Source: Shutterstock.com

We are heading into a crucial week for financial markets, marked by a series of significant economic events that have the potential to cause substantial fluctuations in major exchange rates.

All eyes are currently focused on the upcoming Federal Open Market Committee (FOMC) meeting scheduled for this Wednesday.

While the decision regarding interest rates is a done deal, as the Fed will keep them unchanged, the real attention lies in what Fed Chair Jerome Powell will communicate during the subsequent press conference.

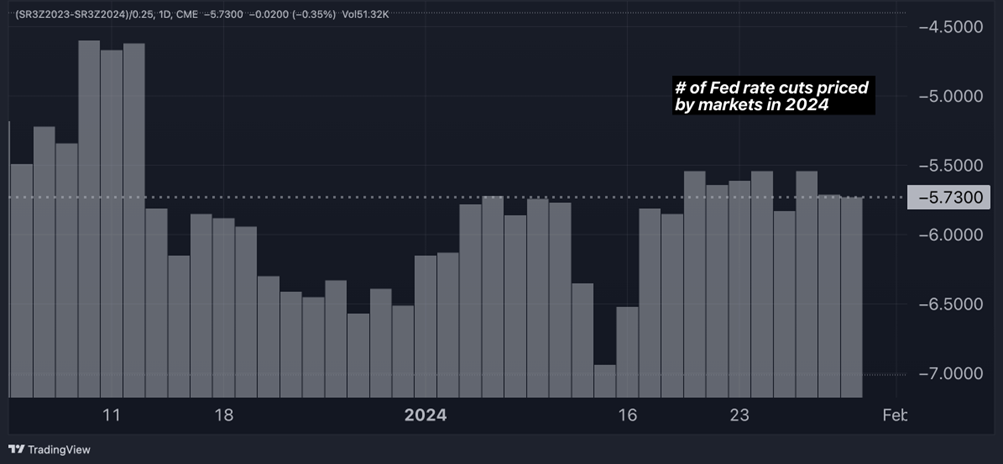

Markets are filled with anticipation to learn if the Federal Reserve is inclined to cut interest rates in March or to maintain the current higher rates for an extended period. Traders are currently assessing a 50% probability of a rate cut in March, but they have already factored in the possibility of as many as six rate cuts by December.

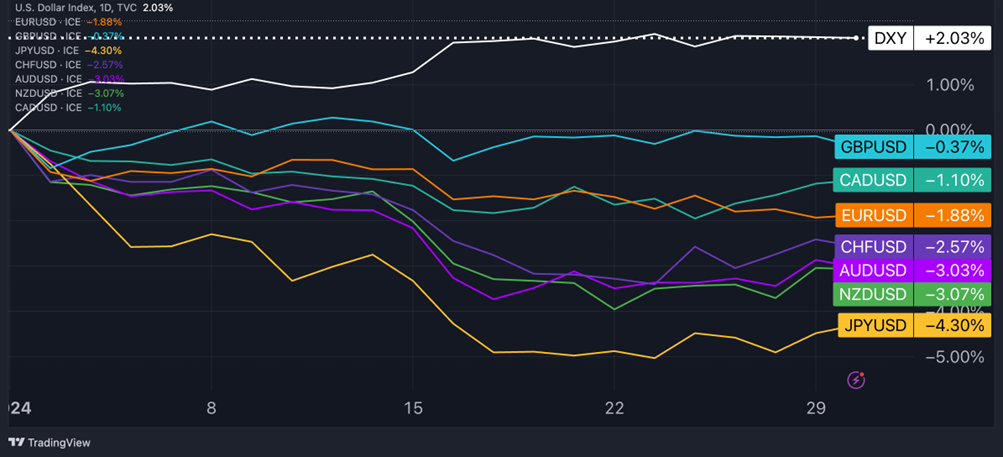

Year-To-Date Performance of Major Currencies: USD Leads, JPY Lags Behind

Source: TradingView

U.S. Dollar Update:

On Tuesday, the dollar index (DXY) remained steady at 103.5, showing minimal change compared to the previous week. Recent data indicated stronger-than-expected growth for the U.S. economy in Q4 2023, at 3.3% instead of the projected 2%, highlighting robust domestic demand.

Additionally, the Federal Reserve's preferred inflation gauge held at a 2.6% annual rate in December, hovering near a three-year low. This has raised hopes of the Fed considering interest rate cuts sooner rather than later. While opinions on a March rate cut vary among economists, there is a consensus that the market's expectation of six rate cuts in 2024 may be exaggerated, and the Fed could pushback such aggressive pricing.

Besides the impending Fed meeting, the dollar's performance will also be influenced by market reactions following the release of the ISM Manufacturing PMI on Thursday and the jobs report on Friday.

Euro Update:

The euro dropped to 1.0820 against the dollar on Tuesday, down by 0.5% for the week. The eurozone narrowly escaped a recession, with its economy showing no growth in the fourth quarter after a 0.1% contraction in the third quarter.

In the previous week, the European Central Bank (ECB) kept interest rates unchanged as expected and emphasized its data-dependent approach for future decisions. However, President Lagarde acknowledged the existence of downside risks to economic growth.

This Thursday, the euro will be put to the test with inflation data. Economists anticipate that the Consumer Price Index (CPI) annual rate will ease to 2.8% in January, down from 2.9% in December.

