The foreign exchange market is undergoing a significant test this week, characterized by a complex tug-of-war as it anticipates substantial interest rate cuts by central banks in 2024, driven by the ongoing alleviation of inflationary pressures.

Major central banks scheduled to meet this week include the Federal Reserve (Fed) on Wednesday, followed by the European Central Bank (ECB), the Bank of England (BoE), and the Swiss National Bank (SNB) on Thursday. Market participants will be closely scrutinizing press remarks made by their respective governors.

Month-to-Date Performance of Major Currencies: JPY Strongest, EUR Weakest

US Dollar:

The U.S. Dollar Index (DXY) rebounded last week, ending a three-week losing streak, thanks to better-than-expected economic indicators. The service sector demonstrated growth in November, with the S&P Global Services PMI reaching 52.7, up from 51.8 and surpassing the expected 52. The labor market also displayed strength, dispelling concerns of a sharp slowdown. Non-farm payrolls for November rose to 199,000, up from 150,000 in October and exceeding the predicted 130,000. Surprisingly, the unemployment rate dropped to 3.7% from 3.9%, and wage growth remained broadly as anticipated. Notably, the University of Michigan consumer sentiment index surged to 69.4 in December, up from 61.3, breaking a streak of four consecutive declines. As a result, markets have postponed the start of the Fed's rate-cutting cycle from March to May 2024 and continue to factor in a cumulative total of five cuts by December next year. Crucial events this week, such as the inflation report on Tuesday and the FOMC meeting on Wednesday, are likely to generate significant fluctuations in the dollar.

Euro:

The euro (EUR/USD) experienced its worst-performing week since early May, declining by over 1% against the greenback. Dovish comments from ECB policymakers weighed on the single currency, as one of the most hawkish voices on the board, Isabel Schnabel, indicated that further interest rate hikes were "rather unlikely." This came after the latest CPI report revealed a decline in the Euro Area's inflation rate to a more than two-year low in November. This week, the ECB meets on Thursday, and markets will focus on whether Frankfurt will choose not to accelerate the unwinding of sovereign bonds and on policymakers’ economic forecasts for the upcoming year. Currently, markets are pricing in nearly 140 basis points of rate cuts in 2024, equivalent to five cuts fully priced in, with the first expected in March.

British Pound:

The pound (GBP/USD) also weakened last week, declining by 1.3%, marking its worst weekly performance since July, although this move was primarily influenced by the improving fundamentals of the U.S. dollar. The most recent UK jobs report indicates a slowdown in total pay growth to 7.2% over the three months leading up to October, falling significantly below the market's 7.7% expectation. The BoE is expected to maintain its 5.25% interest rate at its final 2023 meeting. Market projections suggest that the BoE's first rate cut may come in June, differing from the ECB's March and the Federal Reserve's May forecasts.

Japanese Yen:

The Japanese yen (JPY) has been strengthening for four consecutive weeks against the dollar, marking its longest streak since March this year. Last week, the USDJPY pair reached a four-month low of 141.60 amid hawkish remarks from Bank of Japan officials signaling an earlier than expected departure from the negative-interest-rate policy. However, these remarks were briefly tempered this week, as conviction over a clear shift hinges on substantial proof of wage growth that can sustain inflation. Yen traders will attentively observe the meetings of major central banks this week to assess whether policymakers will embrace the market's anticipated significant rate cuts in 2024.

Swiss Franc:

The Swiss Franc (CHF) experienced a setback last week against the greenback, marking its worst-performing week since February. Switzerland's unemployment rate ticked up to 2.1% in November, while the annual inflation rate slowed to 1.4% in November 2023, falling short of market expectations and October's 1.7%, and marking the lowest rate since October 2021. The SNB meets on Thursday, and markets anticipate no change in interest rates. Markets are pricing in a 60 basis point cut by the SNB in 2024, with the first cut expected to occur in June.

Economic Events You Cannot Miss This Week

United States:

- Inflation rate (Tue): 3.1% year-on-year (y/y) expected, 3.2% y/y previous

- Core inflation rate (Tue.): 4% y/y exp., 4% pre.

- PPI (Wed.): 0.1% month-over-month (m/m) exp., -0.5% pre.

- Fed interest rate decision (Wed.): 5.5% exp., 5.5% pre.

