The dollar just had its worst week in four months after the Fed decided to keep interest rates unchanged, and a labor market report that was weaker than expected led speculators to anticipate more rate cuts in 2024.

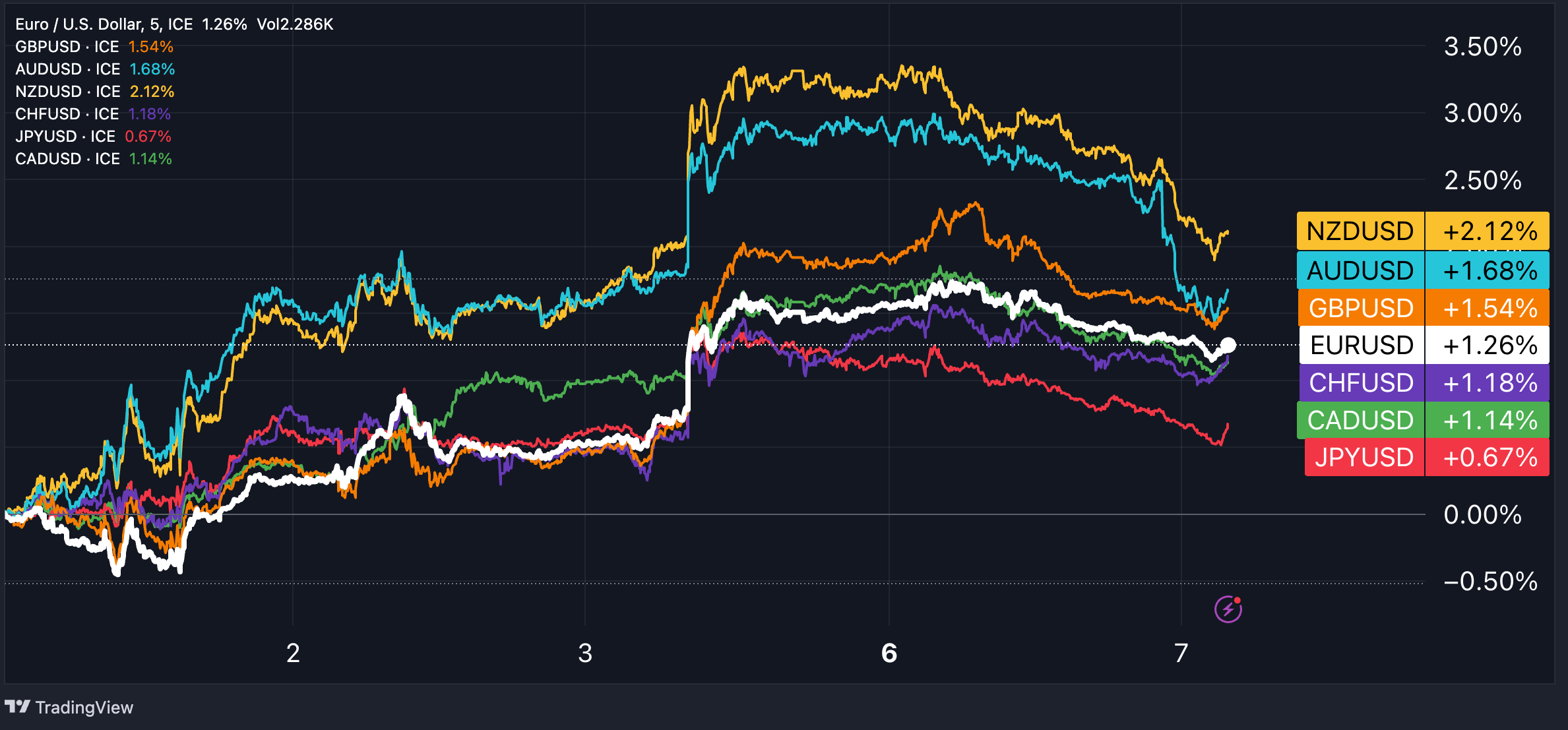

Chart of The Week: USD Weakened Against All Major Currencies In The First Week Of November

Forex Market Review

The U.S. Dollar Index (DXY) fell by 1.4% last week, not only due to a more dovish stance from Fed Chair Powell than anticipated but also because of data indicating a slowdown in the economy. In October, the rate of increase in non-farm payrolls dropped to 150,000, which was only about half of the revised-down 297,000 jobs added in September and below the market's forecast of 180,000. Additionally, both the ISM Services and Manufacturing PMIs came in below expectations last month.

