%, the highest level observed since December 12th. Meanwhile, politics has once again taken center stage as the U.S. Congress finds itself with only four days to pass a crucial spending bill required to prevent a partial government shutdown.

Euro Update:

The euro surged past the 1.08 level against the US dollar, buoyed by cautious remarks from ECB officials and better-than-expected private sector activity surveys for February. ECB President Christine Lagarde indicated on Monday that while the current disinflationary trend is expected to persist, the governing council needs assurance that it will lead sustainably to the 2% target. Currently, markets are pricing in a full percentage point of ECB rate cuts in 2024, with the first cut fully priced in by June.

Pound Update:

Sterling consolidated its recent gains above $1.265, reaching a new high since February 1st, as investors reassessed the Bank of England's policy outlook amid mixed economic data releases. The latest British PMI data showed that private sector activity expanded in February at its fastest pace since last May, surpassing expectations, driven by a significant uptick in service sector growth. However, the Consumer Confidence indicator in the United Kingdom unexpectedly fell more than predicted in February.

Chart of The Week: US 1-Month Yields Spike As Government Risks Shutdown Next Week

This Week's Forex Trading Ideas

Short EUR/NZD

- Entry: 1.7601

- Take profit: 1.7155

- Stop loss: 1.7810

- Risk-reward ratio: 1:2.4

EUR/NZD Fundamental Analysis:

The EUR/NZD pair is poised to experience significant volatility throughout the week due to economic events affecting both regions. The euro will be influenced by February's inflation data, while the Kiwi will be impacted by the policy meeting of the Reserve Bank of New Zealand. On Wednesday, the RBNZ is anticipated to maintain interest rates at 5.5% and uphold its hawkish stance, indicating the necessity of prolonged restrictive policies to curb inflation. Conversely, Friday is expected to see a slowdown in the euro area inflation rate from 2.8% to 2.5%, potentially leading to weakness in the single currency. Currently, there exists a spread of over 200 basis points between New Zealand’s 2-year bond yields and their German counterparts, exerting bearish pressure on EUR/NZD.

EUR/NZD Technical Analysis:

The EUR/NZD pair has been trending within a downward channel since late January, presently testing the resistance of the 50-day moving average at 1.7600. Some selling pressure is emerging at this level, indicating a possible downward movement in the coming weeks. The Relative Strength Index (RSI) is currently at the halfway mark of 50 but has remained below it since February 6th. Bears might target a retest of the May 2023 lows at 1.7155, setting a stop-loss at 1.7810, around the 200-day moving average.

Long GBP/CHF

- Entry: 1.1160

- Take profit: 1.1507

- Stop loss: 1.0999

- Risk-reward ratio: 1:2.1

GBP/CHF Fundamental Analysis:

The GBP/CHF pair continues its ascent driven by diverging inflation dynamics between the two regions. Markets are reducing their bets over Bank of England's rate cuts, now seeing August as the most likely start date instead of June. Conversely, the Swiss National Bank (SNB) has initiated a reserve strengthening program, effectively closing the door on Swiss franc purchases and giving bears room to maneuver. With the 2-year yield spread between the UK and Switzerland hovering above 300 basis points, there is ample room for bullish strategies based on carry trade opportunities.

GBP/CHF Technical Analysis:

GBP/CHF has been on an upward trajectory since the beginning of the year. In February, the pair surpassed the 200-day moving average, further affirming the bullish trend. The RSI has consistently remained above the 50 mark since January 11th, indicating a strong bullish momentum. Following a "trend is your friend" approach, traders may anticipate further gains up to 1.15, corresponding to June 2023 highs, before considering profit-taking measures. Placing a stop-loss below the psychological level of 1.10 offers a favorable risk-reward ratio of 1:2.1.

Short XAU/USD

- Entry 2,036

- Take Profit: 1,967

- Stop loss: 2,068

- Risk-reward ratio: 1:2.2

Gold Fundamental Analysis:

Gold prices have exhibited resilience despite underlying US rate fundamentals suggesting otherwise. This week's release of the PCE data will serve as a significant test for the precious metal's resilience. Economists anticipate a decrease in the annual PCE inflation from 2.6% to 2.4% in January, while core PCE inflation is expected to moderately ease from 2.9% to 2.8%. It's worth noting that the Consumer Price Index (CPI) surprised to the upside, leaving room for a similar outcome with the PCE. Following the data release, a plethora of Federal Reserve officials are expected to comment, likely reiterating the central bank's cautious approach towards premature and aggressive policy easing.

Gold Technical Analysis:

XAU/USD is currently challenging the resistance of the 50-day moving average at levels between 2,033 and 2,040, with the momentum of the mid-February rally appearing to wane. Additionally, prices are nearing a declining trendline formed by connecting lower highs from December 2023 and February 2024. Despite this, the RSI has been trending upwards and has crossed the 50 mark. Overall, the technical outlook remains neutral and lacks a clear bearish bias. However, considering the potential risk associated with the PCE data, a strategic approach may consider a retreat towards the 200-day moving average at 1,967, with a stop-loss placed at 2,068.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.