British Pound Update:

Sterling slipped below the 1.27 mark against the US dollar ahead of the first Bank of England policy meeting in 2024, set for Thursday. The general consensus is that there won't be any changes to the bank rate. However, traders will closely watch the voting split among policymakers to gauge the BoE stance. The main point of discussion right now isn't if we'll have rate cuts this year, but rather when they will happen. Currently, money markets show a 42% chance of a rate cut in May, and those odds increase to 74% for June.

Chart of The Week: Markets Are Pricing Almost Six Fed Rate Cuts In

Source: TradingView

Economic Events You Cannot Miss This Week

United States:

- FOMC Meeting (Wed.)

- ISM Manufacturing PMI (Thu.): 47 expected, 47.4 previous

- Non-farm payrolls (Fri.): 180,000 exp., 214,000 pre.

Euro Area:

- Inflation rate (Thu.): 2.8% year-on-year exp.; 2.9% pre.

United Kingdom:

- Bank of England Interest Rate Decision (Thu.): 5.25% exp., 5.25% pre.

This Week's Forex Trading Ideas

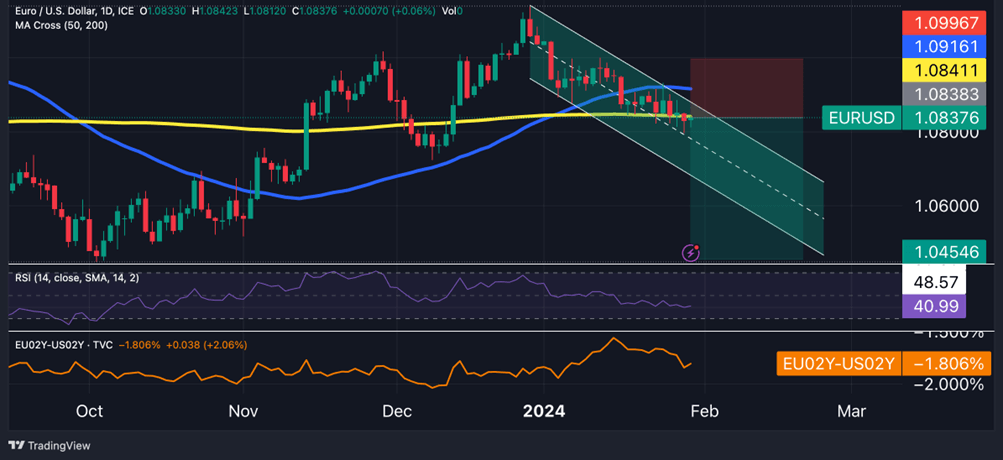

Short EUR/USD

- Entry: 1.0838

- Take profit: 1.0452

- Stop loss: 1.994

- Reward/Risk: 2.4x

Source: TradingView

EUR/USD fundamental analysis:

Short-term interest rate differentials between Europe and the United States could further decline into negative territory if the Fed opposes the market's optimistic expectations of rate cuts in 2024. Currently, the 2-year yield spread stands at -180 basis points, but hawkish remarks from Fed Chair Powell could widen this gap to -200 basis points. If this outcome occurs, it’s likely to exert downward pressure on the EUR/USD pair.

EUR/USD technical analysis:

EUR/USD has been following a descending channel pattern since late December, breaking below the 50 and 200-day moving averages. The short-term setup remains bearish, confirmed by an RSI consistently below 50 since mid-January. The projected downward trend could target 1.0450 by the end of February. Breaking above the 1.0995 level (January 11th’s high) would serve as a potential stop placement point for bearish strategies.

Long USD/CHF

- Entry: 0.8627

- Take profit: 0.90

- Stop loss: 0.8500

- Reward/Risk: 2.9x

Source: TradingView

USD/CHF fundamental analysis:

The USD/CHF pair has experienced a bullish resurgence in January, driven by widening 2-year yield differentials between the U.S. and Switzerland. Beyond the possibility of the Fed pushing back against market expectations of rate cuts, which is likely to bolster the dollar, there are indications that the prolonged trend of the Swiss Franc's appreciation may be nearing its end. During the Davos Summit earlier this month, SNB President Thomas Jordan expressed caution, hinting that the central bank might reconsider its current policy in response to the sharp rise of the Swiss Franc.

USD/CHF technical analysis:

The pair has been following an ascending channel pattern for a month, with USD/CHF breaking above the 50-day moving average last week and finding support this week, awaiting fresh bullish momentum. The RSI has climbed above 50, signaling sustained bullish momentum. With a one-month horizon, bulls might eye the pair potentially retesting the 0.90 level, where USD/CHF traded before the November 14th decline.

Long AUD/JPY

- Entry: 97.20

- Take profit: 102.86

- Stop loss: 94.98

- Reward/Risk: 2.44x

Source: TradingView

AUD/JPY fundamental analysis:

Several factors support a bullish outlook for AUD/JPY. there's a significant interest rate gap between Australia and Japan, favoring a long AUD/JPY strategy. The 10-year spread remains wide at 3.5%, and the BoJ shows no signs of policy shifts in the near term. Secondly, China's larger-than-expected reserve requirement ratio cuts may drive economic recovery, potentially strengthening the Australian dollar due to improved trade relations.

AUD/JPY technical analysis:

AUD/JPY is nearing a critical 98.65 resistance line, previously touched in November 2023 and September 2022. A successful break could target 100 and ultimately the November 2014 highs at 102.89. The level of stop could be placed at the 200-day moving average, below 95.00.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.