Dow Theory, a cornerstone in the world of technical analysis, serves as a critical tool for both short-term traders and long-term investors. This theory, founded on six fundamental tenets, encapsulates trends in market behavior and provides actionable guidance for day-to-day trading strategies. Throughout this guide, we will delve into the rich historical context of Dow Theory, providing a comprehensive explanation of each tenet to ensure that you gain a thorough understanding of the theory's inner workings.

Our detailed analysis will also include an in-depth tutorial on how to accurately read and interpret Dow Theory charts for effective decision-making. You'll discover how Dow Theory can be tactically employed in Swing and Position trading, while also learning about the theory's limitations and modern adaptations.

By the end of this guide, we aim to make you proficient in applying Dow Theory to your day-to-day trading activities, ensuring you are well-equipped to navigate the volatile landscape of modern trading.

Table of Contents: Dow Theory

- What is Dow Theory?

- The Historical Context of Dow Theory

- Why is Dow Theory important?

- The Six Tenets of Dow Theory

- Explanation of Each Tenet in Detail

- How to Read and Interpret Dow Theory Charts

- Dow Theory for Day Traders

- Dow Theory in Swing and Position Trading

- Limitations of Dow Theory

- Modern Adaptations of Dow Theory

- Conclusion - Dow Theory in Modern Trading

What is Dow Theory?

Dow Theory is really a collection of theories about how financial markets move over time. There are six Dow Theory tenets, which were put forward by Charles Dow in a collection of editorials he wrote between 1900-1902. Dow also invented the Dow Jones industrial average with Edward Jones and co-founded the Wall Street Journal newspaper.

The Historical Context of Dow Theory

The Dow Theory has its roots in the late 19th and early 20th centuries, when Charles H. Dow, co-founder of the Wall Street Journal and the Dow Jones Industrial Average, started developing his ideas. Dow's theories were later refined by William Peter Hamilton, Robert Rhea, and E. George Schaefer. They formed the basis for what we now know as the technical analysis in financial markets.

Dow's work was primarily based on his observations of the stock market, particularly the performance of the industrial and railroad sectors. His theories were not intended to provide specific trading advice but rather to offer a broader perspective on market trends.

Why is Dow Theory important?

At it’s core Dow Theory is a theory about how price trends and over one hundred years later, it forms the basis of most technical analysis used in day trading and investing today. Ideas like uptrends, downtrends, support and resistance got their start from Dow Theory.

The 6 Tenets of Dow Theory

The 6 tenets or principles that would be applied to a Dow theory portfolio are as follows:

- The market discounts everything

- There are 3 kinds of market trends

- Primary trends are split into 3 phases

- Indices must confirm each other

- Volume should confirm the price

- Trends persist until there is a clear reversal

These are quite self-explanatory but let’s explore each one a bit deeper before we move on to how to apply them.

The Market discounts everything

This Dow theory principle has been taken from the efficient market hypothesis. It says that all available information is already reflected by the current price from company earnings to macro economics. This is also the philosophy of technical analysis but is the antithesis of fundamental analysis and behavioural economics.

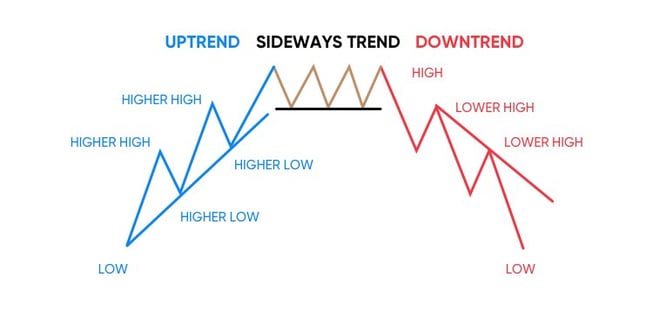

There are 3 kinds of market trends

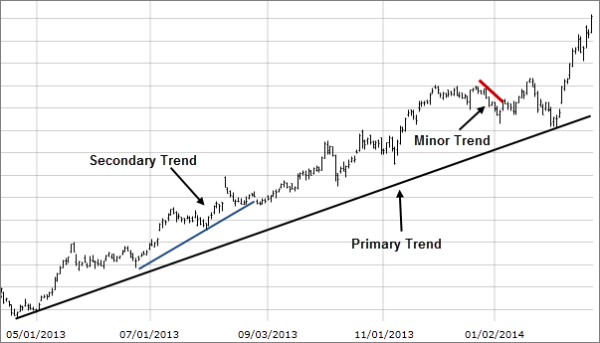

These three types of trend are split by the length of time they occupy.

