Summary: In 2023, EUR/USD saw a 3% surge, breaking a two-year decline. Key factors for 2024 include political events in Europe and the U.S., differing economic outlooks, global conflicts, monetary policy shifts, and technical analysis. These elements will influence the EUR/USD exchange rate throughout the year.

Summary: In 2023, EUR/USD saw a 3% surge, breaking a two-year decline. Key factors for 2024 include political events in Europe and the U.S., differing economic outlooks, global conflicts, monetary policy shifts, and technical analysis. These elements will influence the EUR/USD exchange rate throughout the year.

In 2023, the EUR/USD currency pair witnessed a remarkable 3% surge, providing a much-needed positive annual return following two consecutive years of decline in 2021 and 2022.

2024 is poised to be a pivotal year, driven by significant political and economic events that will shape the world's leading exchange rate.

Below, we delve into the five essential factors that traders need to have on their radar for navigating the EUR/USD pair throughout 2024.

- Political Landscape in Europe And The United States

2024 brings crucial political events in the Eurozone and the United States.

Besides national elections in Austria, Belgium, Croatia, Lithuania, Portugal, and Slovakia, the spotlight falls on the broader European Parliament elections from June 6 to 9, 2024. This event will see the renewal of 705 European Parliament Members and potential shifts in the European Commission and Council leadership.

Meanwhile, across the Atlantic, the United States gears up for its Presidential elections in November, expected to feature the incumbent President, Joe Biden, against the Republican, Donald Trump, in a high-stakes showdown.

Other than the election day itself on Tuesday, November 8, 2024, investors should anticipate increased volatility in the months preceding November, driven by the intense political campaigns from both sides of the political spectrum.

- Economic Outlook: Eurozone vs. US

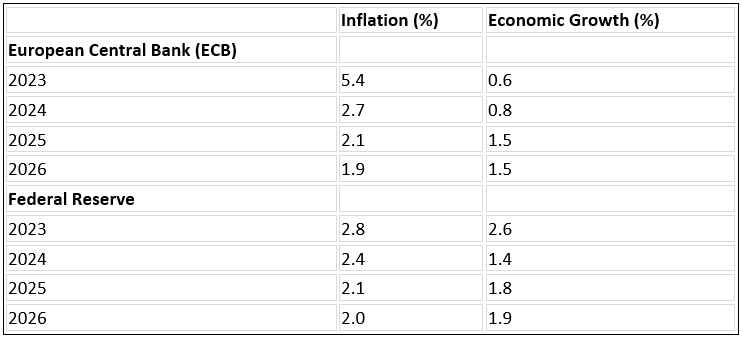

Understanding economic growth and inflation dynamics in these regions is key for assessing interest rate trends and their impact on the EUR/USD pair.

The European Central Bank's (ECB) macroeconomic projections, released in December, paint a picture of inflation gradually subsiding throughout 2024, eventually converging with the Governing Council's coveted 2% target by 2025. Forecasts indicate that headline inflation will register an average of 5.4% in 2023, receding to 2.7% in 2024, further moderating to 2.1% in 2025, and finally settling at 1.9% in 2026. Economic growth is anticipated to rise from an average of 0.6% in 2023 to 0.8% in 2024 and 1.5% in 2025 and 2026.

Economic projections from the Federal Reserve Board members foresee a dip in headline inflation from 2.8% in 2023 to 2.4% in 2024, with a subsequent gradual decrease to 2.1% in 2025 and eventually stabilizing at 2% in 2026. Economic growth is expected to drop from 2.6% in 2023 to 1.4% in 2024, followed by a rebound to 1.8% in 2025 and 1.9% in 2026.

Source: ECB, Federal Reserve as of December 2023

- Wars And Global Geopolitical Challenges

The EUR/USD's journey in 2024 is closely connected to the many global challenges and political tensions happening worldwide.

Notably, the ongoing international conflicts, particularly in Ukraine and the Middle East, pose significant hurdles that could impact the trajectory of this currency pair.

The Ukraine conflict approaches its two-year mark, with the European Council opening accession talks with Ukraine on December 14, 2023, potentially impacting the euro.

In the Gaza Strip, the US's alliance with Israel against Hamas carries the risk of regional escalation, particularly against Iran-backed Yemen's Houthi. Expanded US involvement in the region could affect the dollar.

Additionally, the United States finds itself embroiled in a technology and trade dispute with China, with a particular focus on the semiconductor industry. Semiconductors are pivotal components for the development of cutting-edge technologies, including artificial intelligence. The United States has been steadily tightening its controls on semiconductor exports to China to mitigate potential national security risks stemming from Beijing's technological advancements.

