Source: Shutterstock | Dilok Klaisataporn

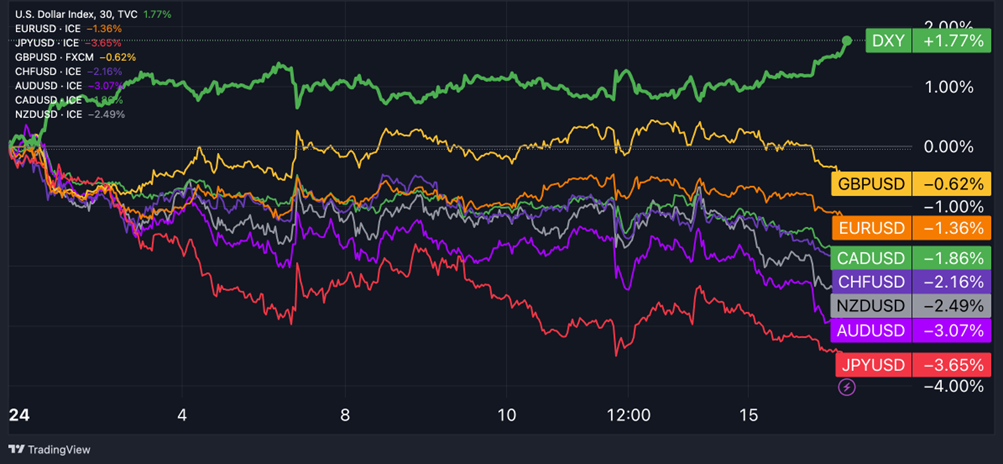

The U.S. dollar has extended gains against all major currencies over the past week, driven by investors’ growing concerns about a resurgence of global inflationary risks, stemming from geopolitical tensions arising in the Red Sea region.

The critical trade route, a vital link for shipping between Asia and Europe, has been significantly disrupted due to ongoing attacks by the Iranian-backed Yemeni Houthis group. This situation has compelled shippers to avoid the Suez Canal, opting instead to reroute via the Cape of Good Hope, and leading to substantially longer transit times and increased costs for reaching their destinations.

Since the beginning of the year, the rates for a forty-foot equivalent unit (FEU) of a container from China/East Asia to the Mediterranean have almost tripled, reflecting the heightened logistical challenges and economic impacts of these geopolitical tensions.

Performance of Major Currencies So Far This Month: USD Leads, JPY Lags Behind

Source: TradingView

U.S. Dollar Update:

On Tuesday, the dollar index surged to around 103, reaching its highest point in almost a month, as market participants reevaluated expectations regarding the Federal Reserve's monetary strategy. The U.S. consumer price index (CPI) inflation data for December exceeded forecasts last week, leading traders to question their predictions about imminent rate cuts by the Fed. Currently, markets are factoring in a 70% likelihood that the central bank will commence rate reductions in March. However, the majority of analysts and Federal Reserve officials view this expectation as overly optimistic.

Euro Update:

The euro remained close to $1.09 as investors analyzed recent economic data showing a 0.3% contraction in Germany's economy last year, linked to ongoing inflation, increased borrowing costs, and subdued demand, alongside a third consecutive month of declining Eurozone industrial activity in November. Despite markets anticipating an ECB rate cut in April, Chief Economist Philip Lane hinted at June as a more realistic timeline. Meanwhile, ECB member Joachim Nagel stated that discussing rate cuts is premature due to high inflation, and his colleague Robert Holzmann deemed rate cuts in 2024 as highly improbable.

British Pound Update:

The British pound slipped below $1.27 as labor market cooling raised prospects of Bank of England rate cuts. UK pay growth slowed to 6.6% in September-November, the weakest since early 2023, while total pay growth fell to 6.5%, below forecasts. Job vacancies also declined for the 18th straight period, reaching a two-year low. Investors await a speech from Bank of England Governor Andrew Bailey and key inflation and retail sales data later this week.

Japanese Yen Update:

The Japanese yen fell to over 146 against the dollar, nearing its lowest level in a month, as diminishing inflation in Japan reduced the likelihood of imminent interest rate increases by the Bank of Japan. Recent figures indicate that Japan's wholesale inflation rate remained steady in December compared to the previous year, continuing a 12-month trend of deceleration. Expected consumer inflation figures for this week are also projected to reveal a continued moderation in pricing pressures.

Chart of The Week: Shipping Costs Between Asia and Europe Triple Since Year's Beginning

Source: TradingView

Economic Events You Cannot Miss This Week

United States:

- Retail sales for December (Wed.): 0.4% month-on-month (m/m) expected, 0.3% m/m previous

- Michigan Consumer Sentiment for January (Fri.): 70 exp., 69 pre.

- Fed speakers: Waller, Barr, Bowman, Woods, Bostic, Daly.

Euro Area:

- Inflation rate final reading for Dec. (Wed.): 2.9% preliminary estimate

- Lagarde speaks (Wed., Thu. and Fri.)

- ECB Monetary Policy Meeting Accounts (Thu.)

United Kingdom:

- Inflation rate (Wed.): 3.8% y/y exp., 3.9% pre.

- Retail sales (Fri.): -0.5% m/m exp., 1.3% pre.

