Switzerland is famous for its high-calibre watches and other luxury goods - which is fortuitous in the current stock market that is putting a high premium on luxury.

What’s Happening?

- Luxury stocks, known for their high-quality products and prestige, are demonstrating remarkable resilience in a fluctuating global market.

- Swiss luxury brands, especially watchmakers, are leading this trend, with sales showing significant strength.

- Concerns arise about the sustainability of this growth, especially considering potential shifts in consumer trends and economic factors.

Primer: What are Luxury Stocks?

Luxury stocks represent companies that deal in high-end products and services, known for their quality, exclusivity, and prestige.

These stocks often belong to brands with a long heritage and a loyal customer base. They include companies specializing in fine watches, designer fashion, premium automobiles, and high-end spirits and cosmetics.

Here are the 10 largest luxury goods companies by market cap:

Source: Companiesmarketcap.com

What sets these stocks apart is their unique ability to maintain value and consumer interest even during economic downturns, often due to the enduring allure of luxury and status symbols.

One way to track and invest in luxury goods as a diversified group is through an ETF. One of the best-known is the Amundi S&P Global Luxury UCITS ETF.

Why are Luxury Stocks Proving So Resilient?

Firstly, luxury brands often have a strong brand identity and loyal customer base, which helps maintain sales even in tough economic times. The wealthy clientele of these brands typically have a high net worth, making them less susceptible to economic fluctuations.

Secondly, luxury brands have been quick to adapt to new market trends, including digital transformation. E-commerce and digital marketing have allowed these brands to reach a broader audience and tap into the younger, tech-savvy generation.

Furthermore, the scarcity and exclusivity associated with luxury goods add to their appeal, allowing these brands to maintain high price points and profit margins. This exclusivity also creates a perceived value, which is less likely to diminish over time.

How Luxury Could Go Out of Fashion

Despite their current strength, there are potential risks that luxury stocks face. Changes in consumer sentiment, particularly among younger generations, could shift preferences away from conspicuous consumption towards more sustainable and ethical choices.

Economic factors also play a role. Global economic downturns, while not affecting the ultra-wealthy to a large extent, can still impact overall consumer spending. Additionally, geopolitical tensions and trade wars can disrupt supply chains and affect sales in key markets.

Swiss Watches and Luxury Brands

Switzerland, known for its precision and high-quality craftsmanship, has been a stronghold in the luxury market, particularly with its world-renowned watches. Brands like Rolex, Patek Philippe, and Omega have become synonymous with luxury and status. Their success is not just due to the quality of the products but also their heritage, marketing strategies, and ability to adapt to changing market dynamics.

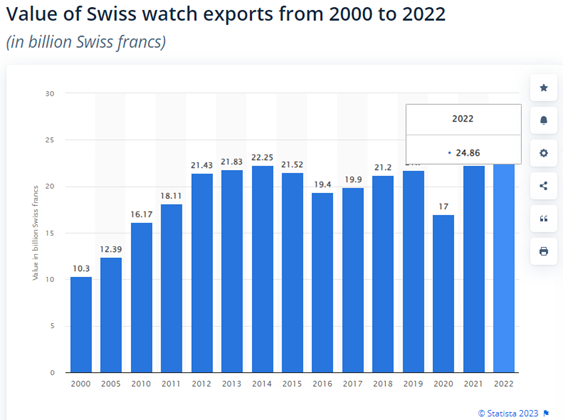

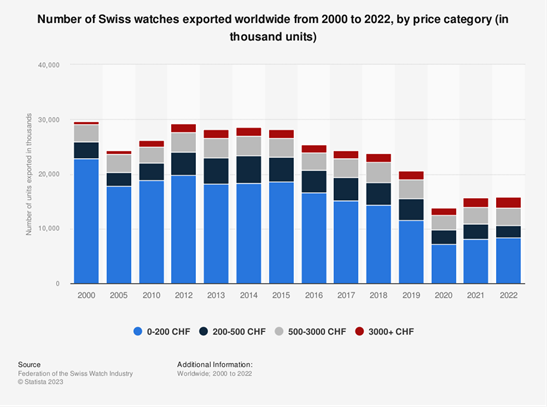

Investors and macroeconomists track sales of Swiss watches as a barometer of risk sentiment and the health of global consumption demand. An interesting phenomenon in recent years is that Swiss watch exports have dropped but revenues from those exports have increased thanks to higher prices.

These Swiss brands have not only weathered economic downturns but have often come out stronger, capitalizing on their status as timeless investments.

In Summary

Luxury stocks, especially those in the Swiss watch and high-end goods industry, have shown remarkable resilience in the face of global economic uncertainties.

Their success can be attributed to strong brand identity, loyal clientele, adaptability, and the inherent value of luxury and exclusivity. However, they face potential risks from shifts in consumer behavior and economic challenges.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.