Over the previous week, key currency pairs have shown little movement, with the U.S. dollar slightly recovering some ground after Fed Chair Powell’s remarks.

The likelihood of the Fed maintaining its current rates in December stands at 85%, according to rate projections, with market speculators forecasting a sequence of three rate reductions starting in June 2024

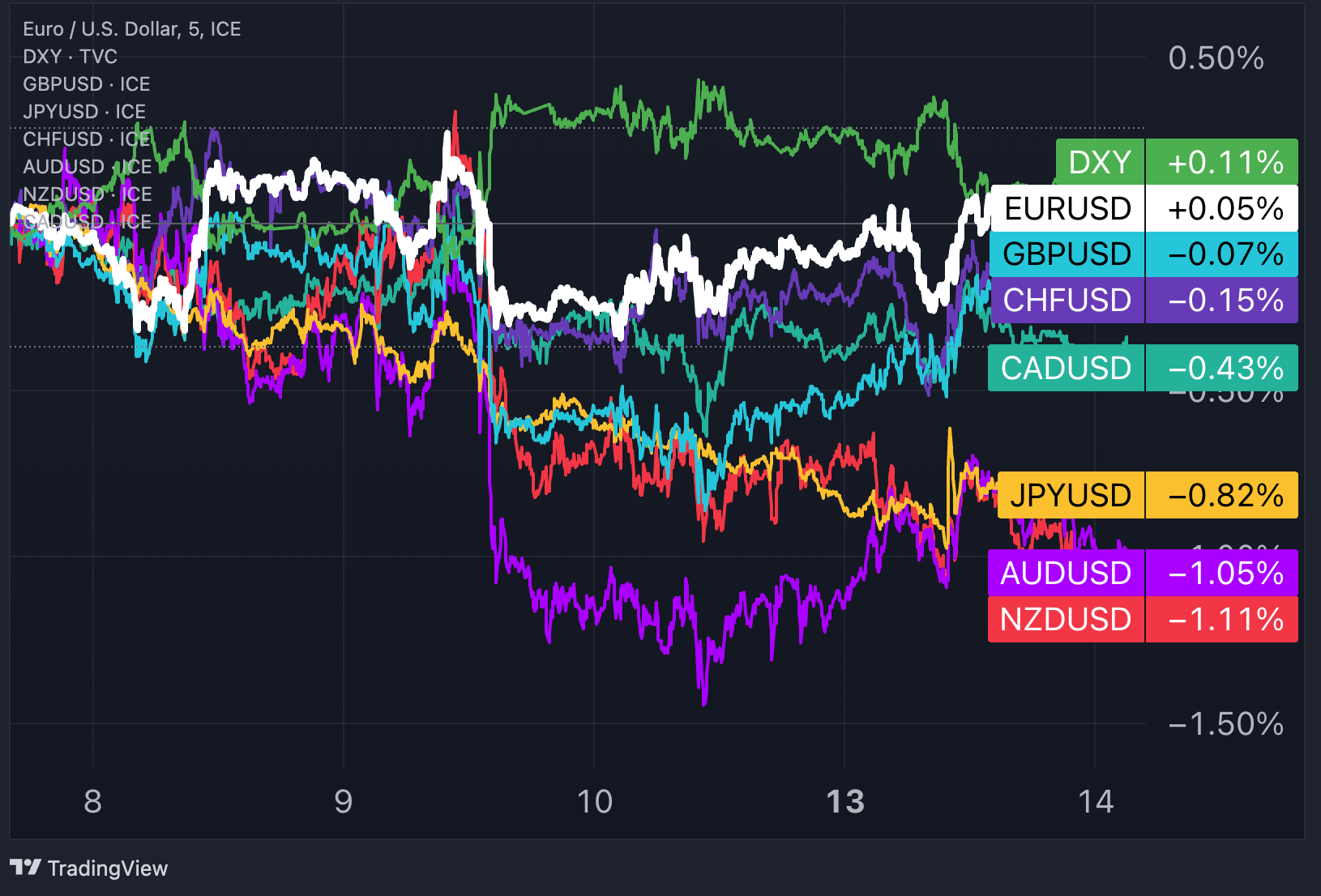

Past 5-Day Performance Of Major Currencies

Forex Market: Week In Review & Week Ahead

The Dollar Index (DXY) stands at 105.66, bracing for the incoming October Consumer Price Index data with anticipation. Last week's narrative saw the dollar ride a bullish wave, fueled by the Fed Chair Jerome Powell’s remarks on taming the stubborn inflation beast—a mission they've openly not declared victory on yet, stirring a fresh wave of market recalibrations.