- Powell’s press conference (Wed.)

- Retail sales (Thu.): -0.1% exp., -0.1% pre.

Eurozone:

- ECB interest rate decision (Wed.): 4% (deposit rate) exp., 4% pre.

- Lagarde’s press conference (Wed.)

- HCOB Manufacturing PMI for December (Fri.): 44.6 exp, 44.2 pre.

- HCOB Services PMI for December (Fri.): 49 exp, 48.7 pre.

Others:

- BoE interest rate decision (Thu.): 5.25% exp., 5.25% pre.

- SNB interest rate decision (Thu.): 1.75% exp., 1.75% pre.

This Week's Forex Trading Ideas

Short EUR/USD

- Entry: 1.0788

- Take profit: 1.0450

- Stop loss: 1.0920

- Reward/Risk: 2.8

Fundamental analysis:

The Fed enters the last meeting of the year in a position of relative strength compared to the ECB. Although both regions have seen signs of easing inflation, the U.S. economy displays greater resilience than Europe's, implying the Fed may hold interest rates steady longer than the market currently anticipates. Tuesday's US inflation report carries significant weight, but Fed Chair Jerome Powell will likely aim to counter the market's current expectation of five rate cuts in 2024, reinforcing the strength of the U.S. economy. Conversely, ECB President Christine Lagarde may acknowledge the ongoing economic challenges in eurozone and potentially revise downward growth estimates for 2024. The 2-year yield spread between Germany and the United States has sharply contracted, reaching a negative 200 basis points.

Technical analysis:

From a technical perspective, the EUR/USD pair slipped below the 50-day moving average last week but found support at the 200-day moving average, resulting in a trading range between these two key levels. The Relative Strength Index (RSI) dropped below the 50 mark for the first time since early November, signaling a resurgence of bearish sentiment, albeit without strong conviction. The pair has retraced approximately half of the October-November rally. A break below the crucial Fibonacci 50% level at 1.0733, coinciding with the 200-day moving average, could likely trigger further downside momentum, targeting a full retracement toward 1.0450. On the other hand, a rise above 1.0920 could indicate weaker-than-expected U.S. inflation data and/or a dovish stance from the Fed, potentially dampening the bullish outlook for the dollar.