Primary trends last a year or more and are the major market trends. They can be bull markets (price travelling up), bear markets (price trending down) or sideways ranges.

Secondary trends last a few weeks or perhaps months and usually counter-trend corrections, where the price moves in the opposite direction to the primary trend.

Minor trends last less than three weeks are the hunting grounds for day traders but considered noise by long-term investors.

Dow Theory chart 1

Primary trends have three phases

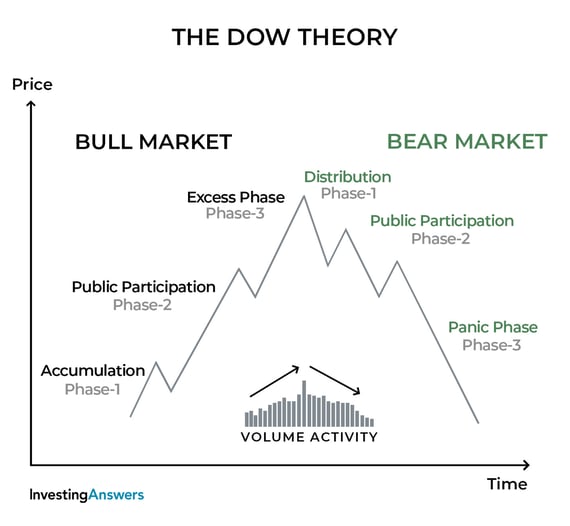

The three phases are dictated by what the price did previously and the role of the ‘smart money’ and the general public. The three phases are given slightly different names depending on whether it is a bull or bear market.

Dow Theory chart 2

A bull market will start with an accumulation, then move to a public participation phases and finishes with an ‘excess’ phases. A bear market starts with a distribution phases, then a public participation phases and then a panic phase.

It is always the smart money buying (accumulating) assets after a big decline, ready for the next bull market or selling (distributing) assets after a big move up ready for the next bear market. Once the price reverses, the general public follow the momentum and after a big move, those buying in greed at the top or selling in fear at the bottom are left ‘holding the bag’.

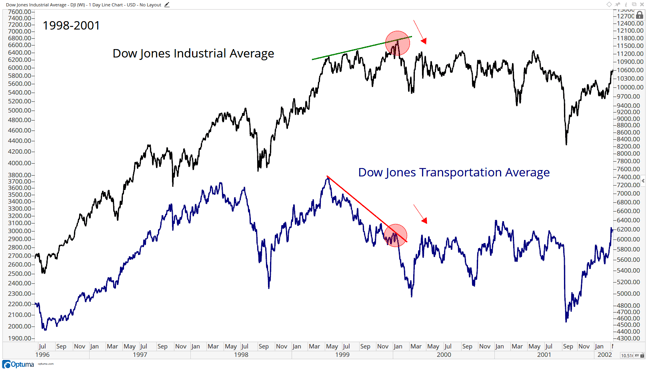

Indices must confirm each other

Charles Dow created the Dow Jones Industrial Average and the Dow Jones Transportation Average and would use these two indices to confirm each other. These days investors will apply the same concept to different national stock indices like the Dow Jones (DJIA), the S&P 500 and the Nasdaq 100.

Dow Theory Chart 3

For example, if one index moves up to a new 52-week high, but the other index remains below that high, then the bullish breakout in the first index is deemed not as strong and susceptible to reverse. Once the second index makes a new 52-week high, then the price action is seemed to have wider breadth and more likely to continue upwards. Vice versa for a move to new 52-week lows.