This Week's Forex Trading Ideas

Long USD/JPY

- Entry: 146.54

- Take profit: 155.10

- Stop loss: 142.95

- Reward/Risk: 2.4x

Source: TradingView

USD/JPY Fundamental analysis:

While the 10-year yield spread between the US and Japan has only modestly widened from 320 to 340 basis points since the start of the year, emerging inflationary risks might trigger a more significant expansion in the coming months. This week, several Federal Reserve officials are scheduled to speak, potentially dampening the market's hopeful anticipation of an early March rate cut. In light of this, the dollar could experience a renewed surge against the yen, a rally that may already be in its initial phase.

USD/JPY Technical analysis:

During Tuesday's session, USD/JPY crossed above its 50-day moving average, after finding support at the 200-day moving average last week. The 14-day Relative Strength Index (RSI) has climbed above 60, indicating an upward trajectory towards an overbought zone not seen since July 2023. The pair's recent rebound has already reversed over half of the November to December downtrend. Bulls might anticipate an extended bullish movement towards the 155.10 level, last observed in June 1990, while considering a stop-loss order below the 50-day moving average in case this support level is breached.

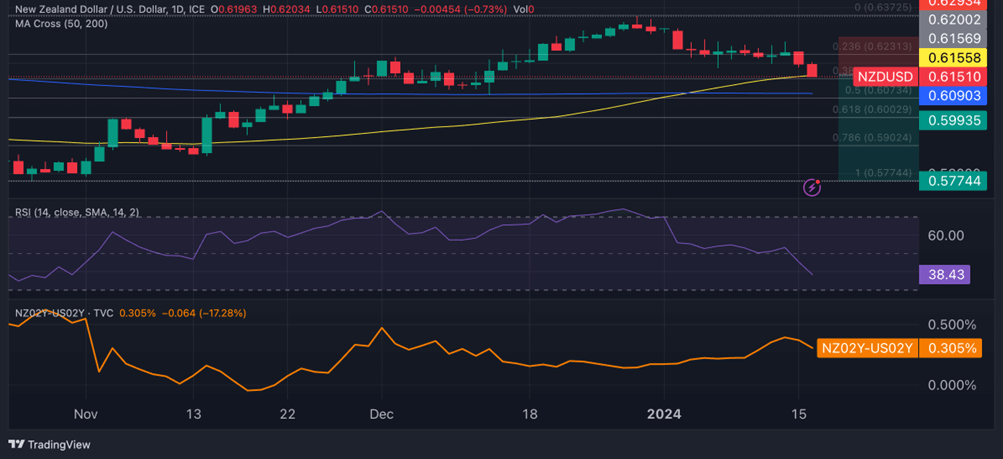

Short NZD/USD

- Entry: 0.6156

- Take profit: 0.5774

- Stop loss: 0.6290

- Reward/Risk: 2.8x

Source: TradingView

NZD/USD Fundamental analysis:

Since the beginning of the year, the New Zealand dollar (kiwi) has faced heightened pressure due to market expectations of more than a full percentage point of rate cuts in New Zealand during 2024. This pressure is compounded by external factors that have dampened risk appetite and reignited concerns about inflation. The 2-year yield spread between New Zealand and the United States has largely stayed steady at around 30-40 basis points since December. However, there is a risk of this spread narrowing towards zero if markets further reduce their expectations for Federal Reserve rate cuts in 2024.

NZD/USD Technical analysis:

The NZD/USD pair has recently broken below the support of the 50-day moving average as we write, which had held up well since mid-November. Just below this level, we find the 200-day support at 0.6090, which also aligns with the 50% Fibonacci retracement level of the bullish trend that occurred from October to December. A breach of this level could potentially trigger additional bearish extensions, initially targeting 0.60 (the 61.8% Fibonacci level) and subsequently descending to 0.5774, where the pair would complete the retracement.

Short GBP/CAD

- Entry: 1.7043

- Take profit: 1.6555

- Stop loss: 1.6750

- Reward/Risk: 2.2x

Source: TradingView

GBP/CAD Fundamental analysis:

Recent weaker-than-anticipated economic data from Britain has led traders to ponder the possibility of additional rate cuts by the Bank of England in 2024. The upcoming December inflation report is a key focus this week, with projections suggesting a dip from 3.9% year-on-year in November to 3.8%. Additionally, retail sales are expected to show a 0.5% month-on-month decline. Should these forecasts materialize, it could pave the way for new downward trends for the pound. Conversely, the Canadian dollar might find support from improved trade dynamics, bolstered by rising oil prices amid Middle East tensions and increased natural gas prices following the severe cold wave in North America.

GBP/CAD Technical analysis:

The GBP/CAD pair is heading for its second consecutive day of losses on Tuesday, following a streak of eight successive gains. In upcoming sessions, the pair is anticipated to challenge the 50-day moving average support at 1.7016. Breaking through this level could lead to further declines, targeting the 200-day moving average at 1.6905. The 14-day RSI is showing signs of a downward trend, suggesting a waning in the bullish momentum. For bears, the 1.6750-1.6760 range is a key area to watch, as it has previously served as support in November and December, and as resistance in October.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.