Moreover, the strategic moves undertaken by BRICS (Brazil, Russia, India, China, and South Africa) nations to expedite the process of de-dollarization in their trading activities represent a critical element that could bear upon the global reserve status of the U.S. dollar.

- Monetary Policy Outlook And Market Expectations

Both the Fed and ECB hint at the end of rate tightening cycles at their most recent meetings, ushering in a phase where rates may remain steady or be reduced.

The Federal Reserve, in its latest 'dot plot' projections, contemplates a potential reduction in rates, with a target range that could shift from the existing 5.25-5.50% to a lower 4.50%-4.75% by the close of 2024, constituting a notable 75 basis point decrease. In stark contrast, the European Central Bank remains poised to tread cautiously, refraining from signaling any imminent rate cuts at this juncture.

It is worth noting that a substantial divergence currently exists between the expectations of central banks and market pricing.

Money markets, as evidenced by futures rates, are pricing in rate cuts by both central banks as early as their meetings in March 2023.

Traders anticipate a total of 150 basis points in rate cuts by the Fed by end-2024, equivalent to six 25 basis point cuts. For the ECB, the market anticipates a total of 169 basis points in rate cuts by end-2024, equivalent to nearly seven 25 basis point cuts.

Chart: What The Market Is Pricing In? ECB vs. Fed Rate Cuts Priced In 2024

Source: TradingView

- Technical Levels To Watch And Seasonality Factors

EUR/USD enters 2024 on a short-term uptrend initiated in early October 2023. Since then, the pair has rallied from 1.0450 to 1.1140 (Dec. 28 peak) before retreating to 1.0940 on the year's first trading day.

Key upside resistance lies at 1.1275 (July 2023 high) and 1.15 (Feb. 10, 2022, high). The 2021 high at 1.2350 remains beyond current investor focus.

Downside watch: 1.0720 (Dec 2023 lows), 1.0450 (Oct 2023 low). Below these, the parity threshold could exert a magnetic pull. The 2022 low at 0.9535 (late Sep 2022) marks a 22-year minimum.

The 50-day and 200-day moving averages are currently intersecting near 1.0850, forming a "golden cross," signaling a potential bullish continuation for the pair. The 50-week and 200-week moving averages stand at 1.0817 and 1.1150, respectively.

Chart: EUR/USD On A ‘Golden Cross’

Source: TradingView

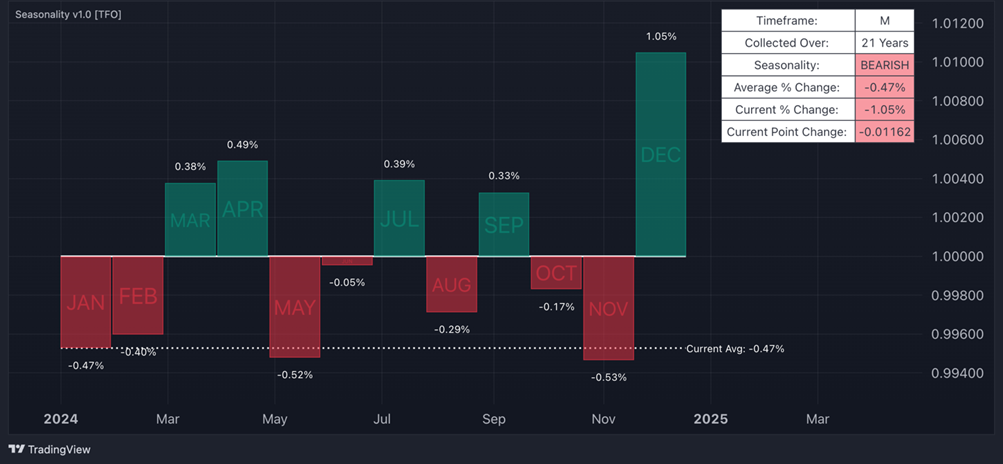

Historical monthly seasonality shows January and February as traditionally negative months, with average declines of 0.47% and 0.40%, respectively. March and April historically witness rebounds, with average gains of 0.39% and 0.49%, respectively. May is the second-worst month with an average decline of 0.52%.

June is relatively flat, while the summer typically favors gains, excluding August.

November emerges as the worst month, with EUR/USD down by an average of 0.53%, while December stands as the best, with an average gain of 1.05%.

Chart: EUR/USD Monthly Average Returns

Source: TradingView

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.