In this blog post, learn about the 7twelve® portfolio strategy and how to replicate it with low-cost ETFs.

The story

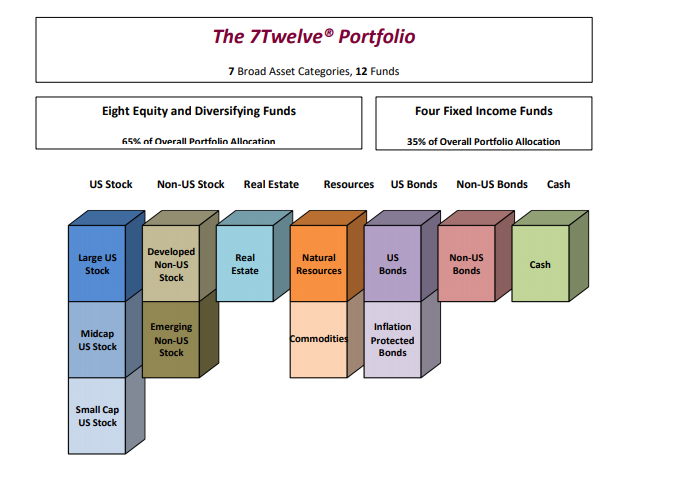

7twelve® is a multi-asset balanced portfolio developed by Craig L. Israelsen, Ph.D. in 2008. Unlike a traditional two-asset 60/40 balanced fund, the 7Twelve balanced strategy utilizes multiple asset classes to enhance performance and reduce risk.

The 7 of 7 Twelve represents the suggested number of asset classes to include in your portfolio. The Twelve represents the 12 separate mutual funds or exchange traded products to fully represent the 7 asset classes in your 7Twelve portfolio.

The portfolio has approximately a 65/35 allocation, i.e around 65% of the portfolio is invested in risk assets (equity and fixed income) and about 35% invested in bonds and cash.

Please find below some details.

Strategic Asset Allocation

Each mutual fund (or "sub-asset") in the 7Twelve strategy is equally weighted, meaning that each fund represents 1/12th of the portfolio. This allocation is maintained by rebalancing the portfolio back to equal portions annually, quarterly or monthly.

The 7Twelve portfolio is a strategic model – meaning that it does not rely on tactical changes

The portfolio has the following strategic asset allocation (source:http://www.7twelveportfolio.com/):

How to replicate the Craig Israelsen 7Twelve Portfolio through ETFs

The website www.lazyportfolioetf.com attempts to replicate the strategy through a 100% ETF asset allocation. The strategy is named the " Craig Israelsen 7Twelve Portfolio"

The Craig Israelsen 7Twelve Portfolio is exposed for 50% on the Stock Market, 33.34% in Fixed Income and for 16.66% on Commodities.

It's a High-Risk portfolio and it can be replicated with the following ETFs (source: www.lazyportfolioef.com):

Historical returns and volatility

In the last 10 years, the portfolio obtained a 4.15% compound annual return, with a 9.17% standard deviation. In 2020, the portfolio is down -6.68% as of the end of July. In 2019, the portfolio was up +17.04%.

This strategic asset allocation returns have been lagging those of other portfolio strategies over the last few years for two main reasons: 1) A relatively high exposure to broad commodities; 2) A relative high allocation to non-US equity markets. Should commodities and EAFE equities start to outperform the other asset classes, this strategy will most likely outperform most other strategic asset allocations.

See below monthly returns since 2007 (past returns are not indicative of future performance).

Read the next article: British pound near 5 month top as uk enters steep recession