Traders are keenly anticipating the U.S. inflation data, where a dip in the annual Consumer Price Index from 3.7% to 3.3% in October is expected. This potential easing in inflation could significantly influence the Federal Reserve's approach to monetary policy, potentially sending waves through the financial markets.

Aside from inflation data, producer inflation and retail sales this week are poised to send ripples across major pairs. Traders also eye the Biden-Xi diplomatic meeting in San Francisco, a potential game-changer for the US-China economic playbook.

The euro (EUR) traded at 1.07, with the market's attention fixed on a series of key economic reports due this week, including the latest on the Eurozone's economic growth, inflation trends, and investor confidence. Central bank officials from the ECB are in the limelight, especially with the European Commission's Autumn economic projections to be announced on Wednesday.

The sterling (GBP) recently reached a weekly peak of $1.23 as market players parsed through the latest UK employment figures following Prime Minister Rishi Sunak's government reshuffle. Data reveals a steady UK jobless rate at 4.2% for Q3, with a slight dip in wage inflation to 7.7%—still near the record highs since records began in 2001. The trading community now keenly anticipates key updates on the UK's inflation and consumer spending this week.

The Japanese yen (JPY) is flirting with 152 against the dollar, edging towards the deepest dip in over thirty years, burdened by the persistent interest rate gap. The Bank of Japan's recent choice to stick with a lenient monetary policy left investors wanting, even as it loosely pegged the 1% mark as a soft ceiling for 10-year Japanese Government Bonds, stepping back from its defense commitment—a move that failed to stir yen bulls

The Aussie dollar (AUD) is struggling to stay afloat, trading under $0.64, on the heels of a rate increase by the Reserve Bank of Australia, which was interpreted with a dovish lens by market observers. The RBA has adjusted its forward outlook, now intimating that future rate hikes will hinge on the necessity signaled by upcoming economic data. Meanwhile, the New Zealand dollar (NZD) has not been immune to the headwinds, dipping below the 0.59 level as it echoes the Aussie trend.

Key Economic Events for the Upcoming Week

United States:

- October’s inflation rate (Tue.): 3.3% year-on-year expected, 3.7% y/y previous

- October’s core inflation rate (Tue.): 4.1% y/y exp, 4.1% y/y exp.

- October’s producer inflation (Wed.): 0.1% month on month exp., 0.5% m/m pre.

- Retail sales (Wed.): -0.3% m/m exp., 0.7% m/m pre.

Eurozone:

- Q3 GDP Second Estimate (Tue.): -0.1% (quarter on quarter annualized) pre.

- ZEW Economic Sentiment Index (Tue.): 2.3 pre.

- Inflation rate (final) (Fri.): 2.9% pre.

United Kingdom:

- October’s CPI (Wed.): 4.8% y/y exp., 6.7% pre.

- October’s retail sales (Fri.): 0.3% exp., -0.9% pre.

New Trading Ideas For The Week

Short CAD/JPY

- Entry: 109.75

- Take profit: 107.18

- Stop loss: 110.67

- Reward/risk: 3:1

Fundamental view:

The Canadian dollar's rally against the yen since late October seems unjustified by interest rate differentials. A glance at the 10-year spread between Canada and Japan shows a dip below 3% from levels close to 3.5%, signaling a reduced 'carry' for the Loonie. Yet, the exchange rate has continued to climb, possibly because the market has overinterpreted the Bank of Japan's decision as excessively dovish. In a week that may witness inflation declines in the United States, the United Kingdom, and Europe, the yen could outperform growth-linked currencies such as the Canadian dollar.