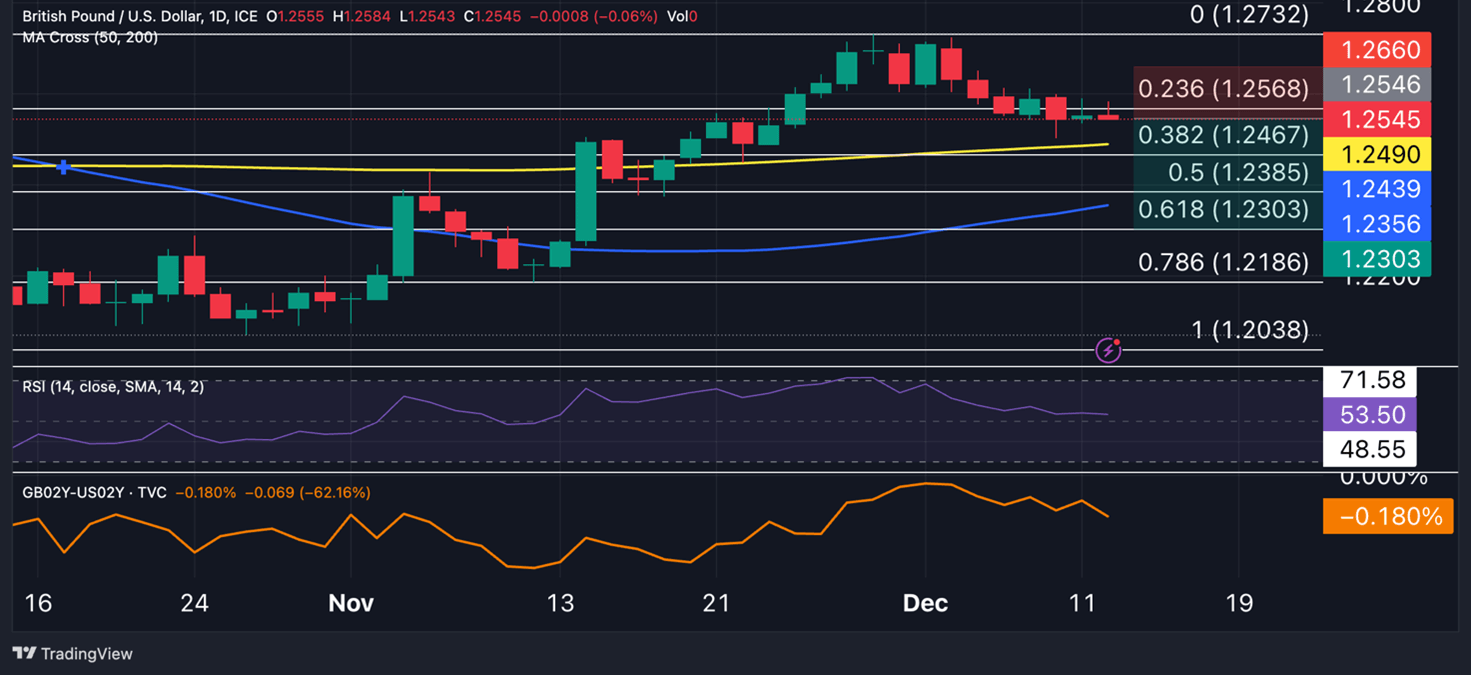

Short GBP/USD

- Entry: 1.2545

- Take profit: 1.2300

- Stop loss: 1.2660

- Reward/Risk: 2.2

Fundamental Analysis:

In December, the British pound has started to experience a slight pullback following a robust 5% rally in November, which was driven by improving relative fundamentals compared to the dollar. Short-term yield differentials, which began the month nearly reaching parity after narrowing from around -40 basis points, have since eased to the current -18 basis points. With the interest rate advantage nearly eroded, the key influence on the pair will be the growth outlooks presented by the respective central banks. The Fed may sound more robust than the Bank of England BoE, as the latter is likely to factor in a weakening economic momentum and outlook in Europe.

Technical Analysis:

From a technical perspective, the GBP/USD pair has retraced approximately a quarter of the rally that occurred between the end of October and November, yet it remains well supported by critical moving averages. Bullish momentum has shown signs of slowing down, with the RSI dropping from overbought levels reached at the end of November to the current 53. If the U.S. inflation reading doesn't come in lower than predicted, the pair could test the 38.2% Fibonacci retracement level at 1.2467 while awaiting the Fed's meeting. In the event that Powell signals a hawkish stance, a pullback to 1.23 (61.8% Fibonacci) could be a likely scenario.