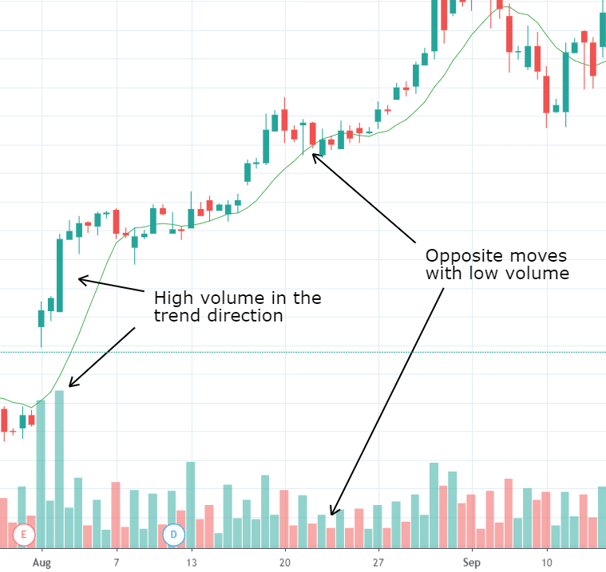

Volume must confirm the trend

This is still the main way that volume data is used today. As a reminder, volume is how many trades took place or the value of the trades that took place over a certain period of time. Volume on a price chart will normally be plotted as a bar chart beneath the price plotted as a line or Japanese candlesticks.

Dow Theory Chart 4

The most volume comes from the smart money that controls billions of dollars so the idea is that if the volume is rising with the price trend, then it means that the smart money is buying into the trend. However if the price is rising but the big volume happens in the declines, then it shows the smart money are selling into the uptrend in expectation that it will reverse.

Trends persist until there is a clear reversal

This if you like is the original ‘the trend is your friend until it ends’. The thing the Charles Dow taught us to keep in mind is that the trend will always last longer than you think. So you need to be very clear that the trend has turned before you start trading against it.

Dow Theory Chart 5

This brings about the need to explain ‘How to identify a trend’ and ‘how to identify a trend reversal’. Dow does this via the idea of peaks & troughs. The idea is very simple but can be hard to implement without extensive practise trading.

Dow observed, as have we all, that market prices do not go up or down in a straight line – the trend is curvy. The top and the bottom of these curves are called peaks and troughs. A peak can also be termed a high and a trough can also be called a low. The thing to do is compare how each high compares to the previous high and how each low compares to the previous low. Is it higher or lower in price?

Explanation of Each Tenet in Detail

The Dow Theory consists of six basic tenets, each of which provides a unique insight into market behaviour:

- The Market Has Three Movements: Dow Theory posits that the market has three types of trends: primary (long-term), secondary (medium-term corrections), and minor (short-term fluctuations).

- Trends Have Three Phases: Each primary trend has three phases: accumulation, public participation, and distribution. These phases are representative of the market psychology at different stages of a trend.

- The Stock Market Discounts All News: Dow Theory assumes that all relevant information - whether it's political, economic, or social - is already factored into the market price.

- Stock Market Averages Must Confirm Each Other: This tenet states that for a trend to be valid, it must be confirmed by both the industrial and railroad (transportation) averages.

- Trends Exist Until Definitive Signals Prove They Have Ended: According to Dow Theory, trends are presumed to continue until there is a clear signal that they have reversed.

- Volume Confirms The Trend: While Dow himself never made specific mention of volume, later theorists added that volume should increase in the direction of the primary trend.

These tenets provide a framework for understanding and interpreting market behavior.

How to Read and Interpret Dow Theory Charts

Dow Theory charts are a crucial tool for traders using this strategy. These charts help traders identify trends and make predictions about future market movements.

For instance, when the Dow Jones Industrial and Transportation averages reach new highs, it suggests the start of an upward trend. Conversely, if both averages reach new lows, it indicates a downward trend. The identification of secondary trends within larger primary trends can also provide valuable insights for short-term trading opportunities.