Following these developments, traders have adjusted their expectations for rate cuts next year, now pricing in four 25-basis-point cuts through December 2024. The dollar saw a slight recovery at the beginning of this week, gaining 0.4%, as traders await further comments from Fed Chair Jerome Powell on Wednesday and Thursday for more guidance.

The euro (EUR) crossed the $1.07 mark for the first time since mid-September, supported by the weakening of the U.S. dollar. Economic data from the Eurozone indicated a contracting economy, with preliminary estimates showing a -0.1% GDP growth in the third quarter, worse than the market's forecast of no growth. The unemployment rate also increased to 6.5%, surpassing the expected rate of 6.4%.

The British pound (GBP) had its best week of 2023, rising by as much as 2.1% against the dollar. This increase followed the Bank of England's decision to keep interest rates steady while signaling the need to maintain them at higher levels for a longer period.

Both the Australian dollar (AUD) and the New Zealand dollar (NZD) were the top-performing currencies of the past week, rising by 2.8% and 3.3%, respectively, against the U.S. dollar, reflecting the improved risk sentiment following the Fed’s rate decision. However, nearly half of this bullish movement was reversed at the beginning of the new week due to growing concerns about a global economic slowdown. The move came despite the Reserve Bank of Australia hiked interest rates to 4.35%, as expected, pushing borrowing to the highest level since January 2011.

The Japanese yen (JPY) continued to face downward pressure, testing lows not seen since October 2022 against the dollar and reaching lows not seen since August 2008 against the euro.

Key Economic Events for the Upcoming Week

This week's data calendar is relatively quiet. In the United States, the focus will be on speeches by various Federal Reserve officials and the upcoming release of the Michigan Consumer Sentiment Index for November. The UK will unveil its third quarter GDP data. In addition, the euro area will publish retail sales data for September.

United States:

- Fed Chair Powell’s speech (Wed. & Thur.)

- Michigan Consumer Sentiment (Fri.): 63.8 exp., 63.7 pre.

Other Data To Follow:

- United Kingdom’s GDP growth rate Q3 (Fri.): -0.1% exp., 0.2% pre.

- Euro area’s retail sales for Sept. (Wed.): -0.2% exp., -1.2% pre.

New Trading Ideas For The Week

Short GBP/USD

- Entry: 1.2309

- Take profit: 1.1743

- Stop loss: 1.2500

- Reward/risk: 3:1

Fundamental view:

The pound experienced a strong rally last week, pushing it up to 1.2430, but this upward movement lacked substantial fundamental support. Instead, it is possible that this surge was primarily influenced by short-covering, as traders reacted to the dollar volatility following the Fed meeting and non-farm payrolls announcement. The 2-year interest rate differential between gilts and Treasury bonds still favors the latter, which could potentially result in renewed bearish pressure on the GBPUSD exchange rate. If the UK GDP data indeed confirms the expectations of a contraction in the third quarter, it is likely that we will see a resurgence of selling pressure on the pound.

Technical view:

The bullish momentum encountered resistance at the 200-day moving average, leading to the return of selling pressure. This suggests that the overall trend remains bearish. The pound might now test the support of the 50-day moving average in the range of 1.2290-1.2300. A break below this level could prompt bearish traders to target 1.2072 (38.2% Fibonacci retracement level between the 2023 highs and 2022 lows). As a medium-term target, the level of 1.1743 could be interesting to look at, as it corresponds to the 50% retracement level of the 2023-2022 price range.