Technical view:

The pair is currently confronting the psychological resistance at 110, a level that marks October's highs. The Relative Strength Index (RSI) is slightly bending downwards, and should it breach below the 50 mark, short-term momentum would shift in favor of sellers.

An intriguing monthly target is 107.19, corresponding to the 23.6% Fibonacci retracement level between the 2023 highs and lows. Setting a stop at 110.67 could present an attractive risk-reward proposition.

Long EUR/GBP

- Entry: 0.8718

- Take profit: 0.8926

- Stop loss: 0.8644

- Reward/risk: 2.8:1

Fundamental view:

The negative gap in 2-year interest rates between Euro area and the UK is narrowing, primarily driven by a notable drop in gilt yields, as market sentiment begins to anticipate at least two interest rate cuts from the Bank of England (BoE) in 2024. Should UK inflation retreat to the projected 4.8% this week, marking the lowest point since late 2021, this could signal further potential weakness for the British pound across various currency pairings.

Technical view:

Technically, a new bullish trend is emerging in the EUR/GBP pair, which has been charting higher lows and higher highs since the end of August. The 50-day moving average is on the brink of a bullish crossover above the 200-day moving average, potentially setting up a 'golden cross' that may bolster further upward momentum. The RSI has consistently found support around the 50 level since mid-September, suggesting that the bulls currently maintain control. A short-term objective could be the 0.8925 level, with a protective stop placed just below the 50-day moving average at 0.8644.

Long AUD/NZD

- Entry: 1.0856

- Take profit: 1.1176

- Stop loss: 1.0750

- Reward/risk: 3:1

Fundamental view:

The 2-year interest rate differential between Australia and New Zealand has surged by 100 basis points since October, currently at its peak since September 2022. Despite this, the AUD/NZD pair has not rallied as one might expect from the enhanced rate outlook. When the 2-year bond yield spread between Australia and New Zealand reached these levels, the AUD/NZD pair was trading in the 1.13-1.15 range. Investors may continue to anticipate a dovish Reserve Bank of New Zealand's end-of-month decision, which might adopt a stance similar to the Reserve Bank of Australia's.

Technical View:

A bullish flag pattern could be in the making for the AUD/NZD if it breaks above the November highs at 1.0940. A successful breakout could give bulls the momentum to target the 2023 upper range between 1.1050 and 1.1085, aligning with the highs from June and February. Looking towards the end of the year, an optimistic target for bulls would be 1.1175, a 3% gain from current levels, with a stop set 1 percentage point lower to preserve an attractive risk-reward ratio.

Open trading ideas:

- Short GBP/USD

- Opened on November 7 at 1.2309

- Current Rate: 1.2299

- Updated Profit & Loss: +0.04%

- Short EUR/USD

- Opened on November 7 at 1.0690

- Current Rate: 1.0712

- Updated Profit & Loss: -0.11%

- Short NZD/CHF

- Opened on November 7 at 0.5327

- Current Rate: 0.5298

- Updated Profit & Loss: +0.32%

- Short EUR/JPY

- Opened on October 30 at 160.66

- Current Rate: 162.30

- Updated Profit & Loss: -1.02%

- Short CHF/JPY

- Opened on October 23 at 168.01

- Current Rate: 168.21

- Updated Profit & Loss: -0.12%

- Long CHF/SEK

- Opened on October 16 at 12.1280

- Current Rate: 12.03

- Updated Profit & Loss: -0.81%

- Long XAU/USD

- Opened on October 16 at $1,912/oz

- Current Rate: $1,945/oz

- Updated Profit & Loss: +1.73%

- Short NZD/USD

- Opened on October 9 at 0.5975

- Current Rate: 0.5867

- Updated Profit & Loss: +1.81%

- Long USD/JPY

- Opened on September 25th at 148.56

- Current Rate: 151.69

- Updated Profit & Loss: +2.11%

- Short GBP/AUD

- Opened on September 18th at 1.9250

- Current Rate: 1.9295

- Updated Profit & Loss: -0.23%

- Short EUR/AUD

- Opened on September 4th at 1.6708

- Current Rate: 1.6821

- Updated Profit & Loss: -0.68%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.