Dow Theory charts also help traders identify potential buy and sell signals. For example, when a secondary trend interrupts a primary upward trend, it can create a "buy" signal once the primary upward trend resumes. Similarly, a "sell" signal is created when a secondary trend interrupts a primary downward trend and the primary trend resumes.

Learning to interpret Dow Theory charts can be complex, but with practice, they can become a valuable tool for any trader.

Reading and interpreting Dow Theory charts involves understanding the three phases of market trends: accumulation phase, public participation phase, and distribution phase. Each phase represents different levels of investor sentiment and can be identified with specific chart patterns.

- Accumulation Phase: This is the first stage, where informed investors start to buy into the market, anticipating a potential future uptrend. The chart at this stage shows a relatively flat trend with low volatility.

- Public Participation Phase: This stage occurs when a significant number of investors start to notice the market's upward trend and decide to buy. The chart shows a noticeable upward trend with increased volumes.

- Distribution Phase: This is the final stage, where informed investors begin to sell their positions to the general public. The chart here shows a slow-down in the upward trend, eventually leading to a downward trend.

Dow Theory for Day Traders

So how do we put all this information about Dow Theory into a checklist for day traders?

- The market discounts everything

Day trading lesson 1: Let economists forecast the economy and investment analysts forecast company earnings; neither of them are of concern for day traders

- There are 3 kinds of market trends

Day trading lesson 2: Look at three timeframes of charts (multi-timeframe analysis)- the chart you are trading, a longer timeframe chart and a shorter timeframe chart. This will help you know which phase of the market the current trend falls within.

- Primary trends are split into 3 phases

Day trading lesson 3: Keep the bigger picture (which part of the major trend) in mind so that you’re day trading is in line with what the smart money are doing. Tried-and-true trend trading methodologies can be used by any day trader.

- Indices must confirm each other

Day trading lesson 4: Look for equivalent assets to confirm each other. If you’re trading forex looks for the dollar to make a move versus two or major currencies. If you’re trading indices, look at one or more stock index that measures the same stocks. If day trading stocks, look for similar companies to perform in the same manner – for example General Motors to confirm a price move in Ford Motor Company.

- Volume should confirm the price

Day trading lesson 5: Volume data in forex markets is almost impossible to find accept for dealer banks. Stock traders and futures traders can use volume to good effects to confirm price moves with convergence or divergence.

- Trends persist until there is a clear reversal

Day trading lesson 6: Wait for reversal price patterns like double tops and head and shoulders patterns to occur before you trade in a new direction. Otherwise assume every counter-trend move is a correction and an opportunity to enter the market at a discount.

Dow Theory in Swing and Position Trading

The Dow Theory can be particularly useful in swing and position trading. In swing trading, traders attempt to capture gains in a stock within one to four days. They can use Dow Theory to identify periods of potential market reversal, entering or exiting trades based on the anticipated change in trend.

In position trading, traders hold stocks for a longer period, from weeks to months or even years. The Dow Theory's major trends, which can last for several years, are a valuable tool for position traders. The identification of these major market trends can help position traders make more informed decisions about when to enter or exit a trade.

Limitations of Dow Theory

While the Dow Theory provides valuable insights, it has its limitations. These include:

- Lack of Specific Timing: Dow Theory can signal the potential beginning or end of a trend, but it cannot predict the exact timing. This can result in either premature or late entries and exits.

- Less Effective in Sideways Markets: The theory is less useful in non-trending or sideways markets, as it's based on the identification of trends.

- Subjectivity: The interpretation of market phases and trends can be quite subjective and may vary among traders.

Modern Adaptations of Dow Theory

Modern adaptations of the Dow Theory have sought to address some of its limitations by incorporating more recent developments in technical analysis. For instance, some traders now use technical indicators such as moving averages and momentum oscillators in conjunction with Dow Theory to pinpoint entries and exits more accurately.

Conclusion - Dow Theory in Modern Trading

In conclusion, while the Dow Theory was developed in the early 20th century, it remains a fundamental tool for many traders today. Its principles of market trend identification are widely used in various trading strategies, from swing trading to position trading. However, like any strategy, it should be used in conjunction with other analysis tools to maximize its effectiveness.