Short EUR/USD

- Entry: 1.0690

- Take profit: 1.0401

- Stop loss: 1.0811

- Reward/risk: 2.4:1

Fundamental view:

The euro has risen to its highest level against the US dollar since mid-September, driven by increasing expectations of Fed rate cuts in 2024. The 2-year yield differential between European and US bonds has shown a slight improvement in favor of the euro, though it still remains significantly negative (-1.83%). This indicates that the broad fundamental outlook still favors the US dollar.

Powell might have the opportunity this week to realign market expectations, which currently anticipate four rate cuts in 2024, with the Fed board's shared view of keeping rates high for an extended period and not currently considering rate cuts.

The euro could potentially witness another negative print in retail sales, which might exert pressure on expectations for rate cuts by the ECB.

Technical view:

The level of 1.0750 has proven to be a challenging hurdle for EURUSD bulls, who had to pause for a breather and attempt to defend the 1.07 level. In the Tuesday morning session, sellers broke below this support, and they are now eyeing the 1.0630 level (50-day moving average) and then 1.06 (38.2% Fibonacci retracement from 2023 highs to 2022 lows). If EURUSD fails to hold this level, the possibility of a decline down to 1.04 (50% Fibonacci) could come back into play.

Short NZD/CHF

- Entry: 0.5327

- Take profit: 0.5100

- Stop loss: 0.5421

- Reward/risk: 2.3:1

Fundamental view:

The New Zealand dollar posted two negative sessions against the Swiss franc at the start of the week, following seven consecutive ones of gains. The rally in the NZDCHF pair between late October and Friday, November 3, was not supported by fundamental factors. In fact, it saw the interest rate differential between New Zealand's 2-year bonds and their Swiss counterparts decrease from 4.36% to 3.78%. While the interest rate differential still favors the kiwi, its significant downward movement raises some concerns and could potentially act as a deterrent for buyers, even though the exchange rate is at levels reminiscent of the COVID crisis in March 2020.

Technical view:

The NZDCHF pair managed to break above the resistance of the 50-day moving average and is currently testing the strength of its support. However, the previously strong bullish momentum has significantly waned recently, with the relative strength index now pointing southward. At this point, there are two possible scenarios for the pair: 1) Formation of a bullish flag pattern, leading to a bounce back towards the 200-day moving average in the 0.5500 area. 2) Retesting of the lows at 0.5180. I

If NZDCHF were to break below the support of the 50-day moving average, the second scenario becomes more likely, with the potential target at 0.5100.

Open trading ideas:

- Short EUR/JPY

- Opened on October 30 at 160.66

- Take Profit: 155.28

- Stop Loss: 162.16

- Profit & Loss: -0.1%

- Long XAG/USD

- Opened on October 30 at 23.18

- Take Profit: 26.17

- Stop Loss: 21.58

- Profit & Loss: -1.8%

- Short CHF/JPY

- Opened on October 23 at 168.01

- Take Profit: 164.90

- Stop Loss: 169.20

- Profit & Loss: +0.5%

- Long CHF/SEK

- Opened on October 16 at 12.1280

- Take Profit: 12.80

- Stop Loss: 11.85

- Profit & Loss: +0.2%

- Long XAU/USD

- Opened on October 16 at $1,912/oz

- Take Profit: $2,050/oz

- Stop Loss: $1,860/oz

- Profit & Loss: +2.7%

- Short NZD/USD

- Opened on October 9 at 0.5975

- Take Profit: 0.5512

- Stop Loss: 0.6130

- Profit & Loss: +1%

- Long USD/JPY

- Opened on September 25th at 148.56

- Take Profit: 154

- Stop Loss: 147.20

- Profit & Loss: +1.2%

- Short GBP/AUD

- Opened on September 18th at 1.9250

- Take Profit: 1.8600

- Stop Loss: 1.9560

- Profit & Loss: +0.5%

- Short EUR/AUD

- Opened on September 4th at 1.6708

- Take Profit: 1.6200

- Stop Loss: 1.6900

- Profit & Loss: +0.4%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.