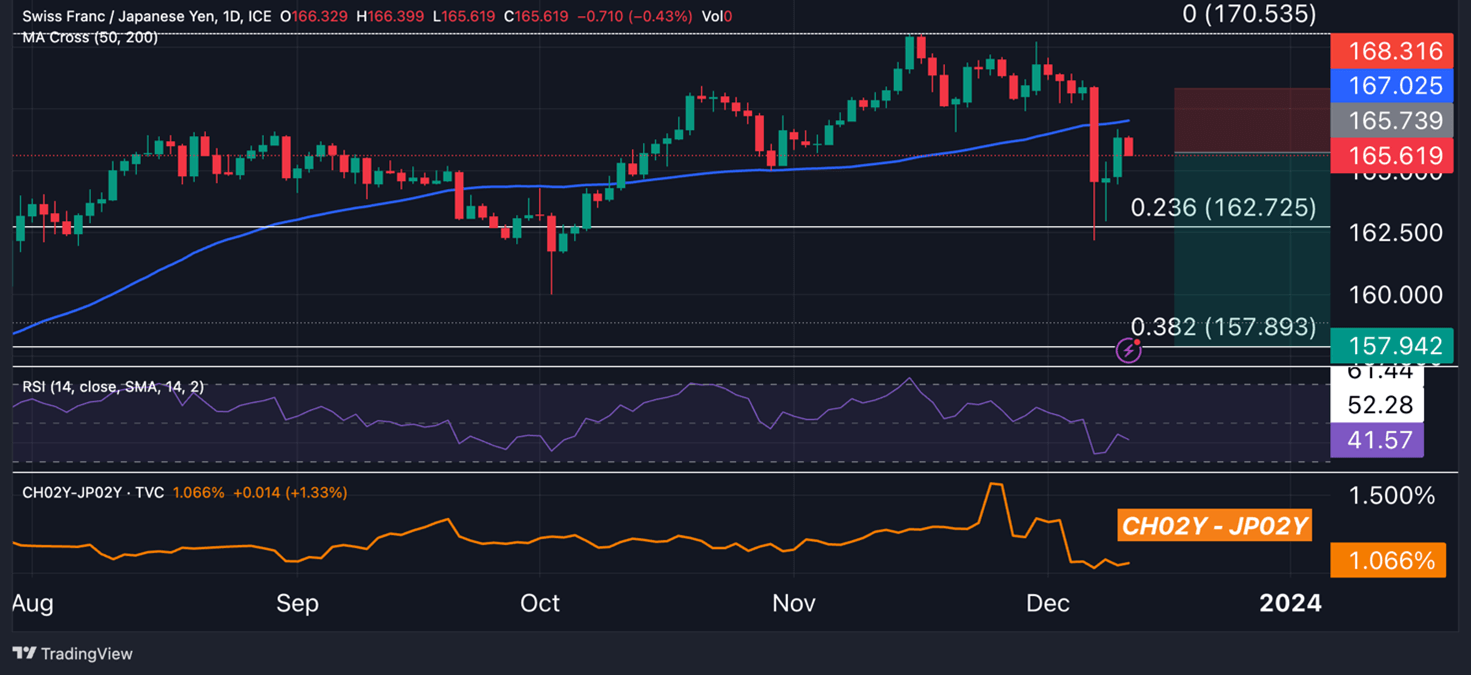

Short CHF/JPY

- Entry: 165.91*

- Take profit:

*Last week, we initiated a short CHF/JPY trading idea at 168.45, briefly reaching a profit level of 162.50.

Fundamental analysis:

The ongoing narrowing of the relative interest rate advantage of the Swiss Franc against the Japanese Yen remains a notable trend, with the 2-year yield spread now declining to as low as 100 basis points, marking its lowest level since early May, and the 10-year yield spread now almost disappearing.

This week, the Swiss National Bank (SNB) lacks a compelling incentive to embrace a hawkish stance, as such a move would likely be perceived by the market as a bluff, especially in light of the recent weakness in Switzerland's inflation. Conversely, the Japanese Yen may experience additional strengthening in comparison to currencies associated with Europe, given the worsening economic prospects within the region.

Technical analysis:

The CHF/JPY pair broke below the critical 50-day moving average, a support level that had held since mid-October. Bearish price action was observed last week, notably on Thursday, when the pair fell to as low as 161.20. However, the decline was partially reversed at the beginning of the new week. This move may have been triggered by the closure of short positions due to profit-taking, especially after the pair abruptly hit the 23.6% Fibonacci retracement level of the range from the 2023 low to high.

Currently, the 50-day moving average is acting as resistance, and the next target for bearish traders could be 157.90 (38.2% Fibonacci). A rally above 168.30, which would completely reverse last week's price action, would likely derail any bearish sentiment.

Open trading ideas:

- Long AUD/USD

- Opened on December 5th at 0.6577

- Current: 0.6589

- Updated Profit & Loss: +0.2%

- Long CAD/CHF

- Opened on November 28th at 0.6485

- Current: 0.6463

- Updated Profit & Loss: -0.1%

- Long USD/ILS

- Opened on November 28th at 3.7063

- Current: 3.7083

- Updated Profit & Loss: +0.1%

- Short EUR/CHF

- Opened on November 21st at 0.9673

- Current: 0.9458

- Updated Profit & Loss: +2.2%

- Short USD/CHF

- Opened on November 21st at 0.8836

- Current: 0.8766

- Updated Profit & Loss: +0.8%

- Long AUD/NZD

- Opened on November 14th at 1.0856

- Current: 1.0715

- Updated Profit & Loss: -1.2%

- Short NZD/CHF

- Opened on November 7th at 0.5327

- Current: 0.5388

- Updated Profit & Loss: -0.3%

- Long XAU/USD

- Opened on October 16th at $1,912/oz

- Current: $1,985/oz

- Updated Profit & Loss: +3.8%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.