Gain a fresh perspective on how mobile banking and digital advancements have already reshaped your financial experiences, and explore what the advent of technologies like quantum encryption and decentralized finance heralds for the future of your financial dealings.

Smart city - Shutterstock.com

What’s happening?

- Mobile banking apps, investment apps, and digitization in financial markets have made it easier than ever to access financial services.

- 5G integration across industries is coming next after 4G ran its course. The Internet of Things (IoT), Artificial Intelligence (AI), Augmented Reality / Virtual Reality (AR/VR) will blend digital and physical operations together. Distributed Ledger Technology (DLT) will make transactions faster. Quantum Computing will empower core financial processes.

- To balance the shift to digital, occasional use of cash, gold investments, or building relationships with advisors are recommended.

A brief history of financial technology

Financial technology (‘fintech’) has transformed global finance from the late 19th century to the present. It began with the development of infrastructure for electronic funds transfer via telegraph and Morse code. The advent of the ATM in 1967 marked a shift towards digitalization, with subsequent innovations like the Nasdaq as the first digital stock exchange, online banking, and the introduction of PayPal.

After the 2008 recession trust in traditional banks dropped dramatically which had the fortunate byproduct of sparking innovation in finance. Bitcoin was born soon after as a decentralized method of making transactions outside of conventional banks. Mobile banking was created around this time since everybody had cell phones with them at all times, making it easy to access accounts anywhere they went regardless of if they were near a bank or not.

Startups started popping up everywhere creating new age products that were available digitally instead of physically, using open banking systems to connect users’ data safely to third-party providers that would then create personalized finance options for each user.

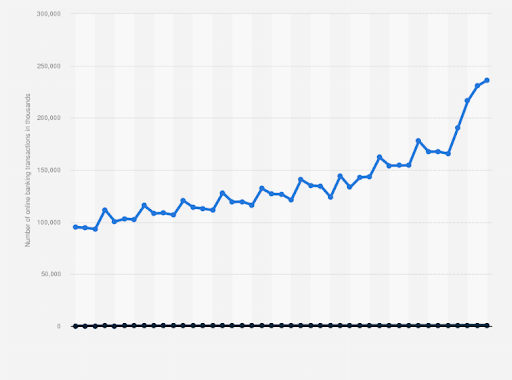

Total number of online banking transactions in Switzerland (2012-2022)

Source: Statista

‘Neobanks’ like FlowBank are a new type of digital financial institution that was created thanks to technology. They don’t have physical branches making them easy to create and maintain. Since they leverage technology so heavily, consumers get access to their funds faster, can customize their accounts easier, and have access to all this at a lower cost than traditional banks. They are also more likely to give higher interest rates on savings accounts which is one of the reasons why people switched over from conventional banks.

The new tech driving finance forwards

The forthcoming era in finance is set to be transformative, with technology playing a pivotal role in shaping services and establishing new norms.

With the advent of artificial intelligence (AI) and machine learning, financial services are on the brink of a major shift towards personalization. These technologies enable the analysis of vast datasets to provide customized recommendations and advice, catering to individual financial goals and preferences, thus enhancing customer experience and satisfaction.

Furthermore, as cyber threats become more sophisticated, the need for robust security measures is paramount. Quantum encryption emerges as a promising solution, offering a level of security that could be virtually unbreakable, thereby safeguarding financial data against cyber-attacks more effectively than ever before.

Decentralized Finance (DeFi) represents another significant shift, leveraging blockchain and Distributed Ledger Technology (DLT) to facilitate financial transactions without the need for traditional intermediaries like banks. This paradigm shift promises to make financial services more accessible and egalitarian, potentially transforming how people access and manage their finances.

Application of smartphone - Shutterstock.com

Biggest fintech stocks by market cap

- PayPal Holdings, Inc. (PYPL) - A dominant player in the digital payments sector, PayPal has expanded its offerings to include payment processing for consumers and merchants, peer-to-peer transfers, and mobile payments through its Venmo platform.

- Square, Inc. (Now Block, Inc. - SQ) - Specializing in payment and financial services for both consumers and businesses, Square has diversified its services to include point-of-sale solutions, small business financing, and the Cash App for personal finance.

- Adyen (ADYEN) - A global payment company offering businesses of all sizes a platform to accept payments, process transactions, and utilize analytics to monitor operations.

- Intuit Inc. (INTU) - Known for products like TurboTax, QuickBooks, and Mint, Intuit offers financial, accounting, and tax preparation software for individuals, small businesses, and accountants.

- Fidelity National Information Services (FIS) - Provides banking and payments technologies for financial institutions and businesses worldwide.

- Global Payments Inc. (GPN) - Offers payment technology and software solutions for card, check, and digital-based payments.

- Affirm Holdings, Inc. (AFRM) - Another "buy now pay later" service that offers consumers a flexible payment option for online purchases — without deferred interest or hidden fees — but instead with transparent financing terms that clearly show how much is owed each month throughout the life of the loan.

Analogue backup for the tech

Despite these technological advancements, there are some traditional financial practices that aren’t going away anytime soon. The tangibility, privacy and security of using cash or investing in physical assets like gold, land, property or fine art and antiques should not be dismissed in the digital era. These offer some much needed diversification to your portfolio and a way to keep you and your wealth not completely reliant on digital infrastructure.

Similarly, the personal touch provided by financial advisors remains invaluable for those seeking tailored financial guidance, underscoring the need for a balanced approach that respects both the efficiency of digital trends and the reassurance of human interaction.

In Summary

The evolution of fintech has already reshaped finance, with mobile banking and digital advancements providing unprecedented convenience. The future promises even more radical changes, from personalization through AI to enhanced security with quantum encryption, alongside the rise of decentralized finance (DeFi). While embracing digital trends is essential, traditional practices like using cash can’t hurt too!

*The information contained on this page does not constitute a solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.