Discover how festive cheer and some indulgence in Swiss chocolate might reflect on the stock performances of Nestle, Lindt, and others.

What's happening?

- The holiday season often correlates with an increase in chocolate consumption, potentially impacting companies like Nestle, Lindt, and others.

- Nestle, with its vast portfolio of products, has a significant presence in chocolate and the broader food and beverage industry.

- Similar to Nestle, companies like Lindt and Bell Foods are known for their quality Swiss produce.

How big is Christmas for Chocolate?

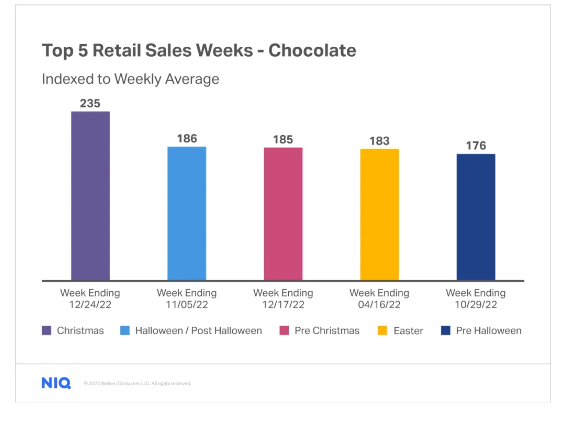

The seasonality of chocolate consumption is a significant factor in the confectionery industry, with peak sales often occurring around key holidays. The top retail sales weeks for chocolate are notably around Christmas, Halloween, and Easter, which are traditionally associated with chocolate treats and gifting.

According to NIQ, Christmas leads the pack, with sales indexing at 235 against the weekly average, indicating a substantial increase in chocolate purchases during this festive period. This spike can be attributed to the tradition of giving chocolate as gifts, as well as the general indulgence in sweets during the holiday season.

Are people eating more Chocolate?

The chocolate industry is undeniably intertwined with the cultural fabric of many societies, particularly in Switzerland, which is renowned for its premium chocolate.

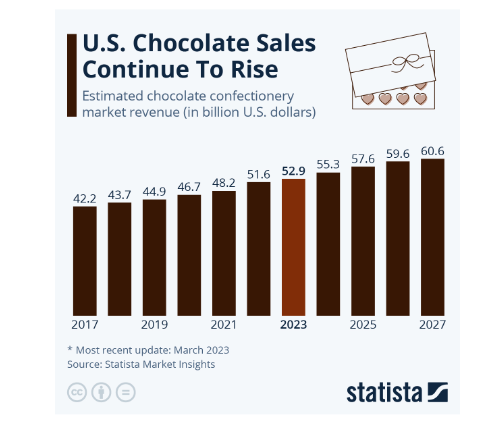

In the US, one of the largest markets in the world, chocolate sales are on an upward trajectory. Estimated revenues in the U.S. chocolate confectionery market are shown to rise consistently from 42.2 billion U.S. dollars in 2017 to a projection of 60.6 billion U.S. dollars by 2027. This sustained growth trend hints at a stable and expanding market for chocolate producers.

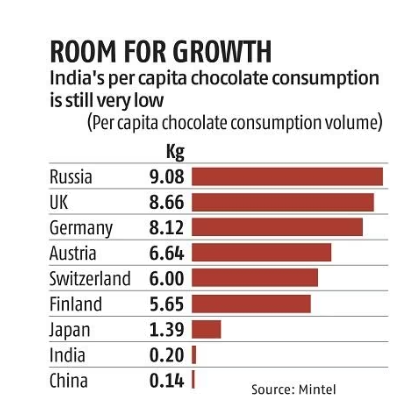

China and India, with their large and increasingly affluent populations, represent significant growth opportunities for the chocolate industry. As the middle class expands in both countries, there is a rise in disposable income, which often results in increased spending on luxury and non-essential goods, including chocolate.

In China, the chocolate market has been growing due to the westernization of tastes and the increase in gifting culture where chocolate is seen as a premium gift. Additionally, the entry of international chocolate brands has stirred interest among consumers looking for quality and variety. India also shows a rising trend in chocolate consumption. The market there has been traditionally dominated by sweet snacks, but chocolate is becoming more popular, especially among the younger generation.

Furthermore, the global chocolate market is also witnessing an increasing demand for artisanal and premium chocolate, trends that Swiss chocolatiers are well-positioned to capitalize on. Switzerland's stringent quality standards and innovative chocolate-making techniques are competitive advantages that can be leveraged to meet this premium demand.

However, it's also vital to consider the challenges that could impact the industry. These include fluctuating cocoa prices, the push for sustainable and ethical sourcing of cocoa, and changing consumer health trends that may affect consumption patterns.

Does Nestle stock present an opportunity?

Nestle is a large multinational conglomerate, much more diversified than just its chocolate division, with a broad product portfolio in the food and beverage sector and other areas. Despite its size and diversity, the company's stock, listed on the Swiss Exchange (NESN:SWX), has seen a 1-year change of -11.8%. In the context of global stock indices reaching record highs, this is relatively poor but offers a possible opportunity for catch-up.

Nestle reported an increase in total sales by 8.4% to CHF 94.4 billion for the full year of 2022, demonstrating solid organic growth of 8.3%. The pricing adjustment of 8.2% in response to cost inflation contributed significantly to this growth, while real internal growth (RIG) remained modest at 0.1%. This indicates the company's ability to grow revenue despite inflationary pressures and a complex global economic landscape.

Nestle has a dividend of CHF 2.95 per share, marking 28 consecutive years of dividend growth.

Investors looking at Nestle's stock would need to consider these aspects, along with the company's future outlook, which includes an expectation of organic sales growth between 6% and 8% and a slight increase in underlying trading operating profit margin for 2023. The company's targets for 2025 remain ambitious, aiming for sustainable mid single-digit organic sales growth and an improved underlying trading operating profit margin range of 17.5% to 18.5%.

Other Swiss Food Stocks to Consider

In addition to Nestlé, which is a giant in the global food industry, Switzerland hosts several other significant companies in the food and beverage sector, including chocolate producers. Here are some prominent ones with their stock tickers:

-

Barry Callebaut AG (SWX: BARN): As one of the world's leading manufacturers of high-quality chocolate and cocoa products, Barry Callebaut represents a significant part of the Swiss market with a strong global presence.

-

Chocoladefabriken Lindt & Sprüngli AG (SWX: LISN): Famous for its premium chocolate products, Lindt & Sprüngli has a substantial market share and is known for its innovation in the chocolate sector.

-

Bell Food Group AG (SWX: BELL): This company is a major player in the meat and convenience food sectors within Switzerland and beyond. It is one of the leading meat processors and manufacturers of convenience products in Europe.

-

Aryzta AG (SWX: ARYN): Aryzta is a global food business with a leadership position in frozen B2B bakery products.

-

Emmi AG (SWX: EMMN): Emmi is a leading Swiss dairy company known for its quality products, including cheese, yogurt, and other dairy items. The company is involved in the development, production, and marketing of a broad range of dairy and fresh products, as well as the production, aging, and trading of primarily Swiss cheeses.

These companies, while having substantial operations in Switzerland, often have an international reach, with products and services that are recognized worldwide. The Swiss food and retail sector is characterized by a focus on quality, sustainability, and innovation, catering to a home market known for its high consumer purchasing power and demand for premium products.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who using it does so at their own risk.